8.3 Inflation and deflation

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

The causes of inflation

2 main causes

excess AD (demand-pull inflation)

a general rise in cost of production (cost-push inflation)

Demand pull inflation

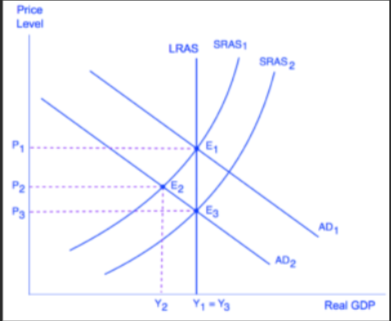

caused by an increase in aggregate demand. If the economy is initially producing on the economy’s SRAS curve, but below the normal capacity level of output (which means to the left of the LRAS curve), the price level has to rise to persuade firms to produce more output to meet the extra demand. In part, this is because firms incur higher costs when they produce more goods. For firms to maximise profits, higher prices are needed to reward firms for producing more output. Once the LRAS curve is reached, higher prices can temporarily encourage firms to produce beyond this point, but the increase in output cannot be sustained. Instead, the quantity of goods and services produced falls back to the normal capacity level of output, in this case at Y2.

demand-pull inflation

a rising price level caused by an increase in AD, shown by a shift of the AD curve to the right. Also known as demand inflation.

inflation

is the sustained rise in the general price level over time. This means that the cost of living increases and the purchasing power of money decreases.

deflation

is the opposite, where the average price level in the economy falls. There is a negative inflation rate

disinflation

is the falling rate of inflation. This is when the average price level is still rising, but to a slower extent. This means the goods and services are relatively cheaper now than a year ago , and the purchasing power of money has increased.

For example, a 4% increase in the price level between 2014 and 2015 would be inflation. A change from 4% to 2% is still inflation, but there has been disinflation where the price rise has slowed. If the change in the price level is now -3% there is deflation

It is important to note that deflationary gov policies aim to reduce AD and do not necessarily result in deflation.

demand pull

This is from the demand side of the economy. When AD is growing unsustainably, there is pressure on resources. Producers increase their prices and earn more profits. It usually occurs when resources are fully employed.

The main triggers for demand pull inflation are:

A depreciation in the exchange rate, which causes imports to become more expensive, whilst exports become cheaper. This causes AD to rise

Fiscal stimulus in the form of lower taxes or more gov spending. This means consumers have more disposable income, so consumer spending increases.

Lower interest rates makes saving less attractive and borrowing more attractive, so consumer spending increases.

High growth in UK export markets means UK exports increase and AD increases

cost push

This is from the supply side of the economy, and occurs when firms face rising costs. This occurs when:

Changes in world commodity prices can affect domestic inflation. For example, raw materials might become more expensive if oil prices rise. This increases cost of production.

Labour becomes more expensive. This could be through trade unions, for example

Expectations of inflation-if consumers expect prices to rise, they may ask for higher wages to make up for this, and this could trigger more inflation

Indirect taxes could increase the cost of goods such as cigarettes or fuel, if producers choose to pass the cost onto the consumer

Depreciation in the exchange rate, which causes imports to become more expensive and pushes up the price of raw materials

Monopolies, using their dominant market position to exploit consumers with high prices.

The effects of inflation on consumers

consumers

Those on low and fixed incomes are hit hardest by inflation, due to its regressive effect, because the cost of necessities such as food and water becomes expensive. |The purchasing power of money falls, which affects those with high incomes the least

If consumers have loans, the value of the repayment will be lower, because the amount owed does not increase with inflation, so the real value of debt increases.

The effects of inflation on Firms

Firms

Low interest rates means borrowing and investing is more attractive than saving profits. With high inflation, interest rates are likely to be higher, so the cost of investing will be higher and firms are less likely to invest

Workers might demand higher wages, which could increase the cost of production for firms

Firms may be less price competitive on a global scale if inflation is high. This depends on what happens in other countries

Unpredictable inflation will reduce business confidence, since they are not aware of what their costs will be. This could mean there is less investment

The effects of inflation on the government

The government will have to increase the value of the state pension and welfare payments, because the cost of living is increasing.

The effects of inflation on workers

Real incomes fall with inflation, so workers will have less disposable income

If firms face higher costs, there could be more redundancies when firms try and cut their costs.

The effects of deflation

Deflation increases the value of money, meaning people can buy more with the same amount.

It discourages spending, as consumers delay purchases expecting lower prices in the future.

Economic decline and unemployment can worsen due to reduced spending.

Debt becomes harder to repay, as its real value increases.

Lower disposable income and falling wages lead to weaker economic activity.

Higher real interest rates worsen growth and unemployment, encouraging saving over spending.

Fisher’s equation of exchange and the quantity theory of money

Quantity Theory of Money: Inflation occurs if the money supply grows faster than national income.

Fisher’s Equation of Exchange: MV=PQMV = PQMV=PQ, where:

MMM = Money supply

VVV = Velocity of circulation

PPP = Price level

QQQ = Real GDP (quantity of goods sold)

Alternative Formulation: TTT (transactions) can replace QQQ, but QQQ is preferred as it represents nominal national income.

Key Conclusion: Total expenditure on goods equals total output value.