FSA Terms

1/76

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

77 Terms

Financial Statement Analysis Framework

Step 1: State the objective and context.

Step 2: Gather data.

Step 3: Process the data.

Step 4: Analyze and interpret the data.

Step 5: Report the conclusions or recommendations.

Step 6: Update the analysis.

Standard-setting bodies

professional organizations of accountants and auditors

that establish financial reporting standards

Regulatory authorities

government agencies that have the legal authority to enforce compliance with financial reporting standards. such as the Securities and Exchange Commission (SEC) in the United States and the Financial Conduct Authority in the United Kingdom, are established by national governments

The two primary standard-setting bodies

Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB). In the United States, the FASB sets forth the U.S. Generally Accepted Accounting Principles (U.S. GAAP). Outside the United States, the IASB establishes the International Financial Reporting Standards (IFRS)

Most national authorities belong to

International Organization of Securities Commissions (IOSCO). IOSCO is not a regulatory body, but its members work

together to improve cross-border cooperation and make national regulations and

enforcement more uniform around the world. The IOSCO Objectives and Principles of

Securities Regulation are based on three main objectives:

1. Protecting investors

2. Ensuring markets are fair, efficient, and transparent

3. Reducing systemic risk

Proxy statements

issued to shareholders when there are matters that require a

shareholder vote. These statements, which are also filed with the SEC, are a good source

of information about the election of (and qualifications of) board members,

compensation, management qualifications, and the issuance of stock options

Financial statement notes

include disclosures that provide further details

about the information summarized in the financial statements.

business segment (operating segment) is

a portion of a larger company that

accounts for more than 10% of the company’s revenues, assets, or income. An operating

segment should be distinguishable from the company’s other lines of business in terms

of the risk and return characteristics of the segment.

Geographic segments

identified when they meet the size criterion given

previously and the geographic unit has a business environment that is different from

that of other segments or the remainder of the company’s business

management discussion and analysis [MD&A])

For publicly held firms in the United States, the SEC requires management commentary

to discuss trends and identify significant events and uncertainties that affect the firm’s

liquidity, capital resources, and results of operations. Management must also discuss

the following:

Effects of inflation and changing prices, if material

Impact of off-balance-sheet obligations and contractual obligations, such as purchase

commitments

Accounting policies that require significant judgment by management

Forward-looking expenditures and divestitures

What is an audit

an independent review of an entity’s financial statements. Public

accountants conduct audits and examine the financial reports and supporting records.

The objective of an audit is to enable the auditor to provide an opinion on the fairness

and reliability of the financial statements

standard auditor’s opinion

1. Whereas the financial statements are prepared by management and are its

responsibility, the auditor has performed an independent review.

2. Generally accepted auditing standards were followed, thus providing reasonable

assurance that the financial statements contain no material errors.

3. The auditor is satisfied that the statements were prepared in accordance with

accepted accounting principles and that the accounting principles chosen and

estimates made are reasonable. The auditor’s report must also contain additional

explanation when accounting methods have not been used consistently between

periods.

unqualified opinion

(also known as an unmodified opinion or clean opinion)

indicates that the auditor believes the statements are free from material omissions and

errors

qualified opinion

If the statements make any exceptions to the accounting principles, the auditor

may issue a qualified opinion and explain these exceptions in the audit report

adverse opinion

The

auditor can issue an adverse opinion if the statements are not presented fairly or are

materially nonconforming with accounting standards

disclaimer of opinion

if the

auditor is unable to express an opinion

modified opinion

Any opinion other than unqualified

What are internal controls in FS preparation

processes by which the company ensures that it presents

accurate financial statements. Internal controls are the responsibility of management. For publicly traded firms in the United States, the auditor must express an opinion on

the firm’s internal controls. The auditor can provide this opinion separately, or as the

fourth element of the standard opinion.

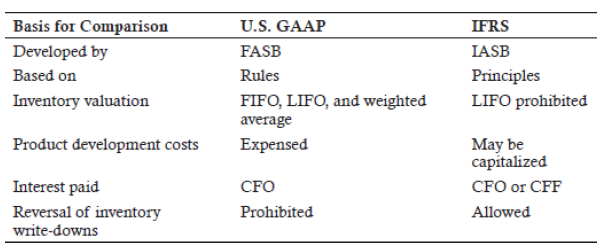

Significant Differences Between IFRS and U.S. GAAP

When a firm constructs an asset for its own use (or, in limited circumstances, for resale), the interest that accrues during the construction period is Expensed/Capitalized

Capitalized

Once construction interest is capitalized, the interest cost is allocated to the income statement through

depreciation expense (if the asset is held for use) or cost of goods sold (if the asset is held for sale)

Firms reporting research and development under IFRS must

Expense research costs as incurred but may capitalize development costs (costs incurred after technological feasibility and the intent to use or sell the completed asset have been established).

What are identifiable intangible assets, provide examples

can be acquired separately or are the result of rights or privileges conveyed to their owner. Examples of identifiable intangibles are patents, trademarks, and copyrights.

What are Unidentifiable intangible assets, provide examples

cannot be acquired separately and may have an unlimited life. The best example of an unidentifiable intangible asset is goodwill.

Are purchased intangible assets amortized or expensed?

Intangible assets that are purchased are reported on the balance sheet at historical cost less accumulated amortization.

Are internal intangible assets expensed or capitalized?

Except for certain legal costs, intangible assets that are created internally, including research and development costs, are expensed as incurred under U.S. GAAP and are not shown on the balance sheet

Goodwill

an unidentifiable intangible asset created when a business is purchased for

more than the fair value of its assets, net of liabilities.

Is goodwill ammortized

Goodwill is not amortized, but it

must be tested for impairment (a decrease in its fair value) at least annually

IFRS has three categories for securities held as assets

Securities measured at amortized cost

Securities measured at fair value through other comprehensive income (OCI)

Securities measured at fair value through profit and loss

U.S. GAAP has three categories that mostly correspond to the IFRS treatments:

Held-to-maturity securities

Available-for-sale securities

Trading securities

Debt securities that a firm intends to hold until maturity, notes receivable, and unlisted securities for which fair value cannot be reliably determined are all measured at what on the BS?

at (amortized) historical cost.

Debt securities for which a firm intends to collect interest payments but may sell before maturity are measured at

fair value through OCI under IFRS and classified as

available for sale under U.S. GAAP.

Equity securities, derivatives, and other financial assets that do not fit either of the other two classifications are measured a

fair value through profit and loss under IFRS

and are classified as trading securities under U.S. GAAP.

under IFRS Interest and dividends received may be classified as pick from the following (CFO/CFI/CFF)

CFO or CFI

Interest and dividends paid to shareholders and interest paid on debt may be classified as pick from the following (CFO/CFI/CFF)

CFO or CFF

FCFF (Free cash flow to the firm)

Same as unlevered which adds back interest

FCFE (Free Cash Flow to Equity)

Same as levered

How is inventory reported under IFRS

At the lower of cost or net realizable value. If NRV is less than the balance sheet value of inventory, the inventory is “written down” to NRV, and the loss is recognized in the income statement either as a separate line item or by increasing COGS.

How is inventory reported under GAAP

Under U.S. GAAP, companies that use LIFO or the retail method value inventories at the lower of cost or market. Market is usually equal to replacement cost, but it cannot exceed net realizable value or be less than net realizable value minus a normal profit margin

When are inventory writeups allowed?

Under IFRS Inventory “write-up” is allowed, but only to the extent that a previous write-down to net realizable value was recorded. Write downs are permitted under both IFRS and GAAP but reversals and writeups are only permitted under IFRS.

LIFO vs FIFO Profitability

Lower with LIFO because of higher COGS under the assumption of rising prices

LIFO vs FIFO Liquidity Ratio for short term inventory

LIFO results in lower inventory because newer more expensive inventory is out first while older cheaper is still on BS. Hence lower liquidity from current ratio.

LIFO vs FIFO regarding activity inventory turnover

inventory turnover (COGS / average inventory) is higher for firms that use LIFO compared to firms that use FIFO.

Reversal of write down is permitted under

IFRS if the Net Realizable Value increases

What are purchased intangible assets

Do not have a physical substance but have finite lives (patent / franchises) are reported on the balance sheet at their fair values, which are reduced over their economic lives by amortization (like depreciation of a . physical asset).

internally developed intangible assets

are not reported on the balance sheet.

Values of intangible assets that do not have finite lives (e.g., goodwill) and of those that

can be renewed at minimal cost (e.g., trademarks) are not amortized, but they must be

checked periodically for impairment.

Under U.S. GAAP, R&D is typically expensed except for:

Cost to develop Software for sale to others. Costs are expensed as incurred until the product’s technological feasibility has been established, after which the costs of developing a salable product are capitalized.

Software for internal use. Costs must be expensed until it is probable that the firm will complete the project and use the software as intended

impairment

An asset is impaired when its carrying value (original cost less accumulated depreciation) exceeds the recoverable amount.

Recoverable amount of an impaired asset

The recoverable amount is the greater of its fair value less any selling costs and its value in use.

What is an asset’s value in use

The value in use is the

present value of its future cash flow stream from continued use and disposal.

Determining an impairment and calculating the loss potentially involves two steps.

.In

the first step, the asset is tested for impairment by applying a recoverability test. If the

asset is impaired, the second step involves measuring the los

The advantages of leasing rather than purchasing an asset may include the following

Less initial cash outflow. Typically, a lease requires only a small down payment, if any.

Less costly financing. Because a lease is effectively secured by the leased asset if the

lessee defaults, the interest rate implicit in a lease contract may be less than the

interest rate would be on a loan to purchase the asset.

Less risk of obsolescence. At the end of a lease, the lessee often returns the leased

asset to the lessor, and therefore, does not bear the risk of an unexpected decline in

the asset’s end-of-lease value.

Under IFRS and U.S. GAAP, any lease in which both the benefits and the risks of ownership are substantially transferred to the lessee is classified as

finance lease

Under IFRS, for both finance and operating leases (except those that are short term or of low value), the lessee records what on BS?

right-of-use (ROU) asset and a lease liability both equal to the present value of the lease payments

What is the loan reduced by in each lease payment under IFRSE

The lease liability is reduced each period by the principal portion of

the lease payment. So, while the asset and liability both begin with the same value and

reach zero at the end of the lease, their values can differ during the life of the lease, as

the amortization of the ROU asset will exceed the principal portion of the lease

payment in the early years of a lease

Under U.S. GAAP, how does a lessee accounts for finance leases

Same as just as under IFRS.

Under U.S. GAAP, how does a lessee accounts for operating leases

The lessee reports both the

Interest portion of the lease payment (Essentially the entire lease payment is interest because it is operating lease).

&

The amortization of the ROU asset (which is equal to the interest portion of the lease payment, not straight-line as under IFRS)

On the income statement as a single expense. Because the amortization of the lease liability and the amortization of the ROU asset are equal each period, the asset and liability will have equal values over the life of the lease.

The change in a net pension asset or liability has five components under U.S. GAAP. The

first three are recognized in the income statement each period, while the last two go to

other comprehensive income

1. Service costs for the current period.

2. Interest expense or income.

3. The expected return on plan assets.

4. Past service costs.

5. Actuarial gains and losses.

discontinued operation

management has decided to dispose of, but

either has not yet done so, or has disposed of in the current period after the operation

had generated income or losse

How are discontinued operations reported

Income and losses from discontinued operations are reported

separately in the income statement, net of tax, after income from continuing operations

Unusual or infrequent items

recorded for events that are either unusual in nature or infrequent in occurrence. Unusual or infrequent items are included in income from continuing operations.

retrospective application to Financial Statements

any prior-period financial statements presented in a firm’s current financial statements must be restated, applying the new policy to those statements as well as future statements.

prospective application to Financial Statements

prior statements are not restated, and the new policies are applied only to future financial statements

Can an impaired asset be recovered?

Under IFRS, the loss can be reversed if the value of the impaired asset recovers in the future. However, the loss reversal is limited to the original impairment loss

How are impairments treated under US GAAP?

Under U.S. GAAP, an asset is tested for impairment only when events and circumstances indicate the firm may not be able to recover the carrying value through future use.

Determining an impairment and calculating the loss potentially involves two steps. In the first step, the asset is tested for impairment by applying a recoverability test. If the asset is impaired, the second step involves measuring the loss.

How is recoverability tested under US GAAP

an asset is considered impaired if the carrying value

(original cost less accumulated depreciation) is greater than the asset’s future

undiscounted cash flow stream.

Formula for net revenue

Revenues less any returns and allowances

Quality of financial reports may be ranked from best to worst

1. Reporting is compliant with GAAP and decision useful; earnings are sustainable and adequate.

2. Reporting is compliant with GAAP and decision useful, but earnings are not sustainable or not adequate.

3. Reporting is compliant with GAAP, but earnings quality is low and reporting choices and estimates are biased.

4. Reporting is compliant with GAAP, but the amount of earnings is actively managed to increase, decrease, or smooth reported earnings.

5. Reporting is not compliant with GAAP, although the numbers presented are based on the company’s actual economic activities.

6. Reporting is not compliant and includes numbers that are fictitious or fraudulent.

Is straight-line depreciation conservative or aggressive form of accounting?

aggressive

Three factors that typically exist in cases where management provides low-quality

financial reporting are

motivation, opportunity, and rationalization

channel stuffing

Overloading a distribution channel with more

goods than would normally be sold during a period

bill-and-hold transaction

the customer buys the goods and receives an invoice but requests that the firm keep the goods at their location for a period of time. The use of fictitious bill-and-hold transactions can increase earnings in the current period by recognizing revenue for goods that are actually still in inventory

Overconfidence bias

having too much faith in one’s own work. underestimating forecasting errors and having narrower confidence intervals than warranted);

Illusion of control bias

creating overly complex models

This is related to overconfidence, but refers specifically to overestimating what an analyst can control and trying to control things an analyst cannot control. This bias is manifested in two primary ways: seeking “expert” opinions to justify a forecast, and making a model more complex

Conservatism bias

insufficiently changing forecasts when new information arrives

representativeness bias

overreliance on known classifications

confirmation bias

seeking out data that affirms an existing

opinion and disregarding information that calls it into question