Business: Finance

1/26

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

Define gross profit.

The amount of money a business makes after the direct costs of making/selling (usually variable) are deducted.

What is the formula for gross profit?

Gross profit = revenue - cost of sales

Define net profit.

The amount of profit after any operating expenses (usually fixed costs) are deducted from gross profit.

What is the formula for net profit?

Net profit = gross profit - other operating expenses

Define revenue.

The income gained by a business from selling a good/service (cash inflow).

What is the formula for revenue?

Revenue = selling price per unit x quantity sold

Define profit.

Then difference between revenue and total costs.

What is the formula for profit?

Profit = revenue - total costs

What is the formula for gross profit margin?

GPM = gross profit/sales revenue x 100

What is the formula for net profit margin?

NPM = net profit/sales revenue x 100

Define costs.

The spending that occurs to set up and run a business.

Define variable costs.

Costs that change as output changes e.g. ingredients.

Define fixed costs.

Costs that do not change as output changes e.g. rent.

What is the formula for total costs?

Total costs = total fixed costs + total variable costs

What’s the formula for total variable costs?

Total variable costs = variable cost per unit x quantity

Define average rate of return (ARR)?

A quantitive method of deciding whether an investment is worthwhile.

What is the formula for ARR?

ARR = average annual profit/initial investment x 100

What are 4 internal sources of finance?

Personal funds

Retained profit

Selling assets

Family & friends

What are the 3 external short-term sources of finance?

Overdraft

Crowdfunding

Trade credit

What are the 2 external medium-term sources of finance?

Bank loans

Government grants

What are the 2 external long-term sources of finance?

Share issue

New partner

Define cash flow.

The process of cash flowing in (cash inflow) and out (cash outflow) of a business.

What is a cash flow forecast?

Predicting the cash inflows and outflows of a business to anticipate profitability.

What is the formula for net cash flow?

Net casas flow = cash inflows - cash outflows

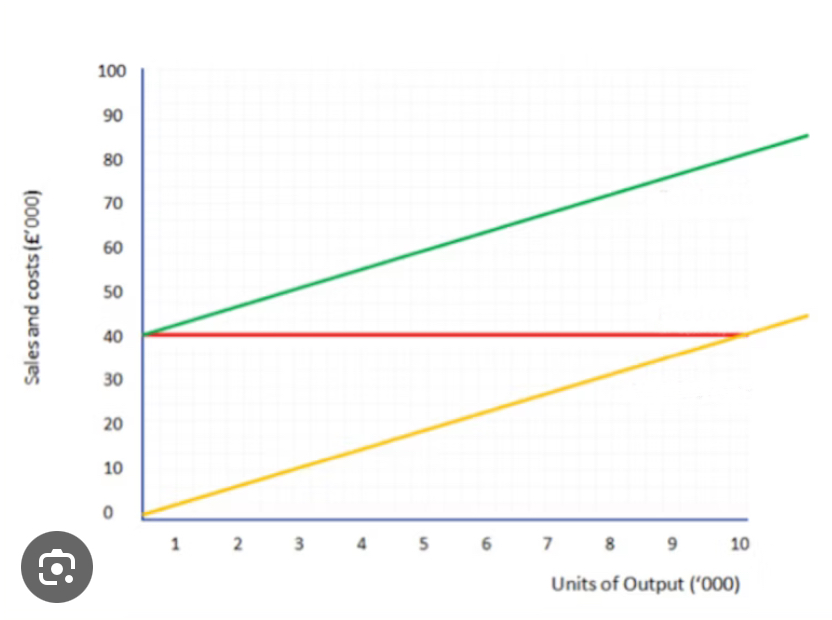

Define break even.

The output (number of units) where total revenue and total costs are equal. You were not making a profit nor a loss.

What does each line on a break even graph represent?

RED = Fixed costs

YELLOW = Variable costs

GREEN = Fixed cots

The total costs and revenue normally meet on a break even graph.

This represents the —

Break even point of the business.