ACYTAXN: Deductions

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

8 Terms

The deduction from gross income, as per section 34 of the tax code, shall include:

I. Necessary and ordinary expenses

II. Interest

III. Taxes

IV. Losses

V. Bad debts

VI. Depreciation

VII. Depletion

VIII. Charitable contribution

IX. Research and development

X. Contributions to pension trust

XI. Premium payments on health and/or hospitalization insurance

XII. Proceeds on life insurance

a. I, II, IV, VI, IX, and X

b. I, II, III, IV, V, VI, VII, VIII, IX, X, and XI

c. I, II, IV, V, VI, VII, IX, and X

d. All of the above

b. I, II, III, IV, V, VI, VII, VIII, IX, X, and XI

Statement 1: A taxpayer can deduct an item or amount from the gross income only if there is a law authorizing such a deduction.

Statement 2: For income tax purposes, a taxpayer is free to deduct from the gross income the full amount or a lesser amount of the deduction allowed or not claim any deduction at all.

a. True, True

b. True, False

c. False, False

d. False, True

a. True, True

Which of the following is a nondeductible expense?

a. Interest incurred between a fiduciary of a trust and a beneficiary of such trust

b. Actual bad debt write-off

c. Depreciation using sum-of-the-years’ digits method

d. Net operating loss carry-over

a. Interest incurred between a fiduciary of a trust and a beneficiary of such trust

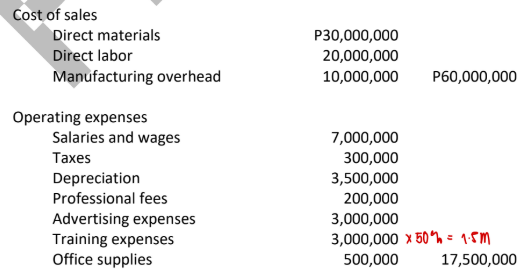

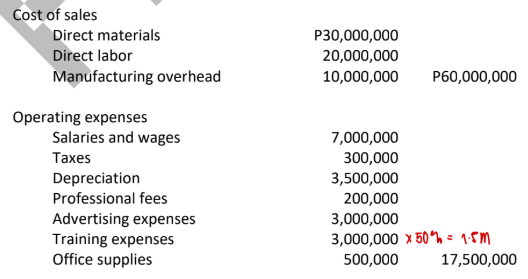

COD Corporation, a domestic manufacturing corporation, had gross sales of P100,000,000 for fiscal year ending June 30 and incurred cost of sales of P60,000,000 and operating expenses of P17,500,000, with the following details:

How much is the additional allowable training expense, if any?

a. P0

b. P1,500,000

c. P1,000,000

d. P3,000,000

b. P1,500,000

COD Corporation, a domestic manufacturing corporation, had gross sales of P100,000,000 for fiscal year ending June 30 and incurred cost of sales of P60,000,000 and operating expenses of P17,500,000, with the following details:

How much is the net taxable income of the Company?

a. P1,500,000

b. P40,000,000

c. P17,500,000

d. P21,000,000

d. P21,000,000

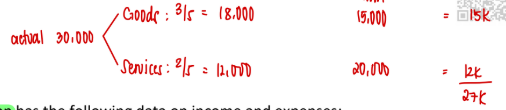

ABC Corporation is engaged in the sale of goods and services with net sales/net revenue of P3,000,000 and P2,000,000 respectively. The actual entertainment amusement and recreational (EAR) expense for the taxable year totaled P30,000. How much is the deductible EAR expense?

a. P30,000

b. P27,000

c. P25,000

d. P0

b. P27,000

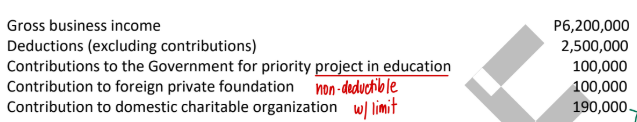

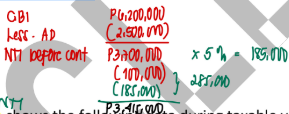

A domestic corporation has the following data on income and expenses:

How much is the deductible charitable and other contributions?

a. P390,000

b. P290,000

c. P285,000

d. P211,000

c. P285,000

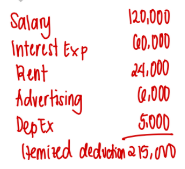

ABC Corporation, with total assets of P15,000,000, shows the following data during taxable year:

Sales P500,000

Interest income, net of 20% final tax 24,000

Cost of sales 300,000

Salary expense 120,000

Interest expense 60,000

Rent expense 24,000

Advertising expense 6,000

Depreciation expense 5,000

What is the correct amount of itemized deduction?

a. P202,400

b. P215,000

c. P205,100

d. P265,000

b. P215,000