1.4 Government Intervention

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

What is indirect taxation?

A type of tax that is applied to goods and services rather than directly on income or profits

Is paid indirectly by the consumer when they purchase the product

Collected by the seller who passes it onto the government

VAT is an example of indirect taxation

Impacts of indirect taxation

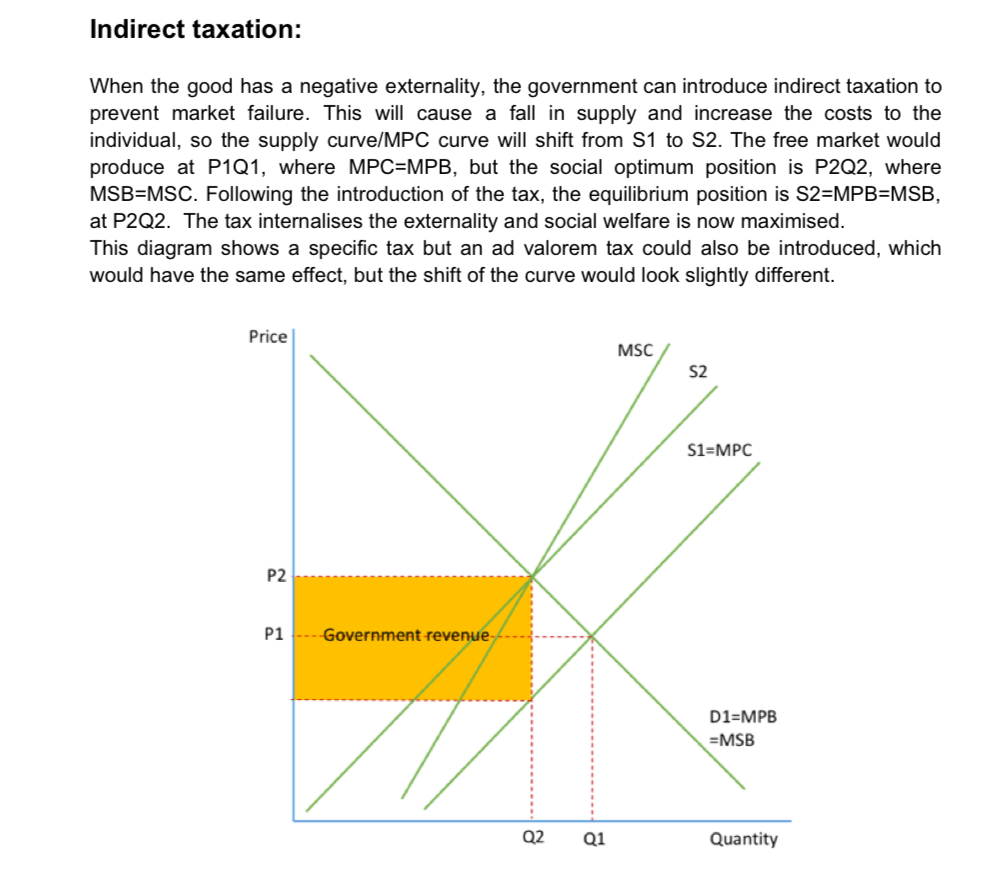

When a good has a negative externality, the government can introduce indirect taxation to prevent market failure

This will cause a fall in supply and an increase in costs to the individual

Advantages of indirect taxation

It internalises the externality- the market now produces at the social equilibrium position and social welfare is maximised

It raises government revenue, which can be used to solve the externality via other methods such as through education

This may help goods become more elastic in the long run- the effect will depend on what the government does with the revenue raised

Disadvantages of indirect taxes

It is difficult to know the size of the externality and so it is difficult to target the tax- the effect depends on where the tax is set and therefore the government suffers from imperfect information

There could be conflict between the government goal of raising revenue and solving the externality, which makes setting the tax difficult

It could lead to the creation of a black market

If there is inelastic demand for the good, the tax will ineffective at reducing output

Taxes are politically unpopular so governments will be reluctant to introduce them

Taxes are regressive- the poor spend a larger proportion of their income on indirect taxes than the rich do

Impacts of subsidies

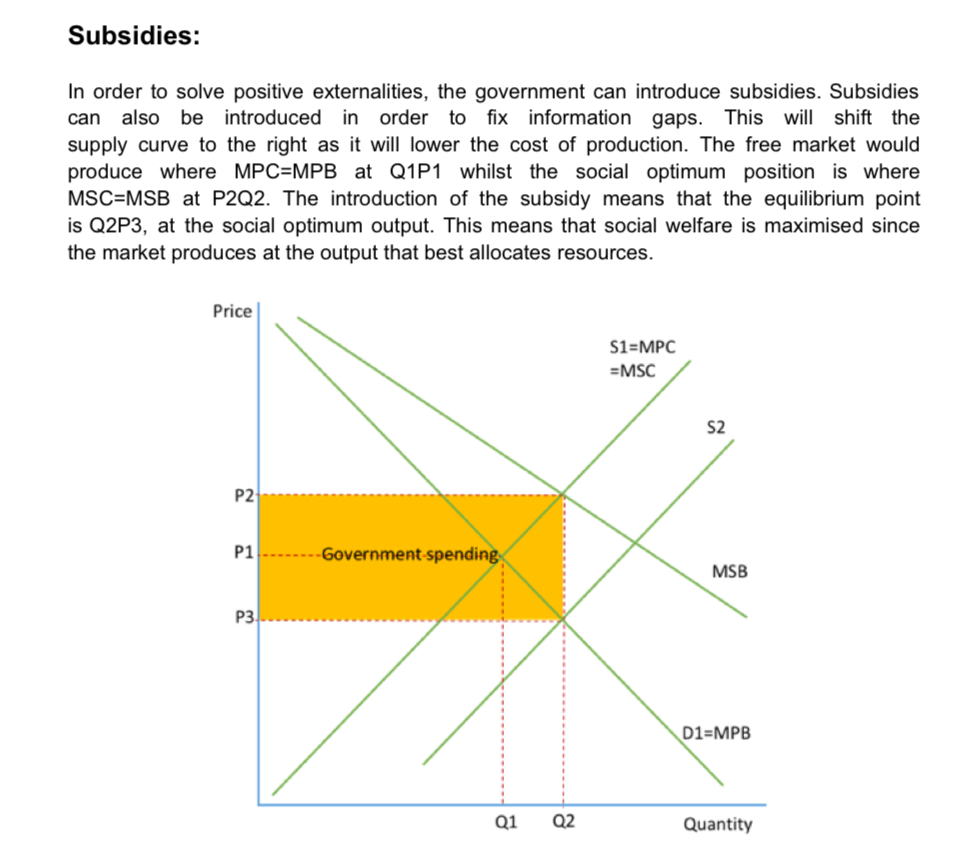

In order solve positive externalities, the government can introduce subsidies

Subsidies can also be introduced to fix information gaps

This will lower the costs of production and the free market would produce at where marginal private cost is the same as marginal social benefit

Advantages of subsidies

Society reaches the social optimum output and welfare is maximised

They can have other positive impacts, such as encouraging small businesses, bringing about equality and encouraging exports

Disadvantages of subsidies

The government has to spend a large amount of money, which will have a high opportunity cost

As with taxes, they are difficult to target due to the fact the exact size of the externality is unkown

Subsidies can cause producers to become inefficient, especially if they are in place for a long time

Once introduced, subsidies are difficult to remove

Examples of subsidies

Biofuels, solar panels, apprenticeship schemes

Maximum pricing

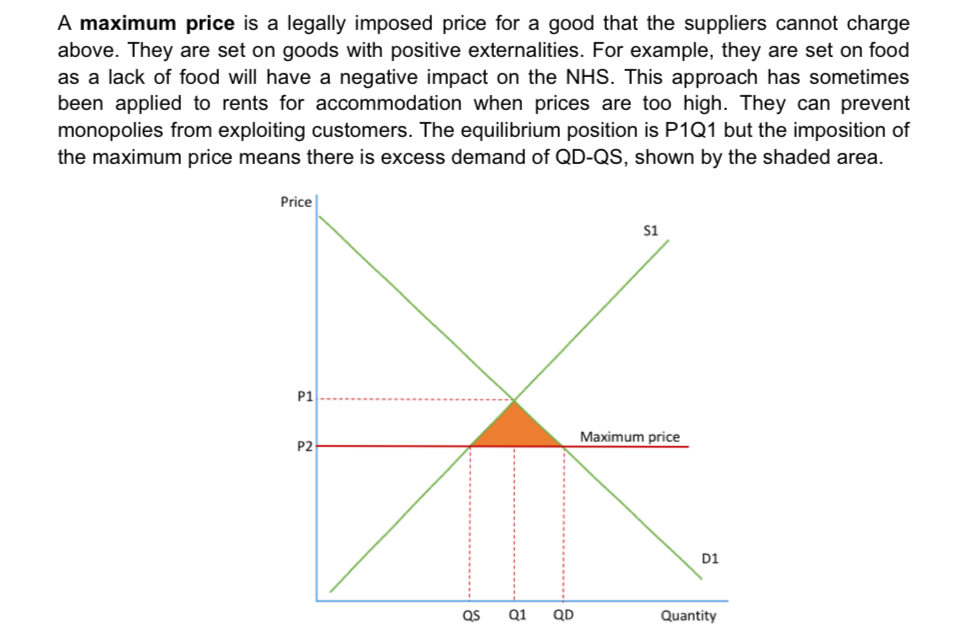

For a maximum price to have an effect, it must be set below the current price equilibrium

A maximum price is a legally imposed price for a good that suppliers cannot charge above

They are set on goods with positive externalities- a lack of food will have a negative impact on the NHS

This approach has been applied to ents for accommodation when prices are too high

They can prevent monopolies from exploiting customers

Minimum pricing

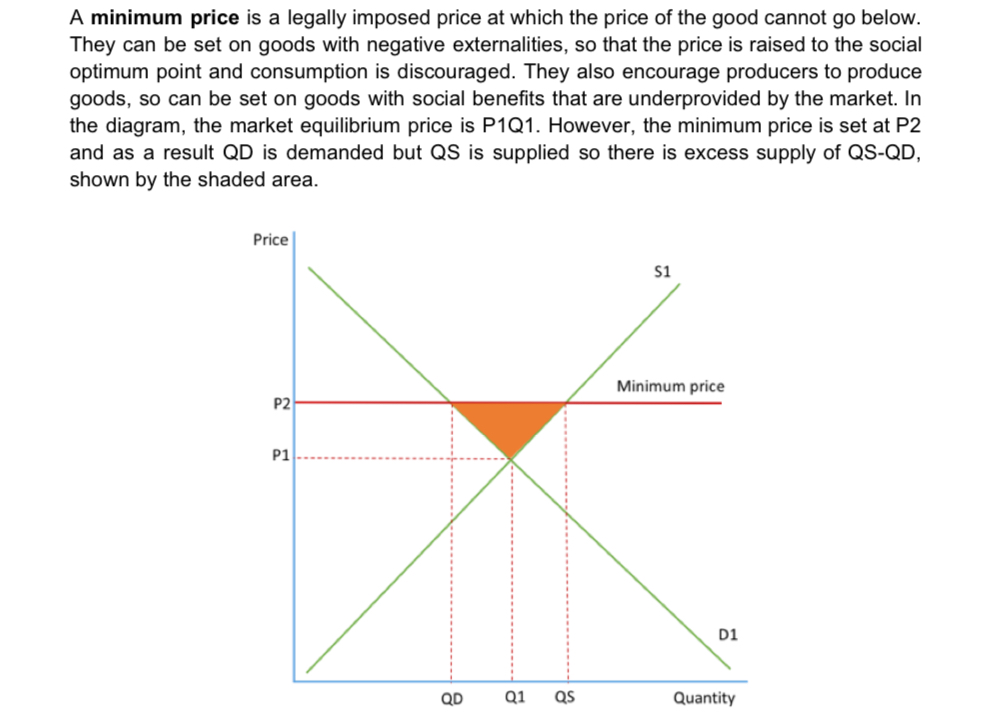

For a minimum price to have an effect, it must be above the current price equilibrium

A minimum price is a legally imposed price at which the price of the goods cannot go below

They are set on goods with negative externalities such as alcohol and cigarettes

This is done so that the price is raised to the social optimum point and consumption is encouraged

It also encourages producers to make goods- can be set on goods with social benefits that are unprovided by the market

Advantages of Minimum and Maximum pricing

They can be set where MSB=MSC- it will allow for the consideration of some externalities so it will help increase social welfare

A maximum prices ensures that goods are affordable, whilst a minimum price will ensure producers get a fair price- both of these are able to reduce poverty and can increase equality/equity

Disadvantages of Maximum and Minimum pricing

There is a distortion of price signals and this causes excess supply/demand- excess demand will lead to questions on the allocation of goods and excess supply will lead to questions about how to handle the excess goods

It i difficult for governments to know where to set the prices- it will have implications on the size of excess demand/supply

Both can lead to the creation of black markets- maximum prices may also lead to illegal bribes or discriminatory policies in allocating goods

Tradable pollution permits

A pollution permit allows the owner to pollute up to a specific amount of pollution

Th government controls how many permits there are and therefore limits the maximum amount of pollution

Companies have to buy permits in order to pollute

To increase profits and cut costs, companies may use greener technology meaning they can sell their unused permits to other companies

If a company goes over their limit, they will face legal action

Due to a fixed supply of permits, an increase in demand will inflate the price of the permits meaning companies have more incentive to cut emissions via greener technology

Advantages of tradable pollution permits

A fall in pollution is guaranteed due to the fact that there is a cap to the number of permits- it will reach the targets set by the government and therefore maximise social welfare

The government can increase revenue via increasing the price of permits and by fining firms who exceed their limit

Encourages investment into greener technology

Firms are able to to make their own decisions about whether to cut pollution or purchase more permits- encourages efficiency

Disadvantages of tradable pollution permits

It can be expensive to monitor and police- it will only work if monitored well- the government needs to impose fines large enough to ensure the following of regulation

It will raise business costs and these could be passed onto consumers

It may be difficult know how many permits the government should allow

State provision of public goods

These are non-excludable, non-rivalrous goods which will be under provided by the free market due to the free rider problem- leading to market failure

As a result, the government will produce the goods with them being financed via taxation

The government can also provide merit goods

Advantages of the state provision of public goods

Correct market failure by providing important goods which other wise would be under produced by the free market- therefore leading to improved social welfare

It can help bring out equality by ensuring everyone has access to basic goods

There will be benefits of the good itself eg: providing healthcare ensures a healthy workforce which will help improve economic growth

Disadvantages of state provision of public goods

It is expensive and has a high opportunity cost

The government may produce the wrong combination of goods due to the fact that the market is not involved- consumers can’t indicate their preferences eg: too few hospital beds and too many soldiers

The government may be inefficient at production since they have no incentive to cut costs

Government officials may suffer from corruption

Provision of Information

When there is asymmetric information, the government provides information to allow people to make informed decisions. They may also force companies to provide information

Advantages of provision of information

This helps consumers to act rationally, which allows he market to work properly

It is best if the government uses this alongside other policies- for example, it can make demand more elastic in the long run and therefore help indirect taxes to be more effective at reducing output

Disadvantages of provision of labour

It can be expensive for the government to do, incurring an opportunity cost

The government themselves may not always have full information, therefore making it difficult to inform potential consumers

Consumers may not listen to the information provided due to irrational behaviour

Regulation

Governments are able to impose laws and caps to ensure that levels are set where MSB=MSC or to ensure that companies provide full information on products

The government can also introduce regulatory bodies for such as OFCOM for communications and OFGEN for energy

These ensure firms follow regulation and do not exploit their customers or take advantage of market position

Advantages of regulation

Can ensure consideration of externalities and prevent the exploitation of consumers and keep consumer fully informed

This will also help to overcome market failure and maximise social welfare

Disadvantages of regulation

Laws may be expensive for the government to monitor, incurring an opportunity cost

They don’t take into account the different costs of following the laws for different companies- compared to tradable pollution permits, regulation is a less efficient method of reducing pollution

Firms may pass on costs to consumers

Excessive regulation may reduce competition in a market and efficiency, by increasing bureaucracy and reducing innovation

What is government failure?

When government intervention in the market leads to net welfare loss and a misallocation of resources

The total social costs arising from the intervention are greater than the social benefit

Causes of government failure

Distortion of price signals

Unintended consequences

Excessive administration costs

Information gaps

Distortion of price signals

Some types of government intervention change price signals in the market and distort the free market mechanism

As a result they keep some companies in business when they are inefficient so the resources should be switched to somewhere else (subsidies) or make consumers pay too much for a good (taxes)

Maximum and minimum prices lead to excess supply/demand and make allocation difficult

The price mechanism aims to allocate resources to their best use and where consumers want and value them most highly- by intervening, the government distorts the mechanism and so resources may be allocated inefficiently

Unintended consqeuences

Some interventions cause effects which the government did not intend to happen

Consumers and producers may react to new policies in unexpected ways and so the policy doesn’t have the effect it should

Excessive administration costs

In many cases, a lot of money that is allocated by the government is actually used up on basic administration costs

The social costs ma be higher than social benefits, once administration costs are taken into account

Eg: a lot of money given to the NHS is spent on organisational administration rather than medical care

Information gaps

Any decisions that the government makes must be based on some data but the information they have is always going to be limited

For example, you cannot accurately predict the number of cancer patients or vehicles on the road

Cost and benefit forecasts of investment are often wrong and so the government invests in a system where the costs are higher than the benefits, so there is welfare loss- it is impractical and usually impossible for a government to get every piece of information they need