Chapter 7: External returns to scale

0.0(0)

0.0(0)

Card Sorting

1/11

Earn XP

Description and Tags

Last updated 8:06 AM on 10/21/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

12 Terms

1

New cards

External increasing returns to scale

looking at the number of firms in the market

When the industry size increasing, so will the efficiency

When the industry size increasing, so will the efficiency

2

New cards

When will firms enter the makets?

They will enter the market up until the point where there is no profit

3

New cards

Average cost

total cost for all units produced divided by the number of units

Downward sloping curve as it decrease as the number of units increase

Downward sloping curve as it decrease as the number of units increase

4

New cards

Increasing returns to scale

When production quantity increases, the average price of producing will decrease (same as economies of scale)

5

New cards

Specialised suppliers

And individual company can not provide a large enough market. A localised industrial cluster will solve this by bringing together many suppliers to create a big enough market to support another market

(think of Silicon Valley as suppliers to the tech industry)

key inputs will be cheaper as many firms compete to provide them

(think of Silicon Valley as suppliers to the tech industry)

key inputs will be cheaper as many firms compete to provide them

6

New cards

Labour Market Pooling

A cluster of firms can create a pooled market for workers with the right skills.

Is an advantage to both workers and producers

Is an advantage to both workers and producers

7

New cards

Knowledge spillover

Firms can learn from the other firms in their industry. Happens when industries are located in a cluster.

8

New cards

Equilibrium

AC=QD

9

New cards

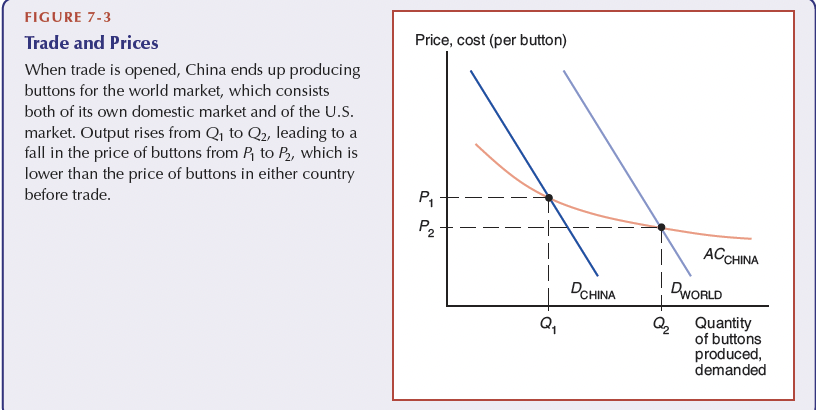

Free trade with external economies of scale

The country with the lower AC curve will expand (output increase and AC decrease). World prices will decrease

The country with the higher AC will contract and import the good.

The country with the higher AC will contract and import the good.

10

New cards

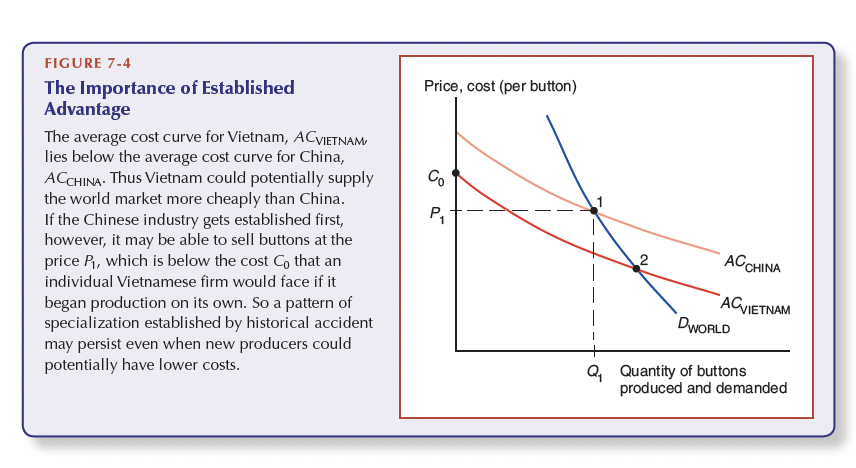

Patterns of trade

Comparative advantage explains some of it (the price of labour/capital, technology).

Historical contingency → Tradition → established advantage in an industry (think Switzerland and watches)

- A single firm with lower prices cannot compete with an entire industry

Historical contingency → Tradition → established advantage in an industry (think Switzerland and watches)

- A single firm with lower prices cannot compete with an entire industry

11

New cards

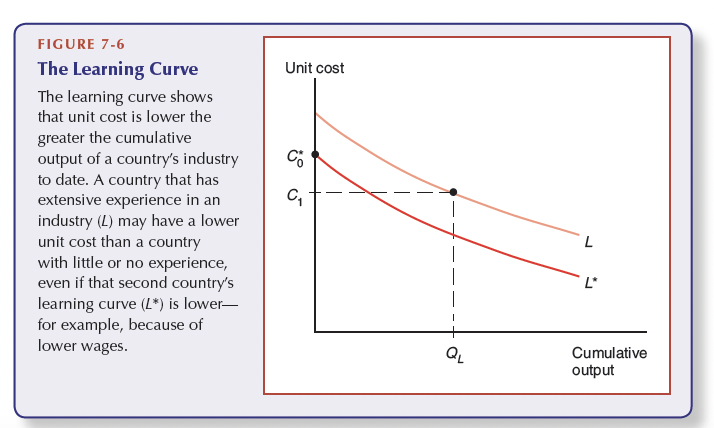

Dynamic increasing returns

learning curve

As one firm improves its products, other firms will learn from that → The entire industry becomes more efficient → increase the cumulative output

An industry with more knowledge might have a higher learning curve than an industry with no knowledge. The other industry has lower production costs (lower wages etc) but less production experience.

As one firm improves its products, other firms will learn from that → The entire industry becomes more efficient → increase the cumulative output

An industry with more knowledge might have a higher learning curve than an industry with no knowledge. The other industry has lower production costs (lower wages etc) but less production experience.

12

New cards

Infant industry argument

new industries require protection from international competitors until they become mature, stable, and are able to be competitive. The infant industry argument is commonly used to justify domestic trade protectionism