Unit 6 microeconomics: 4 Market Failures

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

5 Characteristics of Free Market

little government involvement in the economy

Individuals own resources and determine what to produce, how to produce, and who buys it.

The opportunity to make profit gives people incentive to produce quality items efficiently.

wide variety of goods available to consumers

competition and self-interest work together to regulate the economy.

What is Market Failure?

situation in which the free-market system fails to satisfy society’s wants

private markets do not efficiently bring about allocation of resources.

The government must step into satisfy society’s wants

Markey Failure 1: Public Goods

It’s impractical for the free-market to provide the goods because there is little opportunity to earn profit.

Free Riders are individuals that benefit without paying

keeps firms form making profits

if left to free market, essential services would be underproduced

Definition of public goods

nonexclusive:

Everyone can use the good.

Cannot exclude people from enjoying the benefits

Shared Consumption:

one person’s consumption of a good does not reduce the usefulness to other people.

maximizing rule for Public goods

Marginal social benefits >/= marginal social costs

Market failure 2: externalities

external benefits/costs to someone other than the original decision maker.

with no gov involvement, there would be too much or too little of a good.

Negative externalities

spillover costs

overallocation of resource

negative effect to others, too much produced

Two supply curves: MSC and MPC

ex: cigarettes

solved by per unit taxes

positive externalities

spillover benefits

underallocation of resource

positive effect to others, too little produced

Two supply curves: MSB and MPB

ex: vaccines

solved by per unit subsidy

pollution in negative externalities

Cannot fully get rid of pollution because it is not possible

instead, government can sell the right to pollute and control amount

reduces pollution bc it costs $$

Market failure 3: monopolies

Monopolies destroy the key of a Free Market system - competition

Antitrust laws

Laws designed to prevent monopolies from forming and promoting competition

How to fix monopolies market failure?

government involvement in all 3 branches

legislative branch: passed laws designed to stop monopolies

executive branch: federal trade commission must approve all corporates merges

judicial branch: supreme court finds the firms guilty or not and assigns punishment

The Lorenz Curve

Lorenz curve shows the actual distribution of income

the wider it is the more unequal the income distribution is

Gini Coefficient

the area between the line pf equality and the lorenz curve

G coefficient of 0 =perfect income equality

G coefficient of 1 = perfect income inequality

Why does the government tax?

finance government operations such as public goods and fund gov programs

Influence economic behavior of firms and individuals such as excise taxes to discourage or subsidies to encourage

Types of Taxes

progressive taxes: takes larger % of income from high income

proportional taxes: taxes same % of income for everyone

regressive taxes: takes larger % from low income (sales tax)

designed to push rich people to spend more bc taxed less

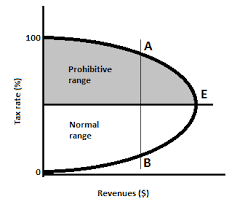

Laffer Curve

shows relationship between tax rate and tax revenue

if the government increases tax rate, tax revenue will increase

if tax rates become too high, tax revenue will fall since workers have no incentive to work harder