Financial Markets

1/58

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

59 Terms

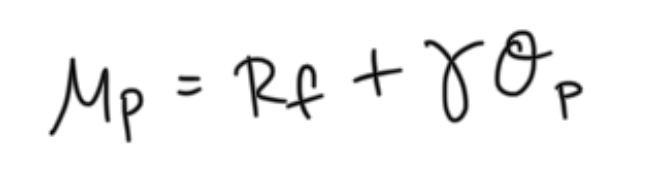

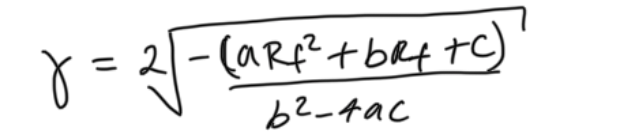

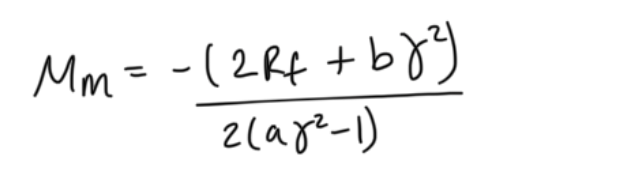

CML

market expected return

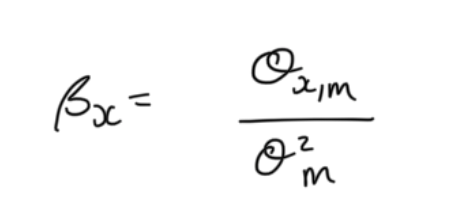

beta

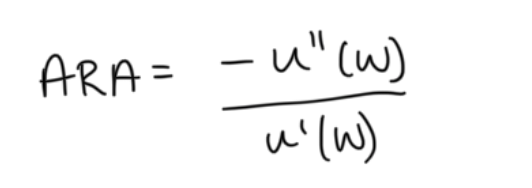

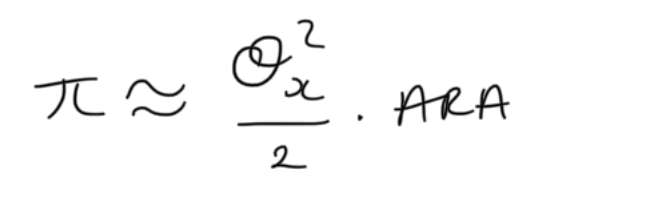

ARA

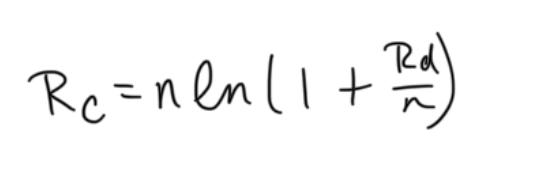

continuous return from discrete

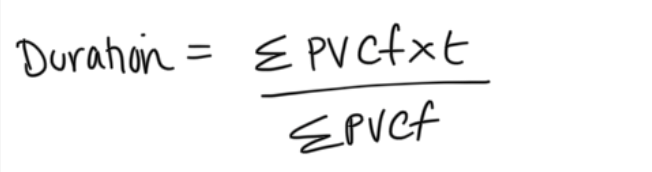

duration

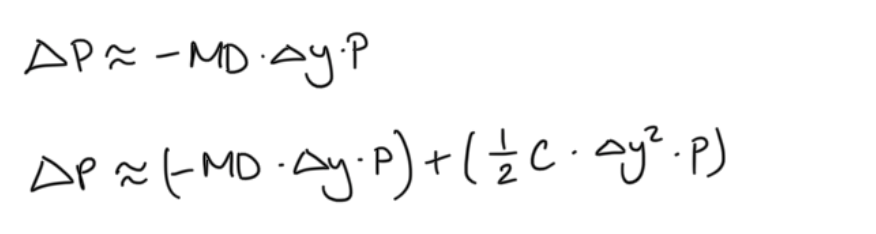

change in price using duration

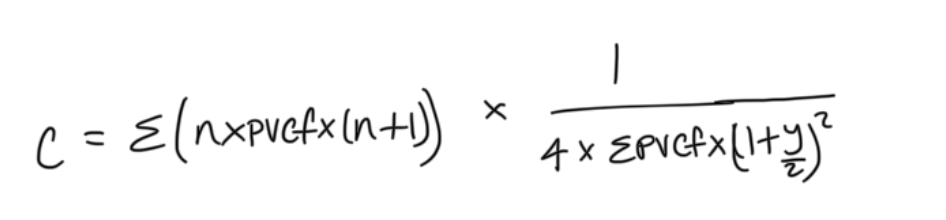

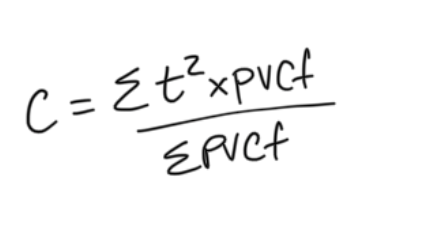

convexity using discrete compounding

convexity using continuous compounding

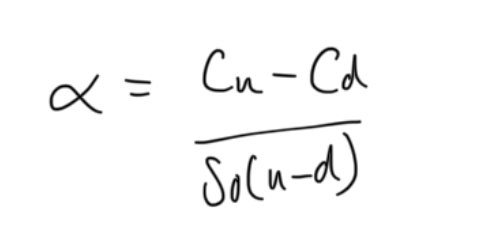

hedge ratio

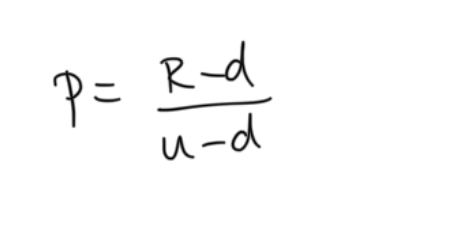

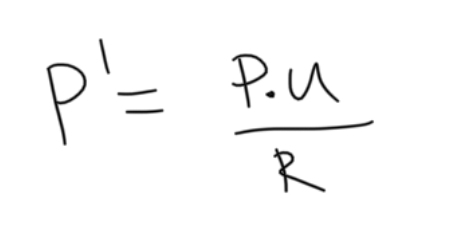

Pseudo probability, p

price of call option

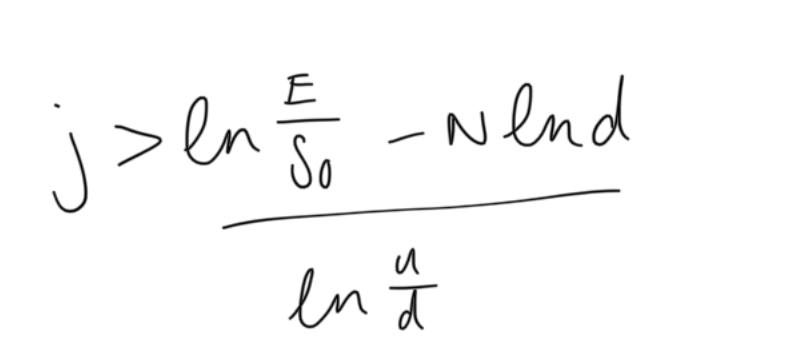

min. number of ups to get positive payoff

RRA

= ARA*w

amount you would be willing to give up in a fair bet

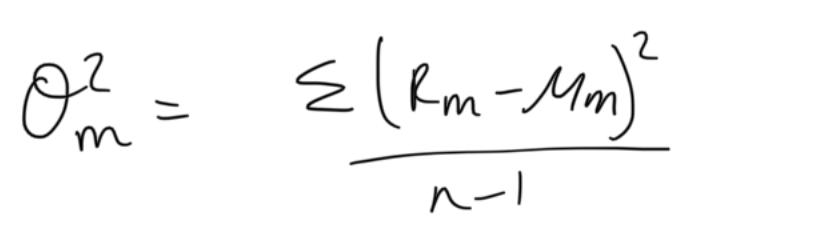

market variance

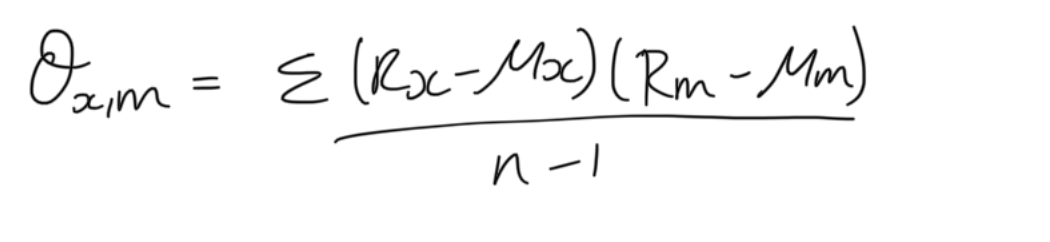

covariance

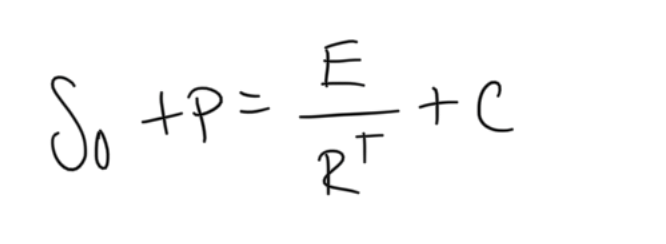

put-call parity

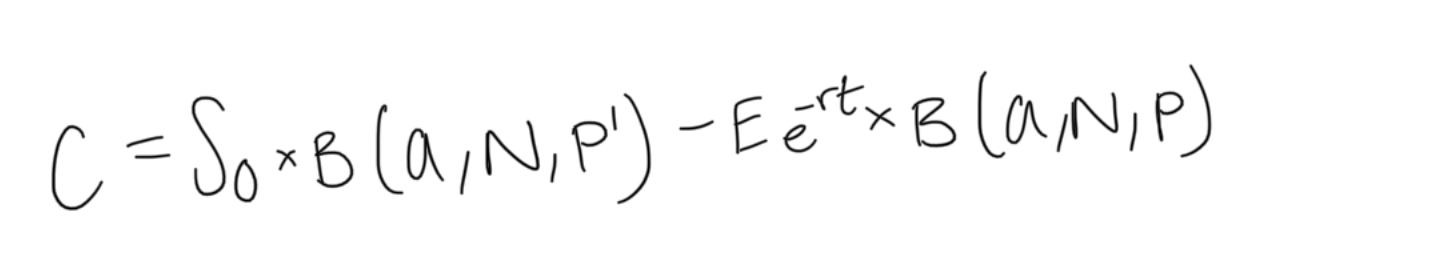

call pricing using binomial approximation

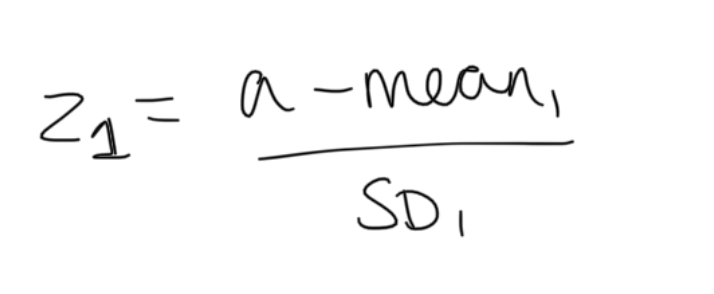

Z1

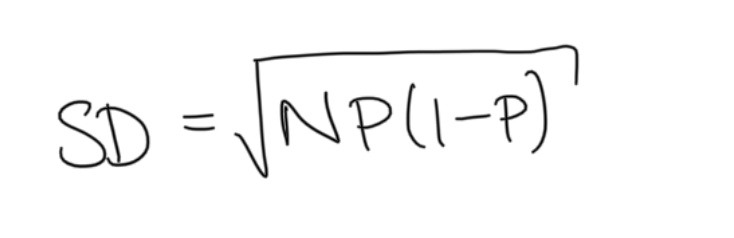

SD1

PI

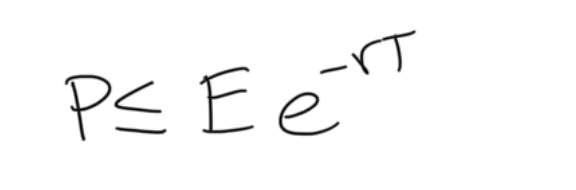

upper bound for call option

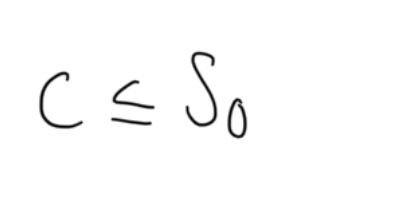

upper bound for put option

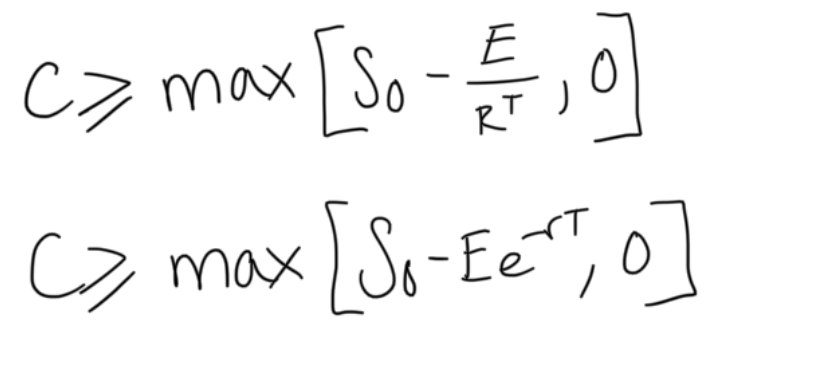

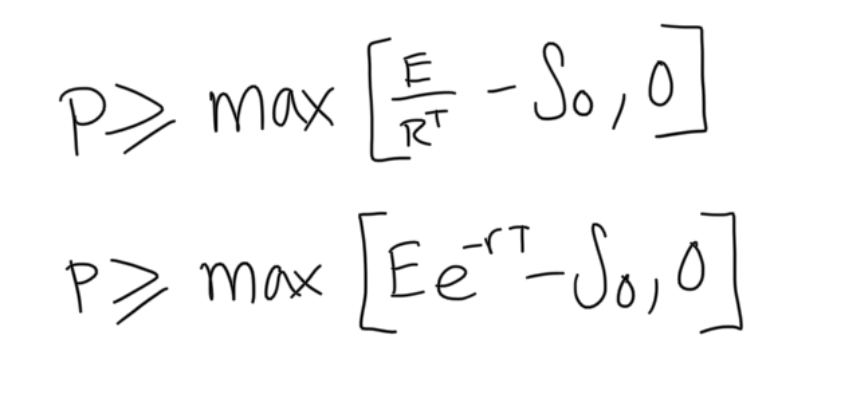

lower bounds of call option

lower bounds for put options

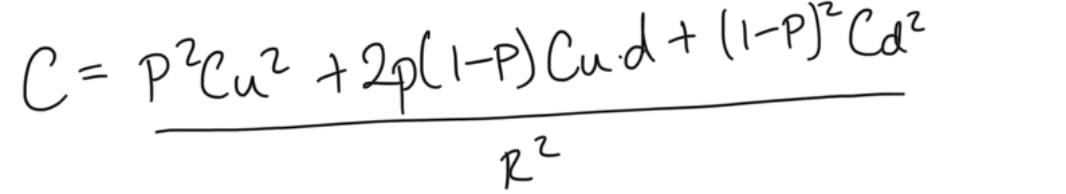

two period binomial option pricing

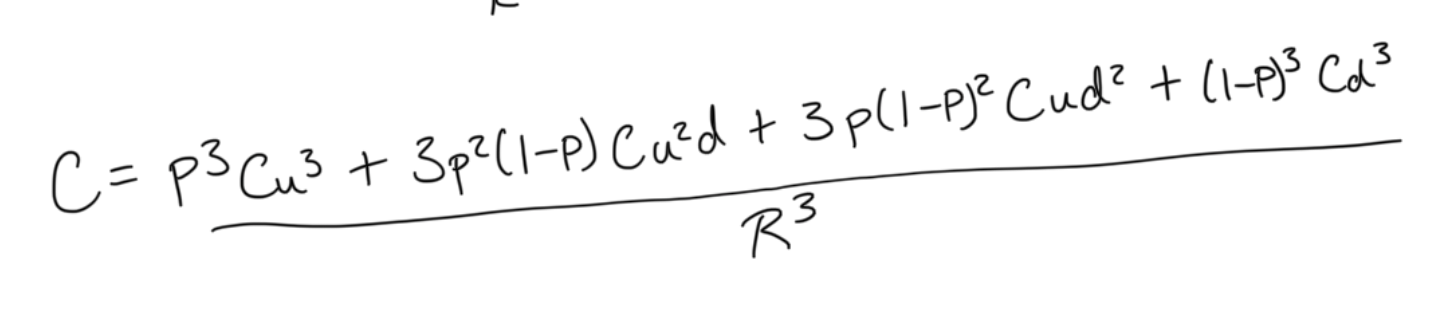

three period binomial option pricing

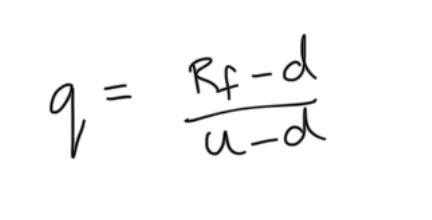

risk neutral probabilities, q

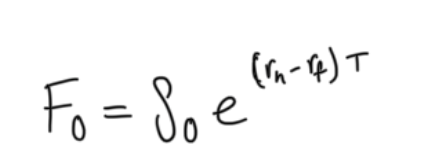

forward prices, no income

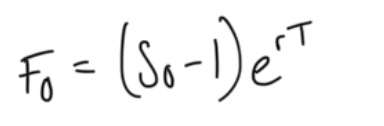

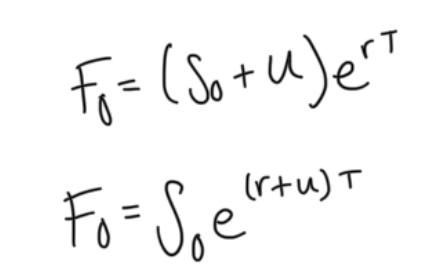

forward prices, predictable income

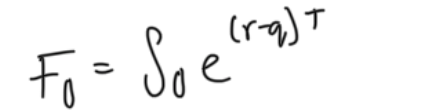

forward prices, predictable yield

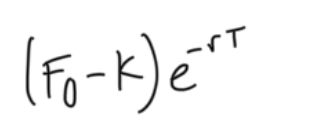

value of long forward

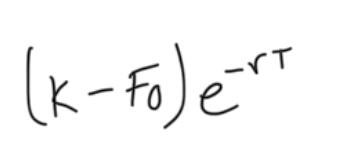

value of short forward

forward rate on currencies

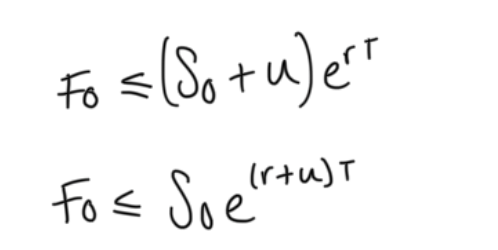

forward rate on investment commodities

forward rate on consumption commodities

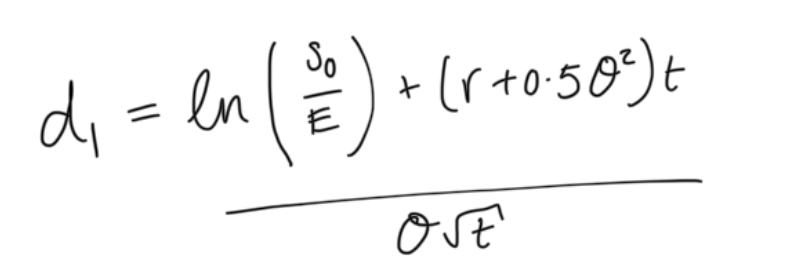

d1

d2

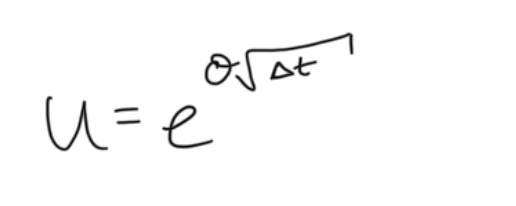

u =

d =

1/u

CAPM Assumptions

no transaction costs

all assets are infinitely divisible

no personal taxes

markets are purely competitive

investors choose portfolios purely on expected return and standard deviation

short sales permitted

unlimited borrowing and lending at the risk free rate

investors have homogenous expectations

arithmetic returns

discrete compounding

multiplicative cumulation

non-symmetric reversal in return

not normally distributed

logarithmic returns

continuous compounding

additive cumulation

reversal in return is symmetric

more normally distributed

fama French model

extends CAPM to include two additional factors that capture systemic risk that is not explained by the market alone

factors: market, size, value

largely empirical

explains more of the variation in average returns than CAPM

empirically supported across many markets and long time periods

lacks strong theoretical foundations

interpretations of size and value factors still debated

carhart four factor model

extends on mama French by adding momentum factor

strong empirical support: captures size, value and momentum effects

widely used in performance evaluation

lacks deep theoretical foundation

momentum may arise from behavioural biases rather than risk premia

CAPM vs APT

CAPM is one factor only, APT has multiple factors

CAPM has market risk only, several system risks priced in APT

CAPM has weak empirical performance but APT has stronger

core idea of CAPM = excess returns depend on exposure to market portfolio

core idea of APT = expected returns are determined by multiple sources of systemic risk. condition of no arbitrage prevents mispricing.

effect of a decrease in market interest rate on utility of borrowers and lenders

market interest rate = -(1+r)

a fall in r makes the budget line flatter

can now access a higher utility curve

consumers consume more this period and next

effect of a decrease in market interest rate on the present wealth of borrowers and lenders

pv of future income = income*1/1+r

as r falls, pv of future income rises

borrower has negative future net income, lower r reduces the pv of loan repayments, increasing the present wealth of borrowers

lender has positive future income, lower r reduces pv of returns from lending - present wealth of lenders decreases

strategy for arbitrage

buy the undervalued option

short the stock if the option is a call

buy the stock if the option is a put

do this without borrowing - borrow cash if necessary

credit default swaps

derivative contract that transfers credit risk of a borrower from one party to another

protection buyer pays premium

protection seller compensates buyer if credit event occurs

settlement may be physical or cash

mainly used to hedge credit risk, speculate on changes in credit quality, and improve pricing efficiency between bond and credit markets

CDS involves counterparty risk, may encourage excessive speculation and can contribute to systemic risk if poorly regulated

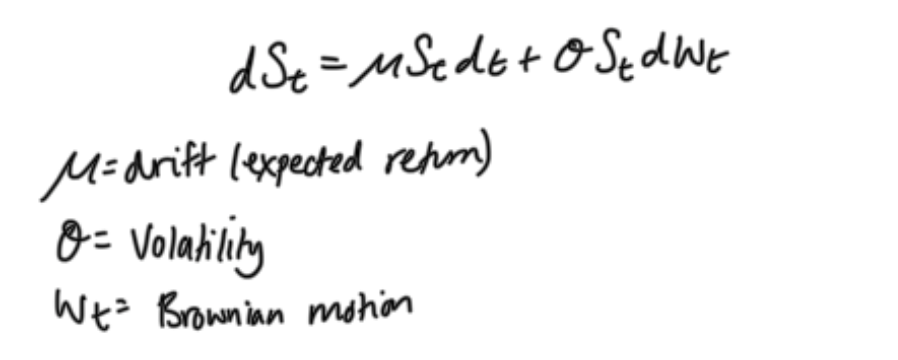

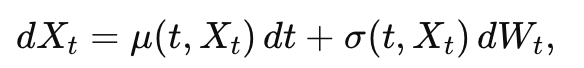

Explain the nature and properties of Brownian motion(BM); and explain the relevance of the standard form of scaled BM with drift to the pricing of options

stochastic process with following properties:

W0 = 0

independent increments: movements over non-overlapping time intervals are independent

normally distributed increments

continuous paths

stationary increments: distribution depends only on the length of the time interval

in finance it is used calculate stock prices

Itos lemma

applying Ito’s lemma gives the stochastic differential equation for option price

decomposition separates random part from deterministic part

by forming a hedged portfolio that eliminates dwt, creating a riskless portfolio

no arbitrage arguments lead directly to the Black-Scholes partial differential equation

complete vs incomplete market

complete = every possible payoff across all states of the world can be replicated exactly using traded assets

incomplete = some contingent payoffs cannot be replicated

redundant assets

if its payoff can be exactly replicated by a portfolio of other traded assets

its presence does not expand the set of attainable payoffs

removing it does not affect market completeness

Type 1 vs Type 2 arbitrage

type 1 = zero initial cost, non-negative payoff in every state, strictly positive payoff in at least one state

type 2 = negative or zero initial cost, non-negative payoff in every state, weak arbitrage

Arrow-Debreu security

hypothetical asset that pays 1 unit of consumption in one state of the world, and 0 in all other states

state price vector

is the vector of prices of all arrow debreu securities

each element gives the todays price of receiving 1 unit of payoff in a specific state tomorrow