FIN453 Lecture 5

1/13

Earn XP

Description and Tags

This set of flashcards covers key vocabulary related to private debt, its characteristics, and its role in investment strategies.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

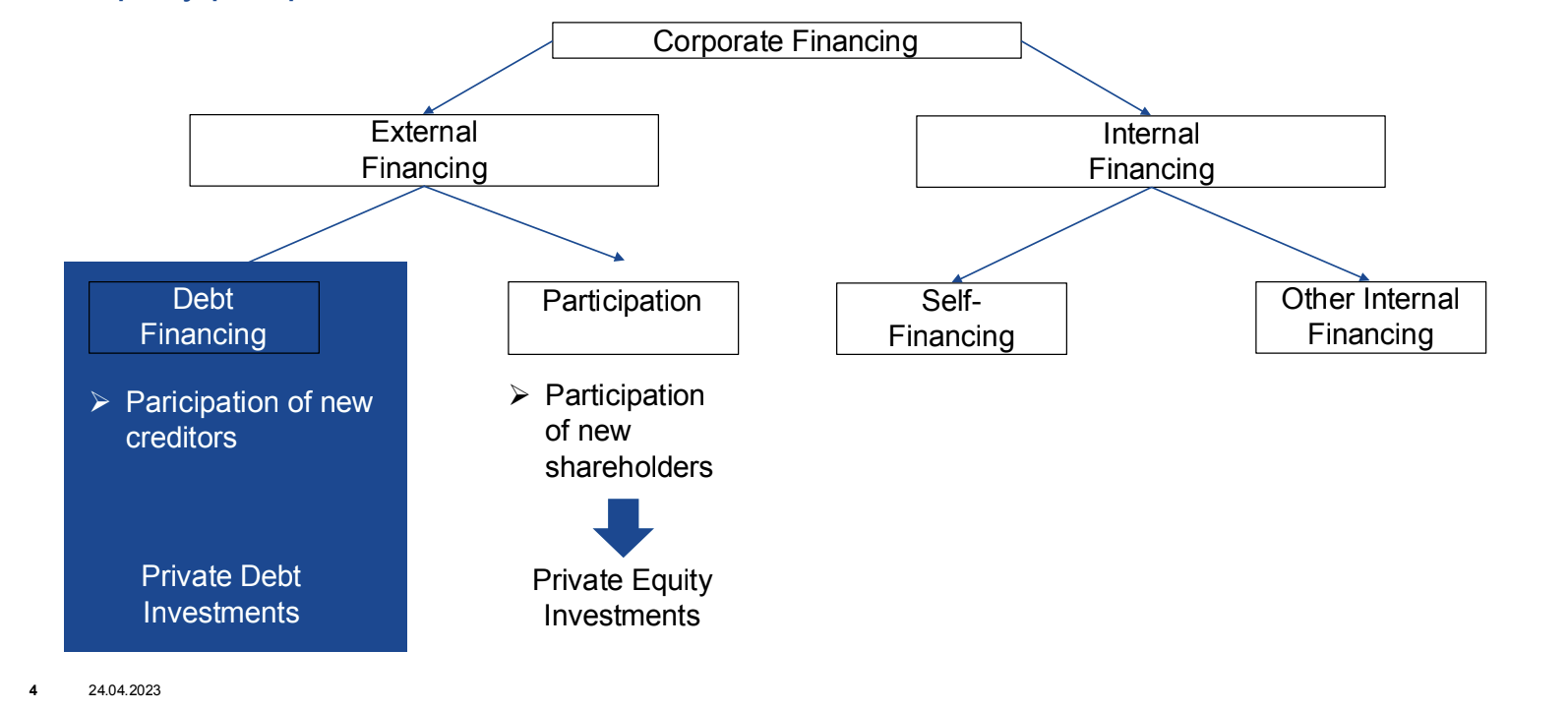

Private Debt

Loans that are privately negotiated between a lender and a borrower, often characterized by various types of securities like senior, junior, or mezzanine.

Direct Lending

A form of private debt where nonbank asset managers issue loans directly to companies.

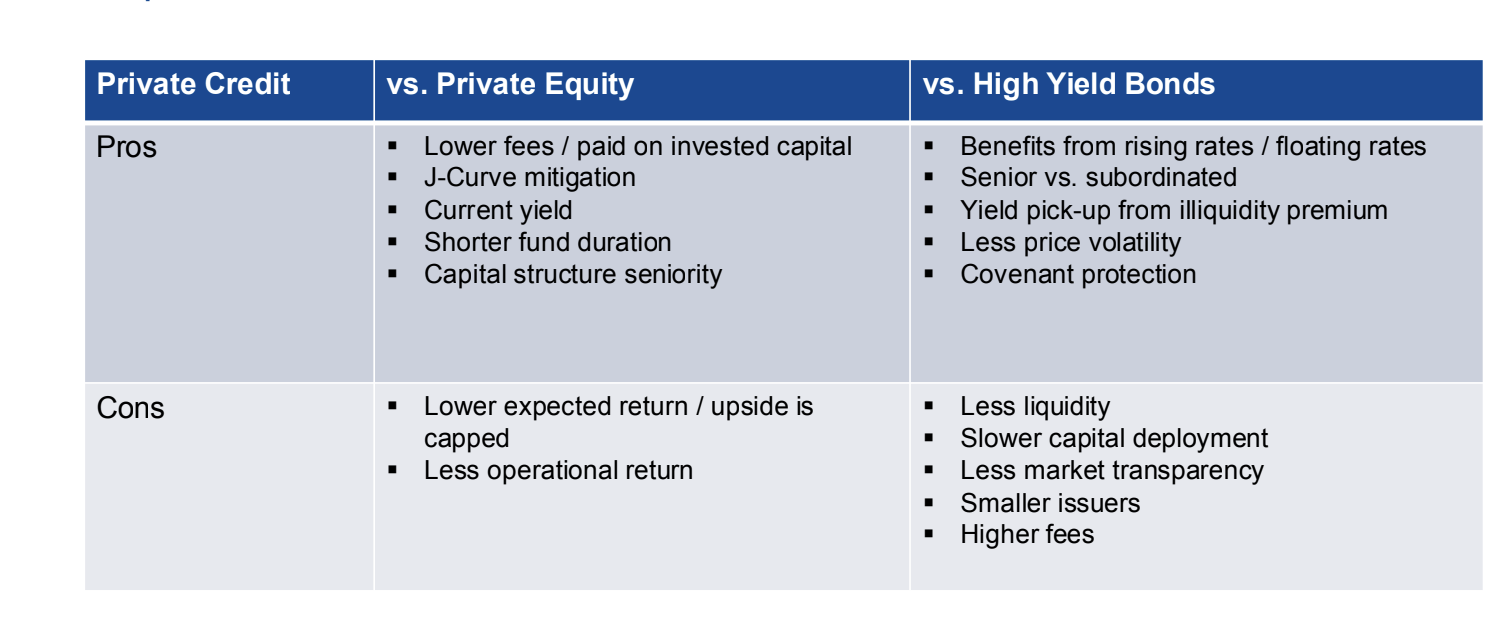

Illiquidity Premium

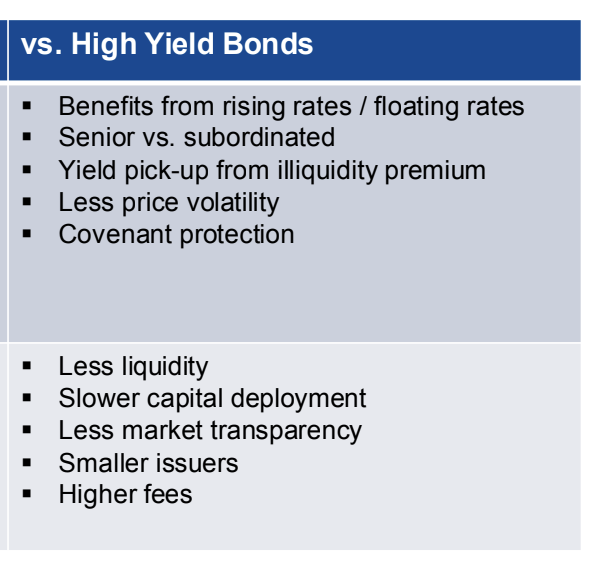

Higher yields offered by private debt due to illiquidity, compensating investors for the inability to quickly sell loans.

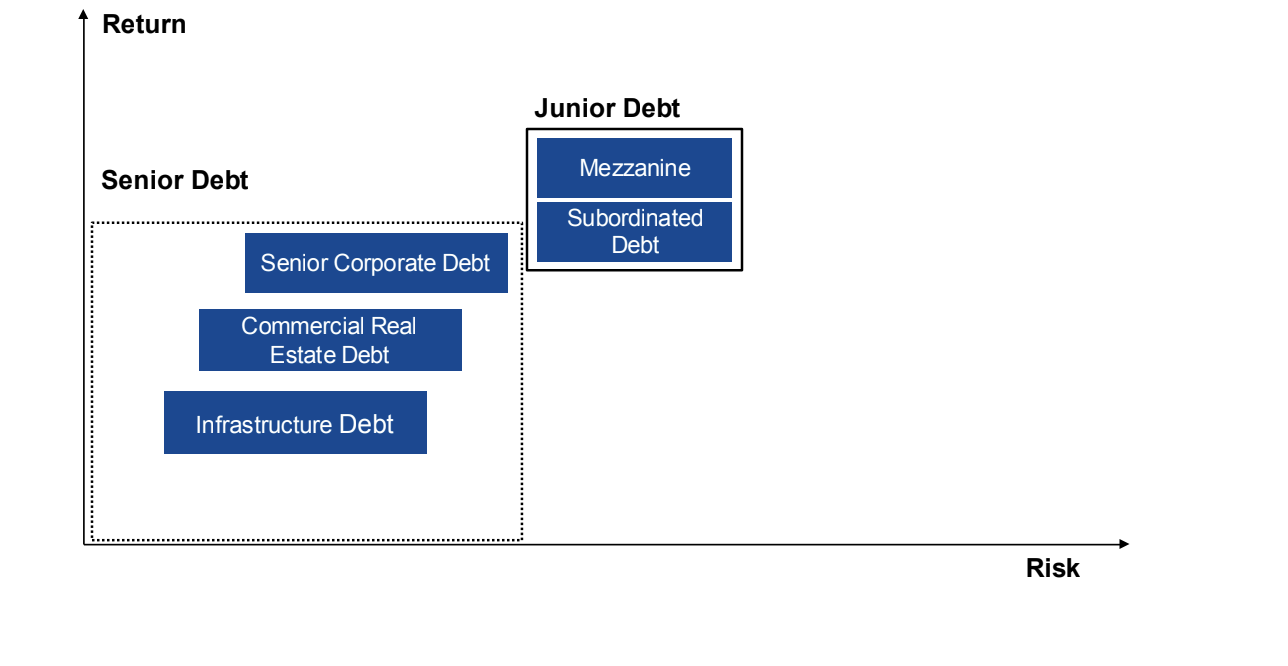

Mezzanine Debt

A subordinated (junior) debt that typically has a higher risk compared to senior loans but offers higher returns.

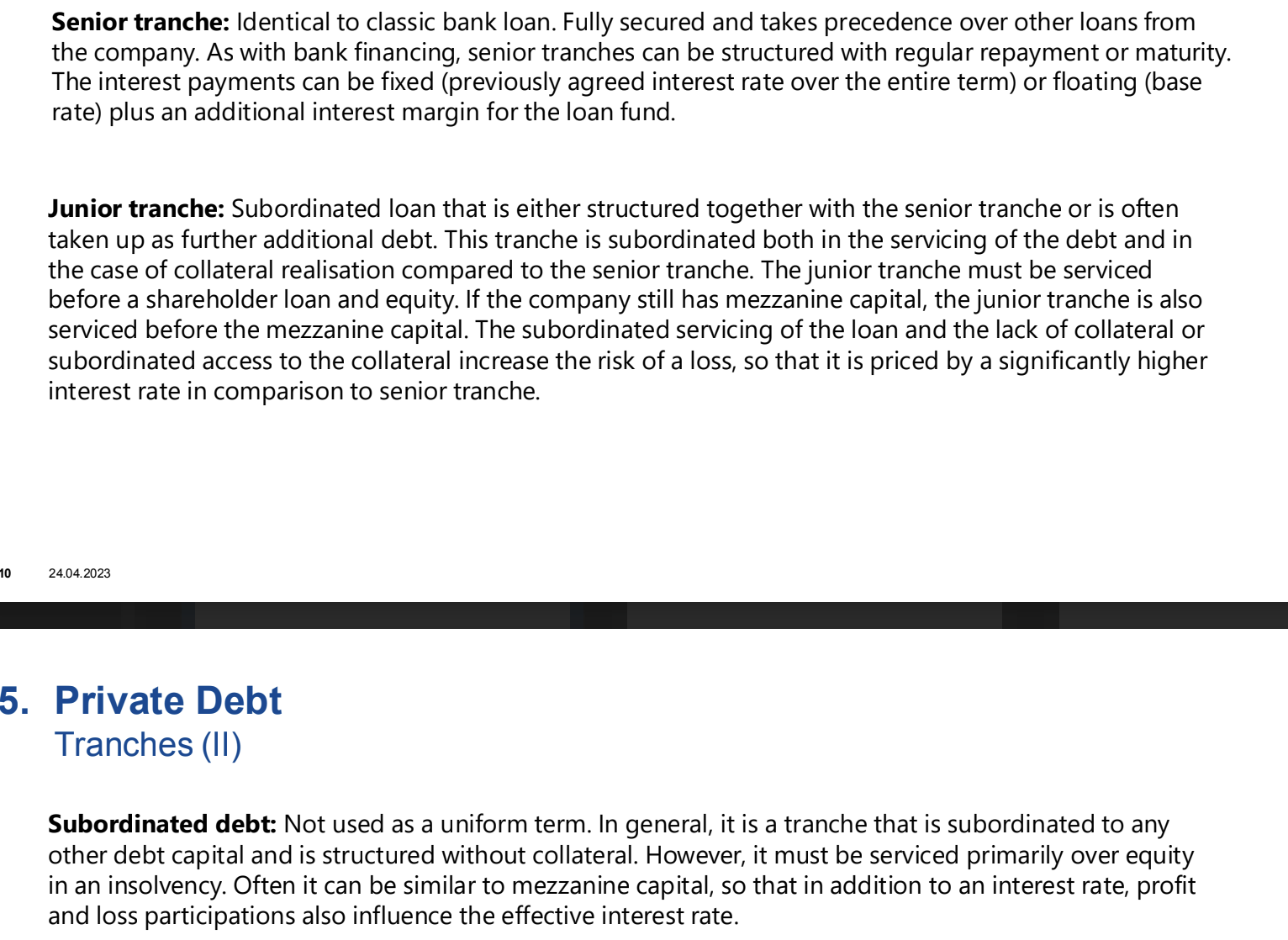

Tranche

A portion, piece, or slice of a pool or series of securities, often with different risk levels and returns.

Senior (like a classic bank loan), junior (either structured together with the senior tranche or is often taken up as further additional debt) and subordinated (Not used as a uniform term. In general, it is a tranche that is subordinated to any other debt capital and is structured without collateral)

Covenants

Conditions that borrowers agree to abide by in a loan agreement, helping reduce default risk.

Credit Risk

The risk of loss due to a borrower's failure to make payments on any type of debt.

Portfolio Diversification

The practice of spreading investments among various financial instruments, industries, and other categories to reduce risk.

Institutional Investors

Organizations that invest on behalf of their members, such as pension funds, insurance companies, and endowments.

High-Yield Bonds

Bonds that are rated below investment grade and offer higher returns due to increased risk.

Lower Market

Refers to companies with smaller revenue or capitalization that may seek funding through private debt.

Floating Rate Structures

Loans where the interest rate can change based on changes in a benchmark rate.

High-Yield Premium

Extra yield offered by private debt investments to compensate for risks not present in traditional investments.

Types

Direct lending, Senior / Junior debt, Mezzanine