Topic 2 - The Double entry system

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

15 Terms

It’s impractical to draw up a new SFP after every transaction, so what do businesses do instead?

What is the set of all these accounts known as?

keep a set of ‘books’ (or ‘ledgers’) with ‘accounts’ for each item

nominal ledger/general ledger = Accountants then use the figures from the nominal ledger to prepare the financial statements

What do accountants use a system of to record transactions in the accounts?

system of ‘debits’ and ‘credits’

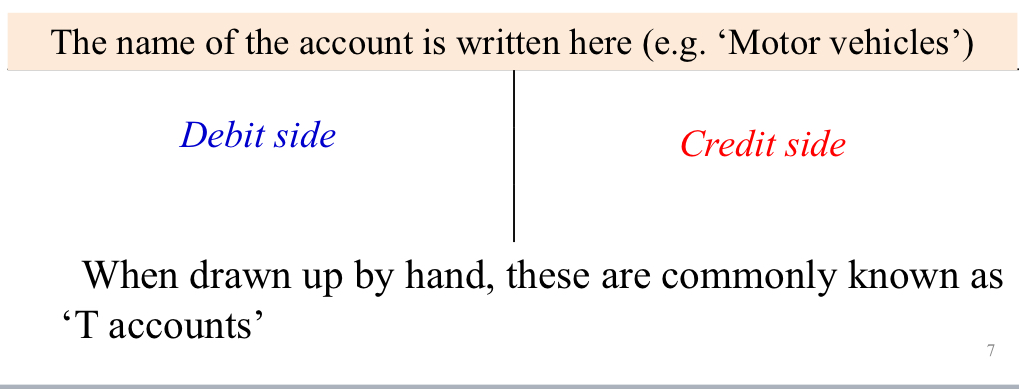

Each account is split into two halves

The left-hand side is always the ‘debit’ side and the right-hand side is always the ‘credit’ side:

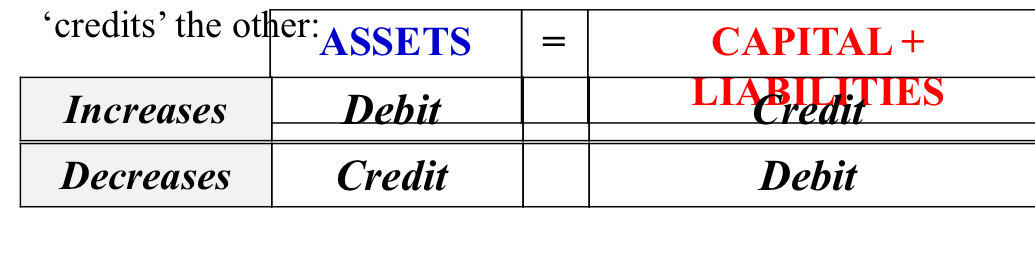

every transaction has two effects (requiring a debit and a credit), and the equation must always balance

Therefore ‘debits’ must represent one side of the equation and ‘credits’ the other:

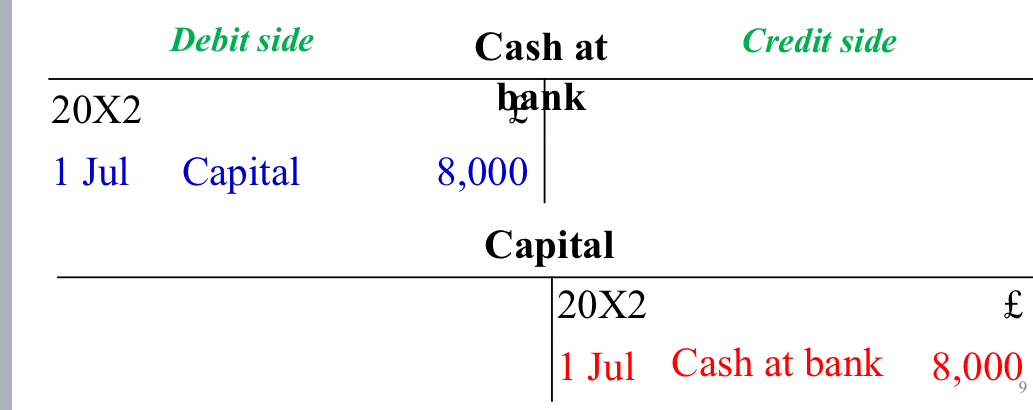

Meg starts a business on 1 July 20X2, transferring £8,000 of her own money into a new business bank account.

Solution:

Dual effect of this transaction:

i)The asset of cash at bank has increased (debit)

ii)Meg’s capital has increased (credit)

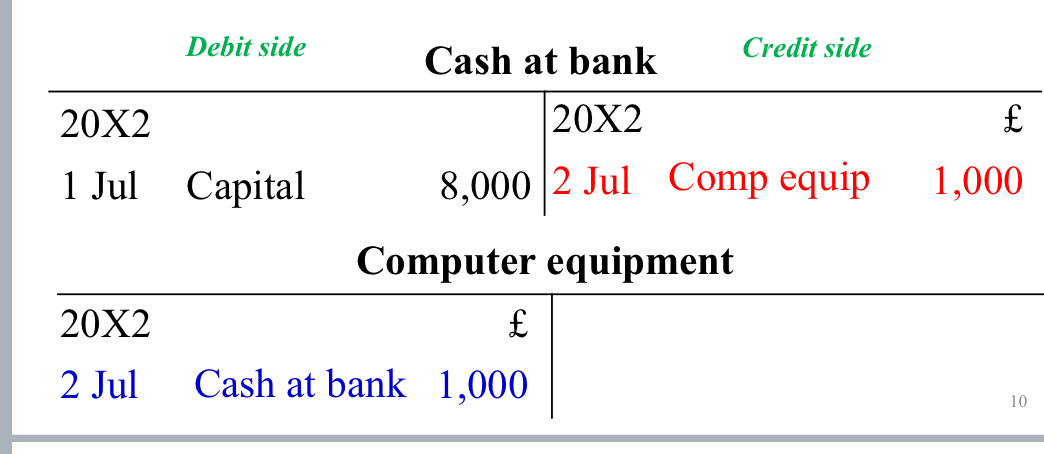

Double entry example: Meg’s business (continued)

On 2 July 20X2, Meg buys a laptop for the business for £1,000, paying in full immediately by bank transfer

Solution:

Dual effect of this transaction:

i)The asset of computer equipment has increased (debit);

ii)The asset of cash at bank has decreased (credit)

What about income & expenses?

businesses will also earn INCOMEand incur EXPENSES

All income and expenses must also be recorded in the accounts using the system of debits and credits

If income exceeds expenses, a profit is made

Since a business’s profit belongs to its owner, profits always increase the owner’s capital

What do ‘drawings’ mean in accounting?

term for what sole traders take out of their business (usually money) for their personal use

drawings are a reduction of owner’s capital,

If the owner takes money for him/herself, the double entry is:

Debit (Dr) Drawings account

Credit (Cr) Bank or Cash account

On 15 July 20X2, the owner takes £160 out of the business bank account for her own personal use.

Solution:

Dual effect of this transaction:

i.Drawings have been made, which are a reduction in capital (debit)

ii.The asset of cash at bank has decreased (credit)

Double entry mnemonic: DEADCLIC

Debit entries record increases in:

Expenses;

Assets; and

Drawings

Credit entries record increases in:

Liabilities;

Income; and

Capital

What does inventory mean?

represents goods bought (or produced) by a business for the purpose of selling them to its customers at a profit

do NOT use an ‘Inventory’ T account to record movements in inventory during the year. Instead:

Goods bought are recorded in the ‘Purchases’ T account

Goods sold are recorded in the ‘Sales’ T account

Goods returned to suppliers are recorded in the ‘Returns Outwards’ T account

What is the purpose of the ‘purchases’ T account?

only used for the purchase of those goods which the business buys with the prime intention of reselling

What’s the purpose of the Sales T account?

Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets.

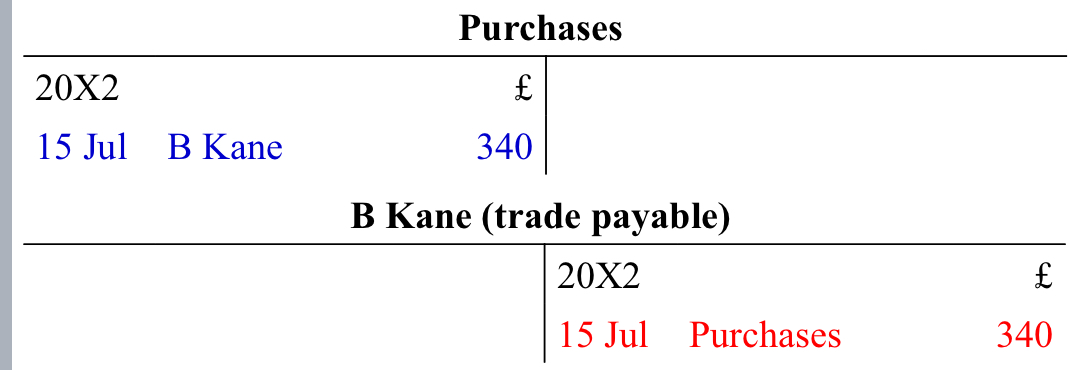

On 15 July 20X2, goods for resale costing £340 are bought on credit from a supplier, B Kane.

Solution:

Dual effect of this transaction:

i) A liability (amount owed to B Kane) has increased (credit)

ii) The expense of purchases has increased (debit)