Understanding Risk and Risk-Taking Behaviour

1/7

Earn XP

Description and Tags

Lecture 9

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

8 Terms

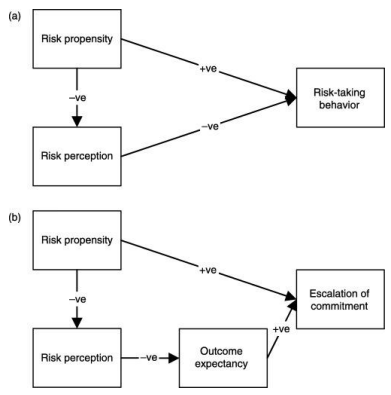

Sitkin & Pablo (1992) Conceptual Framework of Risk-Taking Behaviour

risk perceptions influence taking/avoiding risks. perceptions shaped by context.

risk propensity = tendency for risk-taking vs avoiding. stable but changeable over time.

risk perception = assessment of situation risk. reflects extent individual perceives situations as threat/out of control.

outcome expectancy = judgements of controllability of outcome, regardless of ability to influence.

Modern View of Risk (Mishra, 2014)

risk = uncertainty + possible gains/losses. not just danger, also opportunity.

Risk Propensity

Kogan & Wallach (1964) - general tendency to take/avoid risks. important for understanding who takes risks + why.

Josef et al. (2016) - varies between individuals; can change with experience/age.

Risky Behaviour (Trimpop, 1994)

behaviour where:-

outcomes uncertain

potentially sig. costs/benefits

affects physical, economic or psychosocial wellbeing

take risks due to expectations based on past experience. mediated by speed of learning from outcomes, degree of hating losses/loving gains + tolerance for uncertainty.

Typical Traits of Risk-Takers (Zuckerman, 2007)

impulsive, sensation-seeking

higher boredom proneness

difficulty regulating emotions

risky financial behaviours

risky health/safety behaviours

risky social/ethical behaviours

alcohol and drugs intensify risk-taking + peer pressure and social norms.

Risk Domains

risk-taking varies across domains e.g. finance, gambling, social, health (Mirsha, 2014).

risk unavoidable → decisions involve uncertainty + meaningful consequences. risk propensity differs due to traits/experiences.

risk perceptions drive behaviour - influenced by context/how situation is presented (framing).

Nicholson et al. (2006)

risk propensity links with age, sex + objective measures of career-related risk taking.

risk propensity high in extraversion and openness, low in neuroticism, agreeableness, and conscientiousness.

Rolison, Hanoch & Woods (2012)

age differences may depend on methodology of measuring risk-taking.

BART - behaviour depends on initial risk perception of first balloon+adjustment of behaviour in response to gains/losses.

young adults INITIALLY more willing to take greater risks - changes with experience.

older adults use simpler decision strats, make more errors (Mata et al., 2010).

Ps attend more to losses than gains.