Unit 7

1/105

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

106 Terms

What is macroeconomics?

A branch of economics concerned with the behaviour and performance of an economy as a whole

What are government macroeconomic objectives?

Quantifiable targets that the government wishes to achieve through the implementation of macroeconomic policy

What are the four main objectives for the macroeconomy?

Balance of payments equilibrium

Economic growth at trend rate

Employment

Price stability

What are the other 5 important objectives?

Fiscal balance

Living standards

Income and wealth equality

Productivity

Social indicators

What is GDP?

The total value of goods and services produced within an economy over a given period of time

What is aggregate demand?

The value of the demand for all the goods produced in the UK economy

What is aggregate demand made up of?

AD = C + I + G + N

What are the influences on consumption?

Interest rate

Rate of direct taxation (IT)

Incomes

Consumer confidence

What are the influences on investment?

Interest rates

Rates of direct taxation (Corp Taxes)

Income levels

Profit expectations

What are the influences on government spending?

Economic activity

Market failure

What are the influences on government net exports?

Income abroad

Income at home

Domestic price level

Exchange rates

What is the exchange rate?

The value of one currency in terms of another currency

What is appreciation?

When one currency increases in value against another so can buy more of that currency.

What happens to the price of UK exports following an exchange rate appreciation?

Price of UK exports rises as pound is worth more.

What happens to the price of imports following an exchange rate appreciation?

Price of imports coming into the UK falls as the pound is worth more

What is depreciation?

When one currency decreases in value against another so can buy less of that currency

What is a balanced budget?

When government spending = taxation receipts.

What is a budget deficit (fiscal deficit)?

When government spending exceeds taxation receipts.

What is a budget surplus (fiscal surplus)?

When government spending is less than taxation receipts

What is national debt?

The accumulation of previous borrowing that has not been paid back

Who lends the government money?

Banks/building societies, pension funds, investors

What are the 5 main objectives of the UK taxation system?

Fund Government spending

Managing the economy as a whole

Redistribution of income

Correcting market failure

Repay national debt

What are direct taxes?

Taxes directly levied on an individual or firm

What are indirect taxes?

Taxes on consumption

What are tax thresholds?

The level of income that has to be reached before tax is paid or before the tax payer moves into a higher rate of taxation

What’s hypothecation?

The principle that taxes are raised for a specific purpose. Taxes should be linked to the benefits taxpayers receive.

What is progressive taxation?

When the proportion of a person’s income paid in taxes increases as incomes increases

What is proportional taxation?

The same proportion of a tax payer’s income is taken regardless of the income earned

What is regressive taxation?

The proportion of a person’s income paid in taxes decreases as incomes increase

What are the benefits of income tax?

Direct taxes can be progressive

Can improve distribution of income

Simple to pay

Revenue can be forecast

What are the problems with income tax?

Can only be changed in the budget

Disincentive effects on work

What are the benefits of VAT and indirect taxes?

Influence spending patterns

Correcting externalities (internalising)

Can be changed easily

People have a choice whether to buy products

What are the problems of VAT and indirect taxes?

Regressive distributional effects

Can trigger cost-push inflation

Many people are unaware of how much indirect tax they pay

What are the benefits of corporation tax?

Profitable firms contribute to the economy

What are the problems of corporation tax?

If too high can be a disincentive for FDI

Large MNC’s have avoided paying it

What are the benefits of wealth taxes?

Equitable – those with more wealth should contribute more to society

What are the problems with wealth taxes?

Danger of taxing twice

Wealthy people may not have much income

What is an interest rate?

The cost of borrowing and the reward for saving. It is a percentage charge on the capital sum.

What is a real interest rate?

The nominal interest rate minus the rate of inflation

What is the Annual Equivalent Rate (AER)?

The interest rate on savings with annual compound interest added on.

Why are there different rates of interest?

Risk

Amount

Time

Expectations of future interest rates and inflation

Security

What is economic growth?

An increase in the economic activity of an economy over a period of time

What is GDP?

The value of all goods and services (output) produced within an economy over a given period of time.

What is real GDP?

The country’s output measured in constant prices with inflation accounted for

What is demand-led growth?

When an increase in aggregate demand is due to consumer-led spending or government spending

What is the economic cycle?

The regular fluctuations in economic activity over time. The stages to the cycle consist of boom, recession, slump/depression and recovery.

What happens in a boom?

GDP rises faster than the trend rate of growth. The economy may be producing beyond full capacity.

What happens in a recession?

Economic activity slows down

What happens in a slump/depression?

There’s negative economic growth where the economy is producing at below is the previous peak level of output.

What happens in a recovery?

Economic activity begins to increase and output begins to rise at a faster pace

What is supply led growth?

When increases in aggregate supply are due to the costs of production falling.

What are the benefits of economic growth?

Welfare increases

Employment increases

Living standards increase

Less poverty

What are the costs of economic growth?

Well-being

Other objectives

Relative incomes

Sustainability

Externalities

What is employment? Why is it important?

The employment of labour in the economy. It’s important as people rely on wages for most of their income.

What is full employment?

When the economy uses all of its workforce - those who want a job have one

What is the labour force/workforce?

People of working age who are willing and able to work

What is unemployment?

When workers who are able and willing to work are unable to find employment at current wages.

What is the unemployment rate?

The number of people willing and able to work but unable to secure employment expressed as a percentage of the workforce.

What is the formula for the unemployment rate?

Unemployment Rate = (Number of Unemployed / Labour Force) x 100

What is the claimant count?

A measure of unemployment according to the number of people claiming unemployment-related benefits

What are the 4 main types of unemployment?

Structural, cyclical, frictional, seasonal

What is structural unemployment?

When the industrial structure changes the types of jobs needed and, thus, the skills required

What is cyclical unemployment?

When the economic cycle may be in recession so there’s less demand for goods and services so workers are laid off

What are the problems for the economy that are caused by unemployment?

Wasted resources

Budget deficit

Regional problems

Excluded workers (the Hysteresis effect)

What are the problems for the individual that are caused by unemployment?

Social problems

Lower living standards

Cost to taxpayers

What is price stability?

When the general level of prices is kept constant or grows at an acceptably low rate over time without volatility

What is inflation?

The sustained rise in the general price level over time (the rate figure is positive).

What is the rate of inflation?

The sustained rise in the general price level over a period of time expressed as the percentage increase in the price level.

What is deflation?

A sustained fall in the general price level over time (the rate figure is negative)

What is disinflation?

Falling rates of inflation. This means that the general price level is increasing at a slower rate.

How is inflation measured?

The CPI (consumer prices index) is published by the ONS monthly

What is demand-pull inflation?

Inflation that arises from increases in aggregate demand

What is cost-push inflation?

Arises when the costs of production increase, leading to higher prices goods and services

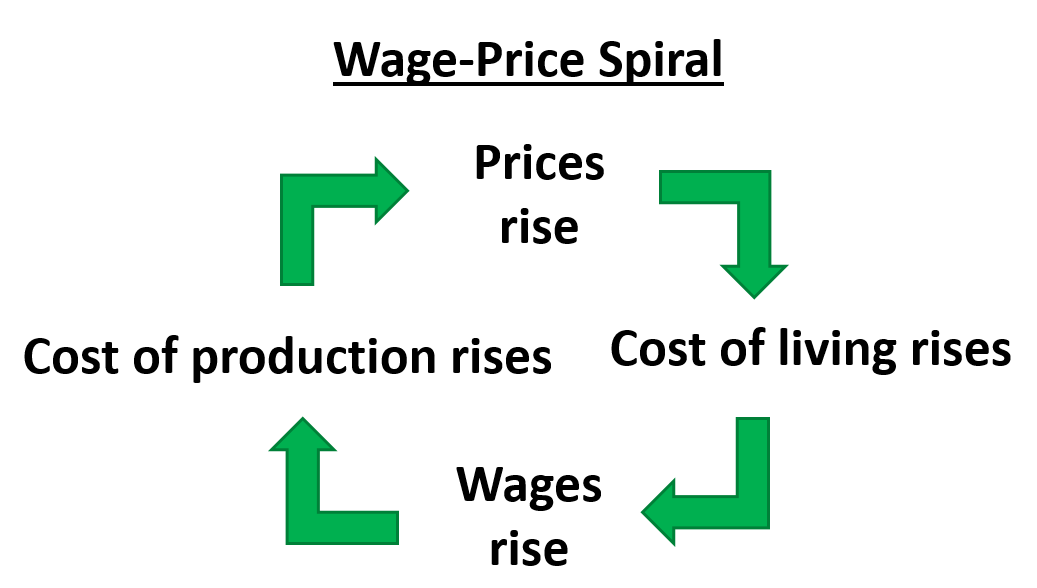

What happens in a wage-price spiral?

If prices rise, the cost of living rises so wages rise. Then the cost of production rises so prices rise

What are examples of cost-push inflation?

Higher wages

Imported inflation

Higher taxes

What are examples of demand-pull inflation?

Lower interest rates

Rising real wages and incomes

Depreciation of exchange rate

What are the costs of inflation to the economy?

Income redistribution problems

Business and consumer confidence decreases

Can affect Bank of England’s credibility as there’s a symmetric target

What are the costs of inflation to an individual?

Income redistribution problems

Real wages are worth less

Fiscal drag (higher wages lead to higher tax brackets)

What are the benefits of inflation to an economy?

Depreciates the real value of debt

Incentives to producers and consumers

What are the benefits of inflation to an individual?

Real value of debt falls

What is the balance of payments?

Records the money flows into and out of a country over time. Record of the financial transactions of one country with the rest of the world

What is the current account?

The balance of payments which measures the inflow and outflow of goods, services, investment incomes and transfer payments

What is the balance of trade?

The difference in value between a country's imports and exports.

How is a deficit on the current account paid for?

By raising money on the financial account

What is a current account deficit?

When a country sends more money abroad than it receives. Outflows > Inflows

What is a current account surplus?

When a country sends less money abroad than it receives from abroad. Outflows < Inflows.

What is a cyclical deficit?

A deficit caused by high rates of economic growth when the economy is in a boom

What is a structural deficit?

A deficit throughout the economic cycle caused by a lack of international competitiveness.

What are the reasons why a current account deficit is a problem?

Financed through the financial account

Shows lack of competitiveness

Too many imports may lead to decreased domestic demand and unemployment

What are the reasons why a current account deficit is not a problem?

A small deficit as a percentage of GDP means it’s not important

Imports of capital good

Only short term so may cure itself

What is income?

A flow of money to a factor of production.

What is the distribution of income?

Describes how income is shared out between the factors of production, households or between regions

What is the gini-coefficient?

A measure of inequality that condenses the income/wealth distribution for a country into a number between 0 and 1

What are the reasons as to why inequality of income is not a problem?

Incentives

Revenue product of labour

Trickle-down effect

What are the challenges as to why inequality of income is a problem?

Inequality of opportunity

Cause social problems

Living wage

What is absolute poverty?

A condition characterised by severe deprivation of basic human needs

What is relative poverty?

When a household’s financial resources fall below the average income level

What is wealth?

A stock of assets owned by an individual or organisation

What does the welfare state do?

Provides benefit payments

Provides vital social services

How is the welfare state funded?

Through tax revenue and NI contributions