BWL

1/107

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

108 Terms

cost comparison calculation

Selection of investment alternatives

Total cost comparison (cost comparison per period) with the same capacity utilisation

Unit cost comparison (cost comparison per quantity produced) with different capacity utilization

Determination of the critical capacity utilisation/quantity for unforeseeable utilisation

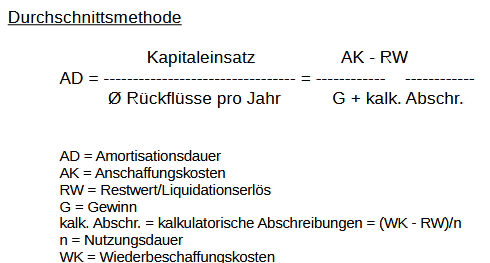

armortization comparison calculation (years of use until the investment was worth it)

influence factors for investments

the current profit situation of the company

the order situation of the company

the economic environment

the level of capital market interest rates

tax aspects

Types of investment

New/Initial Investment: Initial equipment of a company with fixed and current assets.

Expansion Investment: Increase of existing assets by acquiring additional goods, e.g., purchasing more identical machines to expand capacity.

Replacement Investment: Replacement of goods that have been consumed in the production process, e.g., worn-out machines are replaced by new, identical machines, maintaining the same production capacity.

Rationalization Investment: Replacement of economically consumed goods with new, technically improved goods, e.g., old machines are replaced by new, faster, or more efficient machines, often resulting in job losses.

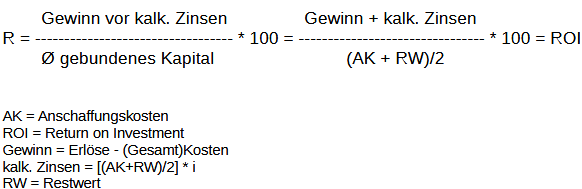

ROI comparison calculation

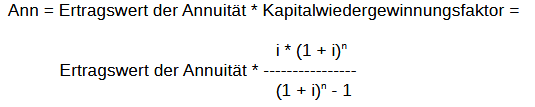

Annuity method formula

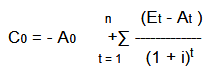

net present value method

cash inflows (Et )

outflows (At )

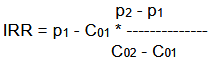

internal rate of return

C = value

p = interest rates

Explain the term effective interest rate.

The term "effective interest rate" refers to the true cost of borrowing money or the actual return on an investment. It takes into account not just the stated interest rate (the nominal rate), but also additional fees, the timing of payments, and compounding effects. This gives a more accurate picture of what you're really paying or earning.

creditworthiness

ability to conclude legally effective credit agreements. The

examination of creditworthiness includes the examination of legal capacity, legal capacity

and power of representation.

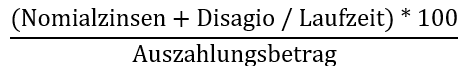

effective annual interest rate

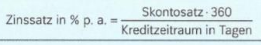

SKonto zu Jahreszinssatz (Näherung)

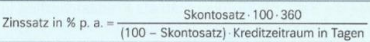

Skonto zu Jahreszinssatz (genau)

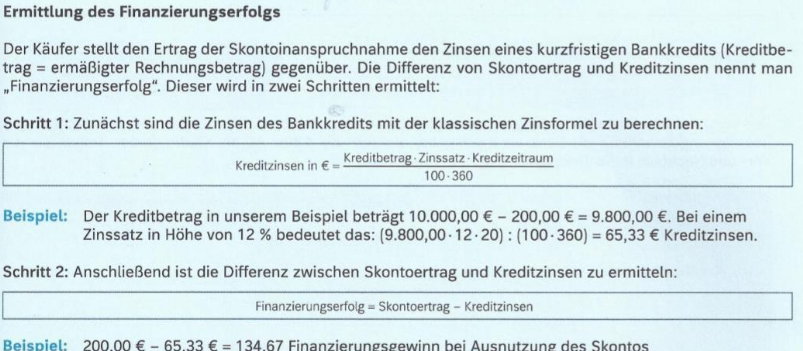

Berechnung Finanzierungserfolg bei Skonto

Marketing

Promoting and selling products by understanding customer needs, creating awareness, and driving sales in a competitive market.

Marketing Mix

Combination of elements used by companies to promote/sell products/services, often called the 4 Ps (Product, Price, Place, Promotion) and expanded to 7 Ps including People, Process, and Physical Evidence.

Product (in Marketing)

What is offered to the customer, including features, design, and quality.

Price (in Marketing)

The cost for the customer, based on costs, demand, and discounts.

Place (in Marketing)

Distribution channels, or where the product is sold.

Promotion (in Marketing)

Methods/strategies of promoting the product, such as advertising, sales promotion, and other activities.

People (in Marketing)

Employees, including their training, motivation, and empowerment.

Process (in Marketing)

Smooth/streamlined delivery to the customer, including ordering process and after-sales customer service.

Physical Evidence (in Marketing)

Tangible elements that support the brand/offerings, such as logo, branding, and design of stores.

Market Research

Gathering information about market situation through surveys, analyzing trends, studying competitor strategies, and finding target audiences.

Product Strategy

Developing/Improving product to meet customer needs and stand out, including product design, feature development, product testing, and gathering customer feedback.

Pricing Strategy

Determine pricing of offering by analyzing production costs, researching competitor pricing, assessing market demand, and setting competitive/ profitable price.

Promotion Strategy

Planning how to communicate/promote product to audience, including designing advertising campaigns, creating marketing materials, managing social media presence, and public relations (PR) efforts.

Distribution Strategy

Deciding how to make product available to customer, including selecting distribution channels, managing inventory, and ensuring efficient product delivery.

Marketing Controlling

Monitoring/Evaluating marketing activities to ensure effectiveness and alignment with company goals and to optimize marketing for better results.

types of market research

primary research

secondary research

quantitative research

qualitative research

market indicators

Market Potential: The maximum possible demand if every potential customer bought the product.

Market Volume: The actual amount of goods sold or consumed in the market during a given period.

Market Share: The percentage of total market sales a specific company or product holds.

Sales Volume: The real number of units a company sells over a specific time.

Sales Potential: The upper limit of sales a company could achieve if it captured all available demand.

SWOT

• Helps to understand a companies position in the market

1. Strengths: Advantages of product/company (strong brand reputation, skilled employees, innovative technology)

2. Weaknesses: Weakness of product/company (lack of resources, outdated technology, poor customer service)

3. Opertuntities: External factor good for company/product (growing market, changing trends, new partnership)

4. Threats: External factor bad for company/product (strong competition, economic downturn, regulations)

STP

Segmentation: Dividing the overall market into distinct groups based on common characteristics like demographics, behaviors, or interests.

Targeting: Selecting one or more of these segments to prioritize, usually those that are most promising or profitable.

Positioning: Crafting a unique value proposition and brand image that clearly differentiates a product or service in the minds of the chosen target segment.

Types of positioning

Market Leader: Holds the largest share and enjoys strong brand recognition.

Challenger: Actively competes against the leader by offering distinctive features or pricing.

Follower: Maintains a stable position by imitating leaders rather than aggressively challenging them.

Niche Player: Focuses on a specific segment with specialized offerings.

types of market segmentation

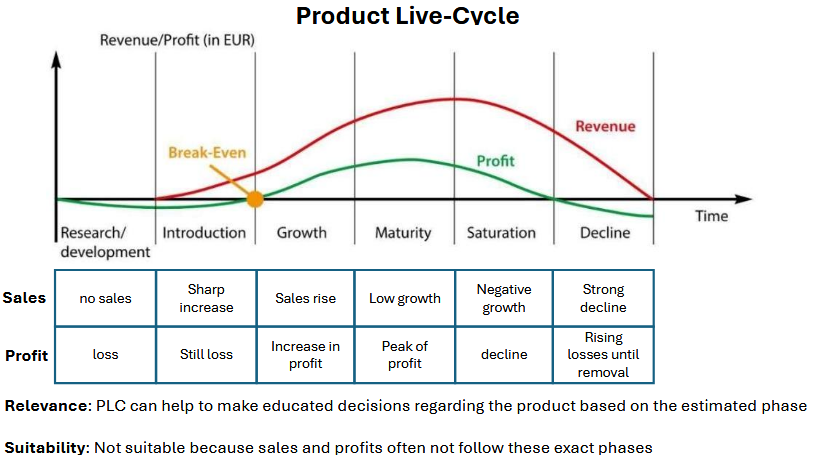

Product Lifecycle

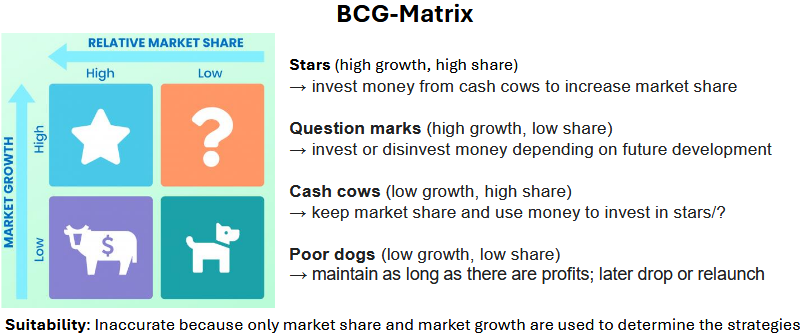

BCG matrix

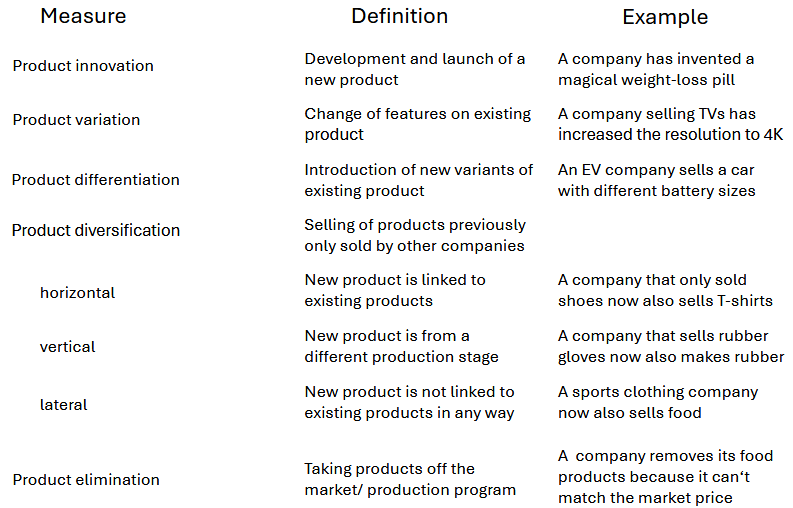

Measures of product policy

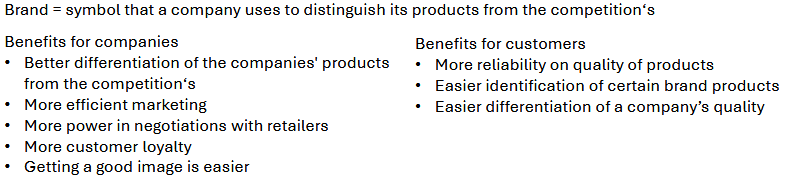

Advantages/Disadvantages of branding

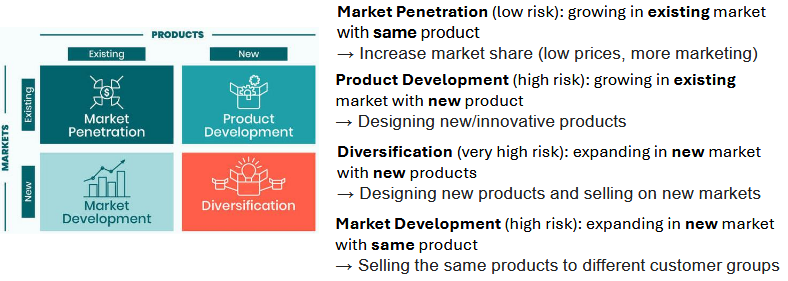

Ansoff matrix

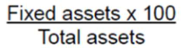

Fixed Asset Intensity Definition

Measures a company's investment in fixed assets relative to its sales or revenue.

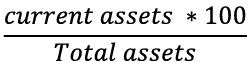

Current Asset Intensity Definition

Measures a company's investment in current assets relative to its sales or revenue.

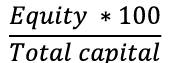

Equity Ratio Definition

Indicates the proportion of equity used to finance a company's assets.

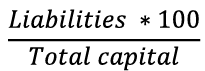

Debt Ratio Definition

Indicates the proportion of debt used to finance a company's assets.

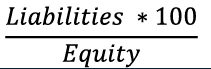

Debt-to-Equity Ratio Definition

Compares a company's total debt to its total equity.

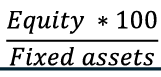

Coverage Ratio I Definition

Measures a company's ability to cover its interest expenses with its earnings.

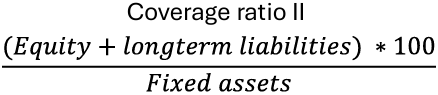

Coverage Ratio II Definition

An alternative measure of a company's ability to cover its interest expenses.

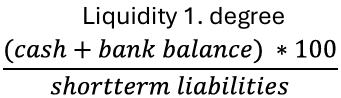

Liquidity 1. Degree Definition

A measure of a company's ability to meet its short-term obligations (One-to-five = min. 20%).

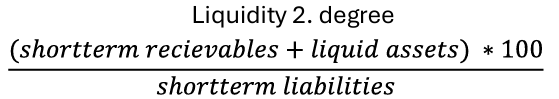

Liquidity 2. Degree Definition

A stricter measure of a company's ability to meet its short-term obligations (One-to-one = min. 100%).

Fixed asset intensity

Current asset intensity

Equity ratio

Debt ratio

Debt-to-equity ratio

Coverage ratio 1

Coverage ratio 2

Liquidity 1. Degree

Liquidity 2. Degree

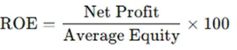

ROE

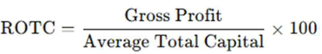

ROTC

Gross Profit

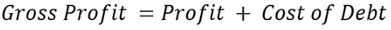

ROS

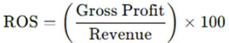

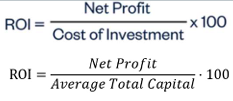

ROI

ROE (leverage)

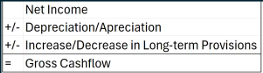

gross cashflow

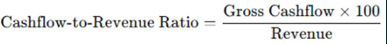

Cashflow-to-revenue ratio

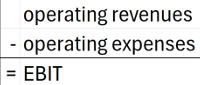

EBIT (short)

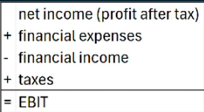

EBIT (long)

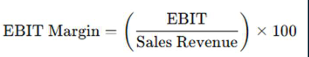

EBIT margin

Pricing Policies

Cost-oriented

Determining minimum price (based on cost accounting)

Short-term, variable cost should be covered

Long-term, total costs should be covered

Market-oriented

Prices based on competitors and customers

Goal is profit maximization

Competition-oriented

Competitors already have optimal prices so copy them

We have to be different in other ways to distinguish ourselfs

Demand-oriented

Based on demand for existing products on market

Focus on price elasticity

Differentiation strategy to create unique selling points

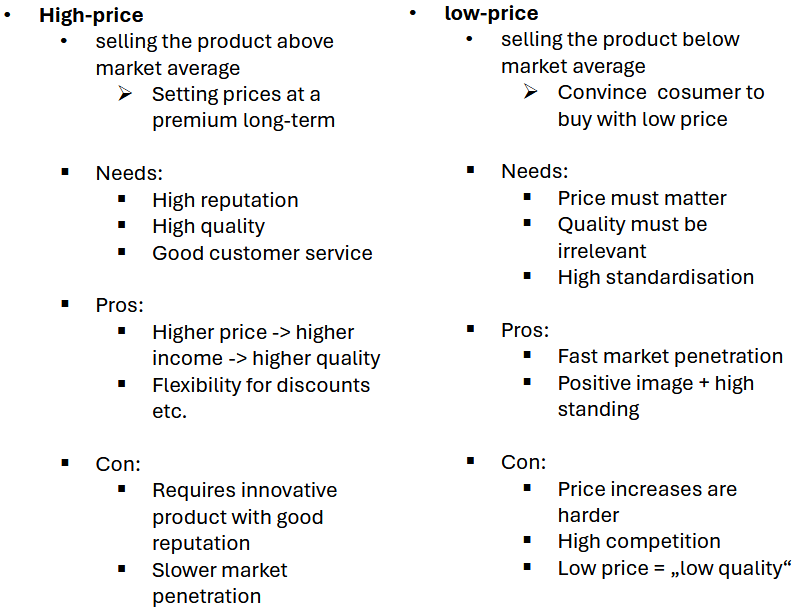

fixed price strategies

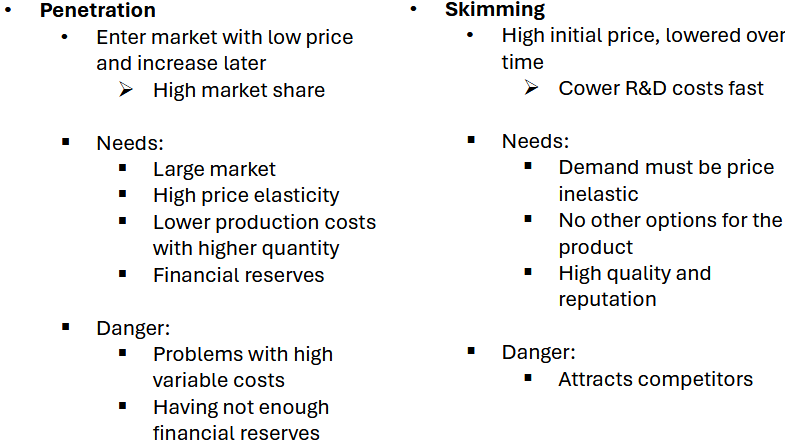

Price sequencing strategies

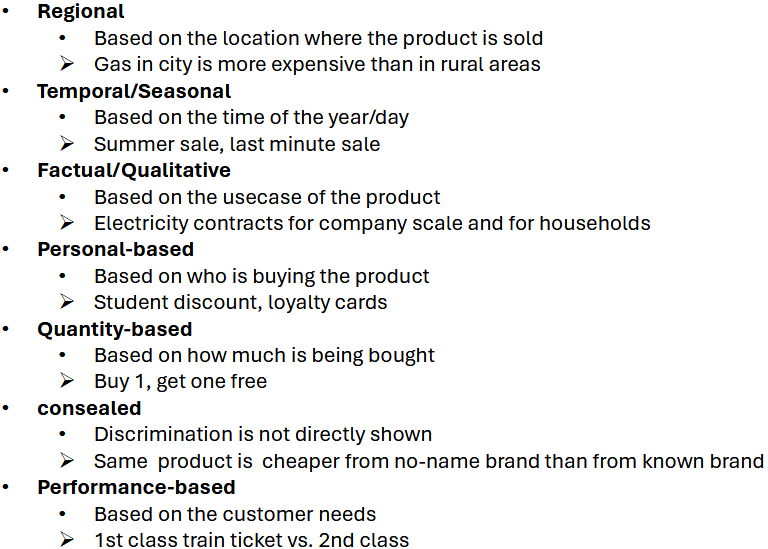

Price differentiation

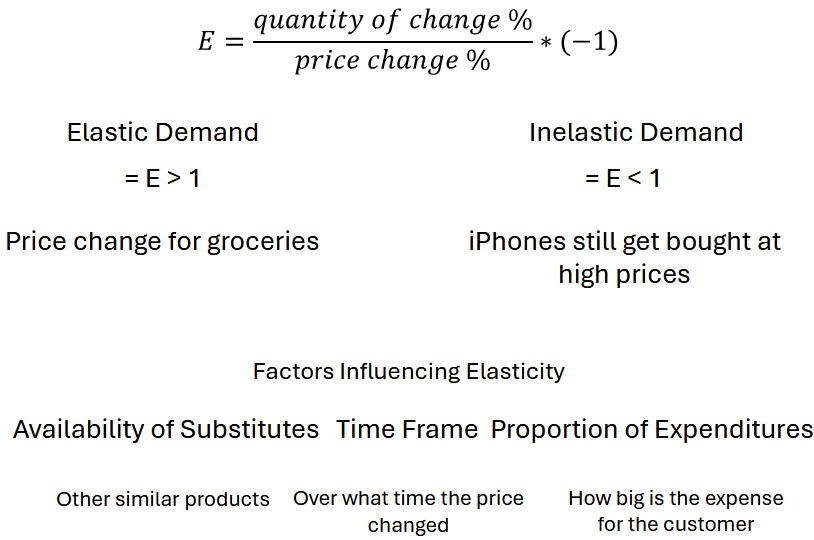

Price elasticity

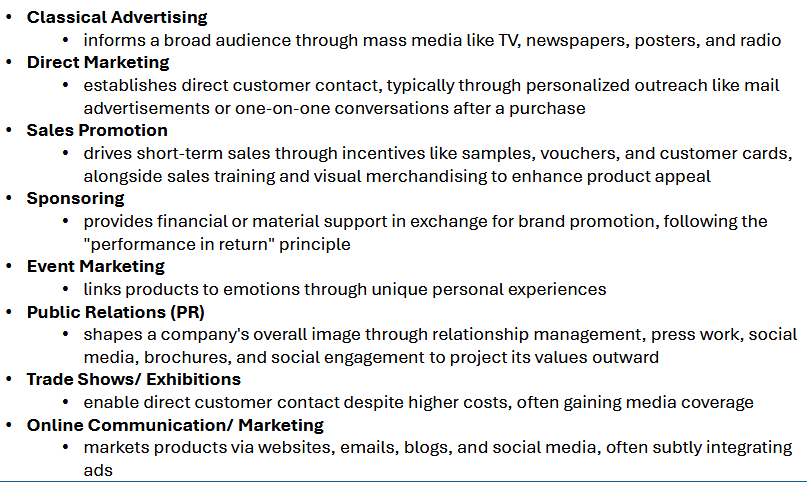

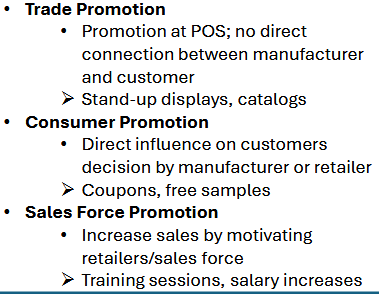

Promotion types

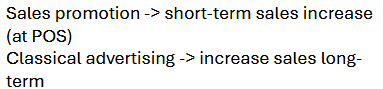

difference between sales promotion and classical advertising

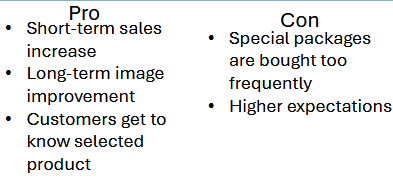

Sales promotion pros/cons

sales promotion types

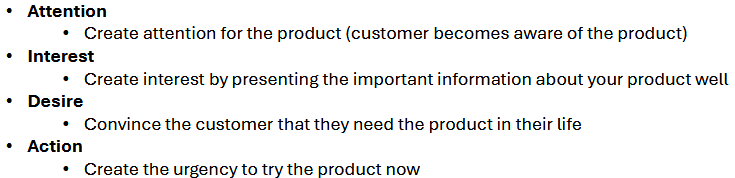

AIDA advertising model

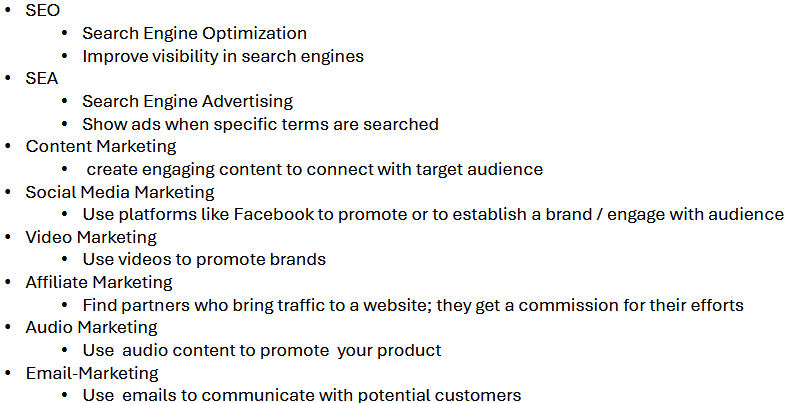

online marketing tools

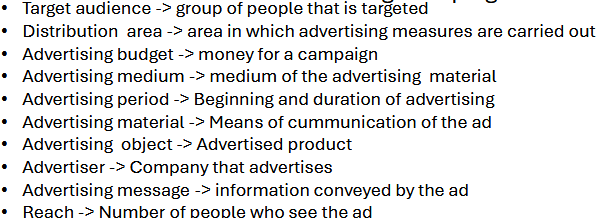

key terms for advertising campaigns

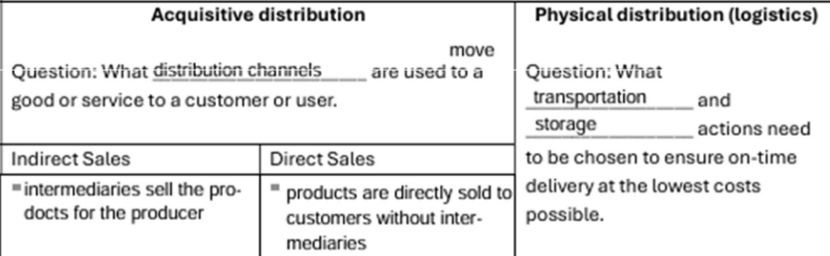

types of distibution

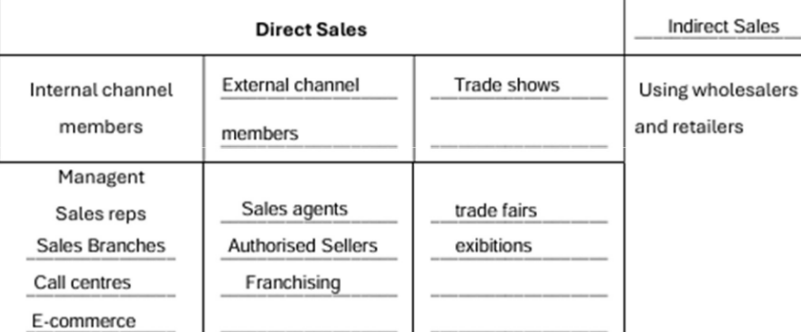

distribution channels

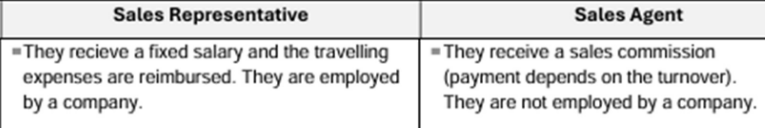

sales representative vs sales agent

Definition Rückstellungen

Rückstellungen sind Schulden (Verbindlichkeiten), die zum Zeitpunkt ihrer Entstehung dem Grunde nach bekannt sind, deren Höhe und/oder Fälligkeit jedoch noch ungewiss ist

Rückstellungen müssen für folgendes gebildet werden:

ungewisse Verbindlichkeiten (z. B. für Pensionsverpflichtungen, für erwartete Steuernachzahlungen, Prozesskosten, Garantieverpflichtungen, Provisionsverpflichtungen),

drohende Verluste aus schwebenden Geschäften (z. B. erheblicher Preisrückgang bereits gekaufter, jedoch noch nicht gelieferter Rohstoffe),

unterlassene Instandhaltungsaufwendungen, die im folgenden Geschäftsjahr innerhalb von drei Monaten nachgeholt werden,

Abraumbeseitigung, die im folgenden Geschäftsjahr nachgeholt wird,

Gewährleistungen ohne rechtliche Verpflichtungen (Kulanzgewährleistungen)

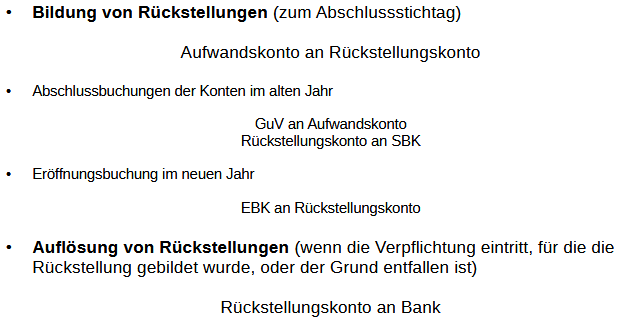

Buchungen zu Rückstellungen

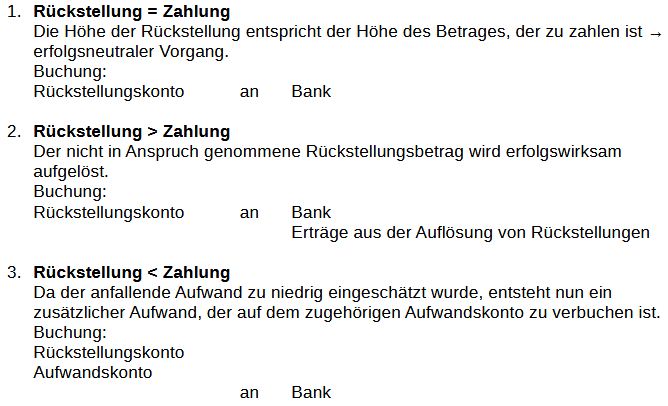

Auflösung von Rückstellungen (Buchungen)

Definition kalkulatorische Kosten

Kosten, denen stehen entweder keine Aufwendungen oder Aufwendungen in anderer Höhe gegenüber. Diese Kosten stellen kalkulatorische Kosten dar.

Arten kalkulatiorische Kosten

Gliederung Rechnungswesen

Buchführung/Finanzbuchhaltung

Dokumentation aller Geschäftsfälle, Rechenschaftslegung (Erstellung

des Jahresabschlusses)

unternehmensbezogen

Rechnungskreis I (RK I)

Kosten- und Leistungsrechnung/KLR

Überwachung der Wirtschaftlichkeit, Ermittlung des Betriebsergebnisses, Ermittlung der Selbstkosten

betriebsbezogen

Rechnungskreis II (RK II)

Statistik

Aufbereitung und Auswertung der Zahlen der Buchführung und der Kosten- und Leistungsrechnung, Vergleichsrechnungen

Planung

Erstellung von Teilplänen (Investitionsplan, Beschaffungsplan, Absatz- und Finanzplan)

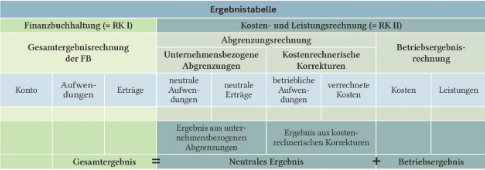

Aufbau Ergebnistabelle

Kriterien für neutrale Erträge/Aufwände

betriebsfremd

periodenfremd

außerordentlich

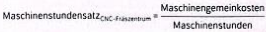

Maschinenstundensatz

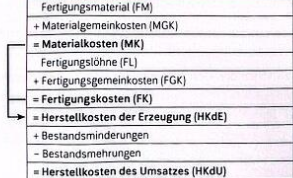

Herstellungskosten des Umsatz

Zuschlagssätze

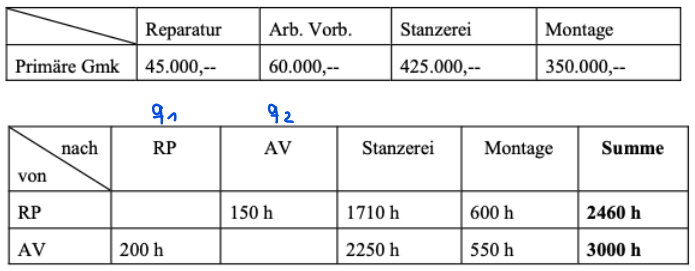

Hilfskostenstellen vs. allgemeine Kostenstellen

Hilfskostenstellen

Geben ihre Leistungen nur an Fertigungshauptkostenstellen ab

allgemeine Kostenstellen

Stellen ihre Leistungen allen anderen Stellen zur Verfügung

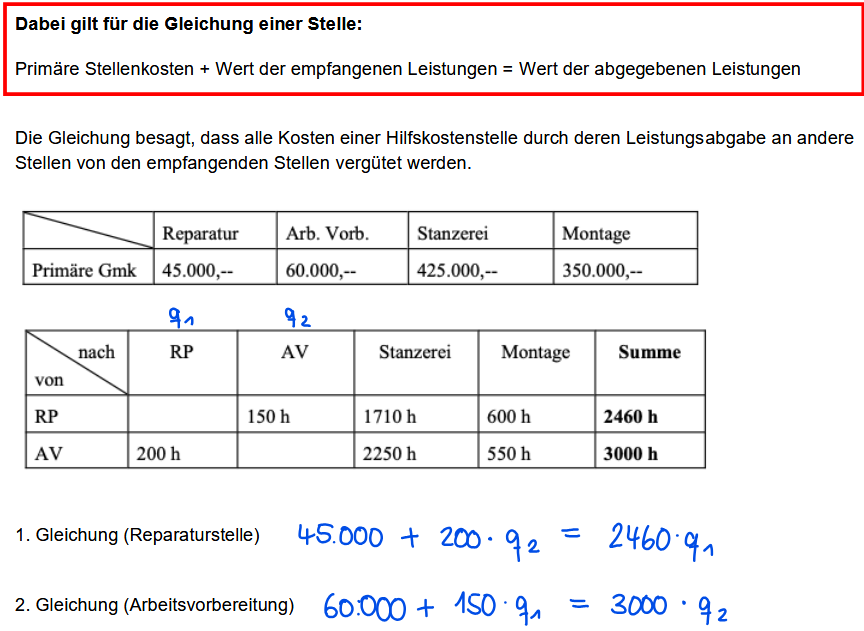

Wechselseitiger Leistungsaustausch

Gleichung aufstellen

Gleichung nach q und q2 auflösen

Gesamte Gemeinkosten berechnen:

Primäre Gemeinkosten

+ Leistungsmenge Hilfsstellen * Verrechnungspreis

= Gesamte Gemeinkosten

Listenverkaufspreis