(T)Chapter 8: Net Present Value and Other Investment Criteria Terms

1/24

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

Capital Budgeting Decision

The process of planning and evaluating long-term investments to determine their potential profitability and financial viability. It involves assessing various investment projects to allocate capital effectively.

Net present value (NPV)

the difference between an investment’s market value and its cost

Estimating NPV

involves calculating the present value of expected future cash flows and subtracting the initial investment cost.

Discounted cash flow (DCF) valuation

(a) calculating the present value of a future cash flow to determine its value today (b) the process of valuing an investment by discounting its future cash flows

Net present value rule

an investment should be accepted if the net present value is positive and rejected if it is negative

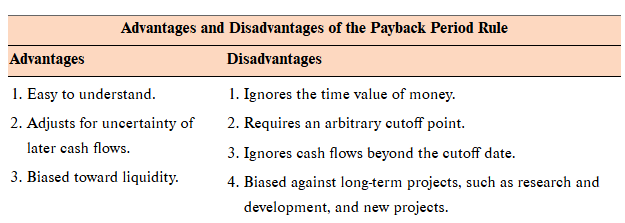

Payback period

the time it takes for an investment to generate an amount of cash equal to the initial investment.

Payback rule

an investment is acceptable if its calculated payback period is less than some prespecified number of years

Cash flow

the net amount of cash being transferred into and out of a business.

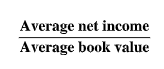

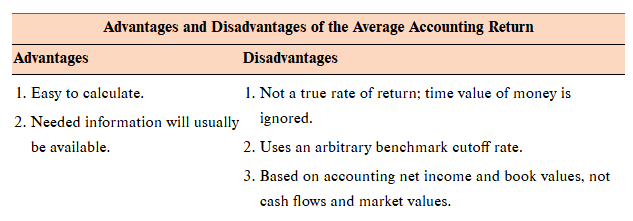

Average accounting return (AAR)

an investment’s average net income divided by its average book value

Average net income

the total net income generated by an investment averaged over its useful life.

Average book value

the average value of an asset over its useful life, calculated as the initial cost minus accumulated depreciation divided by the number of years.

Average accounting return rule

a project is acceptable if its average accounting return exceeds a target average accounting return

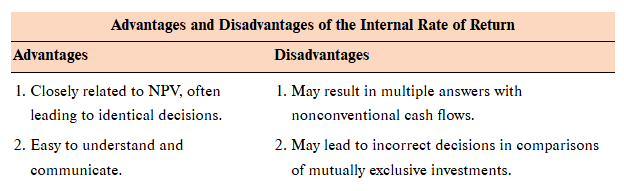

Internal rate of return (IRR)

the discount rate that makes the net present value of an investment zero

IRR rule

an investment is acceptable if the IRR exceeds the required return. It should be rejected otherwise

Discounted cash flow

method for valuing an investment by estimating future cash flows and discounting them to present value.

Net present value profile

a graphical representation of the relationship between an investment’s net present value and various discount rates

Conventional cash flow

initial investment is negative and all the rest are positive

Independent cash flow

the decision to accept or reject this project does not affect the decision to accept or reject any other; each project stands alone in terms of cash inflows and outflows.

Multiple rates of return

the possibility that more than one discount rate will make the net present value of an investment zero

Modified internal rate of return (MIRR)

a financial metric that calculates the profitability of potential investments while accounting for the time value of money and cost of capital.

This Discounting Approach

is used to determine the net present value of cash flows by applying different rates to reflect the risk and timing of cash inflows.

The Reinvestment Approach

is a method that assumes interim cash flows from an investment are reinvested at the internal rate of return instead of the cost of capital.

The Combination Approach

is a method that evaluates investment projects by combining both the financing and reinvestment effects of cash flows, thus providing a comprehensive analysis of their profitability.

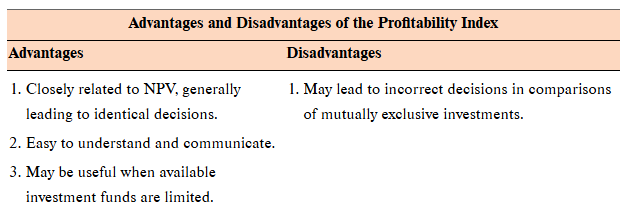

Profitability index (PI)

the present value of an investment’s future cash flows divided by its initial cost (aka benefit-cost ratio)

Capital Budgeting

the process of planning and managing a firm's long-term investments, assessing potential expenditures or investments and deciding which projects to pursue based on expected returns.