Stockholders Equity

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

What is preemptive rights?

Common shareholders may have preemptive rights (allows shareholder to maintain voting strength) to a proportionate share of any additional common stock issued if granted in the articles of incorporation.

What is stockholders equity?

The owners claim to the net assets of a corporation.

Capital Stock (capital equal to par or stated value) overview.

Can not be used to pay dividends

Capital stock could also be referred to as legal capital; the amount of capital that must be retained by the corporation for the protection of creditors.

Dividends are paid from retained earnings.

Some states allow dividends to be paid from APIC.

Note: when a corporation issues stock above or below par this only affects the balance sheet, a corporation cannot record gains and losses on transaction in its own stock.

Par Value

Generally, preferred stock is issued with a par value.

Common stock may be issued with or without a par value.

A. No par common stock may be issued as:

B. True no par stock or

C. No Par stock with a stated value.

Common stock (book value per common share)

Measures the amount that common shareholders would receive for each share if all assets were sold at their book (carrying) value values and all creditors were paid.

See picture

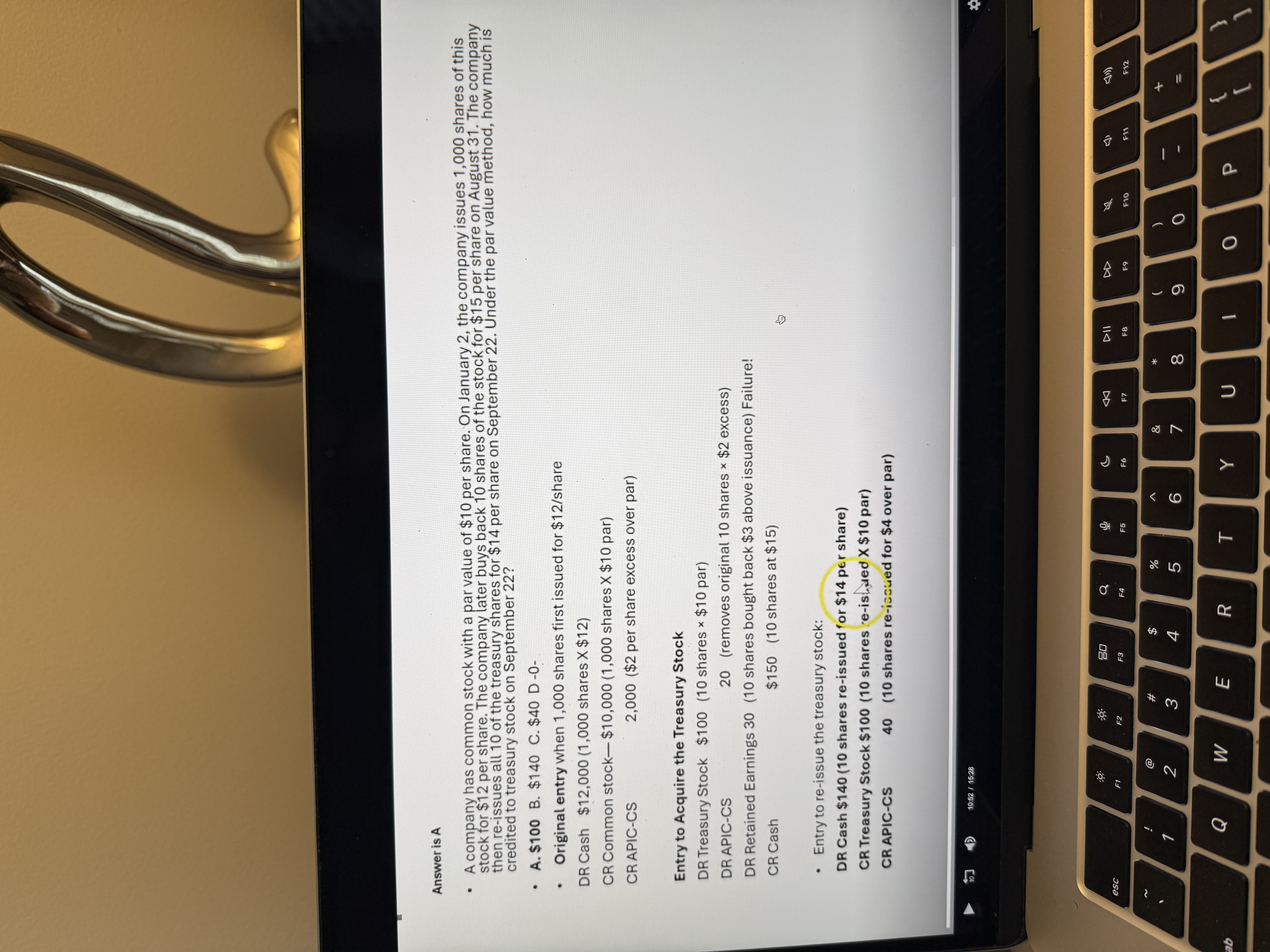

Treasury Stock. What are the 2 methods of accounting for Treasury stock?

Note: Treasury Stock is considered a contra-stockholders equity account and therefore has a normal debit balance.

Cost Method

A. Gain or loss calculated upon reissue

B. Gain or loss = reissue price -repurchase cost.

C. Gain on the sale of treasury stocks are recorded as an adjustment to the APIC – treasury stock stockholders equity account.

Legal (or par/stated value) method

A. gain or loss calculated immediately upon re-purchase.

B. Gain on the sale of treasury stocks are recorded as an adjustment to the APIC – Common stock stockholders equity account.

When reissuing treasury stock, reissue it at the given price, but remember that you will use the original par.

See picture below for reissue of treasury stock- par value method

Issuing Stocks for other than cash

Always use the fair value of the stock if known.

Otherwise, use the value of the product or service.

Small versus large stock dividend

Small stock dividend: company issues less than 20-25% of the companies existing shares outstanding in the form of a dividend.

The new shares are recorded as a reduction of retained earnings equal to the fair market value of the new shares at the time of the dividend.

Common stock is recorded – the number of new shares X par value and APIC – common stock is needed for the excess of FMV over par.

The drop in retained earnings is equal to the increase and common stock plus APIC, therefore no change in total stockholders equity.

Large stock dividend:

Note: unlike a small stock dividend, the amount transferred from retained earnings to common stock is based on the par value of the shares, not the FMV. So for a large stock dividend, ignore the market price of the newly issued shares.

Ex: 50k shares outstanding, 30% stock dividend, par value $10.

Debit Retained Earnings $150k

Credit Common Stock $150k

No APIC is needed.

Stock Dividends

A company has 2000 shares outstanding and issues a 25% stock dividend. What would be the expected new stock price if the shares were currently trading at $80 per share?

Note: no new assets or earnings are created, so the company’s total market value should stay the same immediately after the dividend.

(1) calculate the market value prior to the stock dividend:

2,000 x $80 = $160,000

(2) divide that by the new total number of shares, 2,500.

(3) $160,000/2,500 shares = $64 per share.

2,500 x $64 = $160,000 (maintains the market value)

If the original price of $80 per share was used, that would artificially create additional market value:

2,500 x $80 = $200,000

Note: if a question asks for the par value of common stock after the split, the par value is reduced proportionally to the split.

Ex: $12 par value, 4 for 1 stock split = Original Par value / Split Ratio

$12/4 = $3 per share.

Stock Subscriptions

Example: An investor subscribe to purchase shares of common stock.

Note: Per law, shares cannot be issued before they are purchased. However, the APIC can be recorded immediately.

See picture

Preferred Stock (PS): Cumulative and Participating.

Determine if there are any dividends in arrears.

Calculate the PS dividend.

a. Ex: preferred shares x $ par value x % (dividend rate)

Note: for participating preferred stocks this rate will also be used to calculate the dividends for the common stocks.

Subtract the preferred stock dividends from the available dividends to be distributed.

a. Remember to also subtract any dividends in arrears.

Subtract the common stock dividends from the remaining available dividends to be distributed.

If there’s a balance, this will be distributed between PS & CS by prorating the par value of the PS & CS. ( ex: par value x shares of each, NOT the par amount I.e. $5 par)

Treasury Stock-Cost Method

Under the cost method of accounting for treasury stock, companies record treasury stock (repurchased shares) at the price paid without regard to par value.

Ex: when one share of treasury stock is purchased for $24 and the cost method is used. The treasury stock account is recorded at its cost of $24.

Dr Treasury stock $24 (cost)

Cr Cash $24

At a later date, if the value of the share is $22 instead of $24, and the treasury stock is re-sold, the J/E would be:

Dr Cash $22

Dr Retained Earnings $2 (represents failure to resell the treasury stock for at least cost)

Cr Treasury stock $24 (cost)

NOTE: The difference in the price and the cost is debited to Retained Earnings because there are currently no APIC for Treasury stocks. If there was a value in the APIC Treasury account, then the difference would have applied to APIC, up to the amount available in APIC Treasury stock.

Retirement of treasury shares

Note: retirement of treasury stock under the cost method can increase or decrease stockholders equity, depending on whether the company paid more or less than the original issuance price.

Common stock and APIC – CS are removed from the books based on the original issuance of the stock.

Cash is credited for the cost of the treasury shares. Any difference is debited to retain earnings (failure) or credited to APIC – TS for success.

Treasury stock has a normal debit balance when purchased therefore when retired, treasury stock needs to be credited to zero it out.

Common stock: when shares are retired, the common stock account is debited for the par value of the shares retired.

APIC: the difference between the original issuance price and the Par value, which had been credited to APIC when the shares were initially issued is removed, debited. This is because, upon retirement, the excess of the original issue price over the Par value that was originally credited to APIC needs to be adjusted.

Example: see picture

Treasury Stock - Par Value Method

Note: the applicable date is the Repurchase of shares, unlike the cost method (that use the re-issue of TS date)

Note:

Each common share was originally recorded for par value, and the excess is in APIC - common stock.

When we use the par value method, we need to remove that APIC from the original issuance of the common shares.

Important: when reissuing Treasury Stock under the par value method, remember that you removed the APIC when you repurchased the shares. Your new APIC will be the excess of the reissue price and the original par amount, NOT the repurchase price.

Appropriate retained earnings

The appropriation of retained earnings essentially has no effect on any aspect of the financial records.

An appropriation is intended solely to disclose to the readers of financial statements that the entity has no intention to distribute a portion of retained earnings to shareholders as dividends.

An appropriation is most commonly recorded by a note to the financial statements.

If journal entries are recorded, the effect is to increase one retained earnings account while simultaneously decreasing another retained earnings account, with no net effect on total retained earnings.

Example: appropriate $50.

a. Debit Retained Earnings-Unappropriated $50 (main)

b. Credit Retained Earnings-Appropriated $50 (new)

Reverse the entry once the purpose is fulfilled:

a. Debit Retained Earnings-Appropriated $50 (new)

b. Credit Retained Earnings-Unappropriated $50 (main)

Quasi Reorganization

Quasi Reorganization is an accounting adjustment not a legal reorganization.

Quasi Reorganization Allows a company to eliminate the deficit in retained earnings by reducing contributed capital and increasing earned capital to zero out a retained deficit.