MOS Chapter 5 & 6

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

Managerial Accounting

Field of Accounting that provides economic and financial information for managers and other internal users

3 Broad Functions of Management

Planning

Add value to the business under its control

By establishing objectives (ex. Profits, market share, ESG)

Value is measured by the trading price of the company's shares and the market value of company

2. Directing

Coordinating activities and human resources to operate smoothly

Ex. Implementing planned objectives to motivate employees, selecting executives, appointing managers, hiring and training employees

3. Controlling

Tracking and reporting company activities

Ex. Managers determine whether planned goals are being achieved and monitoring

Monitored by budgets, responsibility centres, performance evaluation reports (MANAGERIAL ACCOUNTING)

Corporation Organizational Chart

Line Positions

Directly involved in line company's main revenue-generating operating activities

Ex. VP of Operations, Supervisors, Plant Managers

Staff Positions

Involved in activities of staff employees that support the efforts of the line employees

Finance, legal, HR

CFO

Accounting and finance issues

Supported by the controller and the treasurer

Controller

Responsible for maintaining company's cash position

Maintain accounting records

Maintain adequate system of internal control

Prepare financial statements, tax returns, internal reports

Internal Audit Staff

Responsible for reviewing the reliability and integrity of financial information provided by the controller and treasurer

Ensure internal control systems are functioning properly to safeguard corporate assets

Financial Accounting VS Management

Feature | Financial Accounting | Management Accounting |

Users of Reports | External: Investors, Creditors, Regulators | Internal: Officers and Managers |

Report Type | Financial Statements (prepared using GAAP) | Internal Reports |

Purpose of Report | General purpose – built for many users | Special purpose – built for internal decision making |

Content of report | Financial Statements

|

|

Report Frequency | Quarterly and Annual | Quarterly and Annual

|

Verification | Audited by CPA | No Independent Audits

|

Code of Ethical Standards

Statement of Ethical Practice follows

Competence, Confidentiality, Integrity, Credibility

Managerial Accounting Today

focuses on long term goals and objective, and is designed to improve quality, reduce costs,

and regain competitive positions; thus it is much more hands on and provides useful, relatable material

Focus on Value Chain

Value Chain is all activities associated with providing a product or service, focused on efficiency

Technological Change

Many companies use enterprise resource planning (ERP) software systems, which provide comprehensive, centralized, and integrated source of information that is used to manage all major business processes

• ERPs can replace as many as 200 individual software packages

○ Many companies use computer-integrated manufacturing (CIM), that is manufacturing products that are untouched by human hands

○ Widespread use of computers has greatly reduced the cost of accumulating, storing, and reporting managerial accounting information

○ Ecommerce

Just-In-Time Inventory Methods

Inventory levels and costs are reduced

Under JIT method, goods are manufactured or purchased just in time for use

Lean production

Quality

JIT systems require increased emphasis on product quality

Total Management Quality (TQM) systems reduce defects in finished products; goal is to achieve zero defects

Activity-Based Costing

Overhead costs are allocated to various products using activity-based costing (ABC)

Beneficial because it results in more accurate product costing and in the more careful scrutiny of all activities in the

supply chain

Theory of Constraints

Theory of constraints is a specific approach used to identify and manage constraints (bottlenecks) in order to

achieve the company's goals

Once a major constraint has been identified and eliminated, the company moves on to fix the next most significant

constraint

Lean Manufacturing

manage operations more efficiently with more control; eliminate waste and concentrate more accurately on customer needs

5 Principles

Specify a value (Target Cost for Customers w/ Profit)

Identify value system (Product Life Cycle)

Create Flow (Production Process has Continuous Flow)

Respond to Customer Demand

Aim for Perfection (Quality Check)

Balanced Scorecard

Performance measurement approach that uses both financial and non-financial measures to evaluate all aspects of a company’s operations in an integrated way

Used so that companies don’t get too focused in one area of improvement that they lose sight of another crucial area

Accounting Organizations and Professional Accounting Careers in Canada

Merging CA, CMA, CGA, CPA to create unified Canadian accounting for international presence and enhance professional development

training opportunities and improved benefits and services to its members

Developing Flexible Budget

1. Identify the activity index and the relevant range of activity (outside of range, expenses will likely differ)

2. Identify the variable costs, and determine the budgeted variable cost per unit of activity for each cost.

3. Identify the fixed costs, and determine the budgeted amount for each cost.

4. Prepare the budget for selected increments of activity within the relevant range.

Responsibility Accounting

Involves accumulating and reporting costs (and revenues, where relevant) that involve the manager who hasthe authority to make the day-to-day decisions about the cost items

*valuable in decentralized companies

Pros of Responsibility Accounting

Used to measure performance and to provide information for decision making by responsibility centre manager

Developed to motivate evaluate, and reward only on what we can control

Criteria for Responsibility Accounting

Costs and revenues can be directly associated with the specific level of management responsibility.

The costs and revenues are controllable at the level of responsibility that they are associated with.

Budget data can be developed for evaluating the manager's effectiveness in controlling the costs and revenues.

Decentralized

Control of operations is given to many managers throughout the organization

Segment

Used to identify an area of responsibility in decentralized operations

• Segment reports prepared periodically

Difference between Responsibility Accounting and Budgeting

A distinction is made between controllable and noncontrollable items

Performance reports either emphasize or include only the items that the individual manager can control

Criteria for Controllable Costs for Managers

All costs are controllable by top management because of its broad range of authority

Fewer costs are controllable as one moves down to each lower level of managerial responsibility because the manager's authority

decreases at each level

Performance Evaluation

Core of Responsibility Accounting

management function that compares actual results with budget goals

uses both behavioural and reporting principles

Principles of Performance Evaluation

Management by Exception, materiality, Controllability, Behaviour Principles, Reporting Principles

Reporting Principles:

○ Contain only data that are controllable by the manager of the responsibility centre,

○ Provide accurate and reliable budget data to measure performance,

○ Highlight significant differences between actual results and budget goals,

○ Be tailor-made for the intended evaluation, and

○ Be prepared at reasonable intervals.

Management by Exception

top management review budget reports, focusing on the variance between actual results and planned objectives

focus on problem areas

investigates materiality and controllability

Materiality

expressed as a % difference from the budget

determines if managers are controlling cost

Controllability

controllable costs with large variances will be investigated

Behaviour Principles

Managers of responsibility centres should be directly involved in setting budget goals for their areas of responsibility.

The evaluation of performance should be based entirely on matters that can be controlled by the manager being evaluated.

Top management should support the evaluation process.

The evaluation process must allow managers to respond to their evaluations.

The evaluation should identify both good and poor performance.

Responsibility Reporting System

report prepared for each level of responsibility in the company’s organizational chart

starts with lowest level of responsibility for controlling costs and moves up

makes it possible for management exception at each level of responsibility

makes it possible to do comparative evaluations

Types of Responsibility Centres

Cost Centre

incur costs but does not generate revenue

evaluated on ability to meet budgeted goals for controllable costs

responsibility reports include controllable costs with flexible budget data

Ex. HR, Maintenance, Production Departments

Profit Centre

incur costs AND generates revenue

managers are judged on profitability (operating revenue, variable costs direct fixed costs - salaries)

indirect fixed costs (ex. property tax, HR costs) cannot be controlled by profit centre manager and there NOT REPORTED

responsibility reports include budgeted and controllable revenue/costs

PREPARED MONTHLY!

controllable fixed costs are deducted from the contribution margin = controllable margin

Investment Centre

incur costs, revenue and control over investment

FIXED COSTS ARE CONTROLLABLE

evaluated by ROI

how effectively is management using assets at their disposal

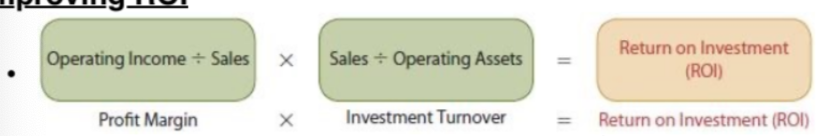

Return on Investment (ROI)

CONTROLLABLE MARGIN + AVERAGE OPERATING ASSETS = ROI

Controllable Margin= Operating Income = EBIT

Operating Asset - used in operation and controlled by manager (ex. cash, AR, inventory, equipment_

Non-operating Asset (ex. land held for future use)

Judgemental Factors in ROI

Valuation of operating assets. Operating assets may be valued at their acquisition cost, book value, appraised value, or market value.

Margin (income) measure. This measure may be the controllable margin, income from operations, or net income.

Improving ROI

Increasing the controllable margin (sales)

Reducing the average operating expenses

Reduce assets

Difference between Residual Income and ROI

ROI is the controllable margin divided by average operating assets. Residual income is the income that remains after subtracting the minimum rate of return on a company's average operating assets. ROI sometimes provides misleading results because profitable investments are often rejected if they would reduce the ROI but increase overall profitability

Static Budget

projection of budget data at one level of activity, not modified if there are changes in activity

the behaviour of the costs in response to changes in activity is fixed

Uses and Limitations:

evaluates how well a manager controls cost and the actual level of activity closely approximates master budget level

Flexible Budget

projects budget data for various levels of activity

recognizes that budget must be adapted to changes in conditions

measures performance evaluation

Anatomy of Flexible Budget

identify activity index and relevant range of activity

identify variable, fixed costs

prepare budget for designated activity increments within the relevant range