IGCSE Edexcel Business 3.1 - 3.4

1/113

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

114 Terms

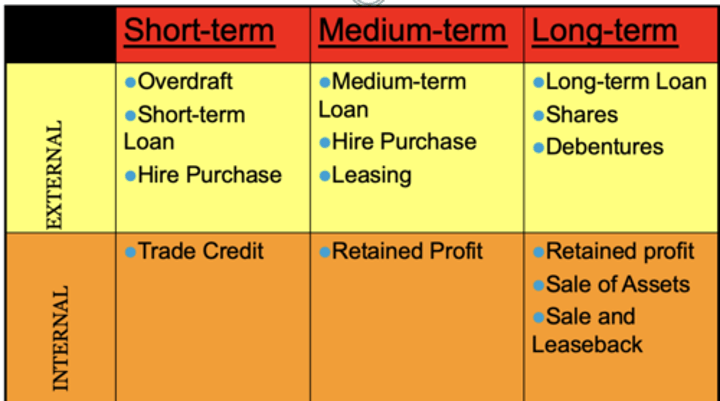

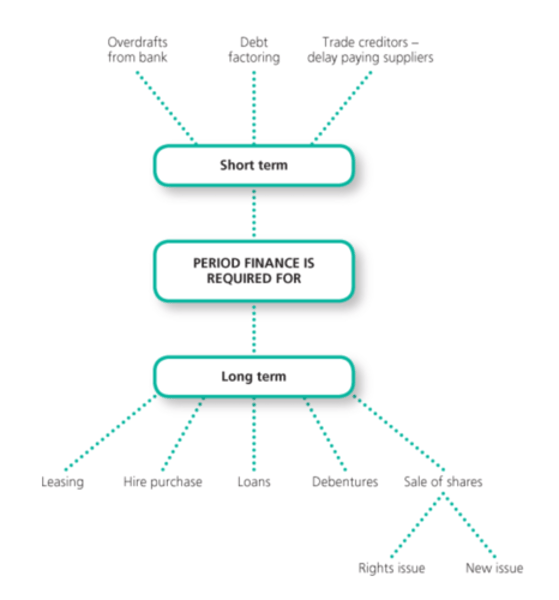

short-term finance

money borrowed for one year or less

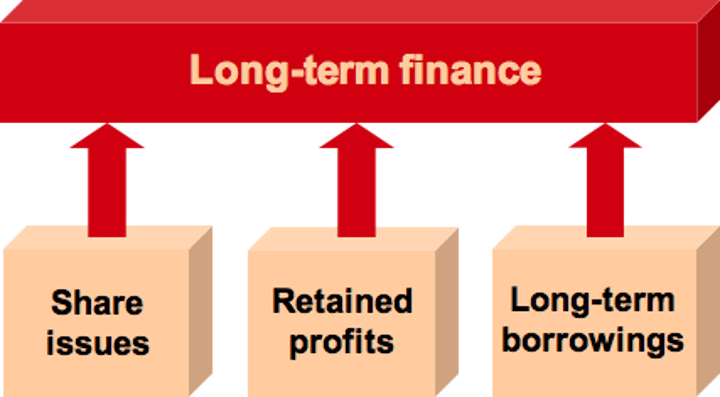

long-term finance

money borrowed for more than one year

examples of short-term finance

bank overdrafts, trade payables

examples of long-term finance

loan capital, venture capital, hire purchase, crowd funding, share capital, leasing

reasons for needing finance

-start-up capital

-operating the business (paying expenses)

-expansion (when established)

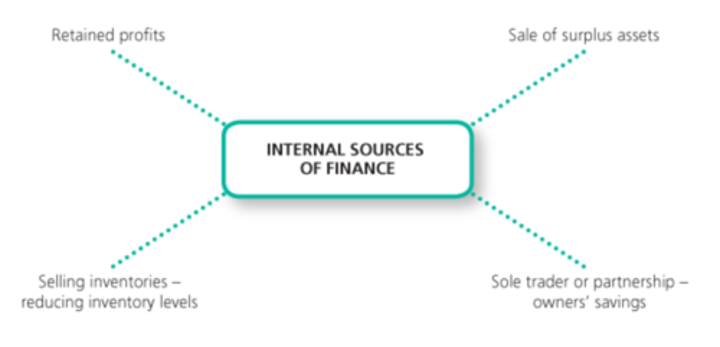

internal sources of finance

come from inside the business and are typically used by established businesses

what are the internal sources of finance?

personal savings, retained profit, selling assets

external sources of finance

come from outside the business. this can help a business pay for short term or long-term transactions

what are the external sources of finance?

loan capital, venture capital, bank overdrafts, hire purchase, crowd funding, trade payables, share capital, leasing, credit cards

personal savings

when an entrepreneur uses personal finance to start / run the business

retained profits

using profit that has not been returned to the owners (established businesses)

selling assets

an established business can sell old assets to raise capital such as old machinery

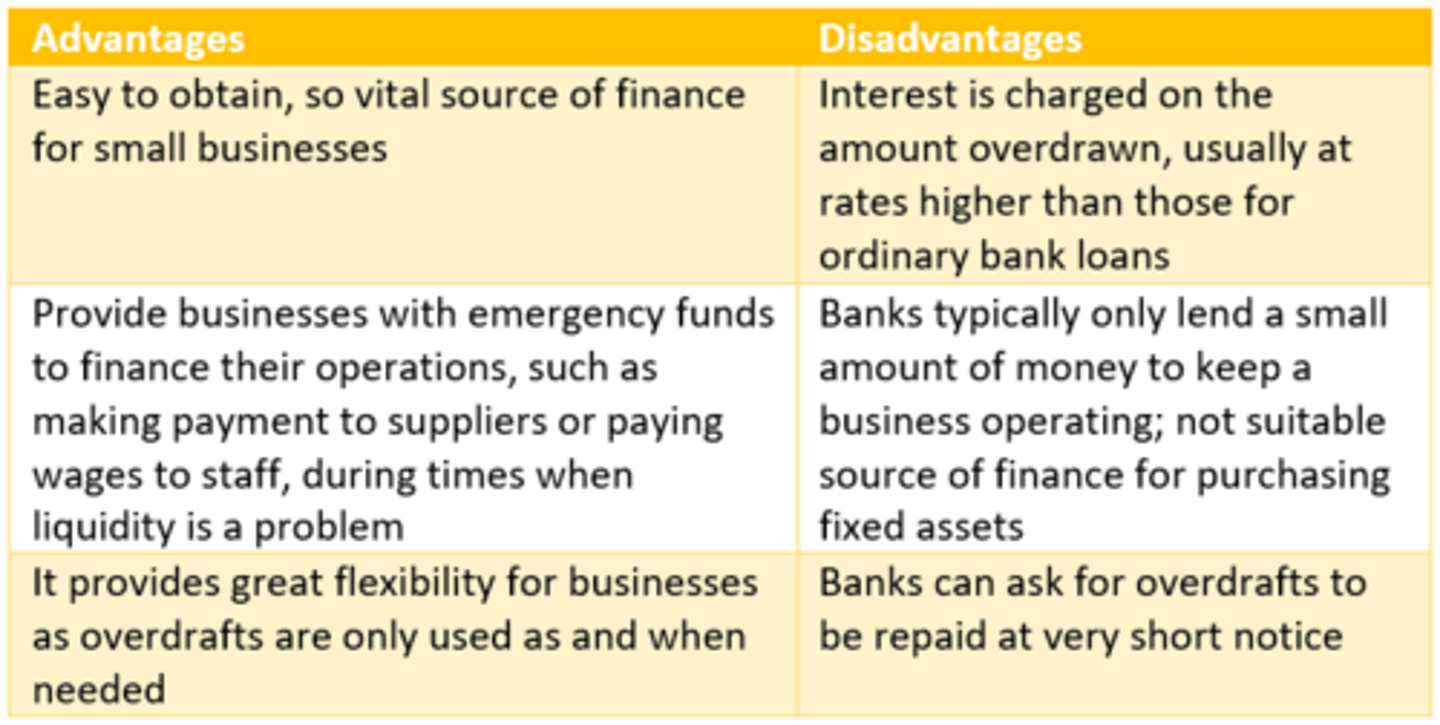

bank overdraft

means a business can spend more money than is in their bank account

loan capital

a fixed agreement between a business and the bank. normally for a large amount

hire purchasing

a loan for equipment such as machinery and tools. a down payment followed by monthly payments

share capital

limited companies (LTD and PLCs) can sell shares to raise finance

crowdfunding

many investors 'the crowd' who invest in business ventures. normal donation online

venture capital

business people who invest in small to medium businesses with high growth potential

leasing

rental of equipment such as machinery. business never owns the equipment

trade payables

receive stock (raw materials) and pay in 30 to 90 days

advantages of personal savings

no interest payments as an internal source -> reduction in cost of borrowing -> possibility of higher profits as lower costs

disadvantages of personal savings

tends to be a limited source of finance -> will need to use external sources in addition

advantages of retained profits

no interest payments as an internal source -> reduction in cost of borrowing -> possibility of higher profits as lower costs

disadvantages of retained profits

reduces the owner's profit or dividend payment for shareholders -> unhappy -> lose motivation to invest

advantages of selling assets

no interest payments as an internal source -> reduction in cost of borrowing -> possibility of higher profits as lower costs

disadvantages of selling assets

all assets are essential to business functionality -> once sold business not able to use the asset

advantages of bank overdrafts

ability to use cash even if there's none in the account -> able to buy raw materials -> keep the business solvent

disadvantages of bank overdrafts

banks can call overdrafts in at any time - business may not be able to repay - insolvent

advantages of loan capital

large amount of capital at once -> fixed monthly repayments -> business knows exact outgoings each month

disadvantages of loan capital

interest payments -> increase in total costs -> making less likely to make profits as costs are increased

advantages of hire purchasing

able to receive machinery with small upfront payment -> frees working capital for the business -> own the machinery following final payment

disadvantages of hire purchasing

interest rates are high -> which increases costs -> business does not own items until final payment is made -> can be repossessed as a result

advantages of share capital

ability to raise large amounts of capital -> no interest payable -> reduction in operating costs

disadvantages of share capital

loss in stake in the business -> must share profits (dividend payments) -> reduction in profits for founder (dilute current shares)

advantages of crowdfunding

crowdfunding can be a fast source of finance -> from numerous investors -> when traditional borrowing methods are not available

disadvantages of crowd funding

could be difficult to encourage investment -> if business is small -> leads to lack of finance raised

advantages of venture capital

opportunity for large investment (normally £10-100k) and additional skills

disadvantages of venture capital

loss of stake in business -> difficult to make decisions -> conflict -> slow decision making

advantages of leasing

the business acquires new equipment with small investment -> any problems in it replaced -> reduces overall costs

disadvantages of leasing

expensive to lease -> leads to increased costs for the business

advantages of trade payables

no payment for 30-90 days -> frees up capital for other business operation -> such as paying wages or promotion

disadvantages of trade payables

could be a more expensive method of purchasing stock -> increasing cost of sales -> decreasing gross profit

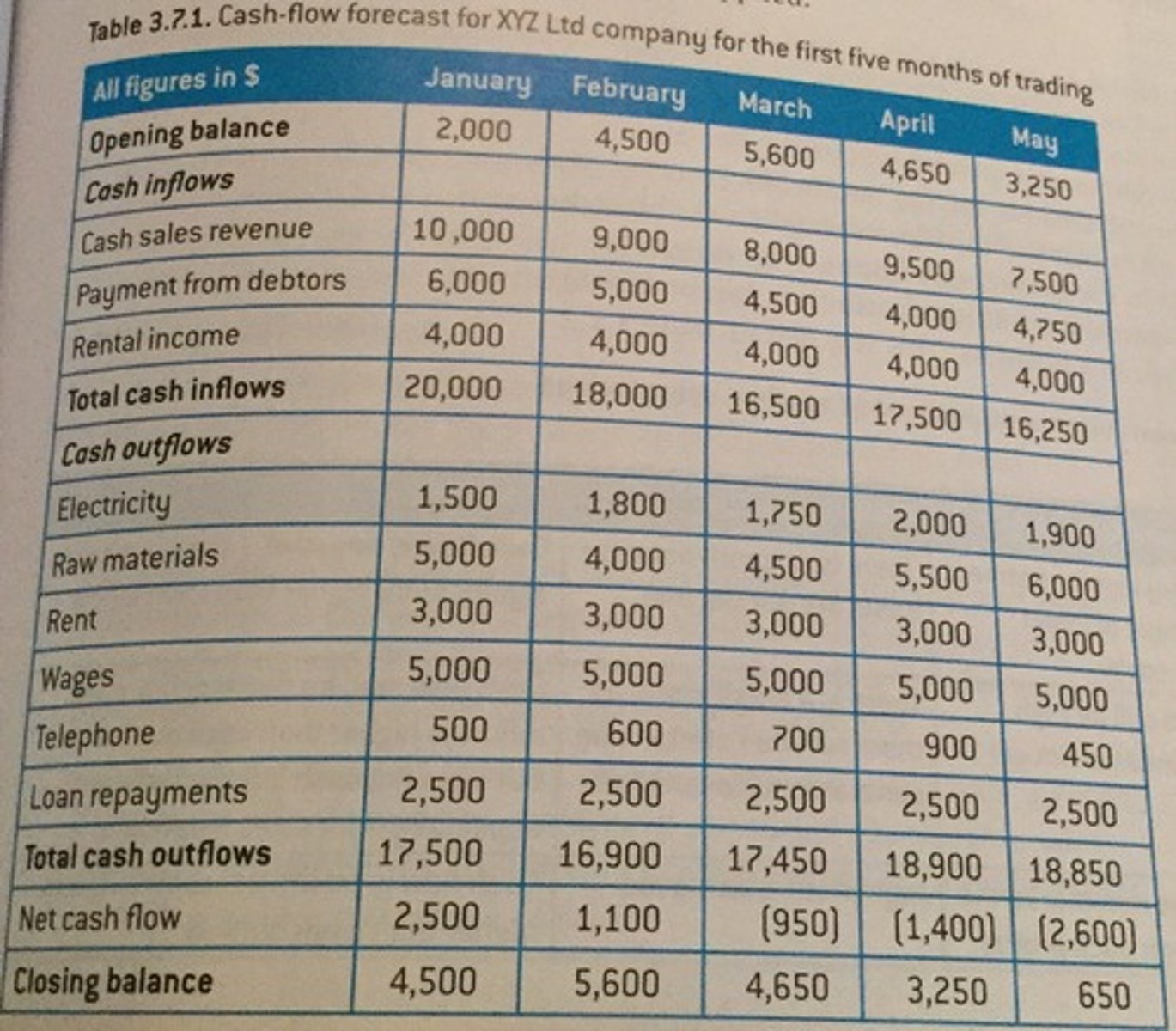

cash flow forecasting

the predicted cash inflows and outflows over a period

reasons for needing cash

-to pay suppliers (cost of sales)

-to pay overheads and employee wages (expenses)

-to prevent business failure (insolvency)

the difference between cash and profit

businesses can function and stay solvent without making a profit, cash is vital to staying solvent. cash is the inflow and outflow over a period time (cash is not always on hand), it can be tied up in trade credit or owners can give a cash injection. profit is calculated through revenues - total costs, typically at the end of a trading period.

cash inflows

flow of money into a business

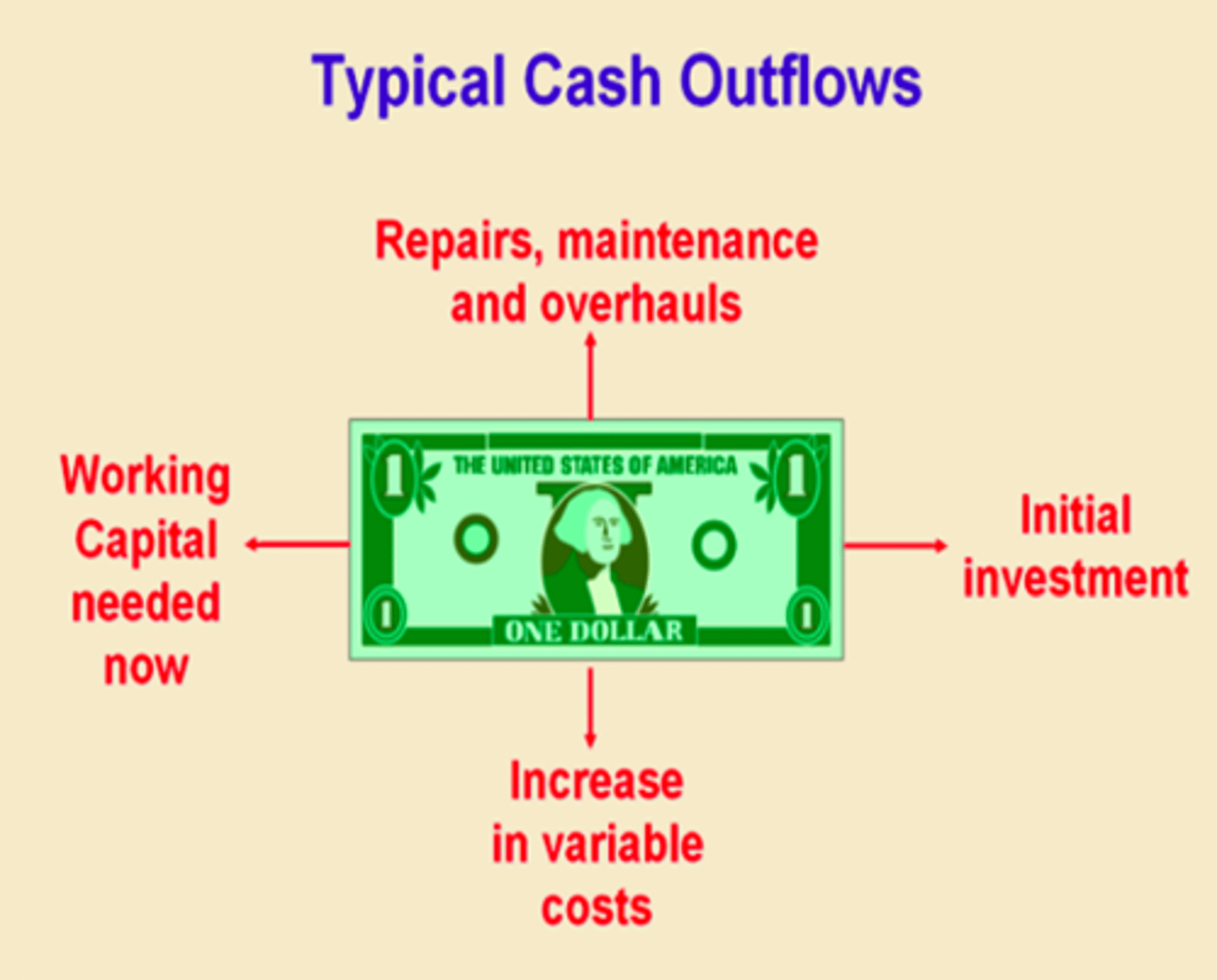

cash outflow

flow of money out of a business

net cash inflow

cash inflow - cash outflow

opening balance

the cash the business expects in the account at the start of the month

closing balance

the cash the business expects in the account at the end of the month. becomes opening balance in following month

how can a business improve cash flow?

-decrease prices (possible to increase also)

-increase promotion

-reduce raw material costs (through changing suppliers)

-reduce wages (through making workers redundant)

-reduce rental costs (moving to a cheaper location)

advantages of creating a cash flow forecast

-can help businesses identify cash shortages -> help to plan solutions -> to ensure the business does not become insolvent

-can help a new business apply for funding -> with a cashflow forecast more likely to be accepted -> helps raise capital for expansion / start-up

disadvantages of creating a cash flow forecast

only a prediction -> could be incorrect -> business makes business decision based on the predictions -> could lead to bad decisions

key to calculating cash flow forecasts

A (total cash inflows) - B (total cash outflows) = C (net cash flow)

C (net cash flow) + D (opening balance) = E (closing balance)

revenue

the money that a business recives because of selling a good or service

costs

the expense that a business must meet when setting up and running a business

formula for revenue

price x quantity sold

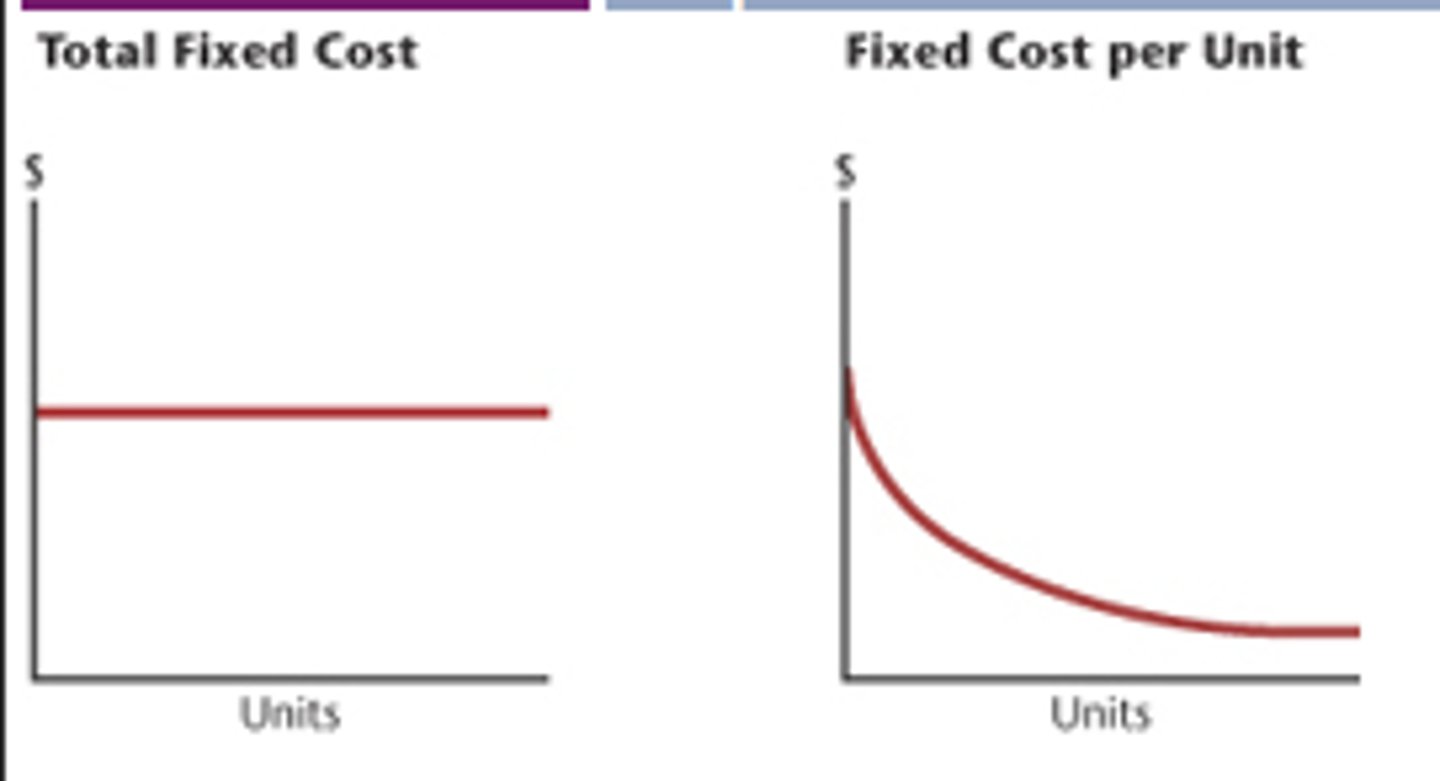

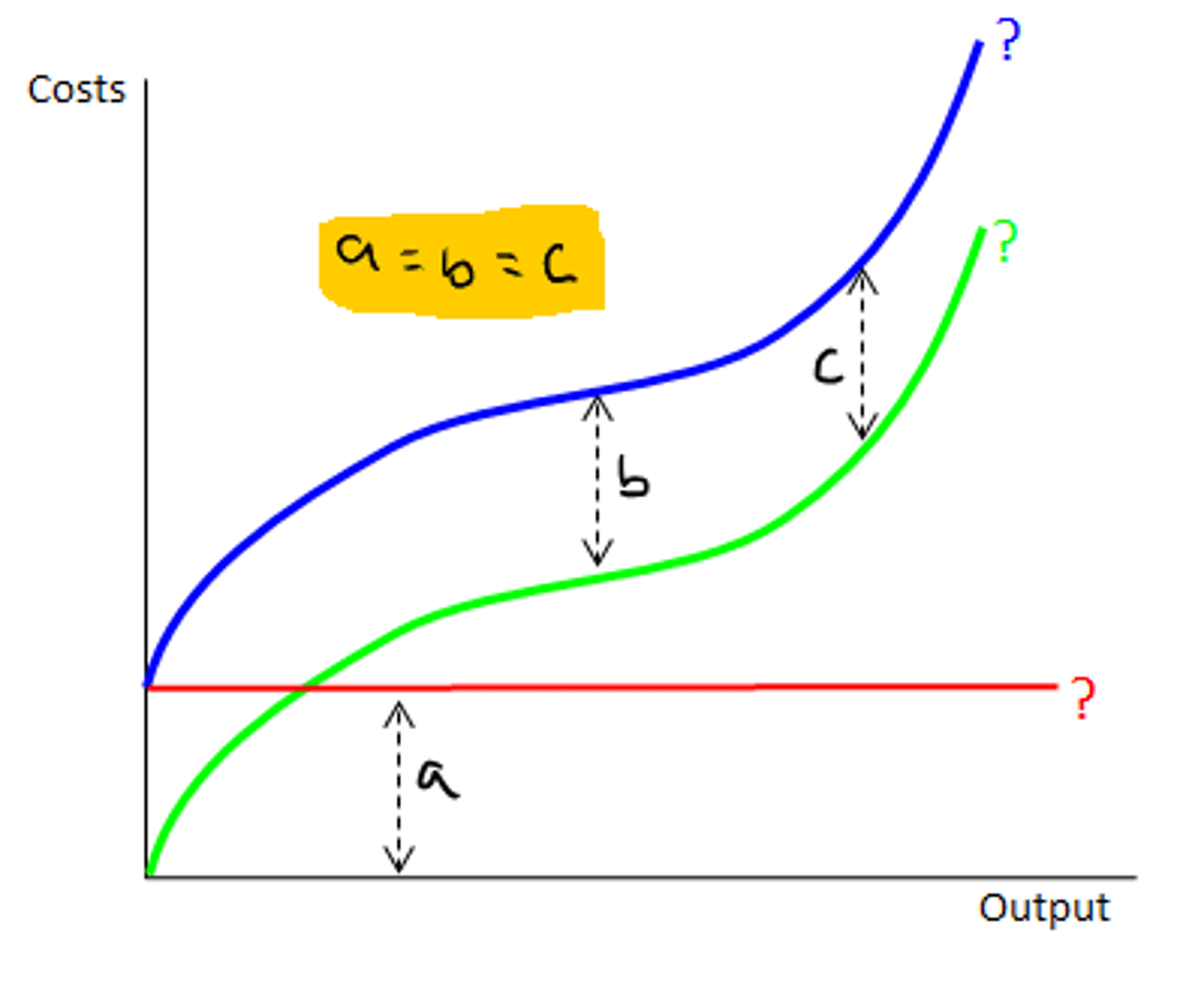

fixed costs

costs that do not change with the level of output

examples of fixed costs

-rent

-business rates

-interest payments

-insurance premiums

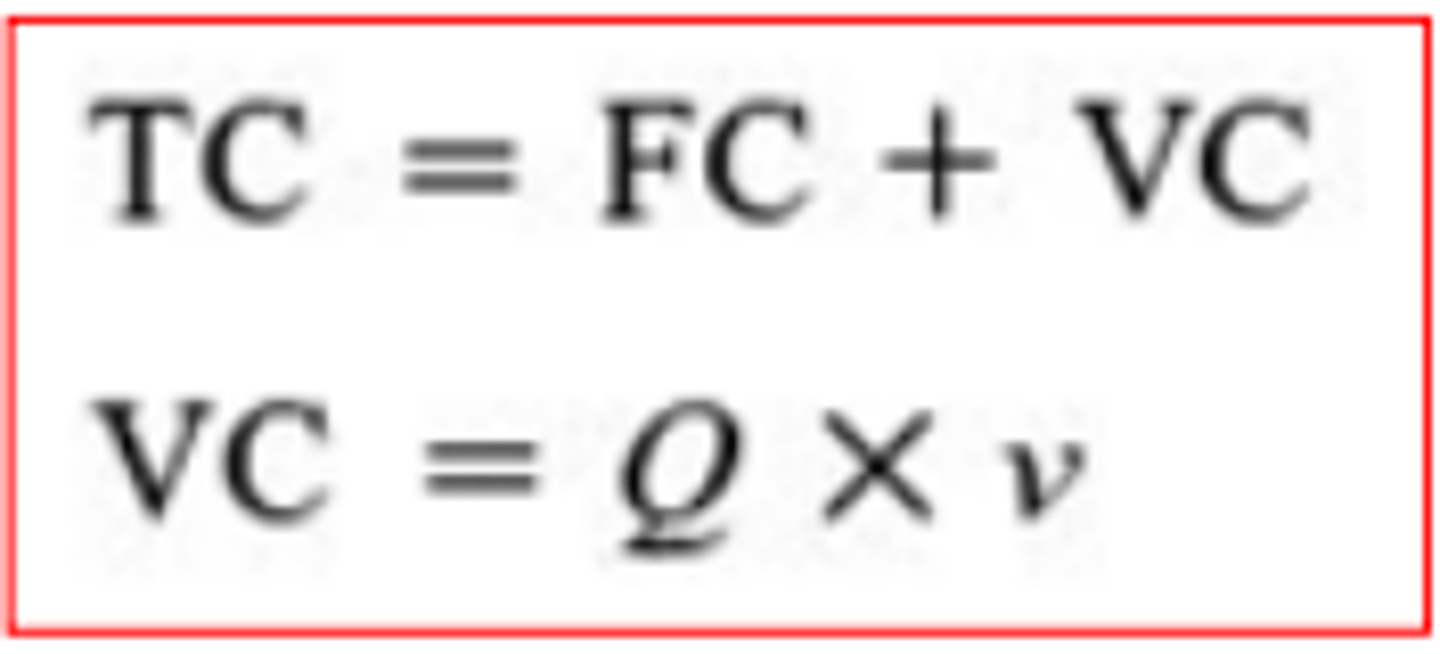

variable cost

costs that change when output levels change

examples of variable costs

-raw materials/packaging

-electric

-labour (if paid hourly or overtime)

total costs

all the business costs

formula for total costs

fixed costs + variable costs

profit

the difference between total revenues and total costs

formula for profit

total revenue - total cost

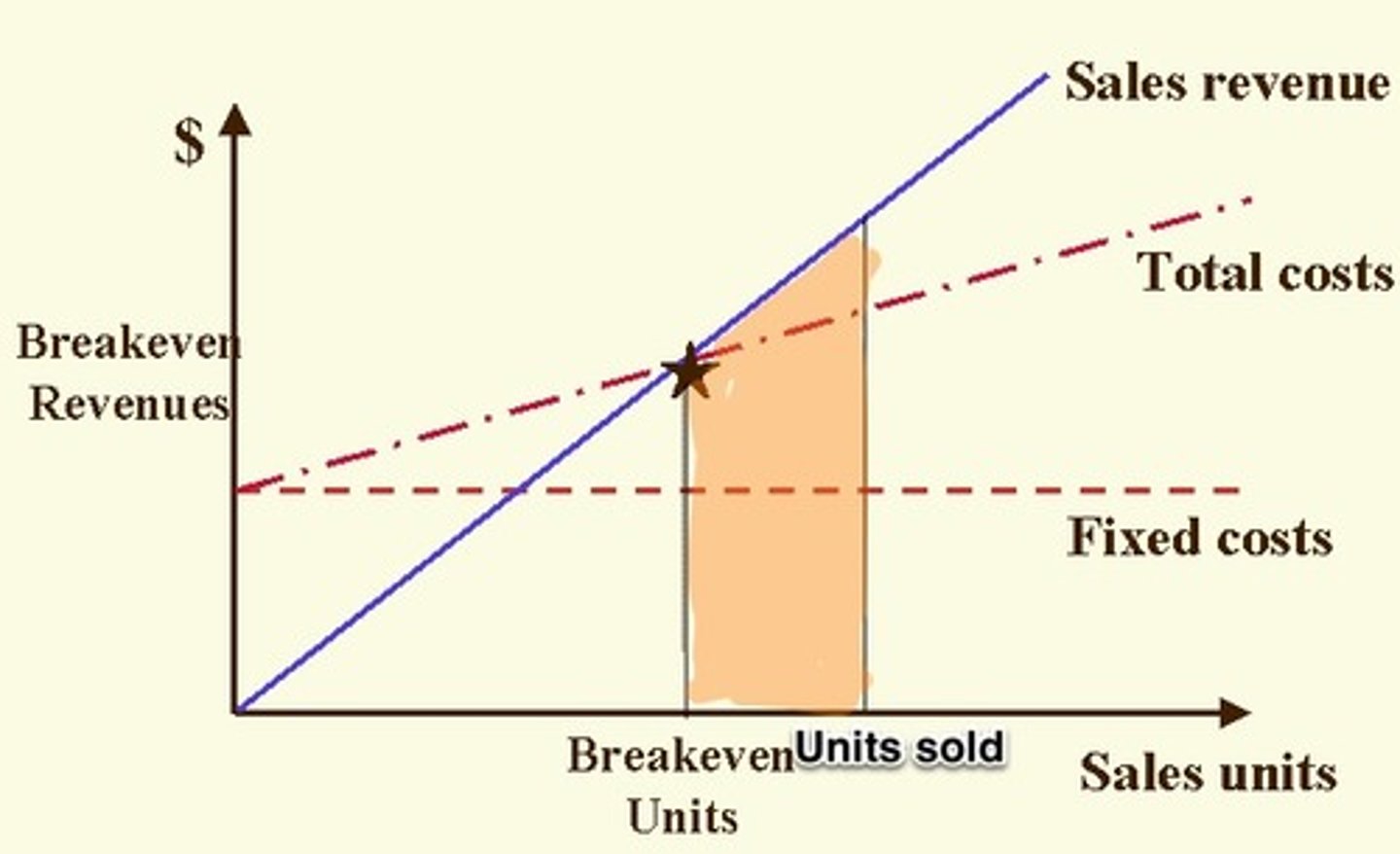

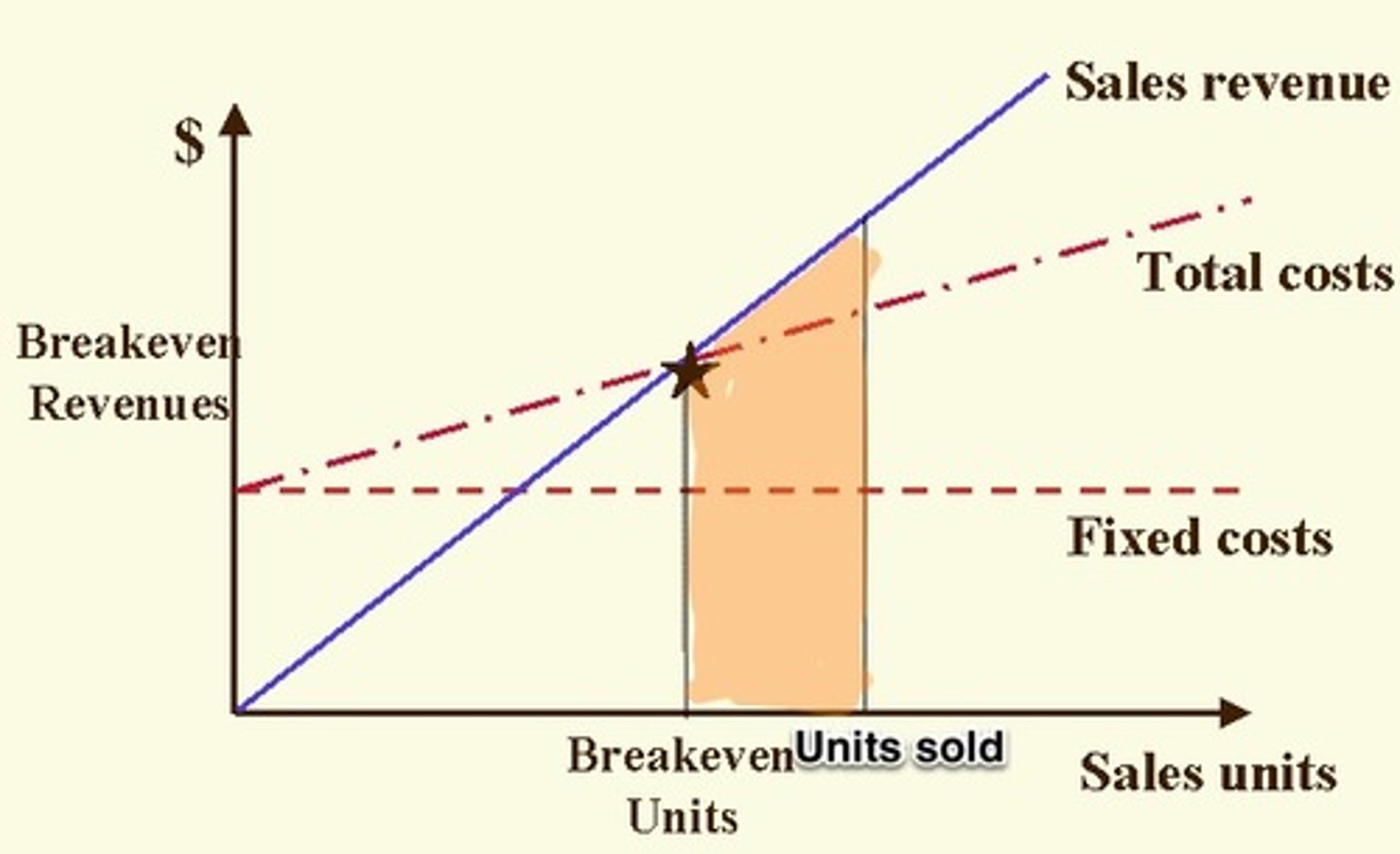

break-even

when total revenues are equal to total costs. therefore, the business does not make a profit or loss

margin of safety

the amount of output available to be sold above the break-even point where the business makes a profit

formula for margin of safety

actual output - break even point

breakeven formula

fixed costs / contribution (selling price per unit - VC per unit)

how does an increase in price impact the break-even chart?

TR becomes steeper -> reduction in break-even point (need to sell less to break-even)

how does a decrease in price impact the break-even chart?

TR becomes flatter -> an increase in break-even point (need to sell more to break-even)

how does an increase in fixed costs or increase in variable costs impact the break-even chart?

TC moves upwards -> the break-even point increasing (need to sell more to break-even)

how does a decrease in fixed costs or decrease in variable costs impact the break-even chart?

TC moves downwards -> the break-even point decreasing (need to sell less to break-even)

advantages of creating a break-even analysis

-it can help a business plan as they can see how many units are needed to be sold to break-even

-business can see the 'margin of safety' -> can create 'what if?' analysis -> what happens if the business increases prices -> can then chose strategy

disadvantages of creating a 'break-even analysis'

-as all lines are straight (TR & TC) it does not factor in if a business does discounts -> therefore is not accurate -> could be misleading -> leading to bad decisions

-if data is incorrect -> due to lack of experience in constructing BE charts -> bad decisions made

statement of comprehensive income

it shows the income and costs of the business and is used to calculate the business profit, at the end of a financial year

keys to calculating the statement of comprehensive income

A (revenue) - B (cost of sales) = C (gross profit)

C (gross profit) - D (expenses) = E (operating profit)

cost of sales

cost of raw materials and/or inventories (stock)

gross profit

revenue - cost of sales (profit before expenses)

expenses

additional overhead costs such as wages and rent. not directly with cost of producing a good or service

operating profit

gross profit - expenses ('bottom line" profit)

finance cost

cost of borrowing money. it's the interest payable to the lender

how can businesses use the statement of comprehensive income?

-investment decisions -> can help a business decide on expansion. if profits are high, expansion may be an option

-cost analysis -> helps a business to identify if costs have risen or fallen and plan a strategy to solve cost issues

-making comparisons -> can be useful for investors to see a comparison of performance and where best to invest their capital

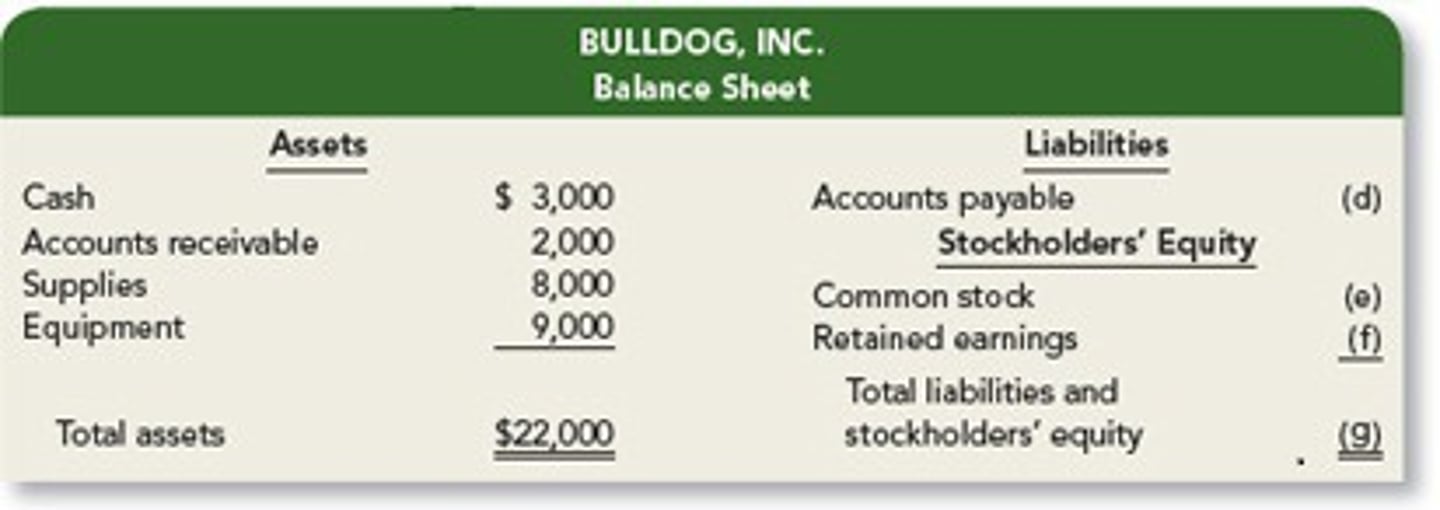

the statement of financial position (balance sheet)

a summary of the business's assets (what the business owns), liabilities (what the business owes) and capital (investment by owners) at a point in time

assets

what the business owns

liabilities

what the business owes

capital

investment by owners

non-current assets

assets that last more than a year

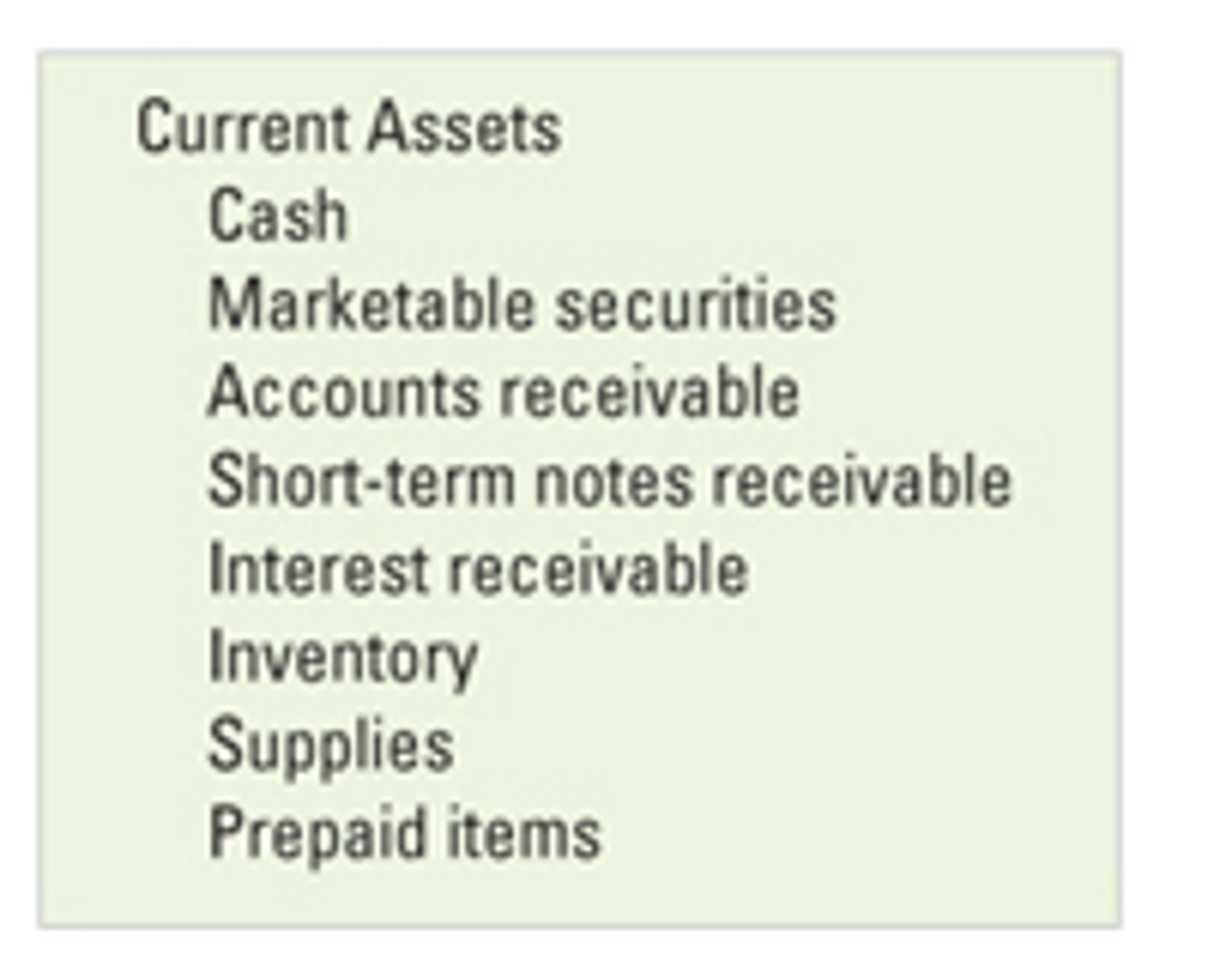

current assets

assets likely to be changed to cash within a year

inventories

this is the stock and raw materials a business is holding

trade receivables

money owed by customers to the company

current liabilities

debts that must be repaid within a year

Trade payables

Money owed to suppliers by the business

non-current liabilities

debts that are payable in more than 12 months

net current assets

current assets - current liabilities

net assets (NCA + CA) - (CL + NCL)

all assets - all liabilities

shareholder equity

all money owed to shareholders (share capital, retained profits and reserves)

capital employed

amount of money invested in a business

examples of current assets

vehicles, property, fixtures & fittings

examples of non-current assets

inventories (stock), cash, trade recievables