ACFI103 Net present value and investment appraisal

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

9 Terms

Cost of capital

The required annual rate of return on an investment project aka discount rate, required rate of return, hurdle rate

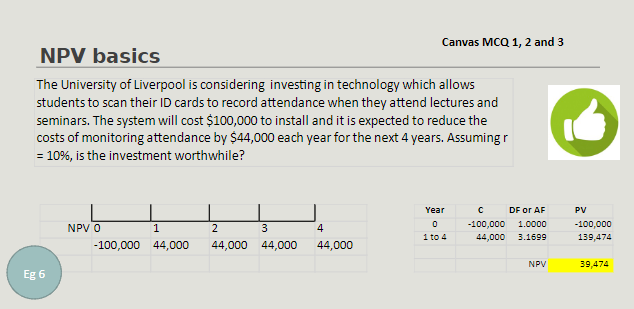

NPV

Present value of the cash inflows mins the present value of the cash outflows

NPV decision rule

If the NPV is >= 0 then accepting the project will increase the wealth of the shareholders

Project cashflow assumptions for our purposes

NPV is based on cash flows

Project cash flows occur annually.

Projects usually begin with a cash outflow at year 0

(t=0)

Decision rule: Mutually exclusive projects

often businesses have multiple investment projects available to them but are only able to proceed with one of them

eg a business may be looking to open new stores and they have a choice between location A and location B

in this case the projects are mutually exclusive and the project with the highest NPV is chosen

NPV: timing decision

Sometimes businesses may have flexibility regarding the timing of an investment decision

eg upgrading systems at any point in time

regardless of when the project starts all projects must be discounted back to PV to ensure they are commensurate(fair comparison)

decision rule: choose the option with the highest NPV( at year 0)

NPV: choice of equipment

often businesses require new equipment but have a range of options in terms of what they can buy

as a decision rule choose the option with lowest EAA

Basic NPV calculation

EAC formula

EAC = NPV/annuity factor