flash cards microeconomics (alll)

1/202

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

203 Terms

what is the decision rule in microeconomics?

we define b(x) befnefits and c(x) the costs-

if b(x) is not greater than c(x) dismiss it

b(x) is also denoted as the mx amount you would be willing to pay and c(x) the value of resources needed

opportunity cost

the cost of doing one over the other

common pitfalls in decision making

ignoring implicit costs

ignoring sunk costs (costs beyond recovery)

measuring costs and benefits as proportions rather than absolute values

failure to understand the average-marginal cost

what the optimal amount of a continuously variable activity

when MB=MC

when to know when to increase or decrease production?

MC is more than MB (reduce)

MC is less that MB (increase)

positive vs normative economics

positive is definitive answer

normative does not have a definitive answer

Perfectly Inelastic Demand

A situation where the quantity demanded does not respond at all to a change in price.

Complement Goods

Products that are often used together; an increase in the price of one leads to a decrease in demand for the other.

Excess Supply

A condition where the quantity that suppliers are providing is greater than the quantity that purchasers want at the current price.

Marginal Cost

The additional cost of producing one more unit of a good or service.

Substitute Goods

Products that can be used in place of each other; an increase in the price of one leads to an increase in demand for the other.

Normal Good

A product for which demand increases as consumer income rises.

Price Ceiling

A legal maximum on the price at which a good can be sold.

Factor Prices

The cost of inputs like labor and capital, which affect how much suppliers are willing to sell.

Tax Burden

The actual economic cost of a tax, distributed between consumers and producers based on elasticity.

Consumer Surplus

A buyer's willingness to pay for a good minus the amount the buyer actually pays for it.

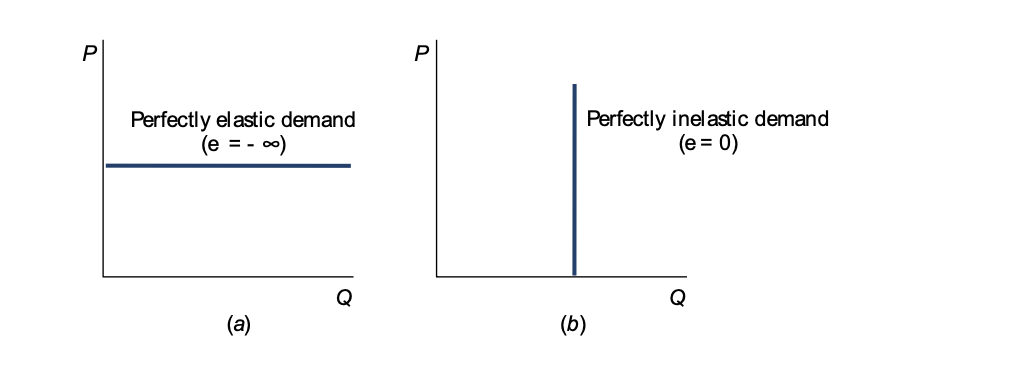

Perfectly Elastic Demand

A situation where any increase in price will cause the quantity demanded to fall to zero.

Price Floor

A legal minimum on the price at which a good can be sold.

Economic Incidence

The division of the tax burden between buyers and sellers, determined by their relative responsiveness to price changes.

role of prices in the adjustment process and markets in general

rationing

2. allocative

determinants of demand

1 Incomes (Normal goods and Inferior goods – chapter 5)

2 Tastes

3 Prices of substitutes and complements (chapter 5)

4 Expectations

5 Number of buyers

determination of supple

1 Technology

2 Factor prices: labor and capital

3 Number of suppliers

4 Expectations

5 Other (e.g. weather)

define unit tax

These are taxes expressed as a sum of money the government needs to receive per unit of the good/service exchanged

how’s does this effect supply vs demand

A unit tax t levied on suppliers shifts supply upwards by t units;

A unit tax t levied on buyers shifts demand downwards by t units.

formula for demand curve

P=a-bQ

formula for supply

P=c+dQ

formula for equilibrium?

D=S

adding tax

A per unit tax t levied on buyers shifts demand downwards by t units:

D :P =a−bQ →P =(a−t)−bQ

tax effect on supplies

A per unit tax t levied on suppliers shifts supply upwards by t units:

S : P = c + dQ → (c + t) + dQ

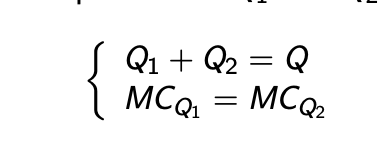

buyers and sellers tax burden

effect of subsidies consumer vs supplier

A subsidy s given to consumers shifts demand upwards by s units:

D :P =a−bQ →P =(a+s)−bQ

A subsidy s given to suppliers shifts supply downwards by s units:

S : P = c + dQ → (c − s) + dQ

key assumptions

1Consumers enter the market with well-defined and stable preferences

2 Consumers take prices as given

3 Consumers’ demands are always satisfied

4 Consumers play by the rules of the game

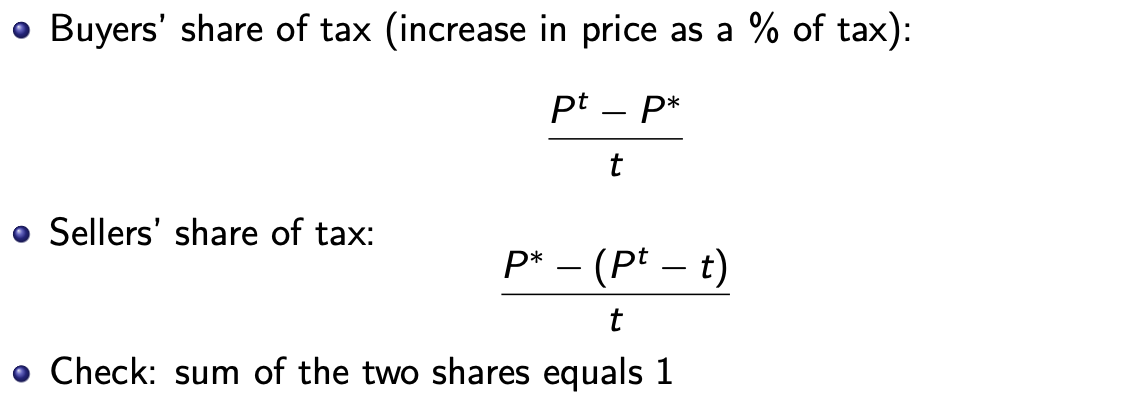

budget constraint

It is the set of bundles such that the consumer

spends all their income

simplest form of the budget constrain

pg1+g2=m

slope of budget contrail

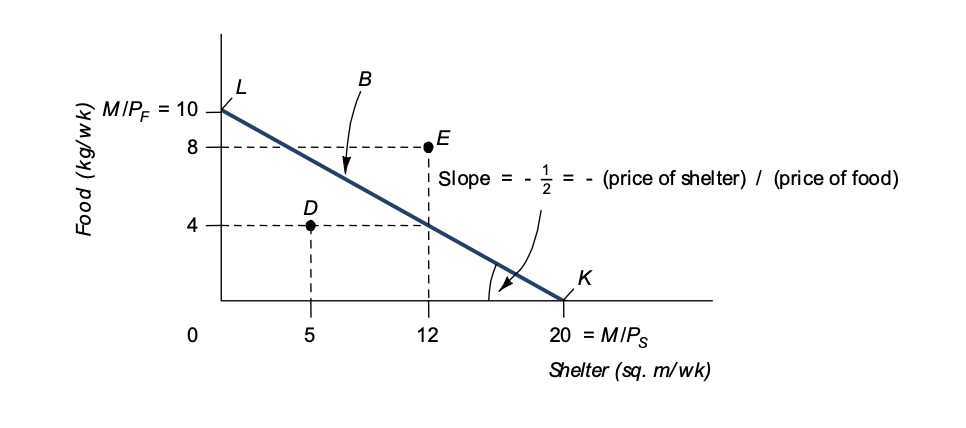

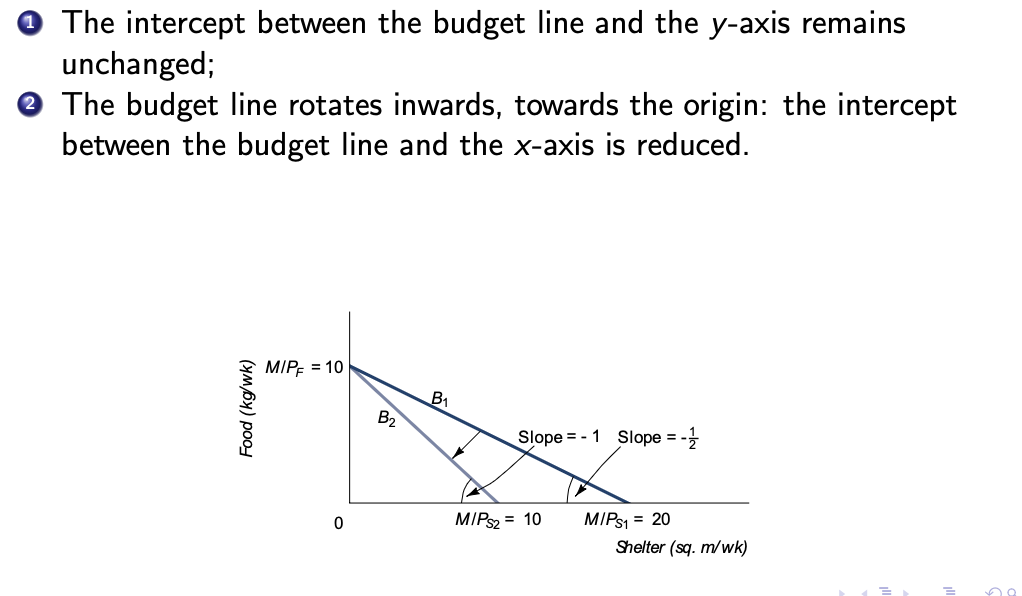

effect of a change in price

consumer income decrease?

Thus, the budget line shifts inwards in a parallel way: the slope of the

budget line does not change.

Pareto efficient

no relalocation can improve some peoples position without harming the position of at least some other

rationing function of price

equilibrium prices curtail these excessive claims by rationing scare supplies to the users who places the highest values to them

composite good

the choice between good x and numerous other goods, the amount of money the consumer spends on those other goods

properties of preference orderings

completness

more is better

transitivity ( if you prefer bundle a over w and z over a then you prefer z over w)

convexity

indifference curves

a set of bundles all of which are equally attractive than the bundles

indifference maps

bundles on a lower indifference curve are less preferred than bundles on a higher indfirence curve

how to get best affordable bundle?

combines the budget constraint and indifference curves

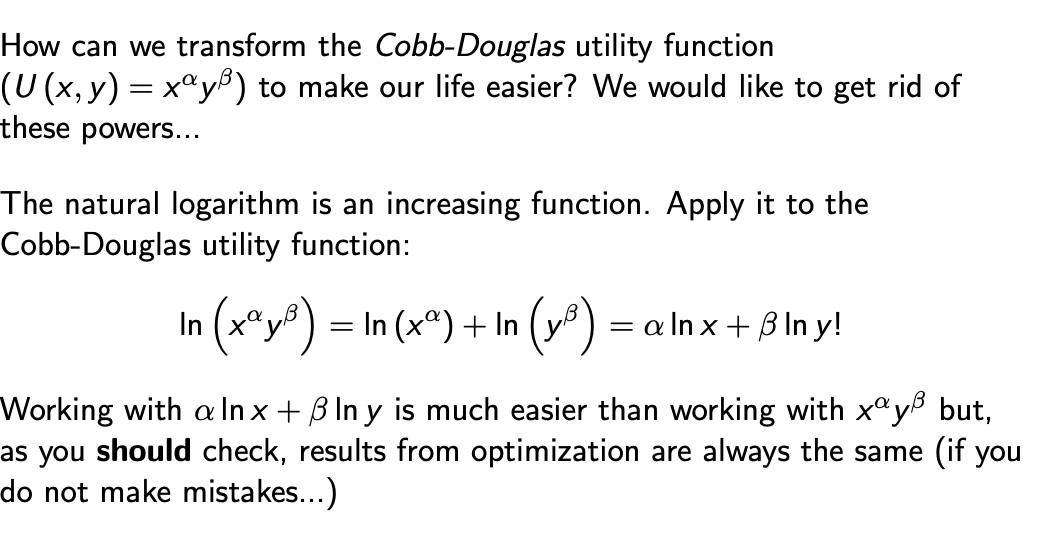

how can we transform the Cobb Douglas utility function

interior vs corner solution

consume a strictly positive amount of all goods

corner solution - for some goods consumption is = 0

equilibrium for interior solutions

MRS = −Px /Py

consumers problem can be solved by

Lagrangian

substitution

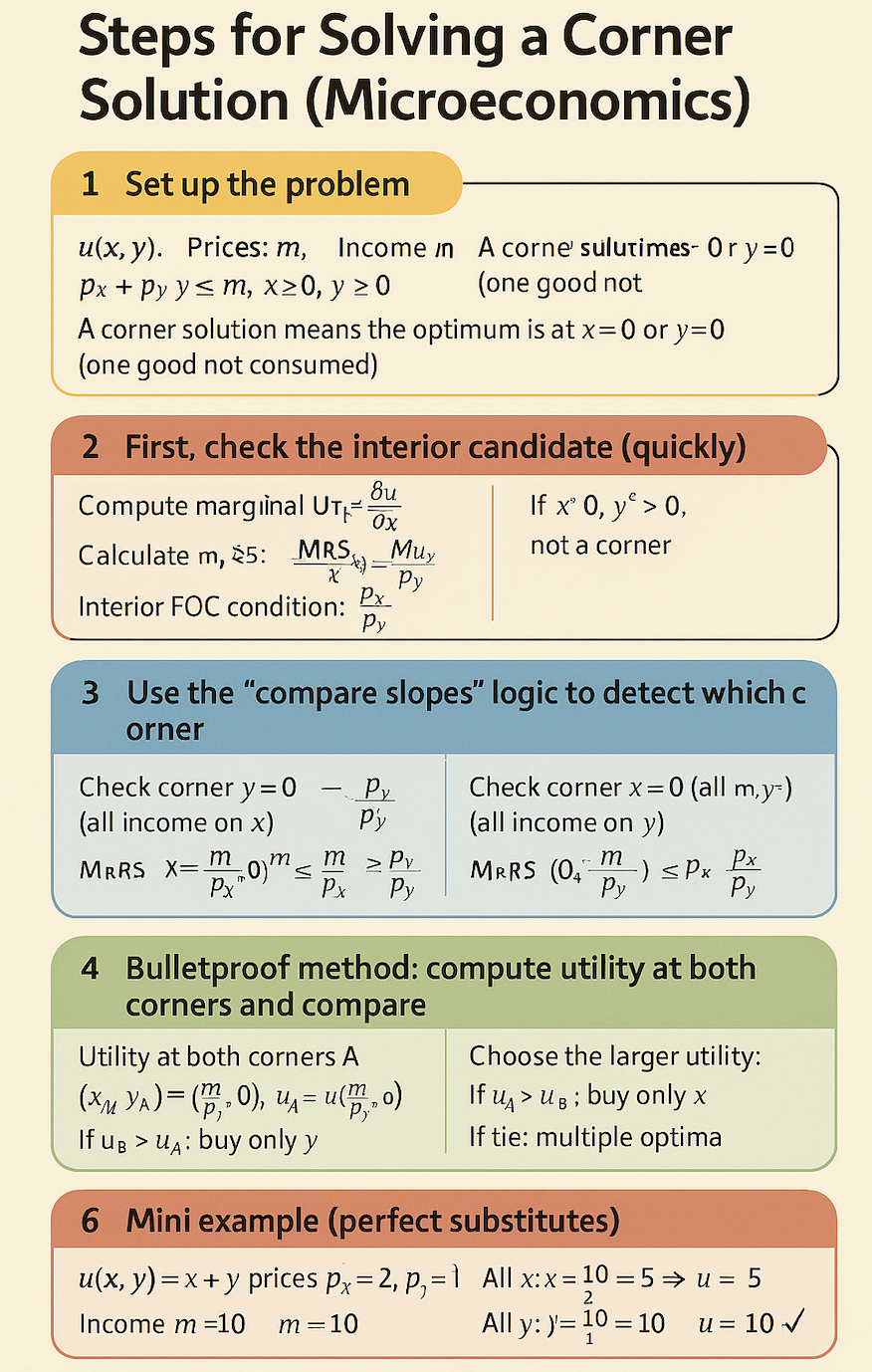

how to solve for a corner solution

what are the different goods and their properties?

normal good

luxury goods

necessity good

inferior good

icc vs pcc

income consumption curve

vs possibilities curve

draw the graph for perfectly elastic and inelastic demand

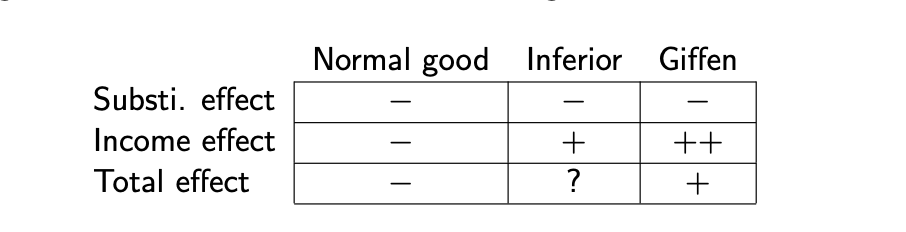

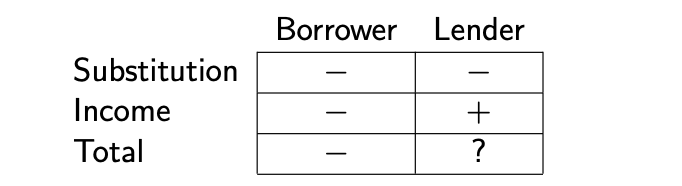

what is some key factors of the substitution effect?

Substitution effect is always negative, that is, the effect of a change

in Px on the demand for x has always the opposite sign of that of the

change in price:

1 If price increases, demand decreases;

2 If price decreases, demand increases

income effect

The income effect can either go in the same direction as the

substitution effect (e.g. normal goods) or go in the opposite direction

(inferior goods).If the direction of the income effect is oppositve to that of the

substitution effect and dominates the substitution effect (e.g. after a

price rise you observe an increase in demand), the good we are

considering is called a Giffen good.

table of goods vs effects

what is the inter-temporal choice model?

The trade-off we focus on here is between consuming today (current

consumption, C1) and consuming tomorrow (future consumption, C2)

financial capital vs real capital?

real capital Is a piece of productive equipment

financial capital is money

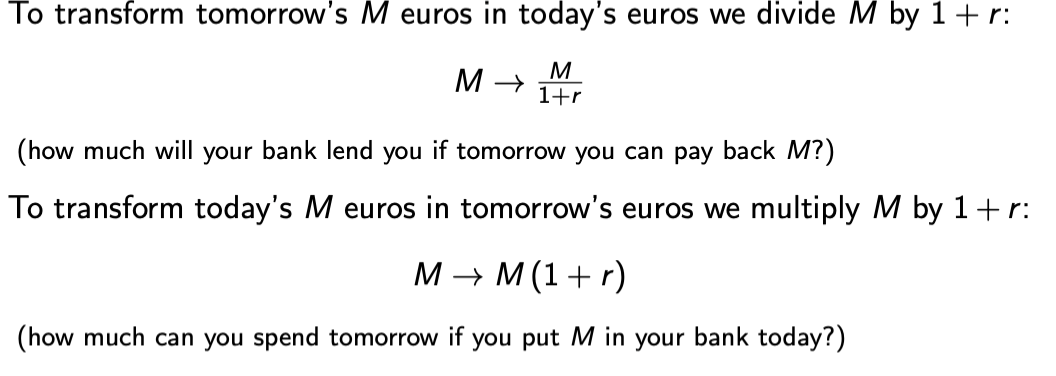

how to transform tomorrows euros into todays euros? and the other way around

real versus nominal interest rates

I = n-q/1+q

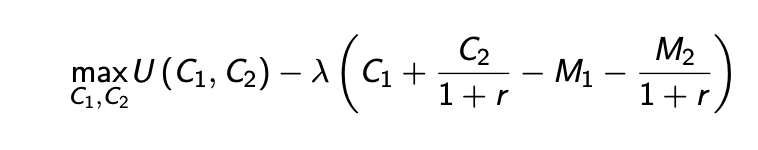

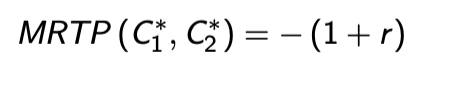

what is problem consumer faces -

what is the optimal condition?

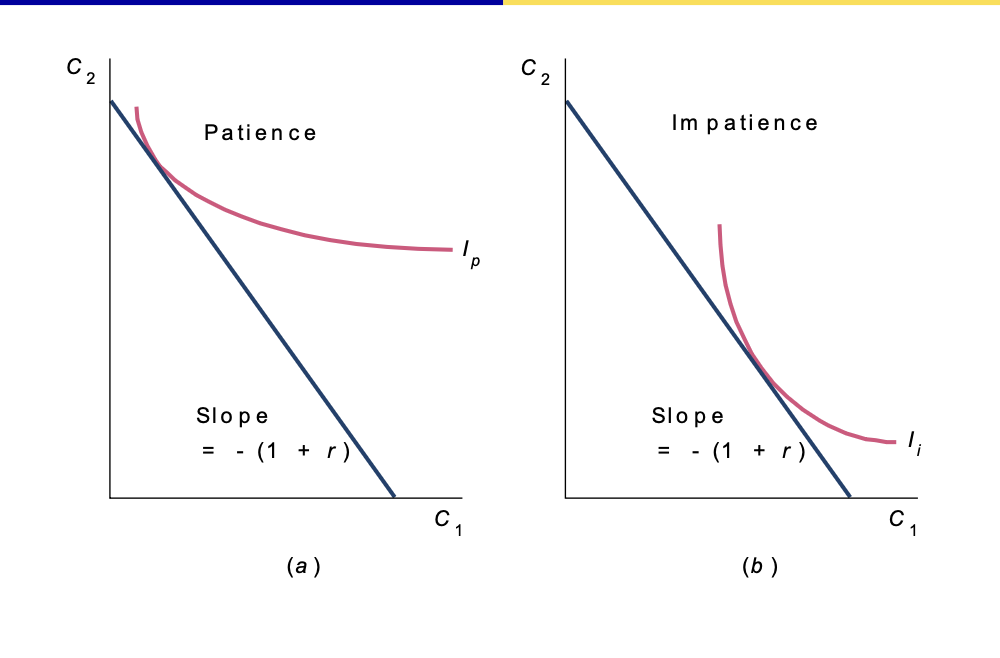

impatient vs patient consumer

the consumer is Patient if at (M1, M2):

- MRTP < 1 + r

the consumer is Impatient if at (M1, M2):

- MRTP > 1 + r

ESE-EUR FEB11001X 16 / 29

impatient vs patience curve

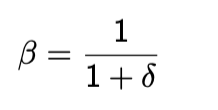

how to measure patience

how different things affect the player in and economy (table

random variable

that can any number of values for which there is an exact uncertainty

lotteries or gamble

discrete vs continues variable

discrete if it can only take on all a finite number

continues if it can take on all the real values that are contained

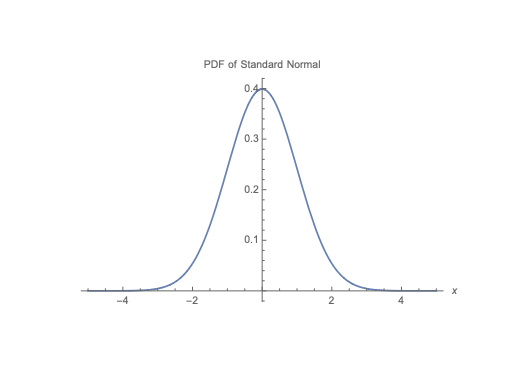

what is a probability distribution?

tells you how the chances that each possible value a random variable can take on are distributed

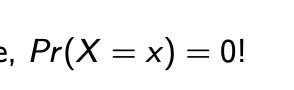

for a continues random variable

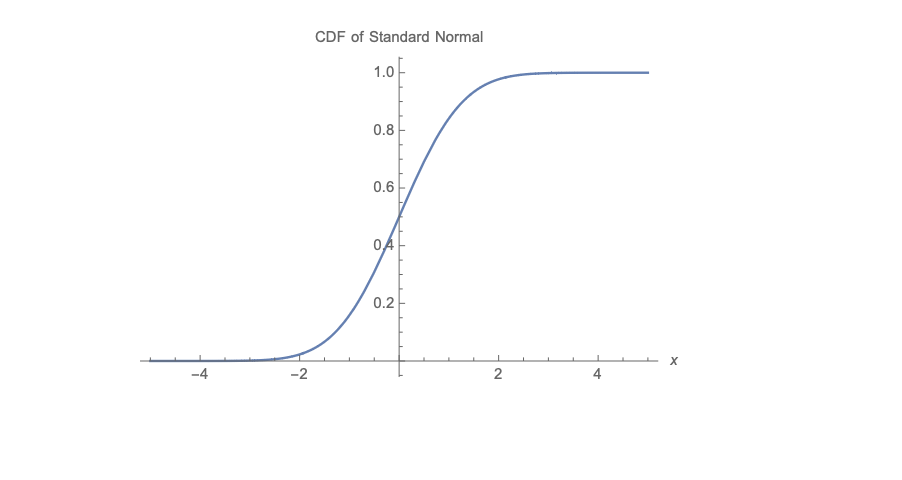

the pdf of standard normal distribution

what do you do for discrete random variables?

look at the frequency with which the random variable could take on eac value that is in it support

what is the pdf of the standard normal

average mean or expected value?

number that can be expected to be realized, on average before we observe the number that is actually realized.

uniform probability distribution

It is such that any value in the possible range of realizations [a, b] with

both a and b finite numbers has the same probability of happening

how to model preference under uncertainty

we need to define the utility function in a world with uncertainty

NO more decreasing marginal return

DO NOT assume the utility function is concave

von Neumann margenstern Utility function

assign a value a utility to each possible realisation of the random variable

This utility satisfies most of the properties of utility functions

described previously, such as completeness, more-is-better, or

transitivityYet, decreasing marginal return is only one possible case and is linked to the consumer’s attitude towards risk.

Expected utility of a gamble E (U): expected value of utility over all

possible outcomes of the gamble.

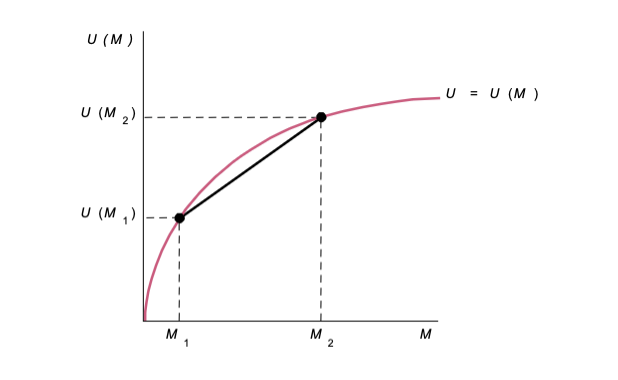

risk aversion (represent graphically

if an agent is ask averse they do not like risks

they will refuse a fair gamble

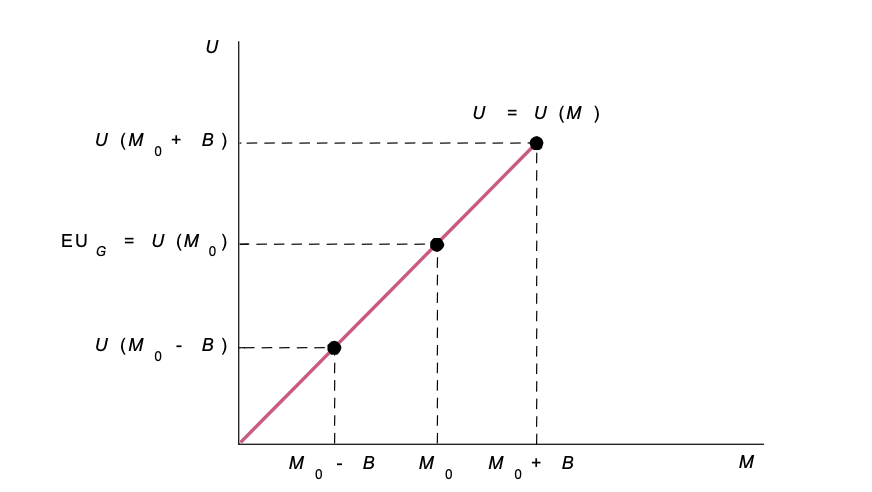

risk neutrality (represent graphically)

they have utility function that is stricly increasing

U’’ = 0

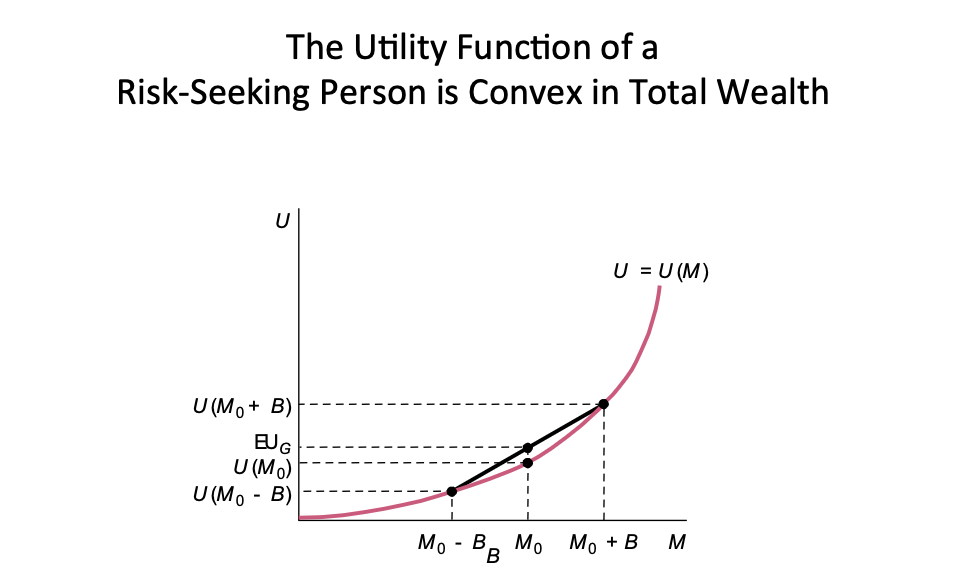

risk lover and risk seeking agents

These agents have a utility function that is again strictly increasing but

this time convex, that is such that U′′ > 0.

These agents prefer extremes to averages

certainty equivalent

paying insurers and advisors

when agents ae risk averse they would especially like to reduce the negative effects of risk

paying for information

alignment of preferences

Information plays an especially important role when the different parties

have preferences that are misaligned, that is, when their objectives do not

coincide.

- Examples of partners with different preferences:

- a buyer and a seller (Akerlof’s market for lemons);

- a manager and his workers;

- two people going out for the first time (only the first time?).

Examples of parties with same preferences:

- athletes in the same team during a competition;

- bridge partners (the card game);

parents with respect to their children (always?).

signaling

communication that conveys information

interpreted as actions

costly to fake

full disclosure

risk pooling

how different sources of risk reduce overall risk

risk sharing

how to share difference risks among different agents

group discrimination

the idea people belong to different groups and have different charateritcs

production

any activity that creates present or future utility

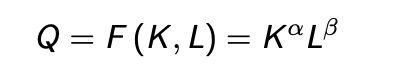

production function

how inputs ( capital and labour) are transformed into output (delivers utility)

long run vs short run

long run- there are only variable inputs

short run- there is at least one input which is fixed

assumption in terms of production

marginal returns are increasing or constant

at some point marginal returns kick in

marginal average distinction

important af

what is isoquant

set of combinations of inputs that all produce the same output

tells us how we can modify combinations of the 2 inputs while keeping production constant

characteristics of production

indifference curves

returns to scale

reaction of output to a proportional increase in all inputs

différent types of returns

IRS: Output increases more than the proportional increase in inputs

CRS: increase in output and in inputs is identical

DRS: increase in output is lower than increase in inputs

represented as a equation

IRS if and only if: F (cK , cL) > cF (K , L)

CRS if and only if: F (cK , cL) = cF (K , L)

DRS if and only if: F (cK , cL) < cF (K , L)

what are the two types of production costs

fixed and variable

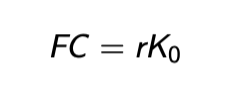

what Is considered a fixed cost and how is it represented?

capital of a firm

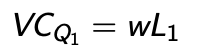

equation for variable costs

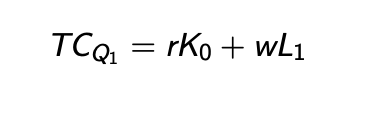

equation for total costs

what do you need to solve these?