FSA

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

Number of Treasury Shares (Treasury Stock Method)

Assumed Proceeds ÷ Average Share Price During the Reporting Period [Assumed proceeds if all options or option like securities are exercised]

Assumed Proceeds

Cash Proceeds + Average Unrecognized Share-Based Compensation Expense

U.S. GAAP Interest Cost (Benefit Plans)

Beginning PBO × Discount Rate

IFRS Net Interest Income (Expense)

Beginning Funded Status × Discount Rate

Funded Status of the Plan

Fair Value of Plan Assets − PBO

Liquidity Coverage Ratio

Highly Liquid Assets ÷ Expected Cash Flows

Net Stable Funding Ratio

Available Stable Funding ÷ Required Stable Funding

Underwriting Loss Ratio

(Claims Paid + Δ Loss Reserves) ÷ Net Premium Earned

CAMELS

Capital adequacy, asset quality, management, earnings, liquidity, and sensitivity

Expense Ratio

Underwriting Expenses Including Commissions ÷ Net Premium Written

Loss and Loss Adjustment Expense Ratio

(Loss Expense + Loss Adjustment Expense) ÷ Net Premium Earned

Dividends to Policyholders Ratio

Dividends to Policyholders ÷ Net Premium Earned

Combined Ratio

Loss and Loss Adjustment Expense Ratio + Underwriting Expense Ratio

Combined Ratio After Dividends

Combined Ratio + Dividends to Policyholders Ratio

Tier 1 Capital Ratio

Tier 1 Capital / Risk-Weighted Assets

AccrualsCF

Net Income − CFO − CFI

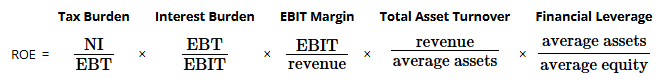

ROE (5 Part DuPont)

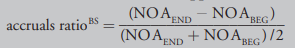

Accruals Ratio (Balance Sheet)

Accruals Ratio (CF Statement)

(NI − CFO − CFI) ÷ ((NOAEND + NOABEG) ÷ 2)

Cash Generated from Operations (CGO)

=EBIT + Non-Cash Charges − Increase in Working Capital

=Operating Cash Flow + Cash Interest + Cash Taxes

Current Ratio

Current Assets ÷ Current Liabilities

Quick Ratio

(Cash + Marketable Securities + Receivables) ÷ Current Liabilities

Cash Ratio

(Cash + Short-Term Marketable Securities) ÷ Current Liabilities

Defensive Interval Ratio

(Cash + Short-Term Marketable Investments + Receivables) ÷ Daily Cash Expenditures

Receivables Turnover

Net Annual Sales ÷ Average Receivables

Inventory Turnover

Cost of Goods Sold ÷ Average Inventory

Days of Sales Outstanding (DSO)

365 ÷ Receivables Turnover Ratio

Days of Inventory on Hand (DOH)

365 ÷ Inventory Turnover

Payables Turnover

Purchases ÷ Average Payables

Number of Days of Payables

365 ÷ Payables Turnover

Total Asset Turnover

Net Sales ÷ Average Total Assets

Fixed Asset Turnover

Net Sales ÷ Average Fixed Assets

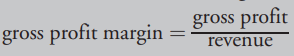

Gross Profit Margin

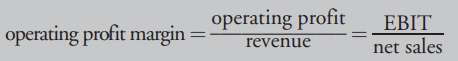

Operating Profit Margin

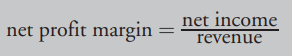

Net Profit Margin

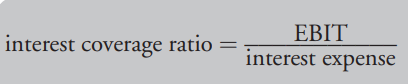

Interest Coverage Ratio

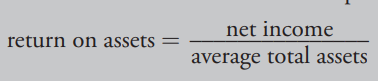

ROA

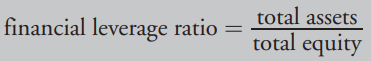

Financial Leverage Ratio

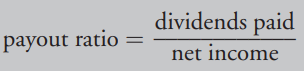

Payout Ratio

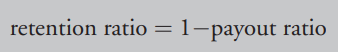

Retention Ratio

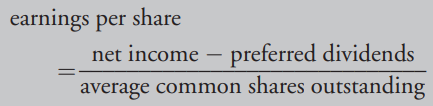

EPS

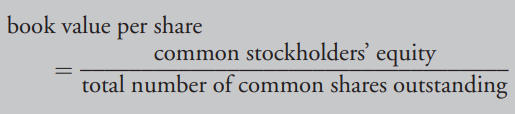

BVPS