TRADING

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

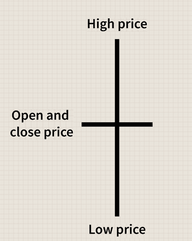

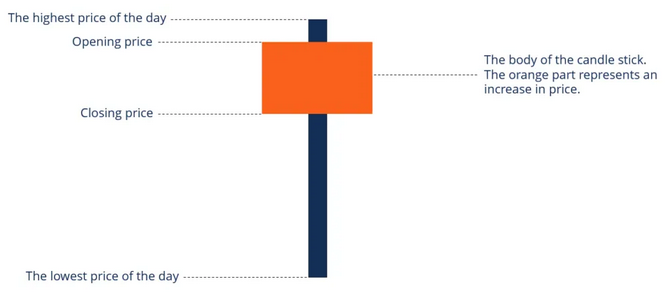

DOJI

short candlestick with little to no body indicating indecision, weakness and trend reversal

open and closes at nearly the same price

LONG LEGGED DOJI

long upper and lower shadows indicating uncertainty

ex: market rallied and sold off significantly but neither position held as market opened and closed in the same spot

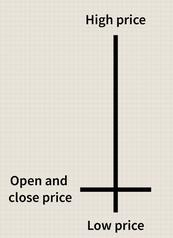

DRAGONFLY DOJI

long lower shadow

greater significance in a downtrend as it has bullish indications

sellers were able to drive price lower but were unable to hold price down

GRAVESTONE DOJI

long upper shadow and no lower shadow

uptrend is running out of steam

indicates buyers pushed price up but were unable to hold the market at higher levels, conceding to sellers

HANGING MAN

bearish trend reversal signal seen in uptrend

long lower shadow is generally bullish

indicates demand forced price into upper third price range for that period

confirmation of trend reversal: the next candle should close below hanging man’s real body (ex: engulfing or piercing pattern)

HAMMER PATTERN

bullish trend reversal signal appearing in downtrend

hammers out a base at bottom of downtrend

confirmation: followed by bullish candle, increased volume

INVERTED HAMMER

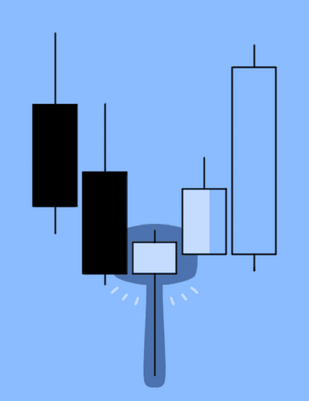

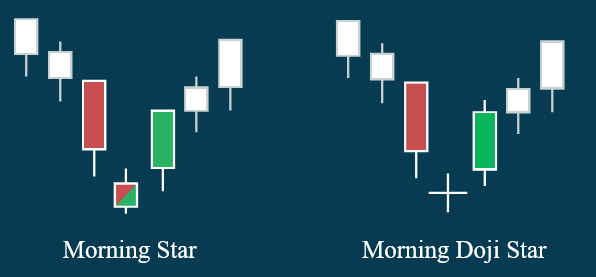

MORNING STAR

bullish bottom reversal pattern

three candlestick pattern

bearish candle confirming downtrend

star, indicating weakness

long green candle providing bullish confirmation

EVENING STAR

bear top trend reversal pattern of an uptrend

three candlestick pattern

large green bullish candle

star with short body, indicating weakness

large red bearish candle

BULLISH ENGULFING PATTERN

trend reversal pattern where the second candle completely engulfs previous candle’s body

appears in down trend

red candle at bottom of down trend, next candle is green and completely engulfs the red candle

BEARISH ENGULFING PATTERN

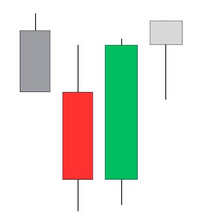

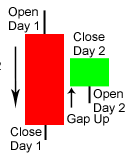

BULLISH HARAMI

occurs at bottom of down trend

large red candle on day one followed by smaller red candle or bullish candle on day two

prices gapped up on day two and price was held up and unable to move lower back to day one’s bearish close

BEARISH HARAMI

occurs at top of uptrend

large green candle on day one followed by smaller bearish or bullish candle on day two

prices gapped down on day two and were unable to move higher back to day one’s close

SHOOTING STAR

TWEEZERS TOP

TWEEZERS BOTTOM

PIERCING PATTERN

DARK CLOUD COVER PATTERN