HC Ch 8: Revenue Cycle Management: Cost Estimation and Rate Calculations

1/21

Earn XP

Description and Tags

Final

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

what is the equation for calculation of total costs?

total costs = fixed costs + total variable costs OR

total costs = fixed costs + (variable cost rate x volume)

what is activity based costing?

it is a costing approach that analyzes the individual units of work performed that contribute to the total cost of a process - it is a 6 step process

identify the activities

identify the activity costs

identify the cost drivers

identify volume or utilization

calculate allocation rates

calculate process totals

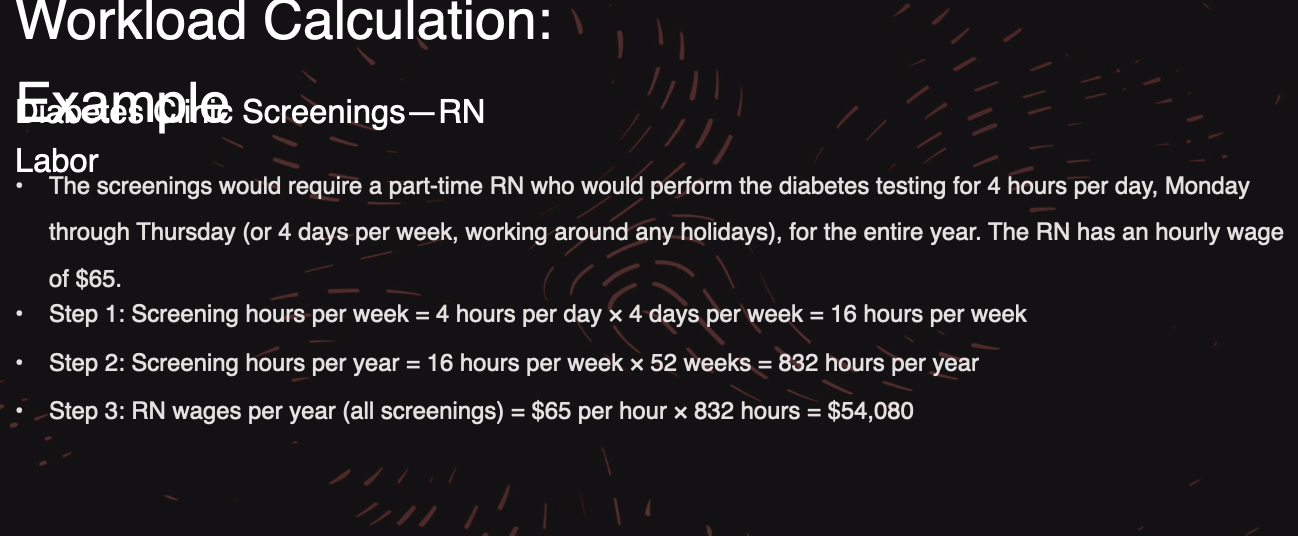

what is a workload calculation?

it is an estimate of the anticipated labor expense for a project or process

tasks that compromise the project or process

completion time for each task

frequency and duration of the tasks/project

pay rate of the employee completing the tasks

workload calculation example

what are rate calculations and price?

price is the amount the organization will charge consumers or patients to utilize the services provided

ex: fixed costs (rent & salary), variable costs (medical supplies & single use items), profit (percentage & specific amount)

what are pricing strategies and profit analysis?

Full cost pricing

marginal cost pricing

price shifting

what is full cost pricing?

this is establishing a price that covers direct fixed costs, direct variable costs, and overhead (indirect)

what is marginal pricing?

marginal pricing is pricing that covers additional units of service only, but not all costs incurred

what is price shifting?

the process of charging higher pricing to one group of consumers to cover the financial shortfall of another group of consumers

what is breakeven are what are the types of breakeven?

a point where total revenue (price x volume) - total costs (foxed costs) (total variable costs) = profit. they are used for profit analysis

economic breakeven: covers costs incurred and includes profit margin

accounting breakeven: covers costs incurred with no profit margin

what is capital structure?

the determination of the ideal financing, by comparing equity financing return on equity (ROE) and the debt financing ROE

every organization has its own unique equity and debt mix

this comparison is done by completing a balance sheet and income statement based on the desired equity and debt percentages

what is the corporate cost capital?

this is calculated using the debt and equity percentages and the required interest rate or rate of return for each

CCC = (equity percentage x equity cost) + (debt percentage x debt cost) x (1-tax rate)

what is the equity percentage?

the percentage of equity to be used in the financing decision

what is equity cost?

the required rate/cost of financing using quality

what is the debt percentage?

the percentage of debt to be used in the financing decision

what is the debt cost?

the required rate/cost of financing using debt and tax rate

what is tax rate?

the organizations tax rate

what are the decision making and data capturing sources?

accounting, budgeting & forecasting, investments, and patient & stakeholder experience

in this case how is accounting used?

this records all financial activity coming in and going out of the organization this data helps decision makers to visualize what financial resources we have now and how we are sending them

in this case how is budgeting and forecasting used?

after the actual financial activity is recorded, decisions must be made on preparing for the future, efforts to maintain the organizations operations must begin with proper planning

in this case how are investments used?

data capture helps to determine what, how, and when to invest in projects and services by providing the much needed detail on available alternatives. data for the “make or buy” decision, as well as the “expand or contract” decision allows leadership to utilize available resources for the appropriate investments

in this case how are patients and stakeholders used?

the needs of stakeholders must be managed, data capture through accounting methods and ABC provides decision makers with information at the transaction levels for patients, clinicians, insurer's and other stakeholders, allowing for continous improvement