Investment appraisal

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

What is Investment Appraisal?

A decision-making process used by businesses to evaluate the profitability and risk of an investment project.

What are the main methods of Investment Appraisal?

Net Present Value (NPV)

Accounting Rate of Return (ARR)

Payback Period

Internal Rate of Return (IRR)

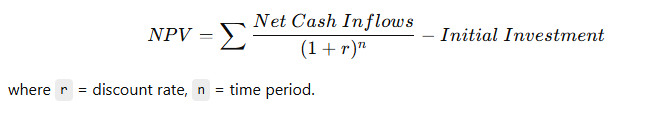

What is Net Present Value (NPV)?

The sum of all discounted cash flows from an investment, minus the initial investment cost.

Formula:

NPV = ∑ (Net Cash Inflows ÷ (1 + r)ⁿ) - Initial Investment

r= Discount Raten= Time Period

What does a Positive NPV indicate?

The project is expected to generate more cash than it costs, suggesting it is a good investment.

What does a Negative NPV indicate?

The project is expected to generate less cash than it costs, suggesting it should not be pursued.

What is the Payback Period?

The time it takes for an investment to generate enough cash inflows to recover its initial cost.

Payback Period = Initial Investment/Annual Cash Inflows

How is Payback Period evaluated?

Shorter payback periods are generally preferred because the investment is recovered faster, reducing risk.

What is the Accounting Rate of Return (ARR)?

The average annual profit from an investment as a percentage of the initial investment.

ARR = Average Annual Profit/Initial Investment × 100

How is ARR evaluated?

The higher the ARR, the more attractive the investment is.

Must be compared to the cost of capital or required rate of return.

What are the main advantages of NPV?

Considers time value of money.

Shows the absolute value of the project's profitability.

Directly correlates with the objective of maximizing shareholder wealth.

What are the main disadvantages of NPV?

Relies on estimates of future cash flows and discount rate.

More complex to calculate compared to Payback or ARR.

May not be useful if the discount rate is hard to determine.

What are the main advantages of Payback Period?

Simple and easy to calculate.

Useful for assessing liquidity risk.

Helps in comparing projects with short-term cash flows.

What are the main disadvantages of Payback Period?

Ignores the time value of money.

Does not consider cash flows after payback.

Only focuses on recovery time, not profitability.

What are the main advantages of ARR?

Simple to understand and calculate.

Focuses on profitability.

Allows easy comparison with other investments.

What are the main disadvantages of ARR?

Ignores the time value of money.

Based on accounting profit rather than cash flow.

Can be misleading if profits are uneven over time.

When is Investment Appraisal used?

Business expansion

New product development

Purchasing new machinery

Entering new markets

How does sensitivity analysis relate to Investment Appraisal?

It is used to test the impact of changes in key assumptions like costs, revenues, and discount rates on the outcome of NPV and other methods.

What role does Discount Rate play in NPV?

Represents the cost of capital or required rate of return.

A higher discount rate reduces the NPV of future cash flows.

Why is IRR important?

Definition: The discount rate at which the NPV of an investment is zero.

If IRR > Cost of Capital, the project is considered profitable.