Principles of Economics Chapter 31 The Impacts of Government Borrowing

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

30 Terms

Timeline for Fiscal Policy

Jan 1, 2018

Feb 2, 2018

1. President submits budget proposals to Congress

2. Congress debates, amends, and enacts the budget

3. The President signs the budget act into law

Oct 1, 2018 - Fiscal 2019 begins

1. Supplementary budget law may be passed

2. State of the economy influences expenditures, tax revenues, And budget balance

Sept 30, 2019 - Fiscal 2019 ends

1. Accounts for Fiscal 2012 are prepared.

2. Expenditures, tax revenues, and the budget balance are reported.

Golden Rule

Quantity of financial capital supplied must equal quantity of financial capital demanded

As Borrowers

Households save more

Private firms borrow less

Additional funds of government borrowing come from outside the country

Sources of Financial Capital

Private savings from inside U.S. economy

Public saving

Total savings =

private savings (S) + public savings (T-G)

S+ (M-X)= I + (G-T)

Quantity supplied of financial capital=quantity demanded of financial capital

Private savings + inflow of foreign savings=Private investment+ Government budget deficit

Gov't spend more: T-G is negative; borrow money in the amount of (G-T)

New equation:

Private investment=private savings+ public savings + trade deficit

I= S+(T-G) + (M-X)

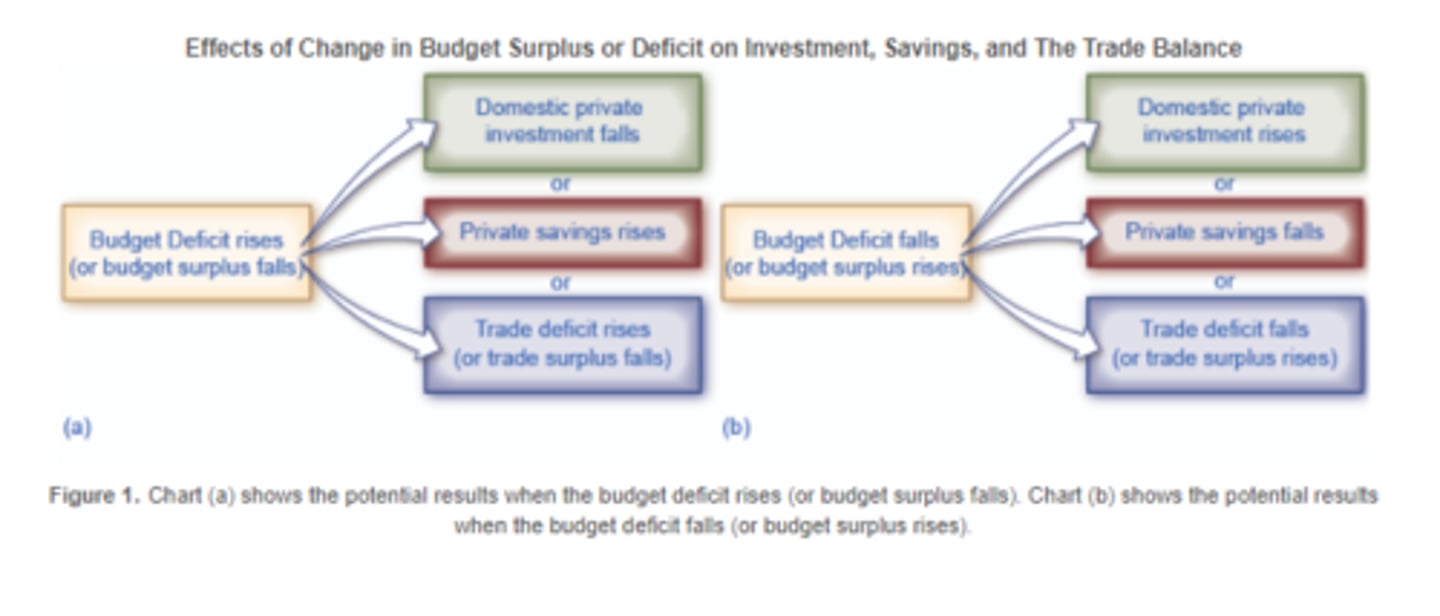

When Budget Deficit increases

Domestic Private investment decreases

Private savings increases

Trade deficit increases (or trade surplus decreases)

When Budget Deficit decreases

Domestic private investment increases

Private savings decreases

Trade deficit decreases (trade surplus increases)

Budget Surplus

Gov't runs budget surplus but economy experiencing trade deficit

New identity:

Private savings + trade deficit+ gov't surplus=private investment

S + (M-X) + (T-G)=I

Budget Deficit

Gov't running budget deficit while economy is experiencing trade surplus

Identity:

Private savings= private investment + outflow of foreign savings + gov't budget deficit

S=I+ (X-M) + (G-T)

what are the 2 main sources for financial capital?

The U.S. economy has two main sources for financial capital: private savings from inside the U.S. economy and public savings.

Total savings =

Private savings (S) + Public savings (T - G)

Effects of Change in Budget Surplus or Deficit on Investment, Savings, and The Trade Balance

Chart (a) shows the potential results when the budget deficit rises (or budget surplus falls). Chart (b) shows the potential results when the budget deficit falls (or budget surplus rises).

Changes in National Savings and Investment Identity

A change in any part of the national saving and investment identity suggests that if the government budget deficit changes, then either private savings, private investment in physical capital, or the trade balance—or some combination of the three—must change as well.

In a country, private savings equals 600, the government budget surplus equals 200, and the trade surplus equals 100. What is the level of private investment in this economy?

We use the national savings and investment identity to solve this question. In this case, the government has a budget surplus, so the government surplus appears as part of the supply of financial capital. Then:

Quantity supplied of financial capital = Quantity demanded of financial capital

S + (T - G) = I + (X - M)

600 + 200 = I + 100

I = 700

Assume an economy has a budget surplus of 1,000, private savings of 4,000, and investment of 5,000.

Write out a national saving and investment identity for this economy.

What will be the balance of trade in this economy?

If the budget surplus changes to a budget deficit of 1000, with private saving and investment unchanged, what is the new balance of trade in this economy?

A. Since the government has a budget surplus, the government budget term appears with the supply of capital. The following shows the national savings and investment identity for this economy.

Quantity supplied of financial capital = Quantity demanded of financial capital

S + (T - G) = I + (X - M)

B. Plugging the given values into the identity shown in part (a), we find that (X - M) = 0.

C. Since the government has a budget deficit, the government budget term appears with the demand for capital. You do not know in advance whether the economy has a trade deficit or a trade surplus. But when you see that the quantity demanded of financial capital exceeds the quantity supplied, you know that there must be an additional quantity of financial capital supplied by foreign investors, which means a trade deficit of 2000. This example shows that in this case there is a higher budget deficit, and a higher trade deficit.

Quantity supplied of financial capital = Quantity demanded of financial capital

S + (M - X) = I + (G - T)

4000 + 2000 = 5000 + 1000

Where does Economic Growth come from?

Economic growth comes from a combination of investment in physical capital, human capital, and technology.

What can Government borrowing crowd out?

Government borrowing can crowd out private sector investment in physical capital

Why have many education experts recently placed an emphasis on altering the incentives faced by U.S. schools rather than on increasing their budgets? Without endorsing any of these proposals as especially good or bad, list some of the ways in which incentives for schools might be altered.

In the last few decades, spending per student has climbed substantially. However, test scores have fallen over this time. This experience has led a number of experts to argue that the problem is not resources—or is not just resources by itself—but is also a problem of how schools are organized and managed and what incentives they have for success. There are a number of proposals to alter the incentives that schools face, but relatively little hard evidence on what proposals work well. Without trying to evaluate whether these proposals are good or bad ideas, you can just list some of them: testing students regularly; rewarding teachers or schools that perform well on such tests; requiring additional teacher training; allowing students to choose between public schools; allowing teachers and parents to start new schools; giving student "vouchers" that they can use to pay tuition at either public or private schools.

What are some steps the government can take to encourage research and development?

The government can direct government spending to R&D. It can also create tax incentives for business to invest in R&D.

Ricardian equivelance

The theory of Ricardian equivalence holds that changes in government borrowing or saving will be offset by changes in private saving. Thus, higher budget deficits will be offset by greater private saving, while larger budget surpluses will be offset by greater private borrowing. If the theory holds true, then changes in government borrowing or saving would have no effect on private investment in physical capital or on the trade balance. However, empirical evidence suggests that the theory holds true only partially.

Imagine an economy in which Ricardian equivalence holds. This economy has a budget deficit of 50, a trade deficit of 20, private savings of 130, and investment of 100. If the budget deficit rises to 70, how are the other terms in the national saving and investment identity affected?

Ricardian equivalence means that private saving changes to offset exactly any changes in the government budget. So, if the deficit increases by 20, private saving increases by 20 as well, and the trade deficit and the budget deficit will not change from their original levels. The original national saving and investment identity is written below. Notice that if any change in the (G - T) term is offset by a change in the S term, then the other terms do not change. So if (G - T) rises by 20, then S must also increase by 20.

Quantity supplied of financial capital = Quantity demanded of financial capital

S + (M - X) = I + (G - T)

130 + 20 = 100 + 50

In the late 1990s, the U.S. government moved from a budget deficit to a budget surplus and the trade deficit in the U.S. economy grew substantially. Using the national saving and investment identity, what can you say about the direction in which saving and/or investment must have changed in this economy?

In this case, the national saving and investment identity is written in this way:

Quantity supplied of financial capital = Quantity demanded of financial capital

(T - G) + (M - X) + S = I

The increase in the government budget surplus and the increase in the trade deficit both increased the supply of financial capital. If investment in physical capital remained unchanged, then private savings must go down, and if savings remained unchanged, then investment must go up. In fact, both effects happened; that is, in the late 1990s, in the U.S. economy, savings declined and investment rose.

A country's economic data indicates that there has been a substantial reduction in the financial capital available to private sector firms. Which of the following most likely had the greatest influence on this economy?

D. especially large and sustained government borrowing.

A prolonged period of budget deficits may lead to ___________________.

lower economic growth

In most developed countries, the government plays a large role in society's investment in human capital through _________________________.

the education system

Crowding out occurs when government borrowing soaks up available capital and leaves less for private investment.

True

A highly educated and skilled workforce contributes to a higher rate of economic growth.

True

When governments are borrowers in financial capital markets, which of the following is least likely to be a possible source of the funds from a macroeconomic point of view?

central bank prints more money

From a macroeconomic point of view, which of the following is a source of demand for financial capital?

domestic household private savings

The U.S. economy has two main sources for financial capital; _______________________ and ____________________________.

private savings from U.S. households and firms; inflows of foreign financial investment

In the national savings and investment identity framework, an inflow of savings from abroad is, by definition, equal to:

the trade defecit

A ___________________________________ can lead to disruptive economic patterns and heavy strains on a country's banking and financial system.

sustained pattern of large trade deficits