Economics- Theme 2.2 + 2.3: Aggregate Demand and Supply

0.0(0)

Card Sorting

1/25

Earn XP

Description and Tags

Last updated 5:04 PM on 9/20/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

1

New cards

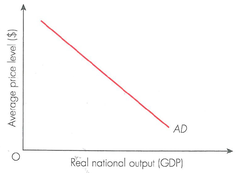

Aggregate Demand

The total level of demand in an economy at a given price level.

2

New cards

AD formula

C + I + G + (X-M)

3

New cards

Yield (Y)

Earnings generated and realized on an investment over a particular period of time.

4

New cards

Consumption

Consumer spending on goods and services

5

New cards

Disposable Income

Money consumers have left available after taxes and benefits added.

6

New cards

Investment

Increase in capital stock of an economy, leads to creating of real goods.

7

New cards

Wealth

The value/stock of assets owned

8

New cards

Government Spending

The expenditures of the Government

9

New cards

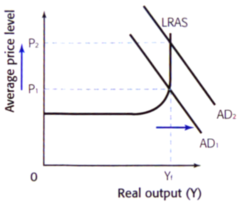

Fiscal Policy

The use of borrowing, government spending and taxation to manipulate the level of AD and improve macroeconomic performance

10

New cards

Types of Fiscal Policy

Discretionary- Implemented through policy change/ government action

Automatic stabilisers- Policies used to offset fluctuations in economic cycle but do not need government intervention or regular policy change.

Automatic stabilisers- Policies used to offset fluctuations in economic cycle but do not need government intervention or regular policy change.

11

New cards

Purpose of Fiscal Policy

Contractionary- Reduce AD

Expansionary- Increase AD

Expansionary- Increase AD

12

New cards

Exports (X)

Spending by foreign consumers on domestic goods and services.

13

New cards

Imports (M)

Spending by domestic consumers on foreign produced goods and services.

14

New cards

Net Trade (X-M)

The difference between the value of exports and imports of an economy.

15

New cards

Exchange rate

The price of a currency in terms of another

16

New cards

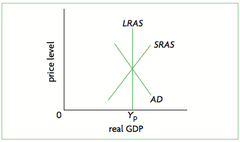

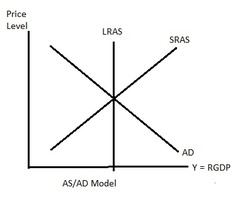

Aggregate Supply

The total amount of output of goods and services at a given price level in an economy.

17

New cards

Short-Run Aggregate Supply (SRAS)

At least one factor of production is fixed

18

New cards

Long-Run Aggregate Supply

A curve that shows the potential amount of real output that will be supplied in the economy in the long run at any given overall price level.

19

New cards

SRAS Shifts

Raw Material/ Energy/ Commodity prices- Increase= Inward, Decrease= Outward

Exchange Rate- Weak= Inward, Strong= Outward

Tax- Increase= Inward, Decrease= Outward

Exchange Rate- Weak= Inward, Strong= Outward

Tax- Increase= Inward, Decrease= Outward

20

New cards

LRAS types

Classical and Keynesian

21

New cards

Classical LRAS

In the Long-Run AS is Inelastic and is determined by supply side policies rather than AD.

22

New cards

Relation Between SRAS and LRAS

SRAS will always shift during a boom or recession but will find a way to come back to LRAS (Perfect Inelastic)

23

New cards

Keynesian LRAS

One Aggregate supply which is determined by the level of spare capacity within the economy.

24

New cards

Spare Capacity

When an economy is not fully utilizing its factors of production.

25

New cards

LRAS shifts

-Change in potential output or productivity

-Increase in quantity FOP

Increase in Education

-Increase in quantity FOP

Increase in Education

26

New cards

Strong Banking/ Financial sector

More money available for investment. Leads to increase in productivity. Therefore, LRAS and SRAS shift outwards.