Retail Merchandising Exam 3

1/86

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

87 Terms

distribution center (DC)

is a facility for the receipt, storage, and redistribution of goods to company stores. It may be operated by retailers, manufacturers, or distribution specialists.

fulfillment centers (FCs)

Similar to a distribution center, but instead of shipping to stores, it ships directly to customers.

Supply chain management

is a set of activities and techniques firms employ to efficiently and effectively manage these flows of merchandise from the vendors to the retailer’s customers.

Strategic Advantage

are unique, and sustainable advantages enable retailers to realize a higher-than-average return on their assets.

The 2 benefits to retailers & their customers with an efficient supply chain management are

Tailored Assortments - making sure that the right merchandise is available at the right store

Fewer Stockouts - A stockout occurs when an SKU that a customer wants is not available

The flow of information

Flow 1 (Customer to Store)

Flow 2 (Store to Buyer)

Flow 3 (Buyer to Manufacturer)

Flow 4 (Store to Manufacturer)

Flow 5 (Store to Distribution Center)

Flow 6 (Manufacturer to Distribution Center and Buyer)

Electronic data interchange (EDI)

is the computer-to-computer exchange of business documents from a retailer to a vendor and back. In addition to sales data, purchase orders, invoices, and data about returned merchandise can be transmitted back and forth.

collaborative planning, forecasting, and replenishment (CPFR)

relies on shared forecasts and related business information and collaborative planning between retailers and vendors to improve supply chain efficiency and product replenishment.

FLOW OF MERCHANDISE THROUGH A SUPPLY CHAIN

1. Blender manufacturer to Target’s distribution centers, or

2. Manufacturer directly to Target’s stores.

3. If the merchandise goes through distribution centers, it is then shipped to stores,

4. and then the customer buys it.

Advantages To Distribution Centers

More Accurate Sales Forecasting

Distribution centers enable the retailer to carry less merchandise in the individual stores,

It is easier to avoid running out of stock or having too much stock in any particular store because merchandise is ordered from the DC as needed

Retail store space is typically much more expensive than space at a DC, and DCs are better equipped than stores to prepare merchandise for sale. As a result, many retailers find it cost-effective to store merchandise and get it ready for sale at a DC rather than in individual stores.

Distribution center elements

planners are responsible for the financial planning and analysis of merchandise and its allocation to stores

Buyers are generally responsible for the purchase and profitability of merchandise

Radio frequency identification (RFID) tags are tiny computer chips that automatically transmit to a special scanner all the information about a container’s contents or individual products.

Cross-docking distribution center, merchandise cartons are prepackaged by the vendor for a specific store.

Floor-ready merchandise is merchandise that is ready to be placed on the selling floor.

Just-in-time (JIT) inventory systems

are inventory management systems that deliver less merchandise on a more frequent basis than traditional inventory systems. The firm gets the merchandise just in time for it to be used in the manufacture of another product or for sale when the customer wants it.

pull supply chain

a supply chain in which requests for merchandise are generated at the store level on the basis of sales data captured by POS terminals. Basically, in this type of supply chain, the demand for an item pulls it through the supply chain.

Drop Shipping

is a system in which retailers receive orders from customers and relay these orders to vendors; the vendors then ship the merchandise ordered directly to the customer

customer relationship management (CRM) programs

all involve some set of activities designed to identify and build the loyalty of the retailer’s most valuable customers.

CRM as an iterative process that turns customer data into customer loyalty and repeat purchase behavior through four activities:

(1) collecting customer shopping data, (2) analyzing customer data and identifying target customers, (3) developing CRM through frequent-shopper programs, and (4) implementing CRM programs.

4 approaches that store based retailers can use to overcome when

customers use third-party credit cards

(1) ask customers for identifying information, (2) connect Internet and store purchasing data, (3) offer frequent-shopper programs, or (4) place RFID chips on merchandise.

Customer lifetime value (CLV)

is the expected contribution from the customer to the retailer’s profits over their entire relationship with the retailer.

Retail analytics

are applications of statistical techniques and models that seek to improve retail decisions through analyses of customer data.

Data mining

is an information processing method that relies on search techniques to discover new insights into the buying patterns of customers, using large databases.

Three of the most popular applications of data mining are

market basket analysis, targeting promotions, and assortment planning.

2 objectives to develop loyalty programs

1) build a data warehouse that links customer data to their transactions and (2) encourage repeat purchase behavior and loyalty.

5 ways to make frequent-shopper programs more effective (remember examples)

retailers also might (1) create tiered rewards, (2) treat frequent shoppers as VIPs, (3) incorporate charitable activities, (4) offer choices, (5) reward all transactions, and (6) make the program transparent and simple.

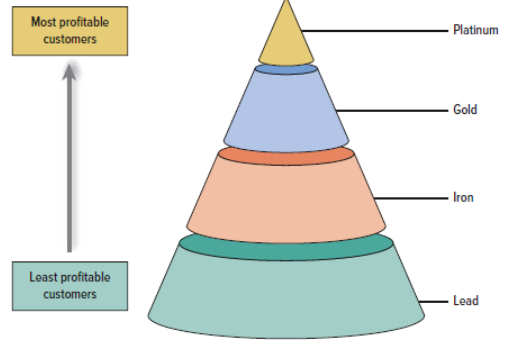

Customer Pyramid

Platinum Segment This segment is composed of the customers with the top 25 percent CLVs. Typically, these are the most profitable and loyal customers who, because of their loyalty, are typically not overly concerned about prices.

Gold Segment The next quartile of customers, in terms of their CLVs, make up the gold segment. Even though they buy a significant amount of merchandise from the retailer, they are not as loyal as platinum customers and patronize some of the retailer’s competitors.

Iron Segment The customers in this quartile purchase a modest amount of merchandise, but their spending levels, loyalty, and profitability are not substantial enough for special treatment.

Lead Segment Customers with the lowest CLVs can make a negative contribution to the firm’s income. They often demand a lot of attention but do not buy much from the retailer. When they do buy from the retailer, they often buy merchandise on sale or abuse return privileges.

2 approaches for customer retention (personalization & community)

Personalization - Developing retail programs for small groups or individual customers is referred to as 1-to-1 retailing.

Community - A retail brand community is a group of customers who are bound together by their loyalty to a retailer and the activities the retailer sponsors and undertakes.

Achieving customer alchemy using add-on selling

which involves offering and selling more products and services to existing customers to increase the retailer’s share of wallet with these customers

Merchandise management

is the process by which a retailer attempts to offer the appropriate quantity of the right merchandise, in the right place, and at the right time, so that it can meet the company’s financial goals.

Merchandise group

Each of the four merchandise groups is managed by a general merchandise manager (GMM), who is often a senior vice president in the firm. Each of the GMMs is responsible for several departments.

Department

The second level in the merchandise classification scheme is the department. Departments are managed by divisional merchandise managers (DMMs)

Classification

is the third level for categorizing merchandise and organizing merchandise management activities. A classification is a group of items targeting the same customer type, such as girls’ sizes 4 to 6.

Categories

Categories are the next lower level in the classification scheme. Each buyer manages several merchandise categories.

SKU

is the smallest unit available for inventory control. In soft-goods merchandise, for instance, a SKU usually means a particular brand, size, color, and style

Category captain

works with the retailer to develop a better understanding of consumer shopping behaviors, create assortments that satisfy consumer needs, and improve the profitability of the merchandise category.

GMROI

A financial ratio that assesses a buyer’s contribution to ROA is gross margin return on inventory investment (GMROI). It measures how many gross margin dollars Page 320are earned on every dollar of inventory investment.

two paths that buyers can take to increase GMROI

(1) improve inventory turnover (sales-to-stock ratio) or (2) increase gross margin.

Increase Gross Margin

Three approaches to increasing the gross margins are increasing prices, reducing the cost of goods sold, or reducing customer discounts.

Improve Inventory Turnover (Sales-to-Stock Ratio)

To improve the inventory turnover (sales-to-stock ratio), buyers can either reduce the level of inventory or increase sales.

Staple merchandise

are those categories that are in continuous demand over an extended time period.

fashion merchandise

categories are in demand only for a relatively short period of time. New products are continually introduced into these categories, making the existing products obsolete.

Forecasting fashion merchandise

Forecasting the sales for fashion merchandise categories is much more challenging than doing so for staple categories. Buyers for fashion merchandise categories have much less flexibility in correcting forecasting errors.

breadth

of a merchandise category is the number of different merchandising Page 332subcategories offered

assortment

of merchandise is the number of SKUs within a subcategory.

Factors to determining variety & assortment

The process of determining the variety and assortment for a category is called editing the assortment

When editing the assortment for a category like jeans, the buyer considers the following factors: (1) the firm’s retail strategy, (2) the effect of assortments on GMROI, (3) the complementarities among categories, (4) the effects of assortments on buying behavior, and (5) the physical characteristics of the store.

Product availability

is defined as the percentage of the demand for a particular SKU that is satisfied.

Merchandise budget plan

specifies the amount of merchandise in dollars (not units) that needs to be delivered during each month, based on the sales forecast, the planned discounts to employees and customers, and the level of inventory needed to support the sales and achieve the desired GMROI objectives

Determining level of back stock (5 reasons)

First, the level depends on the product availability the retailer wants to provide.

Second, the greater the fluctuation in demand, the more backup stock is needed.

Third, the amount of backup stock needed is affected by the lead time from the vendor.

Fourth, fluctuations in lead time also affect the amount of backup stock needed.

Fifth, the vendor’s fill rate affects the retailer’s backup stock requirements.

Inventory management report

The inventory management report provides information about the inventory management for a staple category.

Open-to-buy

system keeps track of the actual merchandise flows—what the present inventory level is, when purchased merchandise is scheduled for delivery, and how much has been sold to customers

Allocating merchandise to stores 3 decisions

Allocating merchandise to stores involves three decisions: (1) how much merchandise to allocate to each store, (2) what type of merchandise to allocate, and (3) when to allocate the merchandise to different stores.

Know the difference with the 3 types of analyses related to the monitoring &

adjustment steps:

sell-through analysis compares actual and planned sales to determine whether more merchandise is needed to satisfy demand or whether price reductions (markdowns) are required.

ABC analysis identifies the performance of individual SKUs in the assortment plan.

multiattribute analysis method for evaluating vendors uses a weighted-average score for each vendor.

National brands, also known as manufacturer’s brands

are products designed, produced, and marketed by a vendor and sold to many different retailers.

Store Brands

are products developed by retailers. In many cases, retailers develop the design and specifications for their store-brand products, then contract with manufacturers to produce those products.

Premium Store Brands

offer the consumer a product that is comparable to a manufacturer’s brand in terms of quality, sometimes with modest price savings.

Exclusive Brands

is developed by a national-brand vendor, often in conjunction with a retailer, and sold exclusively by the retailer.

Copy Cat Brands

imitate the manufacturer’s brand in appearance and packaging, generally are perceived as lower quality, and are offered at lower prices.

Generic Brands

are labeled with the name of the commodity and consequently have no brand name distinguishing them.

3 effects to determine store or national brand

Retailers examine their assortments to make sure they are providing what their customers want.

Stocking national brands is a double-edged sword for retailers. On the one hand, many customers have developed loyalty to specific national brands. If a retailer does not offer the national brands, customers might view its assortment as lower in quality, with a resulting loss of profits.

National brands can limit a retailer’s flexibility. Vendors of strong brands can dictate how their products are displayed, advertised, and priced. Ralph Lauren, for instance, tells retailers exactly when and how its products should be advertised.

Costs associated with global sourcing decisions

These costs include the relative value of foreign currencies, tariffs, longer lead times, and increased transportation costs.

Managerial Issues Associated with Global Sourcing Decisions

quality control, time to market, and sociopolitical risks.

Reverse Auctions

the retail buyer provides a specification for what it wants to a group of potential vendors. Page 367The competing vendors then bid on the price at which they are willing to sell until the auction is over.

Two factors that affect the price & gross margin are:

Margin guarantees are contractual promises ensuring a minimum profit or financial buffer

slotting allowances, are charges imposed by a retailer to stock a new item.

Strategic relationship

emerges when a retailer and vendor are committed to maintaining the relationship over the long term and investing in opportunities that are mutually beneficial to both parties.

Increasing levels of involvement (4) ways for building partnering relationships

Awareness

Exploration

Expansion

Commitment

Maintaining Strategic Relationships

Mutual Trust

Common Goals

Open Communication

Credible Commitments

Counterfeit merchandise

includes goods made and sold without the permission of the owner of a trademark or copyright.

Gray-market goods

involve the flow of merchandise through distribution channels, usually across international borders, other than those authorized or intended by the manufacturer or producer.

Diverted merchandise

is similar to gray-market merchandise except there need not be distribution across international borders.

Chargeback

is a practice used by retailers in which they deduct money from the amount they owe a vendor.

Tying Contract

exists when a vendor requires that a retailer take a product it doesn’t necessarily desire (the tied product) to ensure that it can buy a product it does desire (the tying product).

Value

is the ratio of what customers receive (the perceived benefit of the products and services offered by the retailer) to what they have to pay for it

everyday low-pricing (EDLP) strategy.

This strategy emphasizes the continuity of retail prices at a level somewhere between the regular nonsale price and the deep-discount sale price of high/low retailers.

Advantages of pricing strategies

The high/low pricing strategy has the following advantages:

Increases profits. High/low pricing allows retailers to charge higher prices to customers who are not price-sensitive and will pay the “high” price while charging lower prices to price-sensitive customers who will wait for the “low” sale price.

Creates excitement. A “get them while they last” atmosphere often occurs during a sale. Sales draw a lot of customers, and a lot of customers create excitement. Some retailers augment low prices and advertising with special in-store activities, such as product demonstrations, giveaways, and celebrity appearances.

Sells slow-moving merchandise. Sales allow retailers to get rid of slow-selling merchandise by discounting the price.

The EDLP approach has its own advantages, as follows:

Assures customers of low prices. Many customers are skeptical about initial retail prices. They have become conditioned to buying only on sale—the main characteristic of a high/low pricing strategy. The EDLP strategy lets customers know that they will get the same low prices every time they patronize the EDLP retailer. Customers do not have to read the ads and wait for items they want to go on sale.

Reduces advertising and operating expenses. The stable prices caused by EDLP limit the need for the weekly sale advertising used in the high/low strategy. In addition, EDLP retailers do not have to incur the labor costs of changing price tags and signs and putting up sale signs.

Reduces stockouts and improves inventory management. The EDLP approach reduces the large variations in demand caused by frequent sales with large markdowns. As a result, retailers can manage their inventories with more certainty. Fewer stockouts mean more satisfied customers, resulting in higher sales. In addition, a more predictable customer demand pattern enables the retailer to improve inventory turnover by reducing the average inventory needed for special promotions and backup stock.

Price Elasticity

or the percentage change in quantity sold divided by the percentage change in price:

Markup

is the difference between the retail price and the cost of an item.

Markup Percent

is the markup as a percentage of the retail price

Initial Markup

is the retail selling price initially set for the merchandise minus the cost of the merchandise

Maintained Markup

is the actual sales realized for the merchandise minus its costs.

break-even analysis

which determines, based on fixed and variable costs, how much merchandise needs to be sold to achieve a break-even (zero) profit

Reasons for markdowns

Retailers’ reasons for taking markdowns can be classified as either clearance (to dispose of merchandise) or promotional (to generate sales)

Dynamic pricing

refers to the process of charging different prices for goods or services based on the type of customer; time of the day, week, or season; and level of demand. Ideally, retailers could maximize their profits if they charged each customer as much as the customer was willing to pay.

Zone Pricing

is the practice of charging different prices in different stores, markets, regions, or zones.

Leader Pricing

is the practice of pricing certain items lower than normal to increase customers’ traffic flow or boost sales of complementary products.

Price Lining

Retailers frequently offer a limited number of predetermined price points within a merchandise category

Odd Pricing

refers to the practice of using a price that ends in an odd number, typically a 9.

Predatory Pricing

arises when a dominant retailer sets prices below its costs to drive competitive retailers out of business

Horizontal Price Fixing

involves agreements between retailers that are in direct competition with each other to set the same prices.

Bait and Switch

is an unlawful, deceptive practice that lures customers into a store by advertising a product at a lower-than-normal price (the bait) and then, once they are in the store, induces them to purchase a higher-priced model (the switch).