Lecture 3 - History and Constructions of Charts, trends, breakouts, stops

1/77

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

78 Terms

4 types of charts

Line

bar

Candle

Point and Figure

Line Charts

Uses closing price and time

Used to study long-term trends

Advantage of line charts

Easy to construct and maintain

Disadvantage of line charts

Gives little information, exact time or trend change can be unclear

Bar Charts

Displays high, low, closing prices or HLC

best charts are OHLC

Left tick: open, right tick: close

Bar charts advantages

HLC can give you a better sense of direction

More veratile, volume usually included below

Bar charts disadvantages

Harder to maintain and requires more space if done by hand

Candlestick charts

Useed in Japan in 1600-1700’s

Include HLC, always open price

Real body: rectangular box formed by open and close price

Shadow: price extremes of the session

White: price advance at close

Black: price decline at close

Real Body

Rectangular box formed by open and close price

Shadow

Price extremes of the session

Most important chart in trading

Candlestick Charts

Candlestick chart advantages

More visual, positive and negative easily seen

Candlestick chart disadvantages

Harder to calculate and maintain by hand, patterns must be studied

Point & Figure

X for colume with rising price

O for declining price

Volume excluded normally

$ amount representing one box

The smaller the box, the more sensitive the chart

Point & Figure advantages

Information is compressed

Resistance and support levels are easier to spot

Better price targets for buy/sell signals

Good charting for continuous market

Point & Figure chart disadvantages

They don’t use time and volume as a consideration

Many unique patterns to P&F charts that must be studied

Arithmetic charts

Chart that uses dollars

Logarithmic charts

Chart that uses percentages

Best used for long term charts and for >20% increases

Directional Trend

One of rising or falling prices from which a profit can be generated with a trend following method

Trends tend to continue, rather than reverse

Trends are fractal (same behavior regardless of period)

When prices are trending, they remain headed in one direction and tell us that there is an imbalance of __________

demand and supply

Trading Ranges (sideways trends)

Occur when peaks and troughs appear at roughly similar levels.

Can also be called consolidations or congestion areas or rectangle formations

Graph of uptrend, downtrend, and trading range

Change of polarity

When previous resistance becomes support

Support zones and resistance line

Support becomes resistance line graph

Breakout

When prices break below a support zone or above a resistance zone

Donchian Rule

Buy when the highest high over the past 4 weeks has been broken, and sell when the lowest low of the past 4 weeks has been broken

Best used with price buy breakouts, sell breakouts

Reversal points

Demark Method

Gann Two-Day Swing Method

High Volume Method

High Volume Method

High volume on reversal day, indicates that larger than usual activity occured on that day - ultimately stopping the rally/sell off. This is a strong confirmation signal that previous trend may come to an end

The steeper the angle of the directional trend, the more ________ the trend is. The problem is that it is not sustainable and we can expect a ________ if it gets too overheated

powerful, reversal

Usually any uptrend steeper than a ___ degree angle is _____ and should expect to _______

45, overheated, correct

How are trends spotted

Using a regression line

Using trend lines

Spotting trends using trendlines

Lines are drawn between lows (support points), when the line is rising (uptrend), and is drawn between tops (resistance points), when price is declining (downtrend)

Problem with using trendlines when spotting trends

They may not be a straight line. In speculative bubbles or panics, they will accelerate upward/downward and run away from a standard straight trendline

Decelerating Trend Line/Fan Line

Opposite of an accelerating trend line

After __ fan lines are drawn, we should expect a ______ in direction

3, reversal

The ____ and ____ times the drawn line is touched by prices, the more significant it is when the trend line is finally broken

longer, more

The steeper the trend line, the more __________ it is, the more ______ it will be broken

unsustainable, sooner

Retracements (secondary trends)

Corrections to principal trend

COunters trend moves, requiring only a 33% retracement of a previous trend

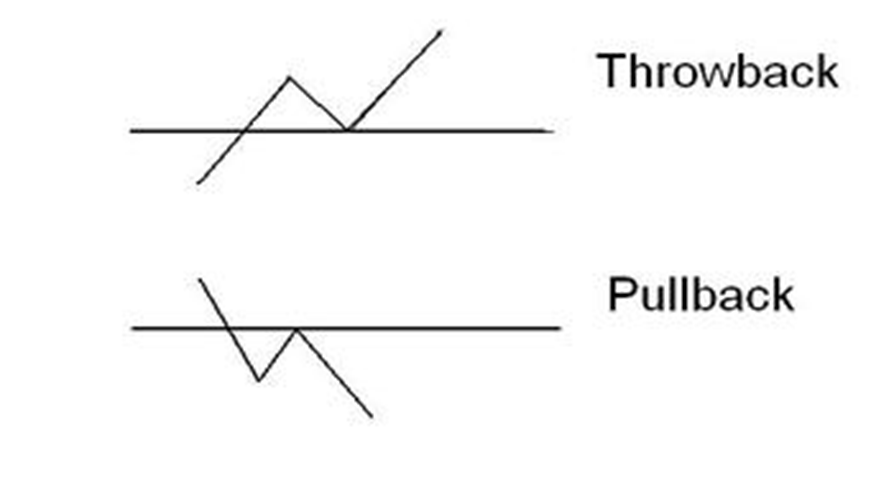

Throwback

Price retracement back to the breakout zone on an upward breakout

Pullback

Price retracement back to the breakout zone on a downside breakout

Pullbacks & throwback graph

Breakouts

Occurs when price breaks through a prior support or resistance level or zone, or a trend line

Signals a change in supply and demand, and that a new trend is beginning

Breakout confirmation methods

Closing Price (Filter)

Price or percent filters

Time since breaking support/resistance

Volume

Volatility

Closing Price (Filter)

Intraday penetrations likely false

2 days/bars

Tradeoff between probability vs opportunity

Closing Price filter graph

Price or percent filters

Use of a breakout zone

3% rule for breakout

3% filter graph

Time since breaking support/resistance

2 days +

Premise is that if prices remain outside the breakout zone for a certain time, it must be real

Volume

Usually increasing

Average True Range

Highly volatile securities should have a wider filter to accout for false breakouts

Moving average of the True Range (difference between each high and low bar over some past period)

True Range is calculated as the greatest of:

Difference between current bar high and low

Absolute value of the difference of the prior bar close and current bar high

Absolute value of the difference of the prior bar close and current bar lows

As price volatility ______, daily True Ranges will ______ and ATR will be ______. This means that highly volatile securities will have a ______ filter to account for its likelihood of a false breakout because of its higher volatility

increases, expand, larger

wider

Pivot Points

Used for confirmation with day trading to determine support/resistance level and as confirmations of breakouts

Pivot Point equation

P = (H + L + C)/3

Pivot Resistance Equation

R1 = (2 x P) - low previous bar

Pivot Support Equation

S1 = (2 x P) - high previous bar

Reward/Risk Ratio

Usually breakouts from support or resistance run to the next zone of support or resistance, giving the investor a price objective for a breakout

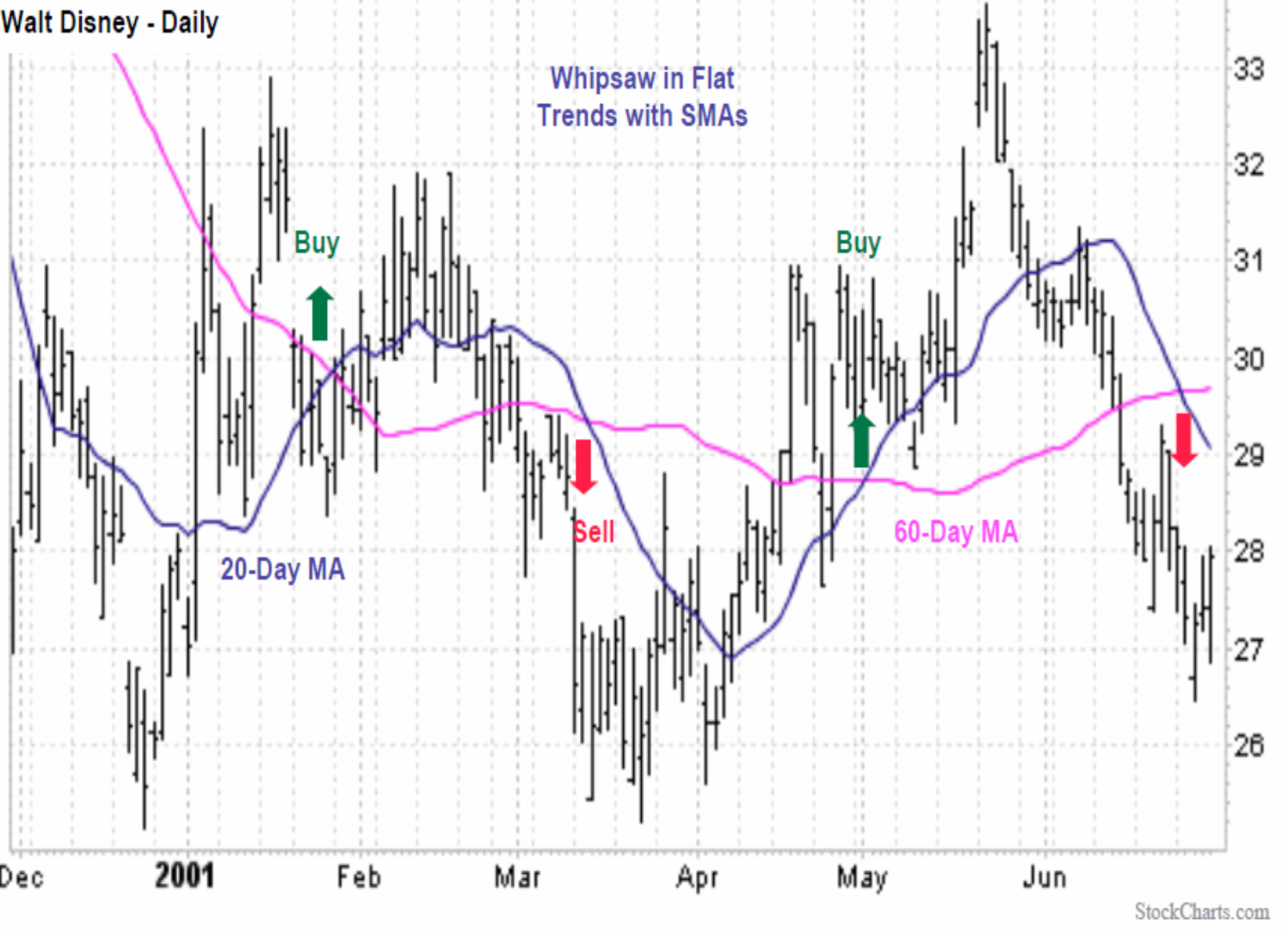

Moving averages are used to _____

smooth erratic data and show trends

The longer the SMA, the ____ influence each data point has on the SMA

less

The longer the SMA, the _____ it is to change but the more ______ it is

slower, reliable

The shorter the SMA, the ___ it changes in direction, but more frequently it errs

faster

Where moving averages cross is often a _______ and ________ area

support, resistance

Buy and sell indicators based on moving averages

Use of moving averages

Determining trend, direction of and slope of moving average

Support and Resistance

Price extremes

Moving average graph

Support and resistance in a moving average graph

Price extremes in moving averages graph

Envelopes percentage

Calculated as taking percentage of a moving average and creates two symmetrical lines

The percentage is determined by experiment and shouldn’t be too large or small

Crossing the bands becomes a trigger for buy/sell

One of biggest problem is that they do not account for the changing volatility of the underlying

Bands

Same as envelope except adjusted for volatility (standard deviation)

Channel

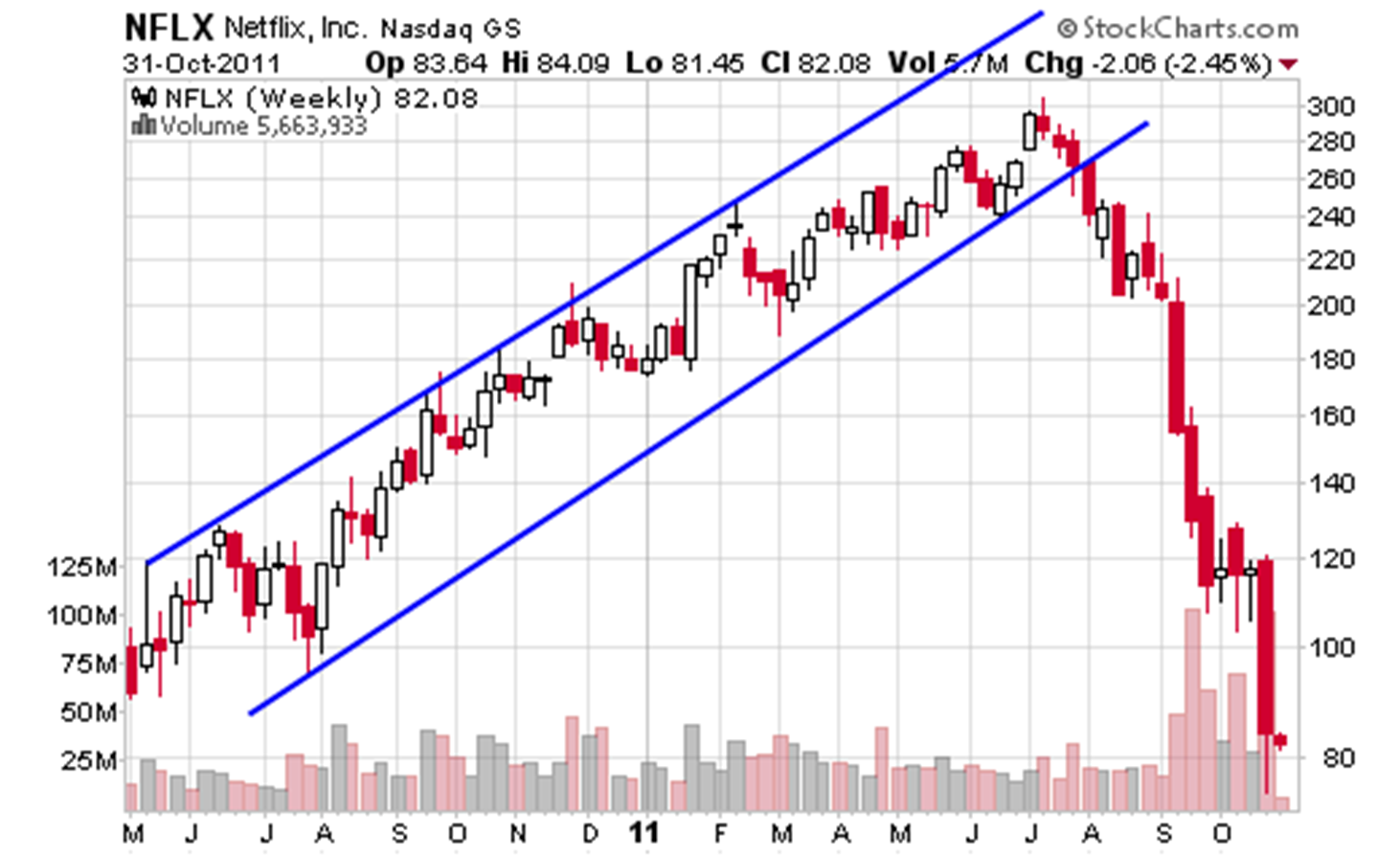

Trading range tipped at an angle such that it trends up/downwards

Bollinger Bands

Bands used standard deviation to measure volatility

± 2 standard deviations of a 20 period SMA (simple moving average)

Bollinger Bands Graph

Tightening bands represent ________ volatility, sharp price move expected

shrinking

Broadening bands represent _______ volatility and and potentially strong trend

increasing

Calculate %B (bandwidth indicator)

Difference between high band and low band, which represents increased volatility; breakouts can be confirmed with this, therefore volatility can warn of trend change

Channels

Can make us predict where the price action in the up or downtrend will occur

Channels example