3.3-3.4 IB Business Test

5.0(1)

5.0(1)

Card Sorting

1/56

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

57 Terms

1

New cards

Average Costs

AC=TC/Q

\

AC = Average Cost

TC = Total Cost

Q = Quality of Output

\

AC = Average Cost

TC = Total Cost

Q = Quality of Output

2

New cards

Average Revenue

AR = TR/Q = P

\

AR = Average Revenue

TR = Total Revenue

Q = Quality of Output

P = Price

\

AR = Average Revenue

TR = Total Revenue

Q = Quality of Output

P = Price

3

New cards

Costs

The charges that an organisation incurs from its operations, e.g., rent, wages, salaries, and insurance.

4

New cards

Direct Costs

Costs that do not change with the level of output or sale of a certain good, service, or business operation, e.g, raw materials

5

New cards

Fixed Costs

Costs that do not change with the level of output, e.g., loan repayments and management salaries.

6

New cards

Indirect Costs (Overhead Costs)

These costs are not easily identifiable with the sale or output of a specific good, service, or business operation

7

New cards

Price (Average Revenue)

The amount of money a product is sold for

8

New cards

Revenue

The money (income) received by a business from the sale of goods and/or services

9

New cards

Revenue Streams

The different sources of revenue (or income) for a business, e.g., revenue from sponsorship deals, merchandise sales, membership fees, and royalties

10

New cards

Total Costs

TC = TFC + TVC

\

TC = Total Costs

TFC = Total Fixed Costs

TVC = Total Variable Costs

\

TC = Total Costs

TFC = Total Fixed Costs

TVC = Total Variable Costs

11

New cards

Total Revenue

The sum of income received by a business from its a trading activities. Calculated by: TR = R x Q

12

New cards

Variable Costs

Costs that change with the level of output - they rise when output or sales increase, e.g., raw materials and packaging costs.

13

New cards

Assets

The possessions owned by a business, which have a monetary value, e.g., buildings, land, machinery, equipment, inventories, and cash.

14

New cards

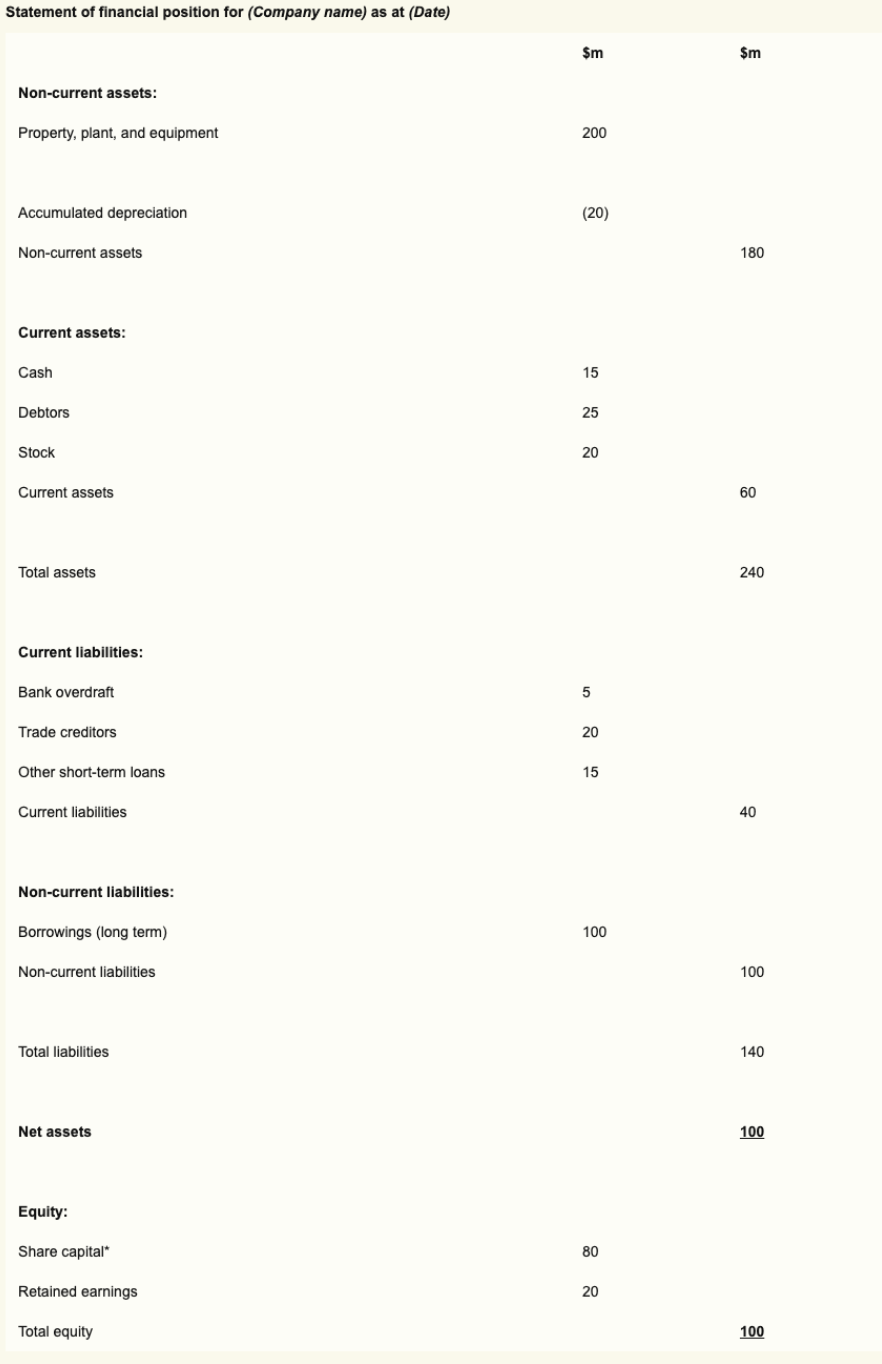

Balance Sheet (Statement of Financial Position)

This set of final accounts shows the value of a firm’s assets, liabilities, and the owners’ investment (or equity) in the business, at a particular point in time.

15

New cards

Cash

This refers to the money an organization has either “in hand” (at its premises) and/or “at bank” (i.e., in its bank account). It is the most liquid type of current assets.

16

New cards

Copyrights

These intangible assets give the registered owner the legal rights to creative pieces of work, such as the works of authors, musicians, conductors, playwrights (scriptwriters) and directors.

17

New cards

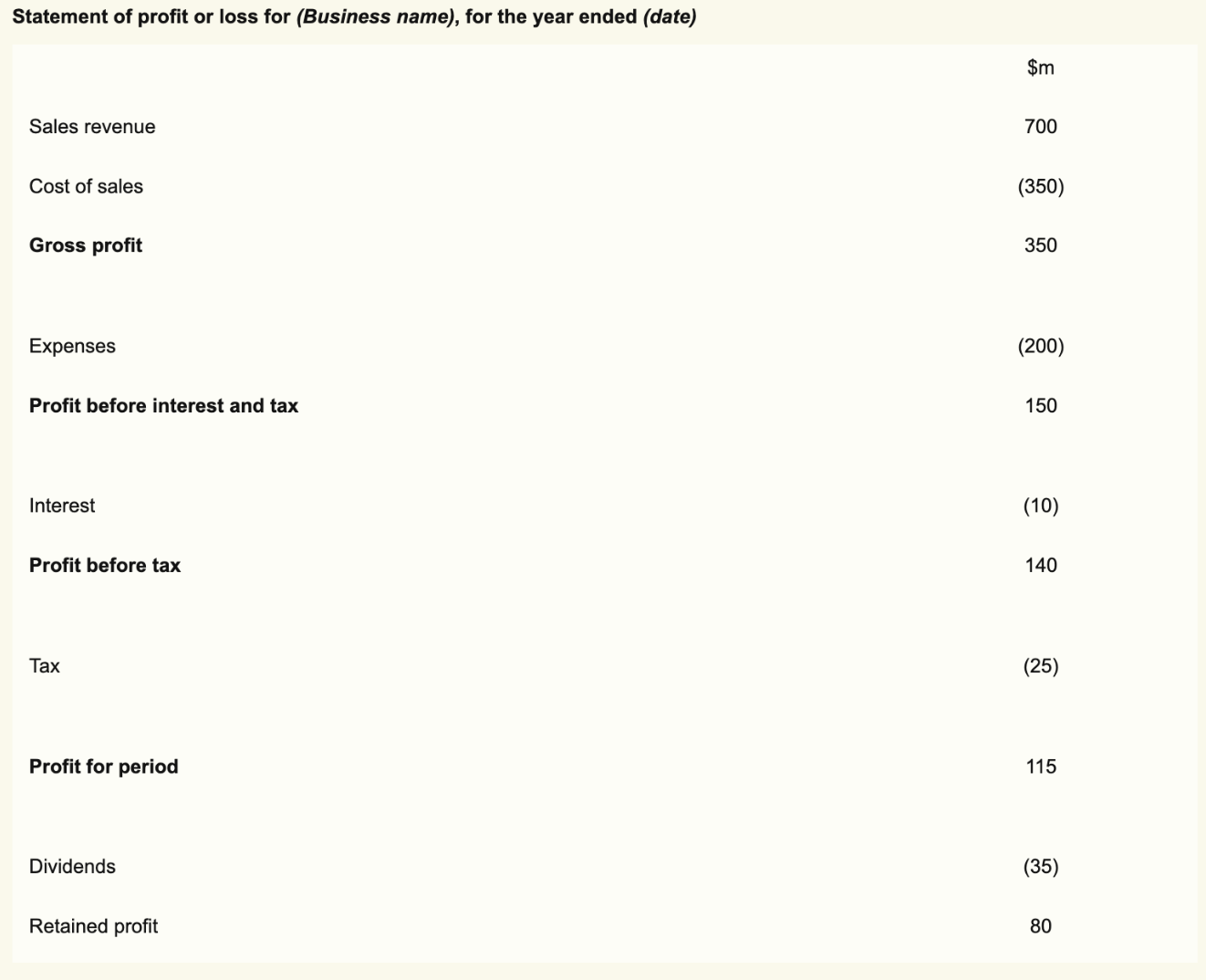

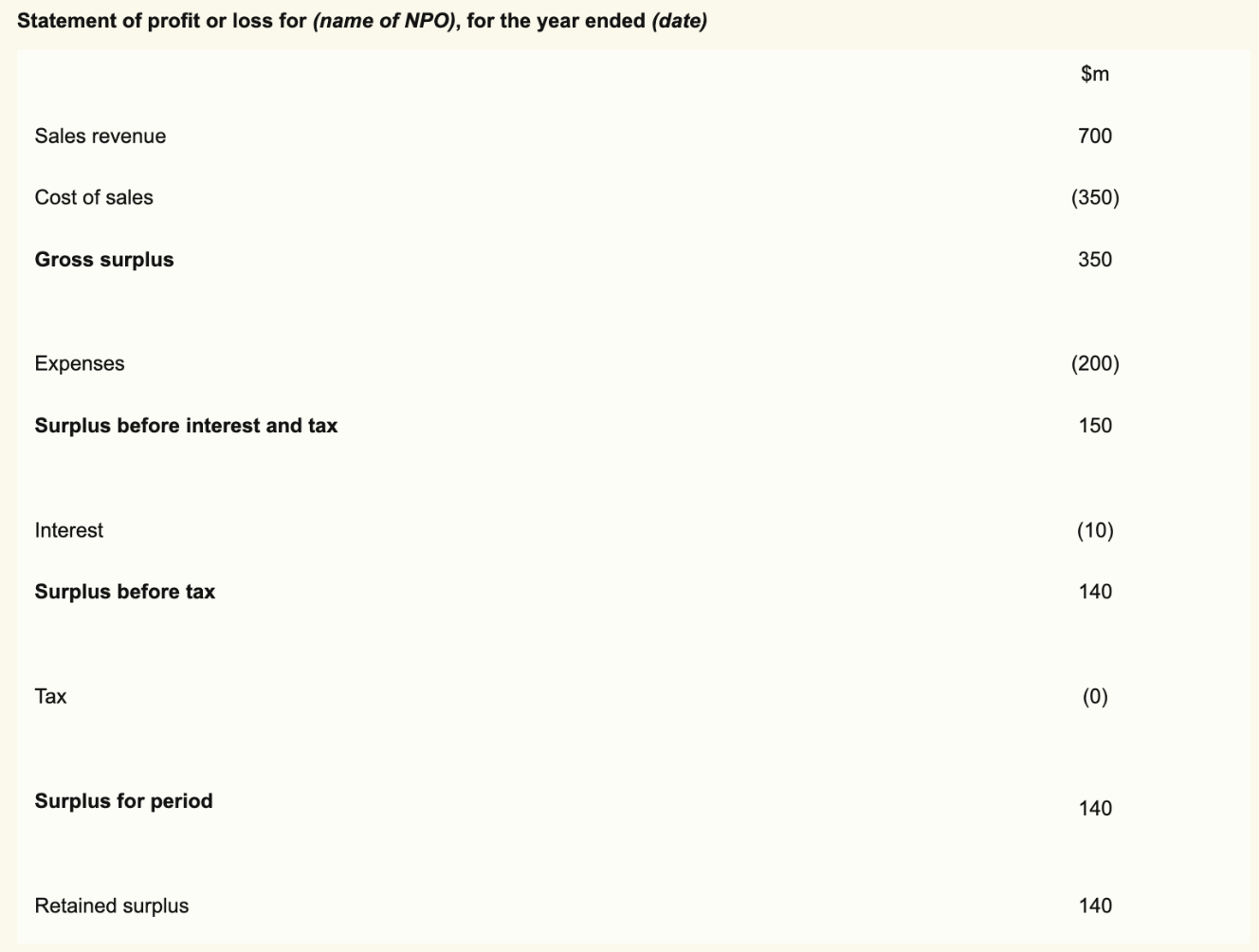

Cost of Sales (COS)

These are the direct costs of production, such as the cost of raw materials, component parts, and direct labour.

18

New cards

Creditors (Trade Creditors)

this refers to the suppliers that allow a business to purchase goods and/or services on trade credit.

19

New cards

Current Assets

Short-term assets belonging to an organization that will last in the business for up to 12 months, e.g., cash, debtors, and stock (inventory).

20

New cards

Current Liabilities

These are the short-term debts of a business, which need to be repaid within twelve months of the balance sheet date. Examples include bank overdrafts, trade creditors, and other short-term loans.

21

New cards

Debtors

\n A type of current asset, referring to individual or business customers that owe money to the organization as they have bought goods or services on trade credit, i.e., they need to pay within 30 and 60 days.

22

New cards

Dividends

These are the payments from a company’s profit (after interest and tax) paid to the shareholders (owners) of the company. The amount of dividends paid to an individual shareholder depends on the number of shares held by the individual.

23

New cards

Equity

\n Refers to the value of the owners' stake in the business, i.e., what the business is worth at the time of reporting the balance sheet.

24

New cards

Expenses

These are a firm’s indirect costs of production, e.g., rent, management salaries, marketing campaigns, accountancy fees, bank interest charges, travel expenses, utilities, repairs and maintenance, and general insurance.

25

New cards

Final Accounts

These are the published accounts of an organization, made available to and used by different stakeholders, e.g., managers, employees, shareholders, sponsors, financiers, and investors.

26

New cards

Finished Goods

These are the final products of a business, ready to be sold to customers.

27

New cards

Fixed Assets

\n The long-term assets (possessions) of an organization that have a monetary value and are used repeatedly but are not intended for resale within the next twelve months, e.g. property and equipment.

28

New cards

Goodwill

\n The reputation and established networks (know-how) of an organization, which adds to a firm’s monetary value.

29

New cards

Gross Profit

This refers to the profit from a firm’s everyday trading activities. It is calculated by the formula: Sales revenue – Cost of sales.

30

New cards

Liquid Assets

\n These items of value, owned by the business, cannot be sold quickly, are difficult to sell, and/or cannot be sold easily without incurring a significant loss in value.

31

New cards

Intangible assets

Non-physical fixed assets that are valuable to a firm’s survival and success, such as brand value, goodwill, copyrights, trademarks, and patents.

32

New cards

Intellectual property rights

Abbreviated as IPRs, these are a firm's fixed, intangible assets with a monetary value, comprised of goodwill, patents, copyrights and trademarks.

33

New cards

Liabilities

\n The debts of a business, i.e., the money owed to others, e.g., money owed to financiers, trade creditors, and the government (for tax).

34

New cards

Net Assets

Refers to the overall value of an organization’s assets after all its liabilities are deducted. It is calculated by the formula: total assets *minus* current liabilities *minus* non-current liabilities.

35

New cards

Non-Current Assets (Fixed Assets)

This refers to the long-term assets or possessions of an organization with a monetary value but is not intended for resale within the next twelve months of the balance sheet date.

36

New cards

Non-Current Liability (long-term liability)

\n This refers to debt owed by a business that will take longer than a year (from the balance sheet date) to repay.

37

New cards

Overdrafts

\n This financial service allows customers to temporarily take out more money than is available in their bank account.

38

New cards

Patents

The official rights given to a business to exploit an invention or process for commercial purposes.

39

New cards

Profit after Interest and Tax (Profit for Period)

This section of the P&L account shows the actual value of profit earned by the business after *all* costs have been accounted for.

40

New cards

Profit before Interest and Tax

This section of the P&L account shows the value of a firm’s profit (or loss) before deducting interest payments on loans and taxes on corporate profits.

41

New cards

Raw Materials

These are the natural resources used in the production process to create goods and provide services to customers.

42

New cards

Retained Profit (Retained Earnings)

This refers to the value of a firm’s earnings after all costs are paid (including interest and tax) and shareholders have been compensated (dividends).

43

New cards

Sales Revenue

Shown on the profit and loss account, this refers to the money an organization earns from selling goods and services.

44

New cards

Share Captial

The value of equity in a business that is funded by its shareholders, either through an initial public offering (IPO) or via a share issue.

45

New cards

Short-Term Loans

These are advances (loans) from a financial lender, such as a commercial bank, that needs to be repaid within 12 months of the balance sheet date.

46

New cards

Stocks (inventories)

These are the goods that a business has available for sale, per time period.

47

New cards

Tax

Refers to the compulsory deductions paid to the government as a proportion of a firm’s profits.

48

New cards

Total Assets

\n The sum of a firm’s non-current assets and its current assets.

49

New cards

Total Liabilities

These are simply the sum of current liabilities and non-current liabilities, i.e., the sum of all the monies owed by the business.

50

New cards

Trade Creditors

Suppliers may give trade credit, which needs to be repaid at a future date (typically 30 to 60 days).

51

New cards

Trademarks

A form of intellectual property or intangible asset which gives the listed owner the legal and exclusive commercial use of the registered brands, logos, and/or slogans (corporate catchphrases).

52

New cards

Window Dressing

Also known as creative accounting, this is the legal manipulation of financial statements based on the accounting principles and rules in the country in order to make the figures look more flattering (in the same way that people clean and tidy their homes before guest are due to arrive).

53

New cards

Work-in-Progress (semi-finished goods)

These are parts and components used in the production process.

54

New cards

Working Capital

\n The money available for the day-to-day running of a business. It is calculated by subtracting current liabilities from current assets.

55

New cards

Profit and Loss Account (For-Profit Organisation)

56

New cards

Profit and Loss Account (Non-Profit Organisation)

57

New cards

Balance Sheet (For-Profit)