Inventory

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

69 Terms

Explain the operations of a trading business.

Trading firms purchase goods form suppliers/wholesalers and then sell them to customers at a higher price, with the difference between the cost price and the selling price earning them profit.

State two reasons why inventory is important to a trading firm.

- Sale of inventory is the main source of revenue for a trading firm, alls profit to be earned.

- Inventory is an important assets in the balance sheet of a trading business.

Define the term ‘Inventory’

Are goods held by a trading firm for the purposes of resale.

Referring to the perpetual inventory system, explain the role of:

inventory card and physical count

• an inventory card - continuous recording of all inventory movements in subsidiary Accounting record

• a physical count - verify that the inventory cards are accurate, and in the process detect any inventory losses or gains.

Define the term ‘purchases’ as it applies to trading firms.

Purchases of inventroy

Define ‘perpetual inventory system’

system of Accounting for inventory that involves the continuous recording of inventory movements in inventory cards

Explain the perpetual inventory system. ( 3 marks )

Continuous recording of inventory transactions on inventory cards.

The business will then conduct a physical stocktake to verify that the inventory cards are accurate, and in the process detect any inventory losses or gains.

Separate inventory card maintained for each individual line of inventory.

Explain the benefits of the perpetual system of inventory recording.

- Inventory losses and gains can be detected by comparing the balances of the inventory cards against the physical stocktake.

- Assists in the re-ordering of inventory. The inventory cards will show when the minimum inventory levels have been reached so an order can be placed with the supplier.

- Fast and slow moving lines of inventory can be identified. The owner can examine the inventory cards to identify the items which are selling well and those that are not and adjust inventory purchases accordingly.

Inventory card

a subsidiary Accounting record that records each individual transaction involving the movement in and out of the business of a particular line of inventory

Gross Profit

the profit earned purely from the purchase and sale of inventory, measured by deducting Cost of Sales from Sales revenue

Sales and purchases

the revenue earned by a trading firm from the sale of inventory

the inventory bought by a trading firm for the purposes of resale

Purchase return

Purchase returns occur when inventory is returned by the business to its supplier.

Sales returns

Sales returns occur when inventory is returned to the business by the customer and again is verified via a credit note.

The business will supply the original to the customer (Caulfield Boarding) and retain a copy for the business records.

State the source document that recognises the return of goods.

Credit Notes

State three reasons why there may be a need to return goods.

incorrect item(s), wrong colour, model or the item was damaged in transit.

Drawings of inventory

Drawings of inventory is the owner taking inventory home for personal use and must be recorded as such to support the Accounting entity assumption. - Negative Owner’s equity

- Decreases Assets

(drawing is not an expense)

Advertising using inventory - Define and Classify

Advertising occurs when a business gives inventory to another entity, to support such events as a school fete or a charity. This could be seen as a donation. Form of marketing and therefore will be recorded as Advertising (not Cost of Sales).

Benefits - A business may often pick up new customers through advertising by way of a community donation.

Inventory is drawings

Advertising is an expense

Increase in advertising expense

Decrease Current Asset/Inventory

Explain why the cost price is not shown on the source document that provides the evidence of a sale

The price on the receipt will be the selling price, but the inventory card is recorded at cost price. The cost price of the inventory is not revealed to the customer in order to protect the Gross Profit on the sale. (You don’t want the customers to know how much you are making on the sale!)

Explain how the inventory card is used to determine the Cost of Sales for each transaction.

OUT column represents the outflow of inventory that occurs when inventory is sold: it is the Cost of Sales for that particular sale . By adding up all the figures in the OUT column that relate to sales - not including memos, and MINUS any sales return the business can determine its total Cost of Sales for that item for the period.

Explain the Identified Cost method as it applies to inventory cards.

Identifies the actual cost of the inventory item when it is purchased and when it is sold. This method requires the ability to be able to track an individual item of inventory in the business until it is sold.

Describe the FIFO

First In, First Out (FIFO) method. This method works on the assumption that the first inventory in (purchased) will be the first out of the store (sold).

FIFO must be applied to all transactions recorded in the OUT column including sales, drawings, advertising and inventory losses, but it is an assumption only; it may not match the actual flow of goods.

Methods like Identified Cost and FIFO are necessary because businesses need a way of valuing their inventory at the time of sale. At the time of purchase, however, no such method is necessary as all items can be valued according at the cost price given by the supplier. This means the choice between Identified Cost and FIFO makes no difference to the way purchases or purchase returns are recorded: they are valued using the cost price noted on the invoice or credit note generated by the supplier.

Physical stock take

A physical count involves someone physically counting of all the items of inventory on hand, followed by the assignment of a cost price to these items.

This physical count figure can then be compared against the inventory cards to verify their accuracy.

verify the accuracy of the inventory cards so that the inventory figure reported in the Balance Sheet is free from bias (i.e. Verifiable and a Faithful representation), and in the process, detect any inventory loss or inventory gain.

The result of the physical count will be recorded on a memo, an internal Accounting document

Referring to one Qualitative characteristic, explain the role of a physical count.

Verifiability - A physical count verifies the inventory records (inventory cards) of the business, in the process detecting any inventory losses or gains, to ensure that the information provided is accurate and free from bias.

State two reasons for the difference between the inventory cards and the physical count.

Due to theft

Oversupply to customer or undersupply by supplier

Explain one reason for the difference between the physical count and the balance shown on the inventory card.

Oversupply by a supplier: the quantity supplied due to a purchase was greater than recorded in the inventory card. Undersupplying to a customer: the quantity delivered due to a sale was less than recorded in the inventory card.

Apart from the detection of inventory loss or gain, state one benefit of recording transactions in inventory cards.

Identifying fast-moving or slow-moving inventory Identifying the need to reorder inventory Identifying the cost price of inventory sold (Cost of Sales)

Define the term ‘inventory loss’. 3 State four reasons for an inventory loss. 4 Explain how an inventory loss is classified in the Income Statement.

An inventory loss occurs when the physical count reveals a quantity of inventory less than the quantity indicated on the inventory cards. This can occur because of: • theft • damage • an oversupply to customers • an undersupply by suppliers • a recording error in the inventory cards or during the physical count.

Explain why inventory loss is classified as an expense.

Inventory loss itself is classified as an expense because it is an outflow of an economic benefit in the form of a decrease in assets (Inventory) that results in a decrease in owner’s equity.

Define the term ‘inventory gain’. 7 State two reasons for an inventory gain. 8 Explain how an inventory gain is classified in the Income Statement

An inventory gain occurs when the physical count reveals a quantity of inventory on hand greater than the number indicated in the inventory card. This can occur because of: • an undersupply to customers • an oversupply by suppliers • a recording error in the inventory cards or during the physical count.

An inventory gain is classified as revenue because it increases assets (Inventory) and results in an increase in owner’s equity (via an increase in revenue – inventory gain).

Explain how FIFO and Identified Cost method differ in recording an Inventory gain in the inventory card.

The FIFO method would value the inventory gain using the latest cost price recorded in the IN column as shown in the inventory card.

Explain the impact using FIFO can have on the financial reports in times of rising prices.

In times of rising prices for inventory, FIFO would be assigning the cheaper inventory to be sold first, leaving the more expensive inventory in the inventory card. This has the effect of reporting a lower Cost of Sales and a higher Net Profit and Inventory in the Balance Sheet

The opposite holds true if there was a consistent decline in inventory prices: Cost of Sales would be higher as the more expensive inventory is sold first, thus lowering Net Profit. The inventory at end would be lower as well because it is recorded at the lower price.

Explain the benefits of the perpetual system of inventory recording.

It allows for: Assistance in the reordering of inventory

The inventory cards will show when the minimum inventory levels have been reached so an order can be placed with the supplier.

Fast and slow-moving lines of inventory can be identified

The owner can examine the inventory cards to identify the items that are selling well and those that are not and adjust inventory purchases accordingly.

For Inventory losses and gains to be detected

By comparing the balances of the inventory cards against the physical count.

Interim reports can be prepared without the need for physical counts

The level of inventory on hand and the amount of Cost of Sales can be determined from the inventory cards (although the level of Inventory loss or gain will not be known).

Explain how ICT can improve the use of the perpetual inventory system.

This technology allows goods to be scanned as they move in and out of the business with the software automatically updating the inventory records. At the end of the day, the owner/manager can print out a report that would show sales, inventory levels, and other essential information that can be used to inform decisions. This could extend to warnings when inventory levels are low, or even automatic reordering.

Explain why the GST on purchases of inventory is not recorded in the inventory card.

The GST does not affect the valuation of the inventory and it does not affect the economic benefit represented by the inventory. (Rather, any GST on purchases decreases any GST liability.)

Explain how the sale of inventory creates an expense.

When a watch is sold, the cost of the watch is recognised as an expense (Cost of Sales) as it represents an outflow of economic benefits (inventory) which decreases assets (Inventory on hand) and decreases owner’s equity.

Calculate the gross profit.

sales - cost of sales

35 times 200 - 2000

Explain one way in which inventory cards can be used to improve the management of inventory.

indicating which lines of inventory are fast selling and which are slow selling. The business could alter its inventory mix to ensure it held more of those items that sell quickly and phase out the items that do not, thus allowing it to improve its Inventory Turnover.

Referring to one Qualitative characteristic, explain why the desks are not recorded in the inventory card at their selling price

This is due to Verifiability as the inventory card only uses cost price which can be verified by a source document while the sellling price can’t The selling price is also not the original purchase price.

Explain one way that inventory cards could be used to reduce inventory loss.

Inventory cards provide an indication of what inventory should be present in the business and allows for spot checks to be carried out on a regular basis to highlight quickly if any inventory is missing.

Define the term ‘Cost of Sales’

Outflow of inventory, creating an expense called Cost of Sales: an outflow of economic benefits (the inventory that has been sold) in the form of a decrease in assets (Inventory) and a decrease in owner’s equity

Explain how the inventory cards can be used to determine Cost of Sales.

Cost of Sales is determined by adding together the value of each sale ( not including memos as they are not sales) recorded in the OUT section of the inventory cards and deducting the value of each sales return recorded in the IN section of the inventory cards.

State three items that might be recorded in the OUT section of an inventory card but are not included in the calculation of Cost of Sales.

Drawings of inventory for personal use, or perhaps a donation as a form of advertising, inventory loss.

State the classification cash flows under which inventory is reported

Therefore, any movement of inventory that causes a cash flow will be recorded as an Operating Cash Flow because it is in the ordinary course of business.

Explain why Cost of Sales is not reported in the Cash Flow Statement.

The expense ‘Cost of Sales’ that we just identified above will not be recorded in the Cash Flow Statement as it involves a movement of inventory, not a movement of cash.

Calculating profit for a service firm is relatively straightforward: expenses are deducted from revenue to determine the Net Profit or Loss

Trading firm - Income Statement will now show two separate figures for profit: Gross Profit and Net Profit.

Define the term ’Net Sales‘.

The overall sales figure for a reporting period calculated by Total sales less Sales returns.

Explain the importance of monitoring the level of Sales returns

The actual amount of Sales returns should be monitored closely as this could have ramifications for our reputation and for future sales. It is a good indicator of the quality of our inventory.

Define the term ’Cost of Goods Sold‘.

All costs incurred to bring inventory into a location and condition ready for sale

State four expense items that may be reported as part of Cost of Goods Sold.

Cost of Sales, but also other expenses like freight/cartage/delivery inwards, import duties, custom duties, modifications, packaging, and other buying expenses.

These are all expenses directly related to inventory, and more specifically, getting inventory into the business – onto the shelf and ready for sale.

Any cost after that point that is involved in selling the inventory – like delivery to customers – is considered an ‘Less Other expense’

Explain why purchase of inventory is not reported as an expense. Explain where a cash purchase is reported.

Cash purchases of inventory ($30000) is not included, as it is not an expense: the purchase of inventory does not involve an outflow of economic benefits because it does not decrease assets overall. A purchase of inventory simply swaps one asset (Bank) for another (Inventory).

Explain why it is important to identify Gross Profit in the Income Statement of a trading business.

It is important to identify gross profit in the income statement of a trading business as a trading business earns profit by buying goods at one price and selling them at a higher price. The owner must be able to asses whether the selling price is high enough to cover the cost of the inventory and other expenses, and still provide net profit,

For this reason, the Income Statement for a trading firm shows whether the business has earned a Gross Profit.

Adjusted gross profit

An Inventory loss is then deducted from Gross Profit to determine . (An Inventory gain would of course be added to Gross Profit.)

Explain how an Inventory loss or gain is determined.

The Inventory loss or gain is determined by comparing the inventory card figures to the physical count.

Explain why Inventory loss and gain are reported separately in the Income Statement

So the owner can identify problems with inventory management so that corrective action can be taken.

Net Profit

All costs incurred to get inventory ready for sale are included as part of Cost of Goods Sold, leaving all the other costs that are required to keep the business operating (like wages, advertising, rent or interest) to be reported as Other expenses. Note that delivery to customers is reported here rather than as part of Cost of Goods Sold, as it is incurred after the sale occurs. Net Profit is thus determined by deducting these other expenses from Adjusted Gross Profit.

Explain how inventory is classified in the Balance Sheet

In terms of the Balance Sheet, inventory will be reported as a current asset: a resource controlled by the business from which future economic benefits are expected in the next 12 months.

Referring to one Qualitative characteristic, explain why the Balance Sheet does not list the balance of every line of inventory.

Relevance dictates that there is no need to report the balance of each individual line of inventory, as this information will not be useful for the types of decisions that are informed by the Balance Sheet. Instead, a single figure for inventory will be reported, and this figure will be determined by using an inventory sheet.

Describe three ways in which inventory can be managed.

Determine the maximum and minimum quantity -For each particular line of inventory, management should determine a maximum quantity to keep in inventory. Once this amount is purchased, sales can be made until the minimum number is reached. At this stage, an order should be placed and the maximum number of units re-ordered. The minimum quantity should be just enough to satisfy sales until the new delivery arrives.

Rotate inventory - older products must be stocked in front so that they are taken first. Otherwise, inventory may remain unsold, resulting in spoilage and wastage.

Consider complementary products - A useful inventory management method is to offer a range of complementary products. This means that the business provides a variety of inventory items that complement one other. The sales of one particular item can then promote sales of other items.

React to changes in the market

Business owners must be checking inventory cards on a daily basis to detect slow-moving items, as these may have to be discontinued.

Fast-moving lines must also be identified, as it is likely that they will sell out. All other inventory must be checked to ensure that items aren’t damaged or dirty and that displays are as required.

If changes in the general market are detected, management must be ready and able to react. Prices and products are subject to change, and management must make decisions in reaction to such changes.

Inventory sheet

An inventory sheet is simply a listing of all the inventory lines, the number of units on hand, and the value of those units.

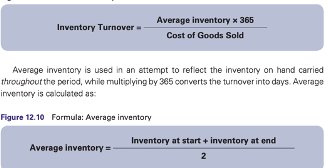

Inventory Turnover

an efficiency indicator that measures the average number of days it takes for a business to sell inventory