Economics - HSC Topic One - The Global Economy - Syllabus Notes

1/106

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

107 Terms

1.0 International economic integration

1.1 The global economy

Define the global economy

The global economy refers to the integration between economies of the world. It considers the sum of all economic activity of individual countries, and the interactions between them. This integration has increased in recent years, along with the process of globalisation.

1.0 International economic integration

1.1 The global economy

Define Economic integration

Economic integration refers to the liberalisation of trade between two or more countries. This means goods and services, labour, and other resources can move more freely between economies.

1.0 International economic integration

1.1 The global economy

How do economies take advantage of economic integration?

We live in a global economy whereby economies of the world take advantage of increased economic integration to maximise output and efficiency. However, with increased integration comes increased risk, such as financial contagion.

1.0 International economic integration

1.1 The global economy

What is financial contagion?

Financial contagion is where news of an economic disaster results in financial traders moving money out of affected or nearby areas/economies. For example, the financial crisis in Greece had many flow-on effects for European countries.

1.0 International economic integration

1.1 The global economy

What is GDP at Purchasing Power Parity (PPP)?

GDP at Purchasing Power Parity (PPP) is the total value of Gross World Product in a given time period, adjusted for national variations in price and different exchange rates. Purchasing power parity is where currencies are converted to be in equilibrium, or 'on par’, so prices can be compared accurately. This is used to compare GDP levels across different economies more accurately.

1.0 International economic integration

1.2 Gross World Product

What is GWP?

Gross World Product (GWP) is the total value of goods/services that are produced worldwide (income) over a period of time (e.g. a year) measured in $USD for consistency. This is used to measure the overall trend of growth or decline for the global economy.

1.0 International economic integration

1.3 Globalisation

Define Globalisation

Globalisation refers to the integration and removal of barriers between countries/economies.

1.0 International economic integration

1.3 Globalisation

What are the main forces driving globalisation?

The forces driving globalisation, according to the World Bank, include:

New markets

New actors

New rules and norms

New tools of communication

1.0 International economic integration

1.3 Globalisation

What are new markets?

New markets: growth of global markets in services, such as finance and international transportation, motivates deregulation of financial markets and antitrust laws. This ensures such markets continue to grow rapidly and expand internationally, facing increased competition, innovation, and opportunity.

1.0 International economic integration

1.3 Globalisation

What are new actors?

New actors: the growth of multinational corporations (MNCs) has caused reformations to global supply chains, where supplies are commonly sourced internationally to take advantage of cheaper inputs. This has increased supply chain links and global integration. The WTO has also been an instrumental actor in facilitating globalisation, as they govern free and fair trade internationally. Non-government organisations which provide foreign aid, trading blocs and organisations like the EU, and government economic forums like the G7 also facilitate global policy coordination and communication.

1.0 International economic integration

1.3 Globalisation

What are new rules and norms?

New rules and norms: with the increased spread of democracy, human rights awareness, action agendas for developing countries, and market-based economic policies (like those of Australia and the US), governments of the world have sought greater global communication and integration. For example, the creation of multilateral and bilateral agreements has facilitated greater global trade links.

1.0 International economic integration

1.3 Globalisation

What are new tools of communication?

New tools of communication: the internet, and the increase in use of electronic communication and international transportation has facilitated an increase in efficiency of global

1.0 International economic integration

1.3 Globalisation

1.3.1 Trade in goods and services financial flows

How has trade in goods/services changed over the last few decades?

Trade in goods/services has increased dramatically in the last few decades, from 38% of global output in 1990 to 50% of global output in 2018 (World Bank). This has been caused by the factors promoting globalisation detailed above, but perhaps most influenced by the increase in trade agreements between countries, and the overall trend of decreased domestic protection.

1.0 International economic integration

1.3 Globalisation

1.3.1 Trade in goods and services financial flows

Why is the composition of trade constantly changing?

The composition of global trade is continually changing due to changing trends in demand for different goods and services. Changes in demand are also affected by the general rise in affluence, new technologies, and innovation. The direction of trade flows has also changed, along with the importance of regions. Trade flows have increased significantly for emerging economies, growing from 7% to 19% of global trade over the past decade.

1.0 International economic integration

1.3 Globalisation

1.3.1 Trade in goods and services financial flows

What is the most globalised feature of economies?

Finance is the most globalised feature of the world economy because everything revolves around money, and recent technologies allow money to move instantly between countries. This facilitates an efficient movement of international finance, contributing to globalisation.

1.0 International economic integration

1.3 Globalisation

1.3.1 Trade in goods and services financial flows

What are the main drivers of global financial flows?

Financial deregulation

Speculators

1.0 International economic integration

1.3 Globalisation

1.3.1 Trade in goods and services financial flows

What is Financial deregulation?

Financial deregulation: beginning on a global scale in the 1970s and 1980s. For example, Australia floated the dollar in 1983, lifting many restrictions on the flow of the Australian currency globally.

1.0 International economic integration

1.3 Globalisation

1.3.1 Trade in goods and services financial flows

What are speculators?

Speculators: investors that buy/sell financial assets with the aim of making profits from short-term price movements. This has increased the amount of global financial transactions, but this has also increased volatility in prices worldwide.

1.0 International economic integration

1.3 Globalisation

1.3.1 Trade in goods and services financial flows

What is the main benefit of foreign exchange?

The main benefit of foreign exchange is it enables countries to obtain greater investment finance to expand operations and output. However, increased global financial flows increases the risk of financial contagion.

1.0 International economic integration

1.3 Globalisation

1.3.2 Investment and transnational corporations

What does investment made by TNCs involve?

Investment made by Transnational Corporations (TNCs) involves the expansion of businesses globally in hopes of reaching a larger market and making greater profits. Investment can also be made by third parties into TNCs through foreign direct investment. The aim of this investment is to receive a share of the company's profits, without getting involved with operations. Foreign direct investment (FDI) is the purchase of a controlling interest in a foreign subsidiary (over 10%). Easing capital controls and financial deregulation has caused DIs to increase to over six times their level a decade ago.

1.0 International economic integration

1.3 Globalisation

1.3.2 Investment and transnational corporations

What caused the global expansion of TNCs?

The global expansion of TNCs has especially been prevalent in manufacturing industries, where countries can take advantage of cheap resources from around the world, and low labour costs to maximise the efficiency of their supply chains. The main drivers of FDI increases include government policies of deregulation that attempt to encourage FDis, and reformed migration laws that encourage an increase in international labour mobility.

1.0 International economic integration

1.3 Globalisation

1.3.3 Technology, transport and communication

How has the growth of new technologies improved the global economy?

Due to the rapid development of new technologies, especially in areas of communication and transport, the global economy has seen an increase in integration.

1.0 International economic integration

1.3 Globalisation

1.3.3 Technology, transport and communication

How are consumers globalised?

Consumers are now global, accessing e-commerce and travel from other economies, and developing new tastes and preferences adopted from other cultures due to this increase in global exposure and choice.

1.0 International economic integration

1.3 Globalisation

1.3.3 Technology, transport and communication

How are firms globalised?

Firms are also global, reforming their supply chains to take advantage of cheaper and more efficient resources, inventory management, and labour. Due to the increased access to global markets, there has also been an increase in competition and efficiency of firms, as innovation is necessary to compete on a global scale.

1.0 International economic integration

1.3 Globalisation

1.3.3 Technology, transport and communication

What are some other improvements caused by technology?

Technology has also facilitated improved transportation. Improvements to infrastructure such as roads, railways, and airports facilitate the movement of all resources (including labour), increasing efficiency for all industries. Communication improvements, such as the continual and rapid development of telecommunication technologies has resulted in rapid spread of information, and has facilitated greater links between consumers, firms, governments, and economies of the world.

1.0 International economic integration

1.3 Globalisation

1.3.4 International division of labour, migration

What is the international division of labour?

The international division of labour refers to the allocation of tasks to different people in different countries, in order to maximise specialisation and efficiency. It includes activities such as TNCs establishing manufacturing plants in emerging economies to utilise cheaper labour, outsourcing services and elements of a supply chain internationally. It also includes geographical mobility and migration of workers to developed economies that are seeking skilled labour.

1.0 International economic integration

1.3 Globalisation

1.3.4 International division of labour, migration

What do immigration laws prohibit regarding globalised labour?

Immigration laws around the world generally restrict lower-skilled workers from moving to other countries. However, higher-skilled workers, and those with skills that advanced economies are lacking are commonly allowed to migrate. This increases the technological gap between developed and developing economies further, as skilled labour is attracted to greater opportunity in the most advanced economies, leaving developing economies behind. Australia's major intake of migration is in the category of 'skilled migration.' According to the World Bank, 3% of the world's population has migrated to work in different countries.

1.0 International economic integration

1.4 The international and regional business cycles

What is the international business cycle?

The international business cycle refers to the changes in world output/economic activity across time. Changes in the international business cycle have varying effects on domestic business cycles, depending on the level of a country's internationalisation and integration.

1.0 International economic integration

1.4 The international and regional business cycles

What is the regional business cycle?

The regional business cycle refers to the fluctuations in the level of economic activity in a geographical region of the global economy over time (e.g. the EU). Regional business cycles can be different to international business cycles.

1.0 International economic integration

1.4 The international and regional business cycles

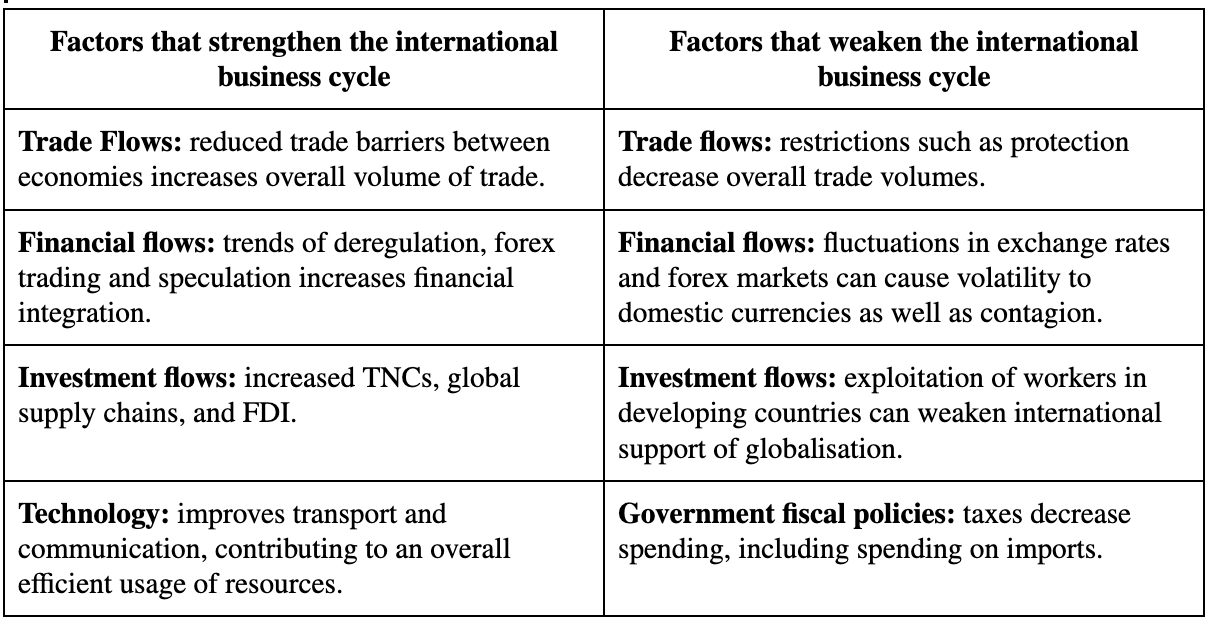

What are the main factors that strengthen and weaken the international business cycle?

2.0 Trade, financial flows, and foreign investment

2.1 The basis of free trade - its advantages and disadvantages

Define Free Trade

Free trade: occurs when there are limited artificial barriers imposed by the government upon the flow of goods/services across international borders. Each country has resources it is naturally abundant in, and skills which are (by comparison) of superior quality to other economies. This theory is referred to as having an advantage over another economy.

2.0 Trade, financial flows, and foreign investment

2.1 The basis of free trade - its advantages and disadvantages

What are the two types of advantages economies can gain through the basis of free trade?

Absolute advantage

Comparative advantage

2.0 Trade, financial flows, and foreign investment

2.1 The basis of free trade - its advantages and disadvantages

What is absolute advantage?

Absolute advantage: when a country can produce more output with the same resources as another country. For example, country A can produce 3 coats with a given amount of wool, and country B can produce 5 coats with a given amount of wool. Here country B has an absolute advantage.

2.0 Trade, financial flows, and foreign investment

2.1 The basis of free trade - its advantages and disadvantages

What is comparative advantage?

Comparative advantage: is when a country has a lower opportunity cost when producing a good, meaning they make most efficient use of resources in production. This is based on David Ricardo's theory of comparative advantage.

2.0 Trade, financial flows, and foreign investment

2.1 The basis of free trade - its advantages and disadvantages

How does the theory of comparative advantage affirm the basis of free trade?

The theory of comparative advantage forms the basis for the reason why free trade is so effective in supporting global economic growth. Producing and exporting goods/services which an economy has comparative advantage in allows the economy to take advantage of economies of scale and high efficiency levels, meaning more goods can be produced at a lower price. When economies are able to specialise in a product, they hold comparative advantage in, and trade with the rest of the world to acquire products they are inefficient at producing, global output increases overall, boosting global economic growth.

2.0 Trade, financial flows, and foreign investment

2.1 The basis of free trade - its advantages and disadvantages

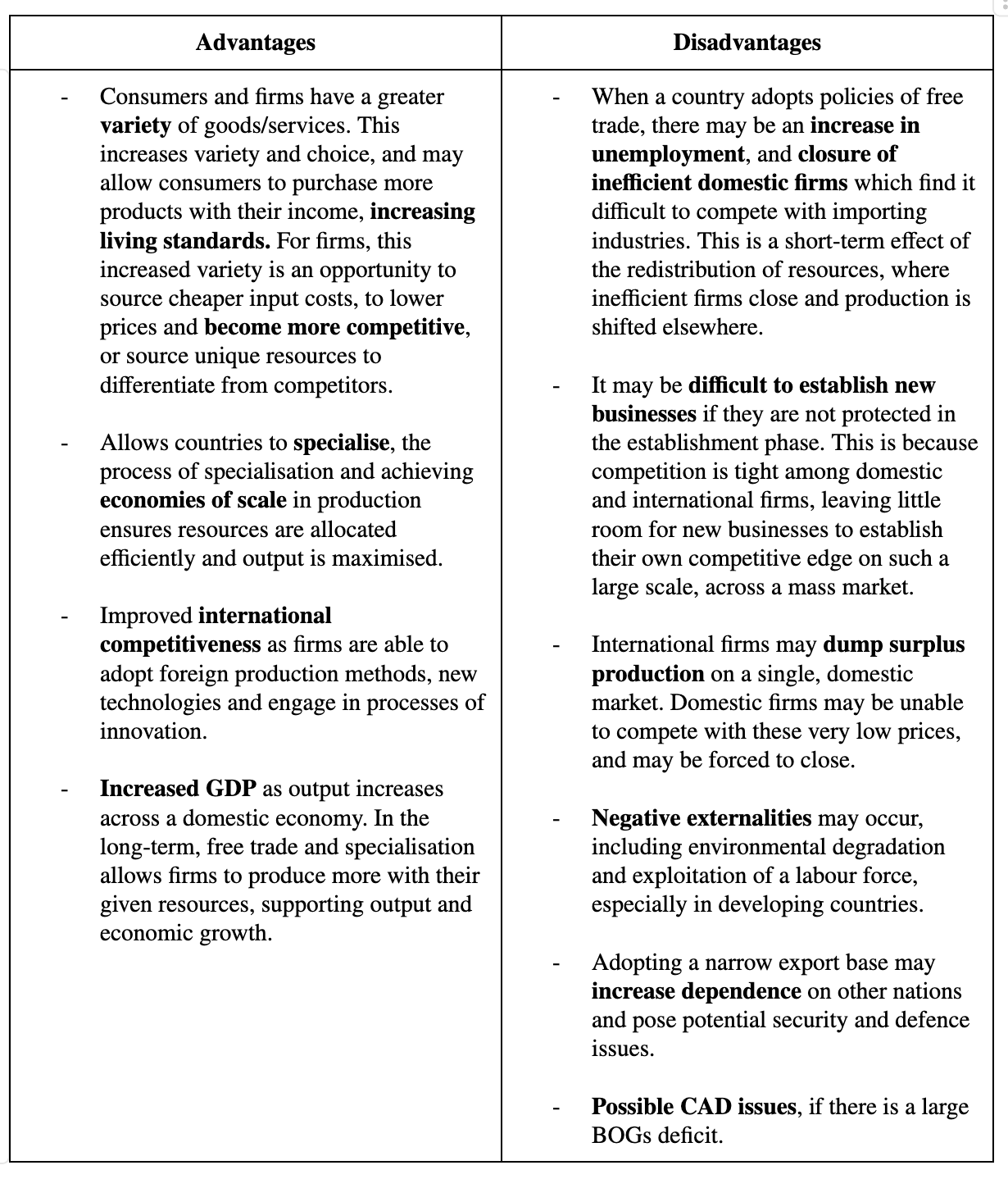

What are the main advantages and disadvantages of free trade?

2.0 Trade, financial flows, and foreign investment

2.2 Role of international organisations

What do international organisations promote?

Global organisations promote international policy coordination, as a forum for global issues and disputes.

2.0 Trade, financial flows, and foreign investment

2.2 Role of international organisations

2.2.1 World Trade Organisation (WTO)

What is the WTO?

The WTO is a multilateral trade organisation and agreement, binding governments to keep trade policies. This is the largest multilateral trade agreement, and the organisation monitors developments in world trade to provide basic principles, including trade liberalisation, with the aim to eliminate trade barriers through multilateral negotiation, and stability of trade relations, acting as a mediator to solve disputes

2.0 Trade, financial flows, and foreign investment

2.2 Role of international organisations

2.2.2 International Monetary Fund (IMF)

What is the IMF?

The IMF is an international agency that oversees the stability of the global financial system. They aim to:

Promote international monetary cooperation and exchange rate stability

Facilitate the expansion of international trade and the multilateral payments system

Give resources and funds to members experiencing balance of payments difficulties

The IMF is an important organisation for the global economy as a country in severe financial trouble poses potential problems for the stability of the international financial system, which the IMF was created to protect sources funds from a pool of advanced economies' contributions. These funds are then used to support countries experiencing short-term financial problems. All of these loans need to be paid back to the IMF with low rates of interest.

2.0 Trade, financial flows, and foreign investment

2.2 Role of international organisations

2.2.3 World Bank

What is the World Bank?

The World Bank aims to promote economic development in developing countries through influencing macro and micro economic policy. The world bank aims to assist developing economies through providing:

Development assistance (foreign aid) and loans

Support for long-term investment projects to encourage economic development

Dispute settlements in investment projects (e.g. disputes hindering progress between governments and firms)

However, the World Bank and IMF usually require governments to implement specific structural reforms in their economies to receive assistance. This is called the conditionality principle. This principle can be seen as undermining a nation's sovereignty and autonomy, and therefore may restrict the ability for these organisations to assist nations who disagree with their terms.

2.0 Trade, financial flows, and foreign investment

2.2 Role of international organisations

2.2.4 United Nations (UN)

What is the UN?

The UN's primary aims involve peacekeeping, conflict prevention, humanitarian assistance, and human rights on a global scale. The UN covers a wide range of issues from sustainable environmental

management to economic development. They also provide the global standard for development to ensure no country is left behind, known as the 2030 Agenda for Sustainable Development. This features 17 goals, aiming to end all forms of poverty. These goals officially came into effect in 2016, covering the next 15 years. Examples of these goals include:

Eradicate poverty and hunger everywhere by halving the number of people living in extreme poverty

Achieve gender equality and empower all women and girls

2.0 Trade, financial flows, and foreign investment

2.2 Role of international organisations

2.2.5 Organisation of Economic and Cooperation of Development (OECD)

What is OECD?

The OECD engages in research, consultation, and coordination of economic issues. With only 34 member countries, they are the smallest of the international organisations, however this allows the organisation to promote coordination of macroeconomic policy among members to support economic growth. The organisation aims to:

Promote sustainable economic growth and development, and maintain financial stability

Contribute to global economic development through providing specialised advice to member nations.

It publishes regular reports such as the OECD Economic Outlook on each member's economic performance and prospects. It also makes policy recommendations to improve the economic performance of its member nations. For example, in 2018, they released an OECD Pensions Outlook, which examines how pension systems are adapting to improve retirement outcomes.

2.0 Trade, financial flows, and foreign investment

2.3 Influence of government economic forums

What are government economic forums?

Government economic forums are global forums that influence and coordinate world trade and economic policies across the global economy. Discussions include those around global economic governance, environmental and ethical issues, and international security.

2.0 Trade, financial flows, and foreign investment

2.3 Influence of government economic forums

2.3.1 G20

What is the G20 and why was it established?

The G20 was established after the 2008 GFC to coordinate a global response to avert a depression. G20 members account for 85% of the world economy, 75% of global trade, and approximately 66% of the world's population (DFAT). It came about because the G7 wasn't truly global. G20 leaders meet annually at the G20 Summit. Australia hosted the G20 Summit in Brisbane in 2014, which agreed to lift growth by 2%. The G20 aims to:

Coordinate fiscal stimulus around the world

Improve supervision of global financial system

Discuss key issues in the global economy

2.0 Trade, financial flows, and foreign investment

2.3 Influence of government economic forums

2.3.2 G7

What is the G7?

The G7 has been the unofficial forum for coordinating global macroeconomic policy due to its influence over the fiscal and monetary policies of the world's largest economies. Lately, the significance of G7 has declined. This is because there has been a shift from the global balance of power towards emerging economies, in particular China.

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

What is a trading bloc?

A trading bloc is where countries enter preferential trade agreements, establishing free trade between themselves and external tariffs on imports for the rest of the world. This is beneficial if there is trade creation and not trade diversion (ie. increased trade volumes overall), as countries are able to utilise comparative advantage. Trade diversion is where trade with non-member countries decreases.

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

What is a monetary union?

Monetary unions are formed when groups of countries share a common currency and monetary policy. This creates an increasingly integrated regional market, boosting financial inefficiencies. An example of a monetary union (and trading bloc) is the Eurozone, consisting of all the European Union (EU) countries that adopted the Euro as their national currency.

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

What are free trade agreements?

Free trade agreements are formal agreements between countries to reduce trade barriers such as tariffs.

Free trade doesn't necessarily mean no barriers at all; it refers to the reduction of barriers (some forms of protection may remain). Free trade agreements can be multilateral (e.g. WTO agreements), regional (e.g. the EU), or bilateral (e.g.AUSFTA, the Australian-United States Free Trade Agreement).

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

2.4.1 Evaluating multilateral and bilateral trade agreements

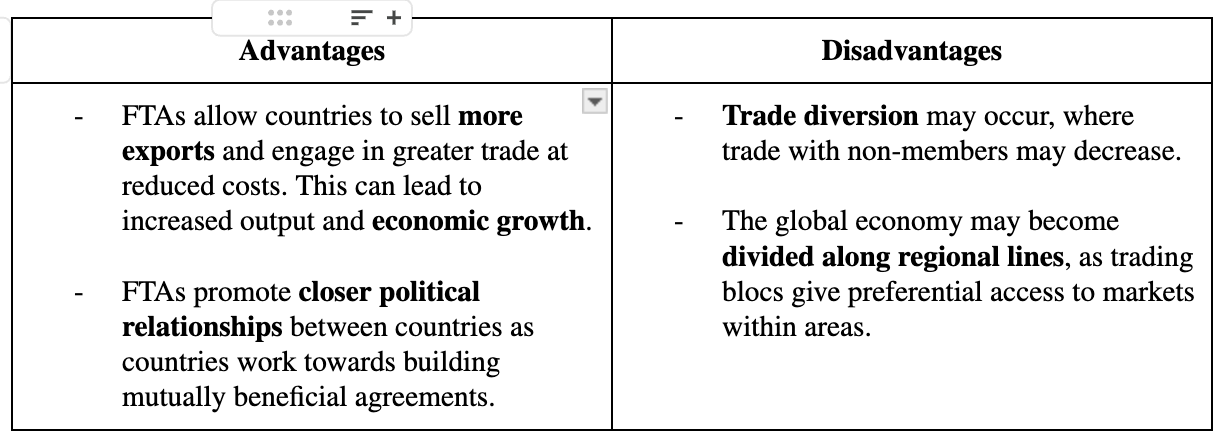

What are the main advantages and disadvantages of trade agreements?

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

2.4.2 European Union (EU)

What is the EU?

The EU is a customs and monetary union (for countries in the Eurozone), trading bloc, and multilateral agreement consisting of most European countries. The creation of a single European market through common trade and migration policies has allowed for increased efficiency in the allocation of resources in this region. The single currency of the Euro (€) managed by the European central bank, reducing transaction costs in an increasingly integrated regional market.

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

2.4.3 Asia Pacific Economic Cooperation (APEC)

What is APEC?

APEC is a multilateral trade agreement and regional economic forum created to promote free trade within the Asia-Pacific region. The aims of APE include to:

Implement common trade policies with member nations

Develop mechanisms for closer trade and investment links in Asia Pacific (e.g. dispute settlement procedures)

APEC is non-discriminatory, as it agreed not to become a protectionist trading bloc, but also aims to reduce barriers to non-member countries as well. However, in recent years the significance of APEC has declined due to the forum's large size and subsequent inefficiency.

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

2.4.4 North American Free Trade Agreement (NAFTA)

What is NAFTA?

NAFTA: multilateral free trade agreement consisting of Canada, Mexico, and the US mainly based on

eliminating agricultural protection and tariffs.

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

2.4.4 North American Free Trade Agreement (NAFTA)

What are the benefits for each country in NAFTA?

The benefits to the US and Canada include the opportunity to increase international competitiveness by exploiting lower production costs by shifting production to Mexico. The advantages for Mexico include greater access for firms to the large markets of the US and Canada. However, trade diversion may have been created due to this agreement, as there is an incentive for American and Canadian firms to relocate production to Mexico and close manufacturing in Canada and the US. Despite this, consumers have benefited from lower prices, and US corporations from the lower costs. NAFTA accounts for 13% of global merchandise trade.

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

2.4.5 Association of South-East Asian Nations (ASEAN)

What is ASEAN?

ASEAN is a free trade area covering emerging and developing economies in South-East Asia. The aim of ASEAN is to promote economic development, social progress, and cultural development within this region. It has acted as a counterweight to the APEC forum, which tends to be dominated by the large economies like the US and China. Australia and New Zealand created a multilateral agreement with ASEAN in 2010 called the ASEAN Australia New Zealand Free Trade Area (AANZFTA).

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

2.4.6 Bilateral trade agreements

What caused the increase in bilateral agreements?

The slow progress in WTO negotiations (such as the Doha Round) led to the rapid growth in bilateral FTAs in recent years.

2.0 Trade, financial flows, and foreign investment

2.4 Trading blocs, monetary unions, and free trade agreements

2.4.6 Bilateral trade agreements

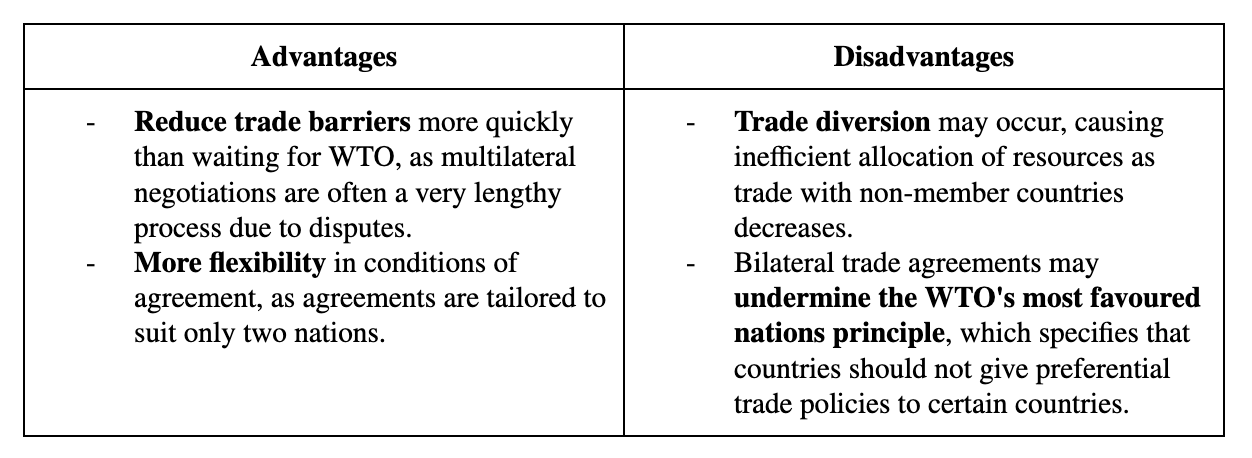

What are the main advantages and disadvantages of bilateral trade agreements?

3.0 Protection

Define Protection

Protection refers to the use of artificial barriers that restrict the free flow of goods and services in international trade, to give domestic producers an artificial advantage.

3.0 Protection

3.1 Reasons for protection

What are the main reasons for protection?

The main reasons for protection include the infant industry argument, domestic employment, dumping, and defence.

3.0 Protection

3.1 Reasons for protection

Explain the infant industry argument

Infant industry argument: allowing newly established industries sufficient time to achieve economies of scale to compete in global markets and become efficient. When companies engage in open trade policies, competition between firms becomes high and those that are able to achieve economies of scale and hold a competitive edge over others find the most success and profits. This makes it difficult for new firms to establish a place in the market, as they are unable to achieve the same level of production and scale as well-established firms with high rates of investment. However, if protection is implemented for new firms, it should be temporary, until they are internationally competitive. Otherwise, this may result in inefficient resource allocation if firms become reliant on protection and don't innovate.

3.0 Protection

3.1 Reasons for protection

Explain Domestic employment

Domestic employment: if overseas countries offer cheaper production, then domestic jobs are put at risk as firms shift production elsewhere to decrease costs. Imposing tariffs or barriers can prevent job losses which have the potential to cause economic contractions and recessions. However, this may be at the expense of efficient export industries, as higher trade barriers may affect export competitiveness and terms.

3.0 Protection

3.1 Reasons for protection

Explain Dumping

Dumping: if a country has an oversupply of goods it may dump excess products on another economy at a very low price, damaging local businesses as they are unable to compete. This may be due to excess supply and stock levels. This especially hurts developing economies as they drive down world prices of key commodities and create unfair trade. A country may impose a quota on imports to restrict dumping from occurring.

3.0 Protection

3.1 Reasons for protection

Explain Defence

Defence: involves defence of the nation in the event of war, or defence of a cultural preservation. It is a form of national security for countries to have their own goods, including weapons and essential goods such as food production, rather than solely rely on imports.

3.0 Protection

3.2 Methods of protection

3.2.1 Tariffs

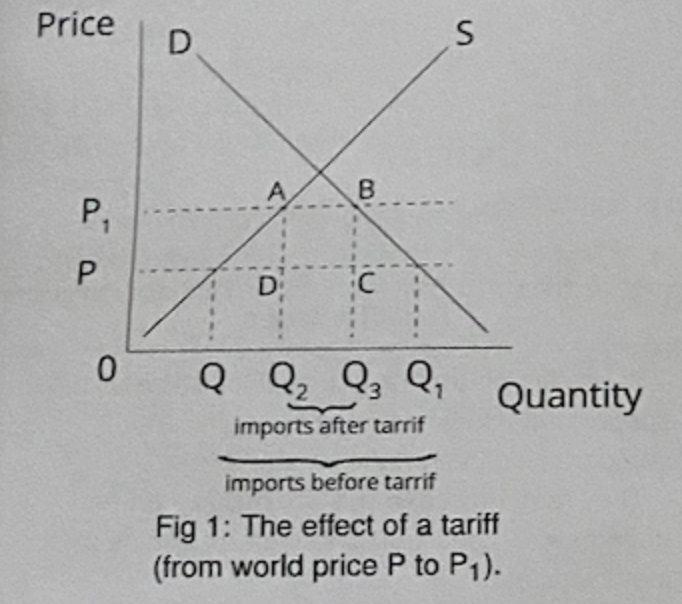

Define Tariffs

Tariffs are taxes on imported goods imposed for the purpose of protection.

3.0 Protection

3.2 Methods of protection

3.2.1 Tariffs

The effect of a Tariff:

3.0 Protection

3.2 Methods of protection

3.2.2 Quotas

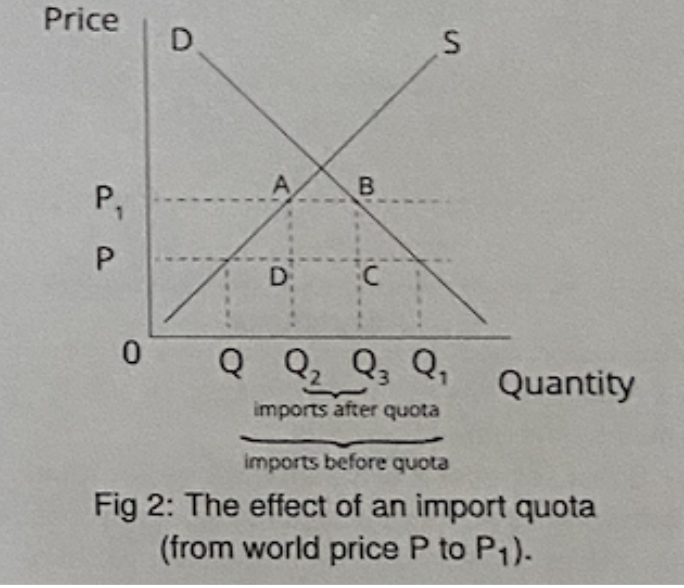

Define Quotas

Quotas are quantitative restrictions on certain categories of imported goods.

3.0 Protection

3.2 Methods of protection

3.2.2 Quotas

The effect of an import quota:

3.0 Protection

3.2 Methods of protection

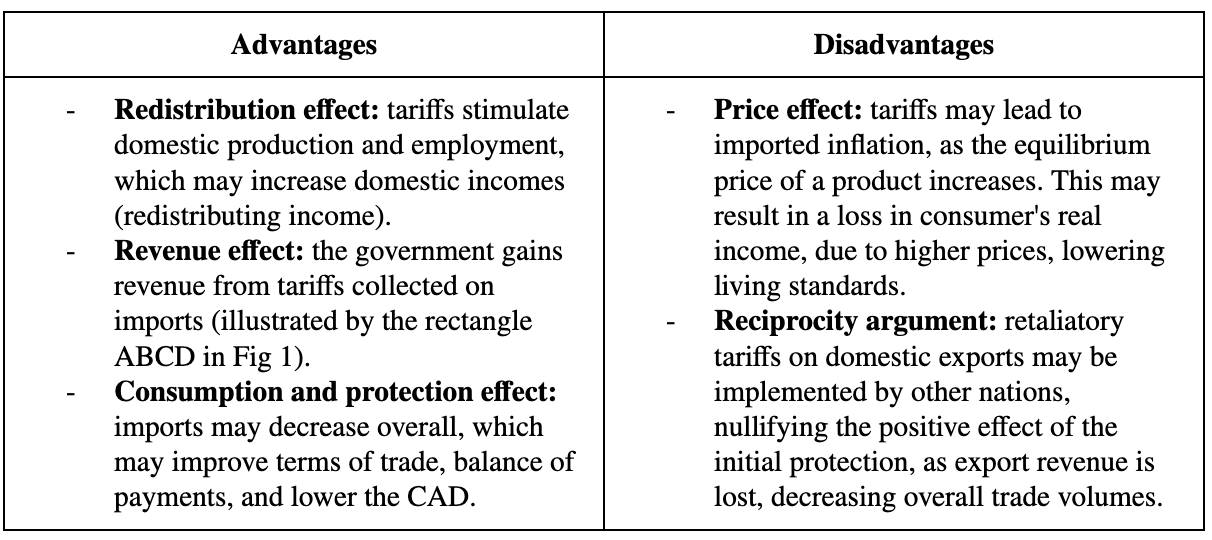

What are the main advantages and disadvantages of tariffs and quotas?

3.0 Protection

3.2 Methods of protection

3.2.3 Subsidies

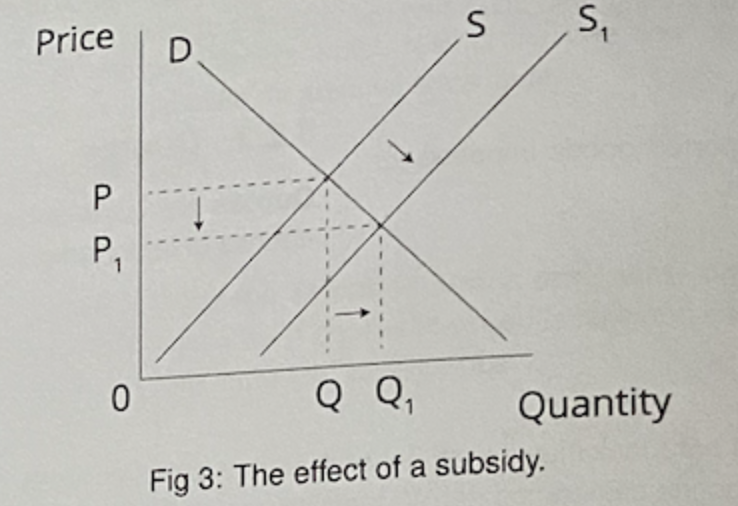

Define subsidies

Subsidies are forms of financial assistance paid to domestic producers such as farmers to allow them to increase supply and compete internationally.

3.0 Protection

3.2 Methods of protection

3.2.3 Subsidies

The effects of a subsidy:

3.0 Protection

3.2 Methods of protection

3.2.3 Subsidies

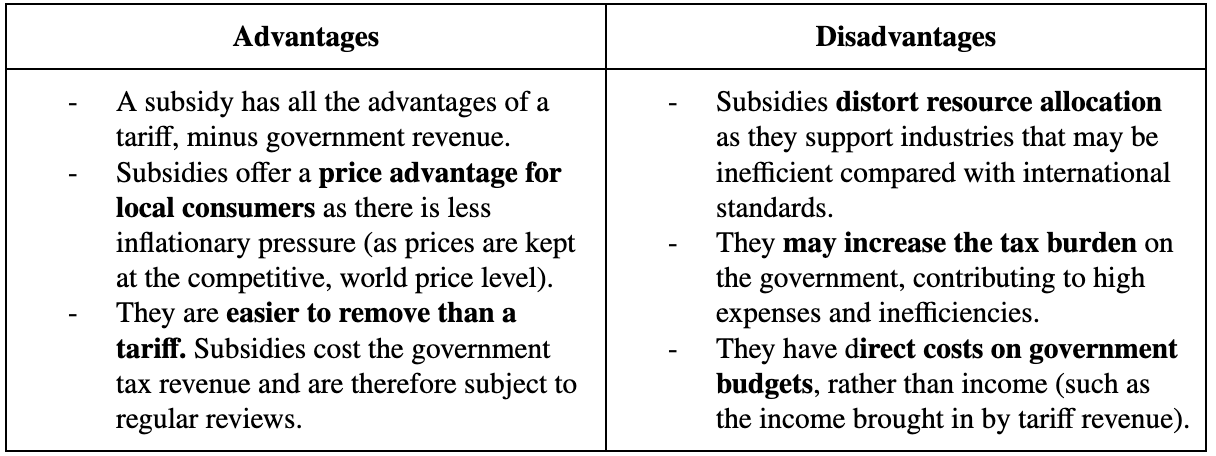

What are the main advantages and disadvantages of a subsidy?

3.0 Protection

3.2 Methods of protection

3.2.4 Local content rules

What are local content rules?

These specify that goods must contain a minimum percentage of locally produced parts, or a proportion of goods in the market must be locally made. An example of an Australian local content rule is that all commercial, free-to-air television licensees broadcast an annual minimum transmission quota of 55% Australian programming between 6:00 a.m. and midnight. This protects Australia's dramatic and informative entertainment and culture.

3.0 Protection

3.2 Methods of protection

3.2.5 Export incentives

What are export incentives?

These give domestic producers assistance (e.g. grants, loans or technical advice) to encourage businesses to penetrate global markets and expand market share. For example, Austrade is a government body that helps businesses in importing and exporting. It provides advice and guidance on overseas investment opportunities.

3.0 Protection

3.3 Effects of protectionist policies

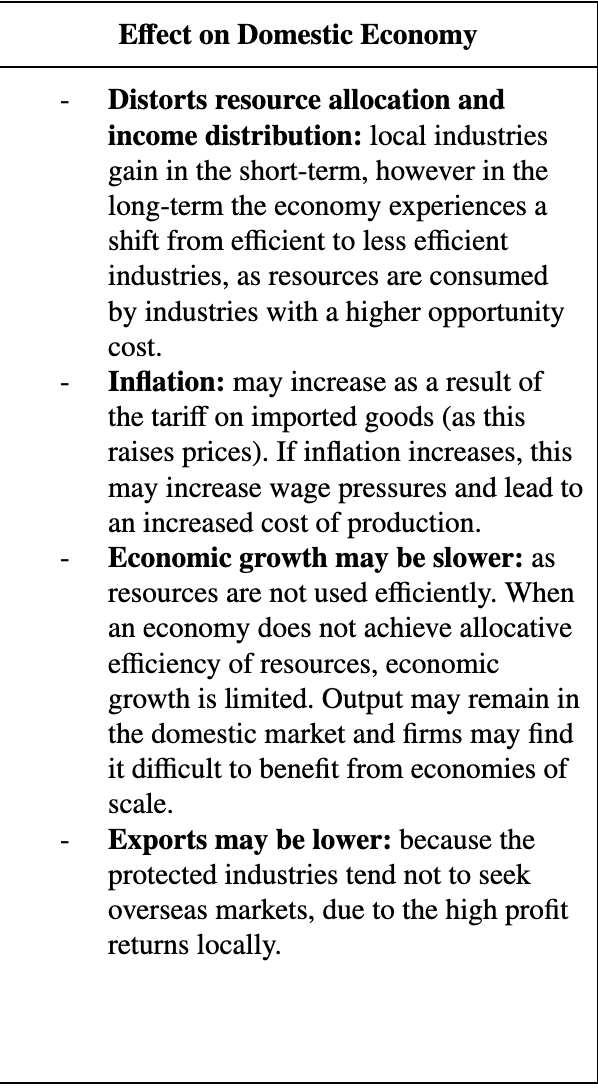

What are the effects of protectionist policies on domestic economies?

3.0 Protection

3.3 Effects of protectionist policies

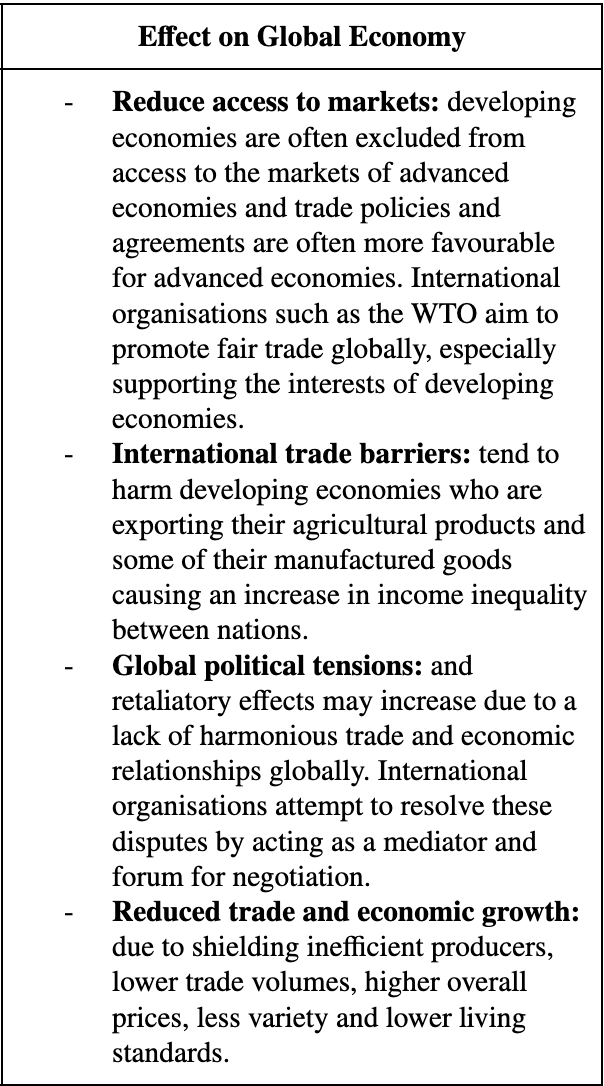

What are the effects of protectionist policies on global economies?

4.0 Globalisation and economic development

4.1 Differences between economic growth and development

Define economic growth

Economic growth is the increase in GDP over time, adjusted for inflation (real GDP). Economic growth is a quantitative measure of the performance of an economy.

4.0 Globalisation and economic development

4.1 Differences between economic growth and development

Define economic development

Economic development is the structural changes needed for growth to occur in an economy and to sustain increases in living standards. Economic development is a qualitative measure of the performance of an economy.

4.0 Globalisation and economic development

4.1 Differences between economic growth and development

What is a measure of economic development?

Economic development can be measured by the Human Development Index (HDI), a metric devised by the UN. HDI is measured on a scale of 0 to 1; the higher the score, the more economically developed a nation is.

4.0 Globalisation and economic development

4.1 Differences between economic growth and development

What does HDI take into account?

Life expectancy, education levels and GNI per capita.

4.0 Globalisation and economic development

4.1 Differences between economic growth and development

Define life expectancy

Life expectancy: indicative of the health and nutrition standards in a country, which are critical for a country's economic and social wellbeing. If health levels are low, the quality of labour resources are also lower and hence less productive.

4.0 Globalisation and economic development

4.1 Differences between economic growth and development

Define education levels

Education levels: refer to the development of the skills of the workforce, which determine the future development potential, innovation, and productive capacity of an economy.

4.0 Globalisation and economic development

4.1 Differences between economic growth and development

Define GNI per capita

GNI per capita: shows citizens' access to goods and services, and the extent of potential demand in an economy. It also offers insight into living standards in an economy, as higher incomes generally support higher living standards.

4.0 Globalisation and economic development

4.2 Distribution of wealth and income

What is the distribution of income?

The distribution of income refers to the comparison of annual incomes, which are direct returns from factors of production (land, labour, capital and enterprise investment) of citizens.

4.0 Globalisation and economic development

4.2 Distribution of wealth and income

What is the distribution of wealth?

The distribution of wealth refers to the comparison of asset ownership of citizens.

4.0 Globalisation and economic development

4.3 Income and quality of life indicators

Define GNI

Gross national income (GNI) measures the sum of value added by all resident producers in the economy, plus primary income from foreign sources, on a purchasing parity basis (US$).

4.0 Globalisation and economic development

4.3 Income and quality of life indicators

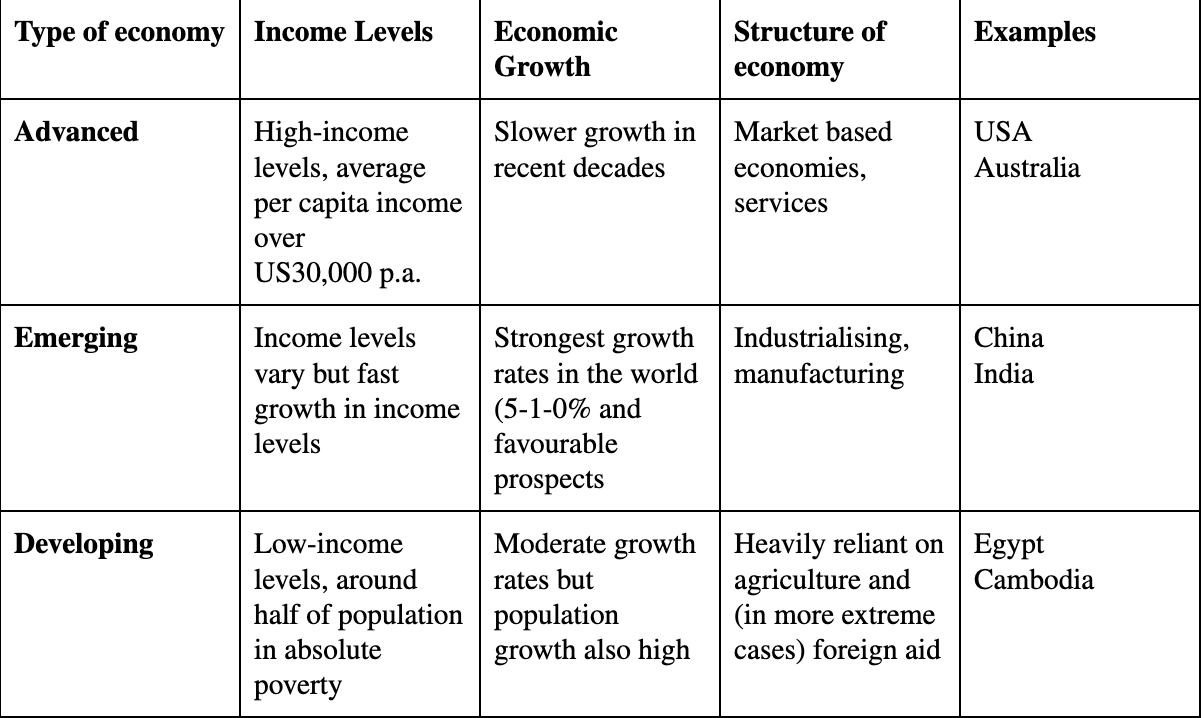

What are the characteristics of developing, emerging and advanced economies?

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.1 Global factors

What are the main global factors that contribute to inequality between nations?

The main global factors that contribute to inequality between nations include:

Global trade system

Global financial architecture

Global technology flows

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.1 Global factors

Explain the Global trade system

High global protectionism in the agricultural sector has caused high inequality globally, as developing economies aren't exporting to developed economies due to the restricted market access. The failure of the Doha Round is an example of the inequality caused by the global trade system, as high-income nations resisted making concessions on the issues that would provide the greatest benefit to developing countries.

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.1 Global factors

Explain the Global Financial Architecture

Many advanced economies will engage in short-term financial investment in emerging economies, as they offer high returns due to the high risk involved. This creates economic volatility, as money is moved in and out of the financial market quickly, which can have flow-on effects for investor confidence, market stability, terms of trade and exchange rates.

Furthermore, due to the high rates of foreign borrowing and low incomes of developing nations, massive foreign debt burdens occur for those nations who are already experiencing balance of payment difficulties.Interest repayments on these loans grows exponentially as the nation accumulates more debt to pay off previous loans, resulting in a debt-trap cycle. This further reduces income available for economic growth and development and causes inequality between nations.

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.1 Global factors

Explain the Global technology flows

Technology flow between advanced and emerging economies entrench rather than alleviate inequalities between nations, as advanced economies have access to greater amounts of capital, boosting productivity.

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.2 Domestic factors

What are the two core reasons for a nation to be unable to accumulate wealth?

Domestically, a variety of factors can contribute to a nation's inability to accumulate wealth. These can be separated into two core reasons: economic resources and institutional factors.

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.2 Domestic factors

What are the economic resources that could cause a nation to be unable to accumulate wealth?

Natural resources

Labour supply and quality

Lack of both infrastructure and capital formation

Low pe

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.2 Domestic factors

Explain natural resources

Natural resources: a lack of natural resources results in a lack of resources for production, creating higher opportunity costs across an entire economy. Resource-rich nations tend to have higher amounts of wealth. Also, countries that heavily rely on natural resource exports are exposed to downturns in commodity prices which can result in sudden falls in a nation's income.

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.2 Domestic factors

Explain Labour supply and quality

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.2 Domestic factors

Explain Lack of both infrastructure and capital formation

Lack of both infrastructure and capital formation: slow economic growth contributes to an inefficient use of both labour and capital.

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.2 Domestic factors

What are the institutional factors that could cause a nation to be unable to accumulate wealth?

political and economic institutions

Economic policies

High levels of foreign debt

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.2 Domestic factors

Explain political and economic institutions

Political and economic institutions: political instability and corruption means investors may not have confidence in an economy and are reluctant to take risks in investment.

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.2 Domestic factors

Explain Economic policies

Economic policies: governments that collect less tax revenue due to the low incomes of citizens cannot provide the same level of public services and social welfare as advanced economies. This limits the government's capacity to support economic growth and development within the economy, increasing inequality between nations.

4.0 Globalisation and economic development

4.4 Reasons for differences between nations

4.4.2 Domestic factors

Explain High levels of foreign debt

High levels of foreign debt: leads to higher debt-servicing costs, which diverts money away from other essential services and limits economic growth and development.

4.0 Globalisation and economic development

4.5 Effects of globalisation

What type of economy best benefits from globalisation?

There are mixed effects of globalisation on the different economies of the world. Globalisation has mostly benefited emerging economies, as the reformation of trade and financial flows has allowed these economies to experience rapid economic growth and development.