ECON 2020 Exam 1

1/151

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

152 Terms

scarcity

economic resources are constrained (natural, labor, capital)

Thomas Sowell: Conflicts of Visions

unconstrained: sufficient resources exist to satisfy desires

constrained: limited resources can't satisfy all desires

trade

voluntary exchange

Four Properties of Trade

1. Trade helps both sides

2. Trade creates value

3. Trade is a positive sum game

4. Trade encourages diverse interactions

zero-sum games

- winner takes all

- loser gets nothing

life has many zero-sum games

ex: sports games

Rabbi Jonathan Sacks

"It is through trade that difference becomes a blessing, not a curse."

Rotunda Principles

1. Trade creates value (voluntary exchange makes both sides better off)

2. Incentives affect behavior

positive science vs. normative science

positive science = "what is"

normative science = "what should be"

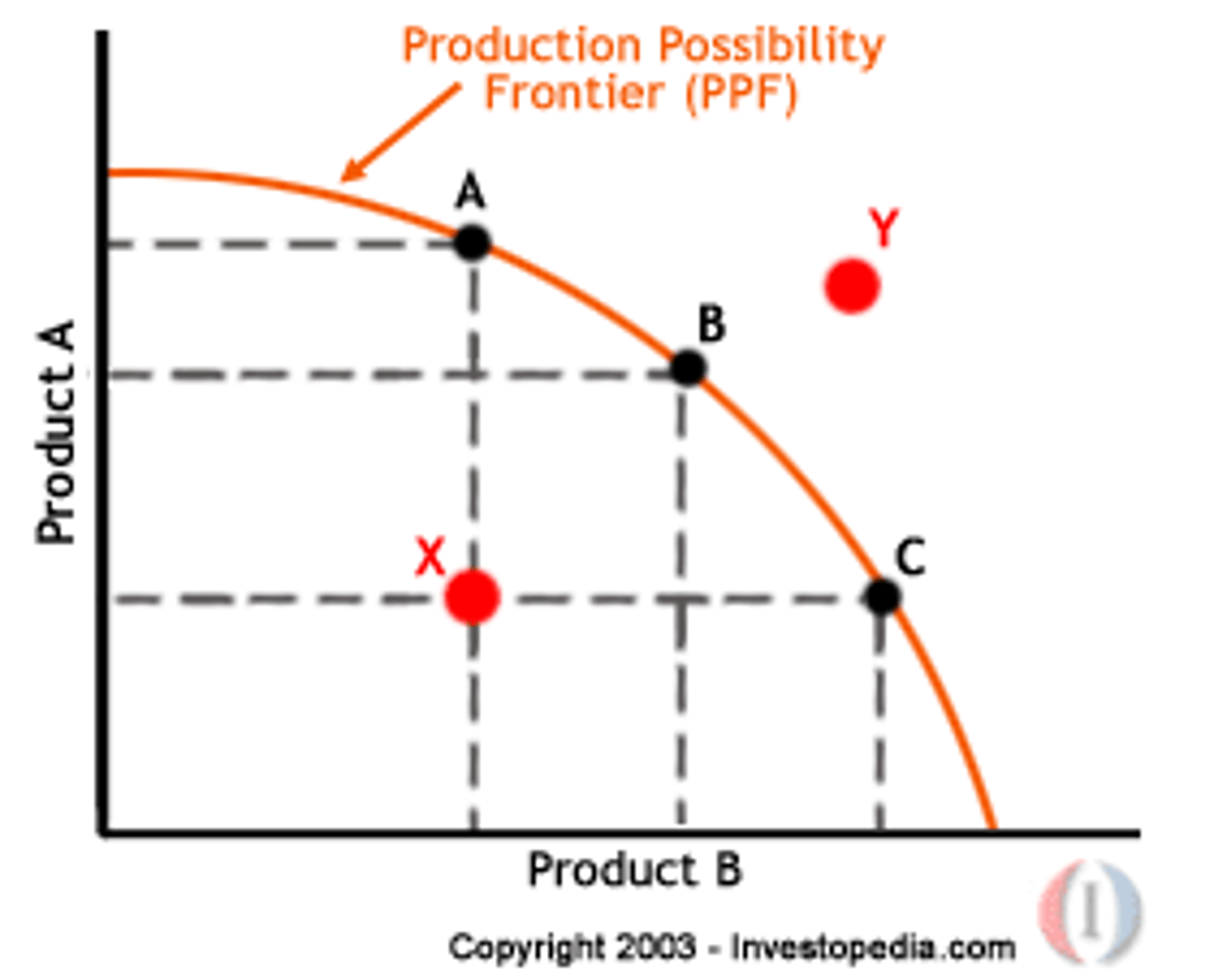

Production Possibilities Frontier

combinations of outputs where resources are used efficiently

ON curve ==> efficient

OVER ==> impossible

UNDER ==> inefficient

- slope is opportunity cost

Law of Increasing Opportunity Cost

- bowed outward because opportunity cost of a good increases as you produce more of it

Shifts in PPF

- whole thing shifts outward (x & y) ==> more/less resources (more capital investment can lead to outward shift in LR)

- biased shift ==> new tech/productivity/inputs

comparative advantage

producing @ a lower opportunity cost than a competitor ==> allows for specialization

specialization

limiting one's work to a specific area

==> encourages trade

absolute advantage

producers ability to create more than another producer w/ same Q of resources

When is trade mutually beneficial?

when the exchange ratio falls between the parties opportunity cost ratio

consumer goods vs capital goods

consumer = present consumption

capital = help produce other goods

investment

process of using resources to create/produce new capital

market vs planned economy

market (trade) ======> socialism (gov. decides)

US --------Argentina---------------------------North Korea

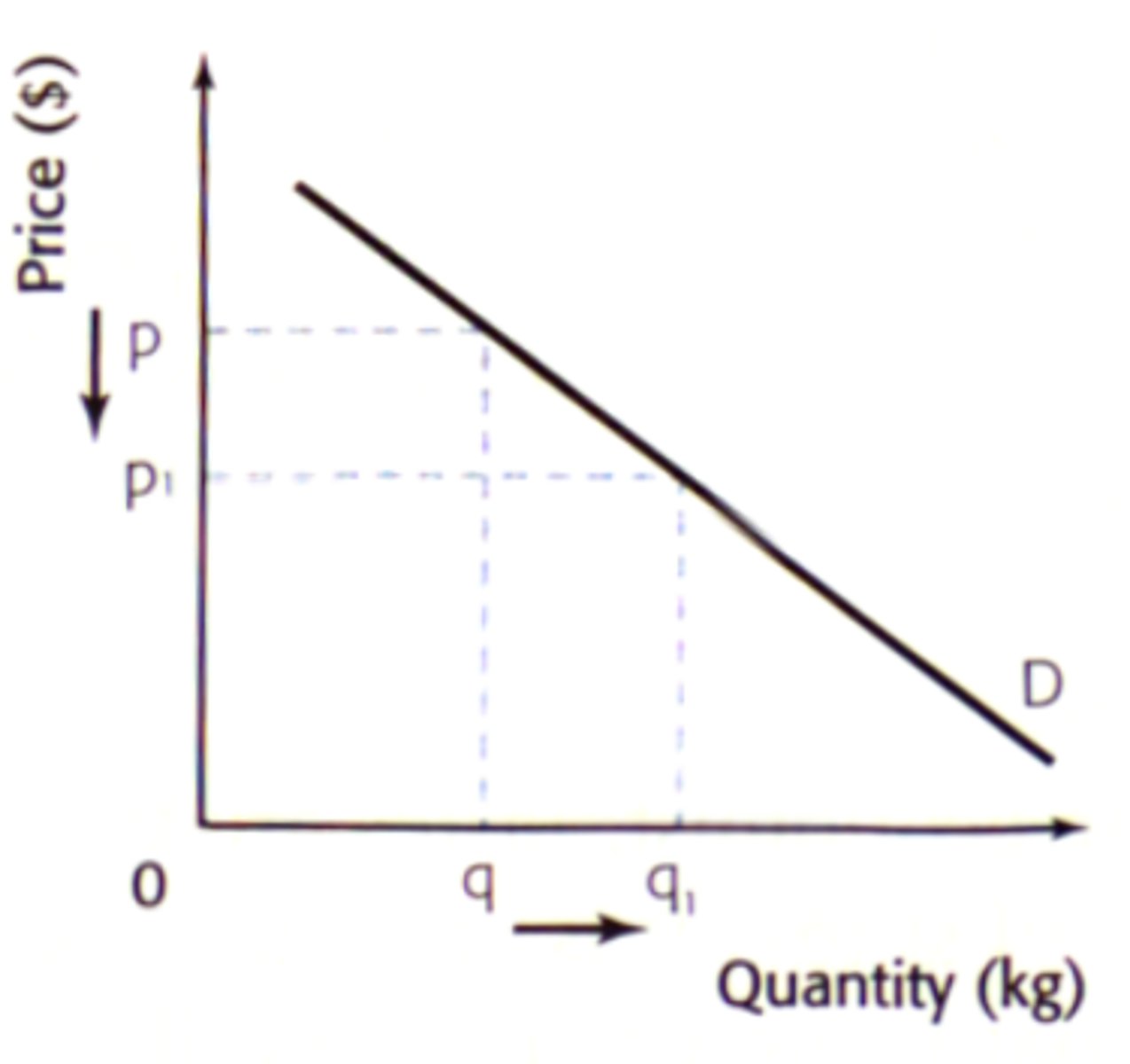

Law of Demand

quantity demanded increases, as price decreases

market demand ==> sum of ind. d curves

competitive market

so many buyers & sellers that each individual firm doesn't have control over price ==> similar goods & participants

imperfect market

buyer & seller can influence price (market power)

monopoly

single supplier for entire market

purchasing power

how income affects how much you can afford

normal good

Qd ⬆️as income ⬆️

inferior good

Qd ⬇️ as income⬆️

complement good

goods or services that are used together

a decrease in the price for one good will increase the quantity demanded for the other good

substitute good

can be used in place of each other.

a decrease in the price for one good will decrease the demand for the other product

subsidy

payment from the gov to shift demand of a product

ex: tax break

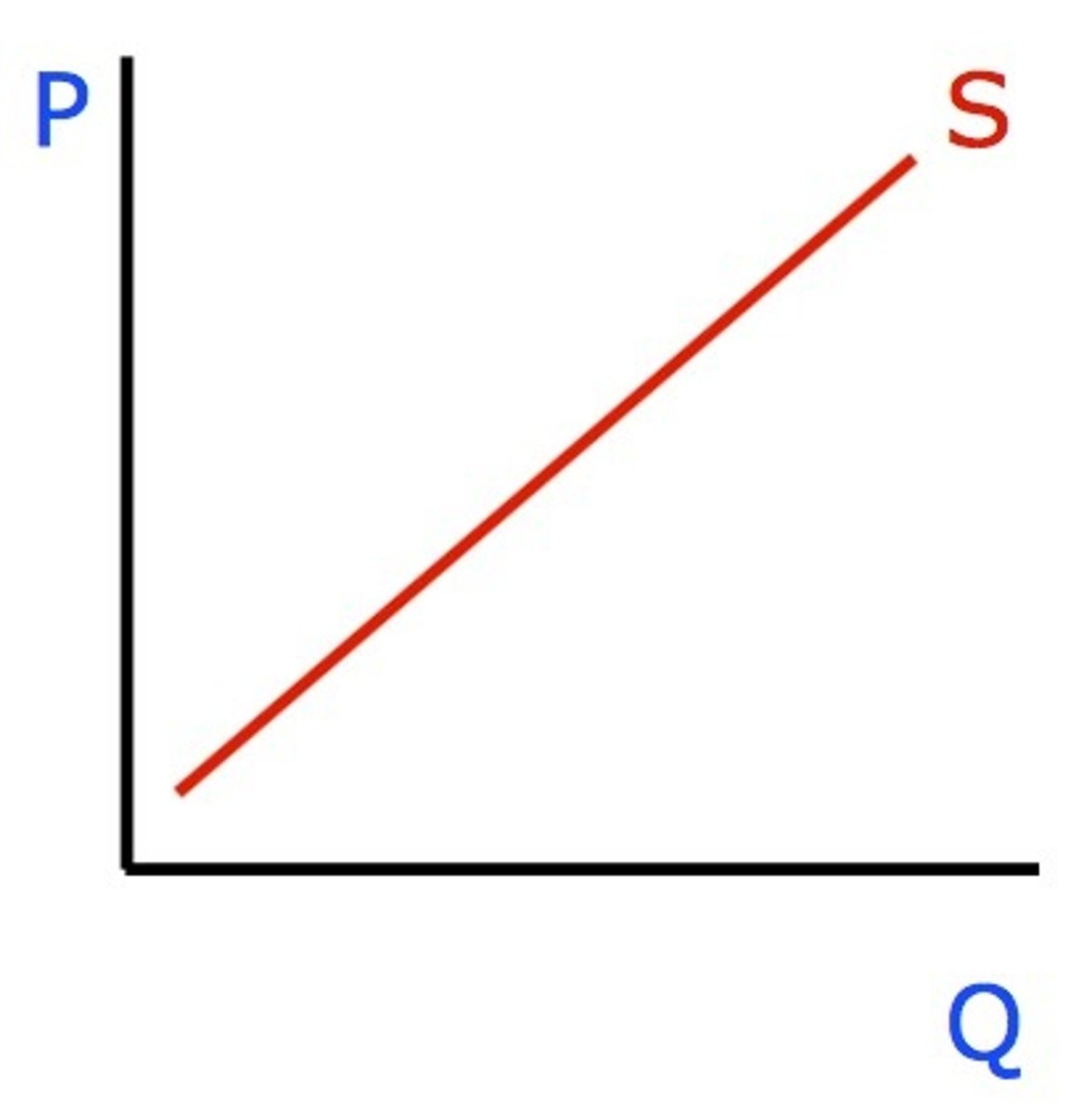

Law of Supply

as price increases, quantitsy supplied increases

market supply: sum of ind quantities from each seller

Does the law of demand apply to necessities like gasoline?

yes (NOT inelastic)! incentives affect behavior and people will shift their choices, price of gasoline increase ==> carpooling, walking, etc.

Will the supply of gasoline ever run out?

No.... the price will increase, people will find more known oil reserves over time

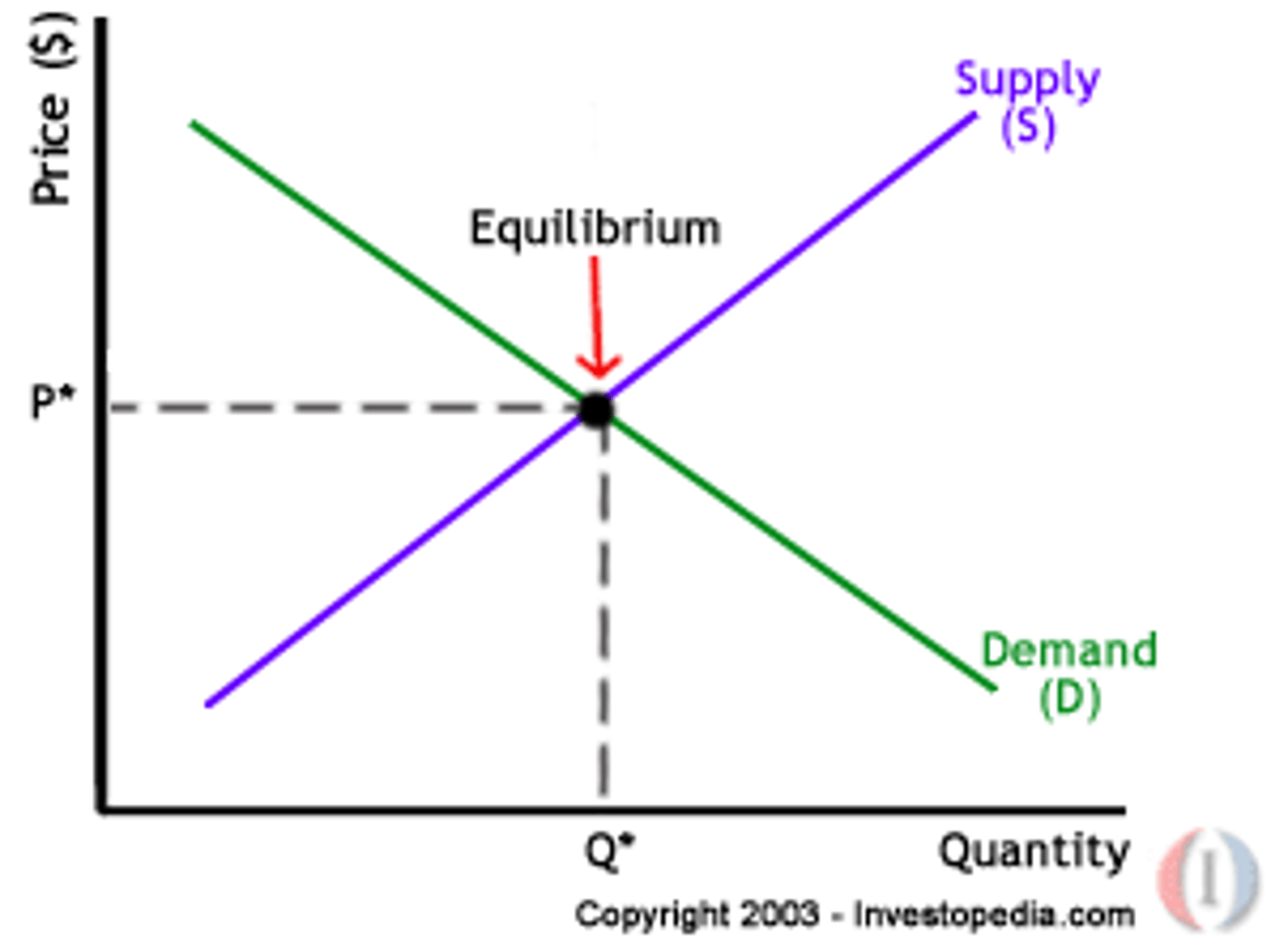

Equilibrium

Economic Way of Thinking

prices are....

signals

Argentina Example

- exports soy & beef

- fields or factories

- become more of a market economy recently

Bird Flu....

reduced supply, higher prices

Gross National Product (GNP)

output produced by workers and resources owned by residents of the nation

ex: Nike in Thailand ==> US bc owners of Nike are US

GDP

gross domestic product: the market value of final goods and services produced in a country in a year

measures...

= output = income

How to earn income in a market system?

produce GDP that others value and will trade for

How to use GDP data?

1. living standards

- higher GDP ==> more output ==> more income

- GDP per capita

2. economic growth

- measured in growth rate (% change) of real GDP per capita

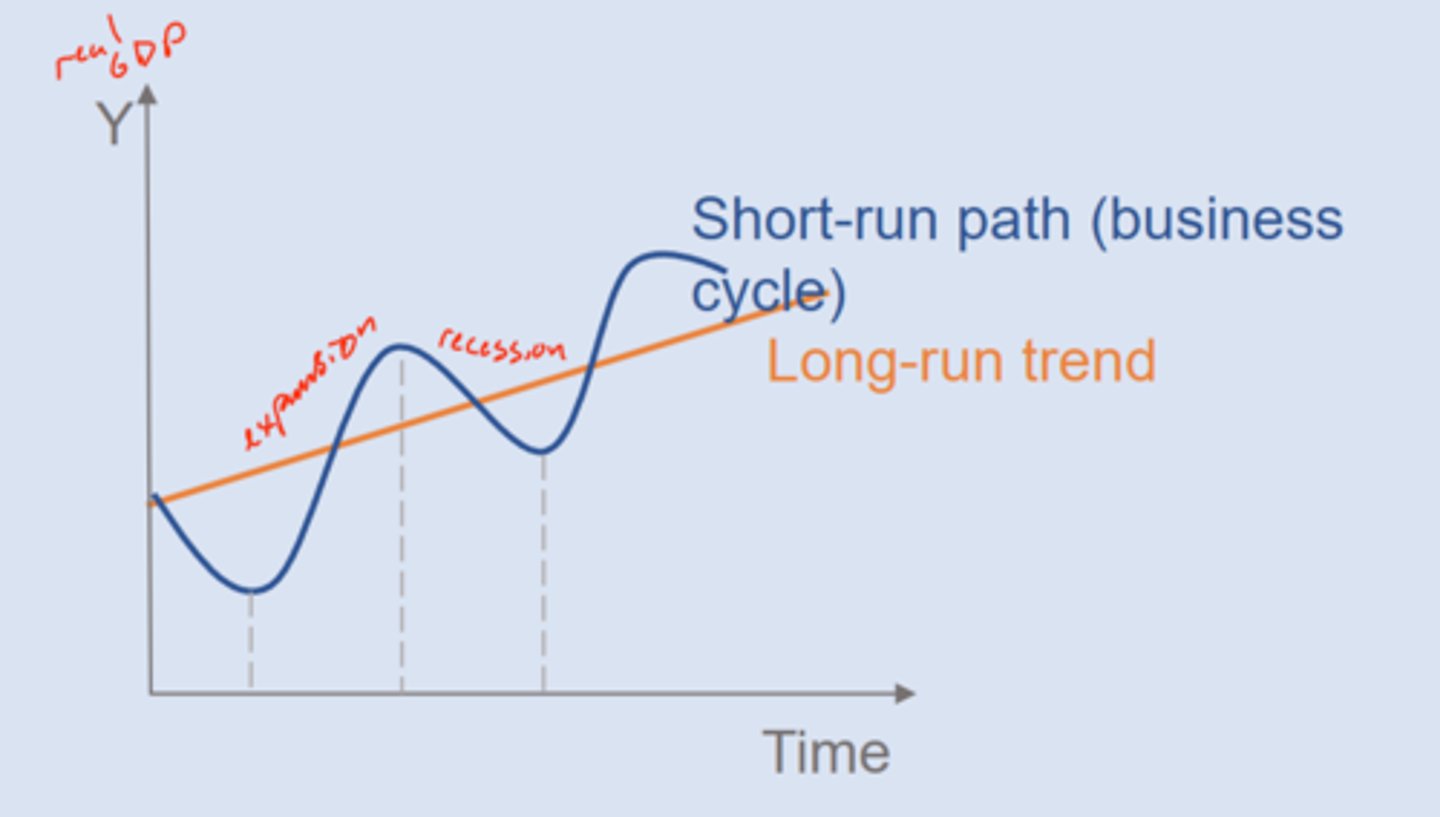

3. business cycles

- short run fluctuations where real GDP increases or decreases

- recessions (contractions) and expansions

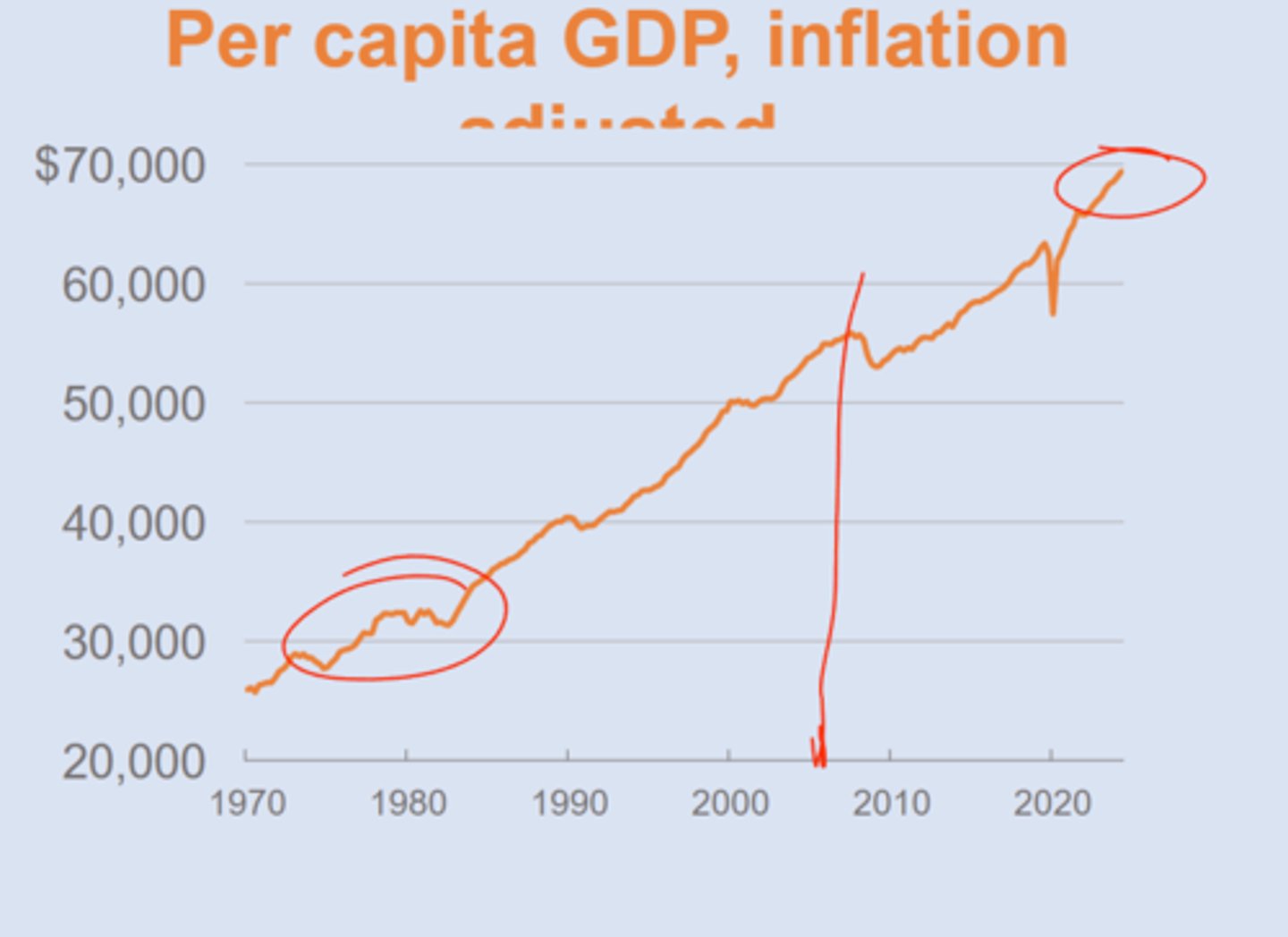

GDP per capita

GDP / population

(thing avg persons income)

real GDP per capital

GDP adjusted for inflation and population size

recession

short run economic downturn, decrease in real GDP

market value

the amount the goods and services sell for, or what they are worth in a market.

==> P (price) x quantity

final goods

products that are purchased by their end users

intermediate goods

goods used in the production of final goods

services

output that provide benefits w/o tangible products

ex: doctor, accountant, broker

==> greater consumption is spent on services than in past (.42 in 1950 to .64 now)

Is it included in GDP?

- goods produced but not sold ✅

- used goods sold❌

- financial assets sold❌

- brokerage fees ✅

Top 10 Nations GDP and GDP per capita

per capita real GDP Historical Trend

USA

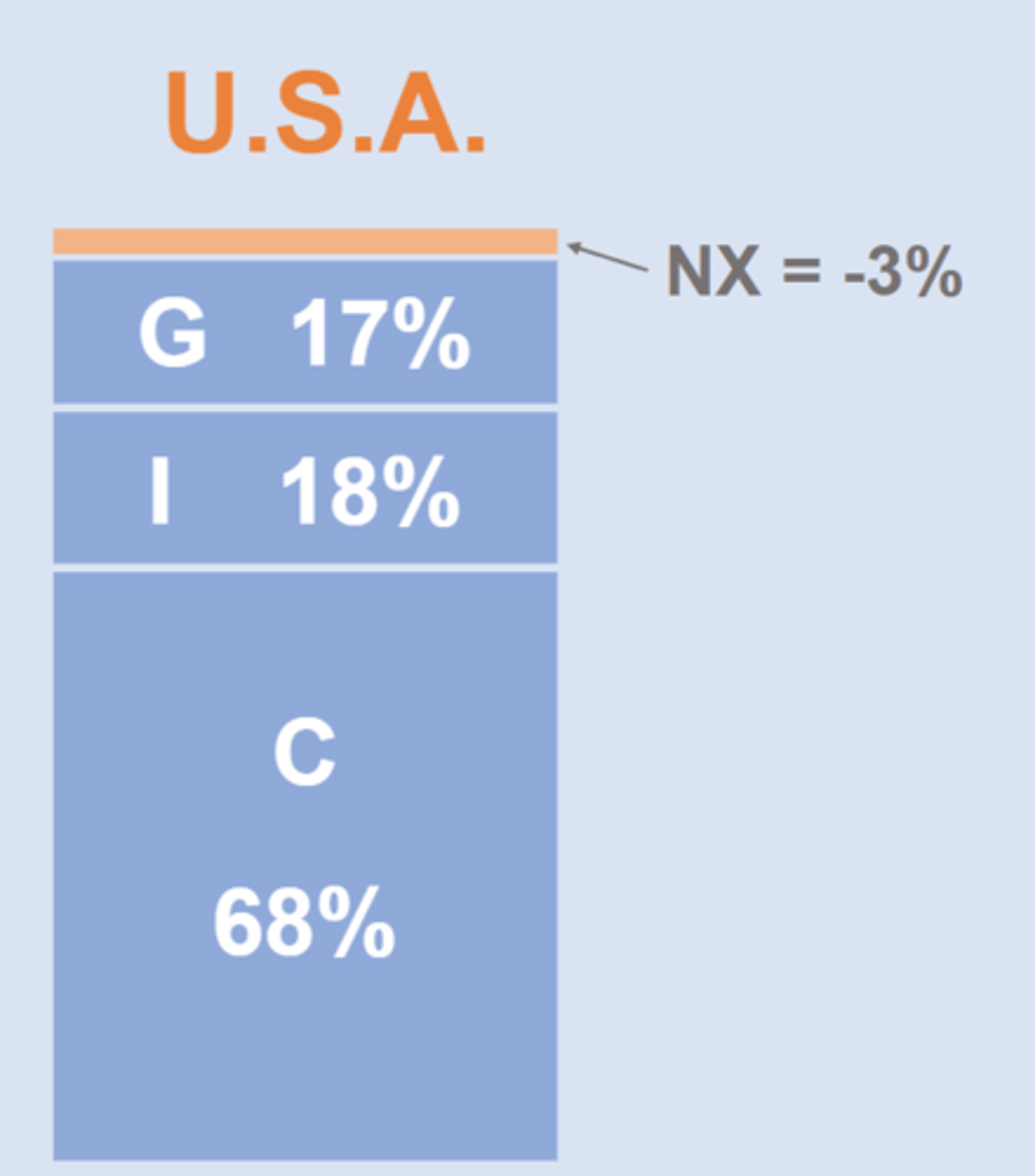

Four Pieces of GDP

C + I + G + NX = Y

consumption, investment, government spending, net exports

consumption

private spending (goods/services)

==> non-durable goods (short-term, purchase regardless of recession)

==> durable goods (long-term, hold off in recession)

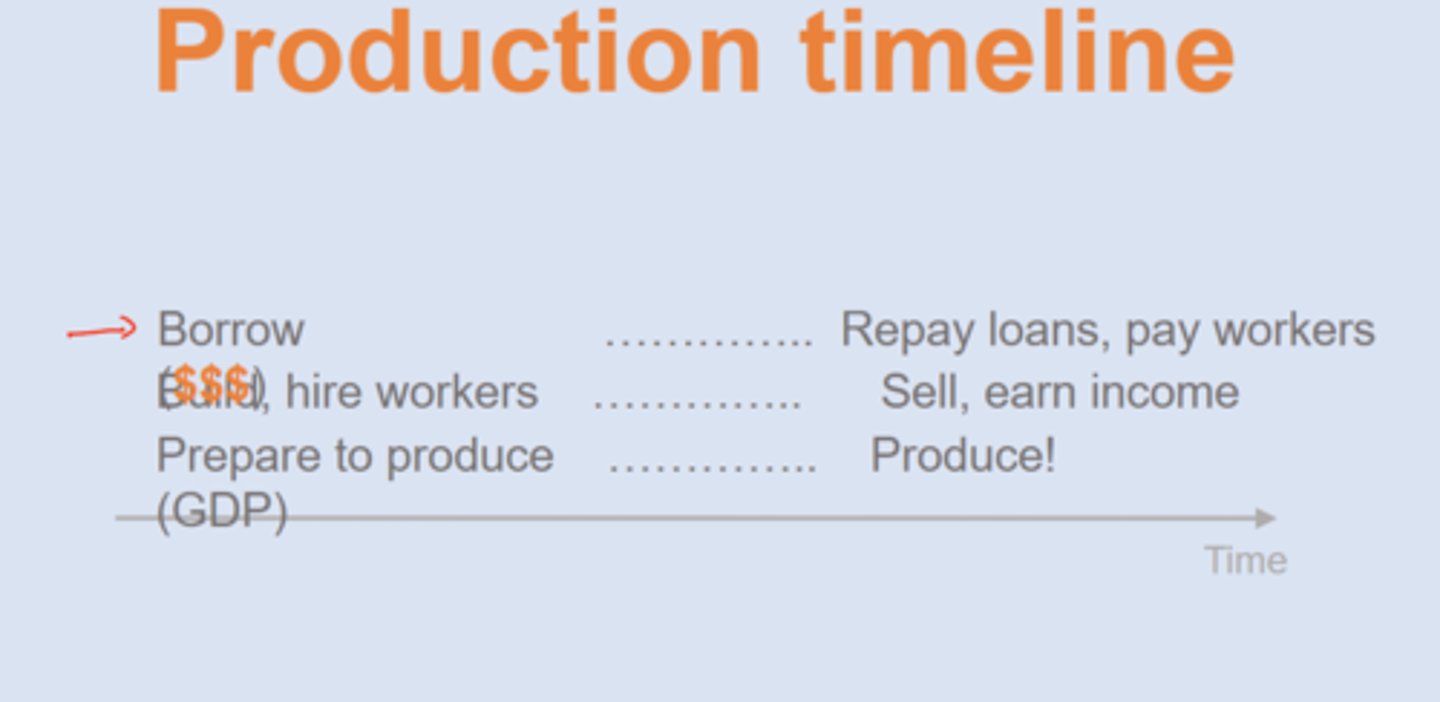

investment

spending on capital for future GDP/output

government

spending by local, state, national, federal governments

ex: public projects

NOT transfer payments (SS, unemplyment)

net exports

exports - imports

imports are negative because we consume them in other categories

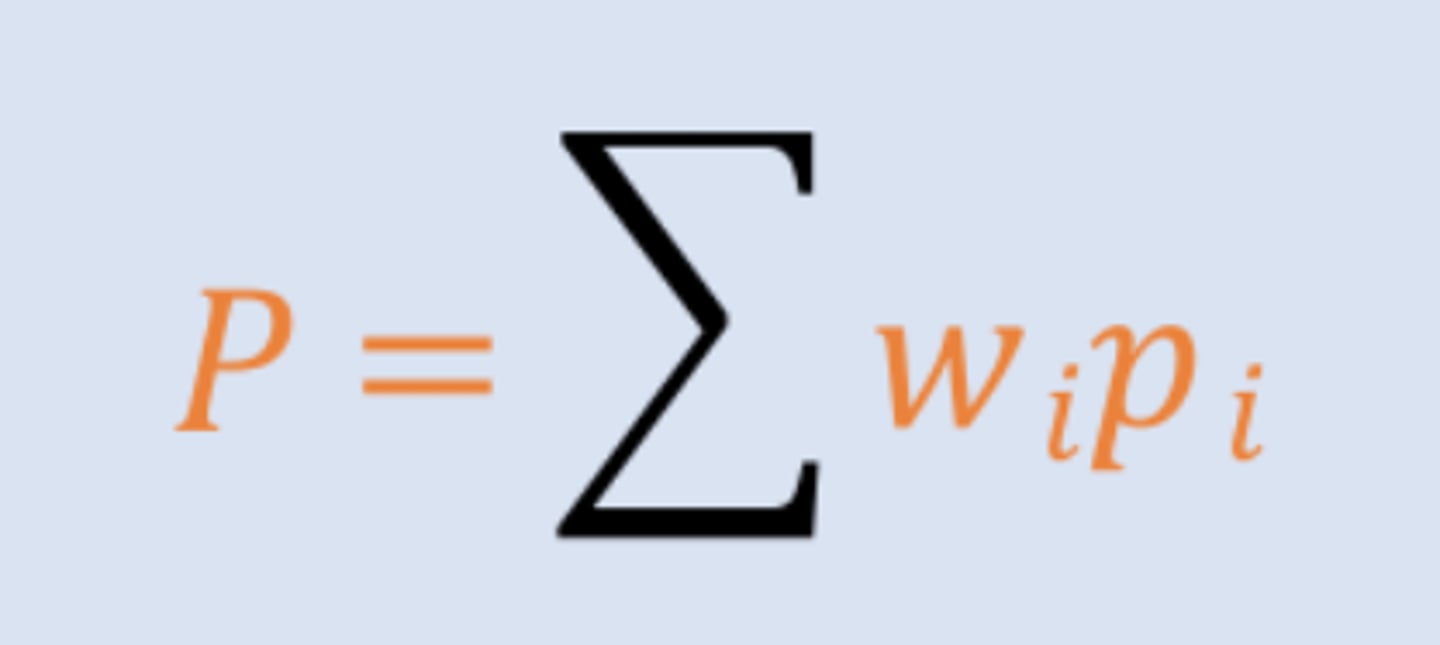

US GDP makeup

GDP equation

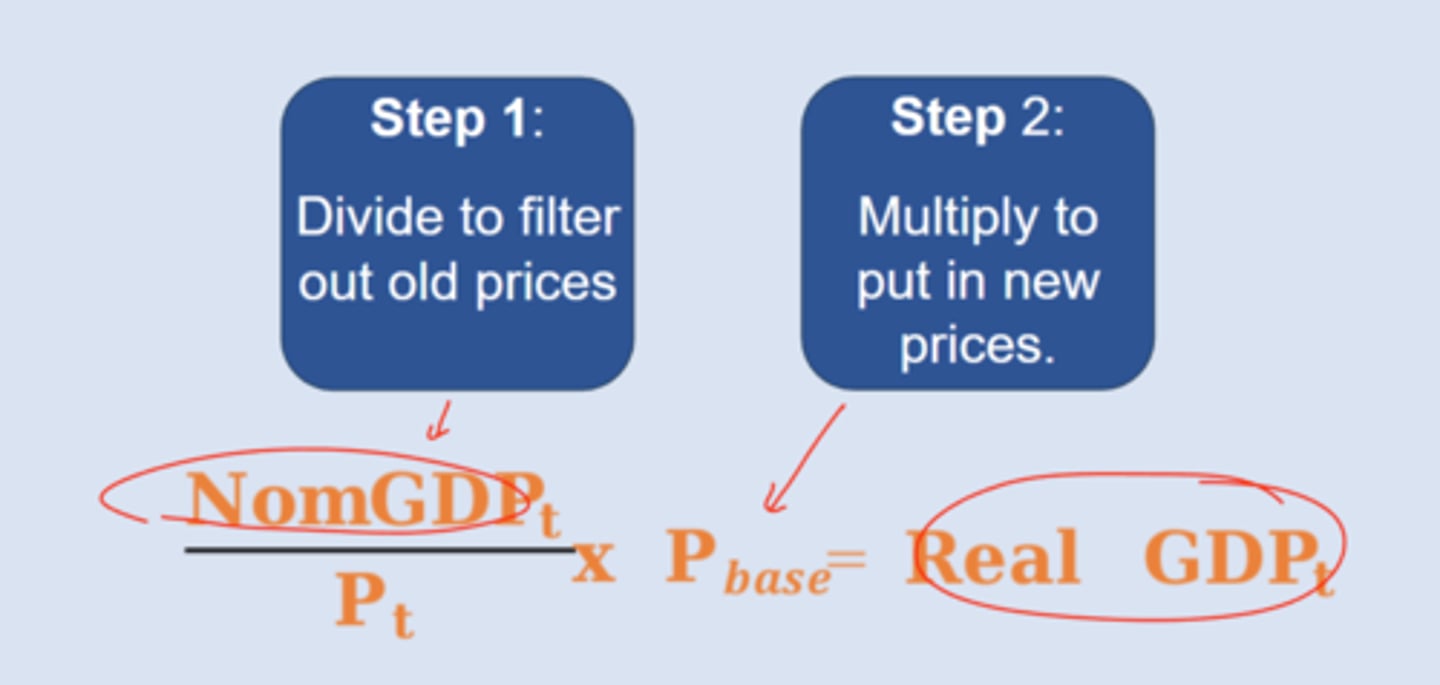

sum(pxq)

nominal GDP

raw GDP data, not adjusted for inflation, "current dollars"

real GDP

GDP data adjusted for inflation, "constant dollars"

price level

index measure of overall prices for all relevant goods and services in the economy

"GDP deflator"

steps for computing real GDP

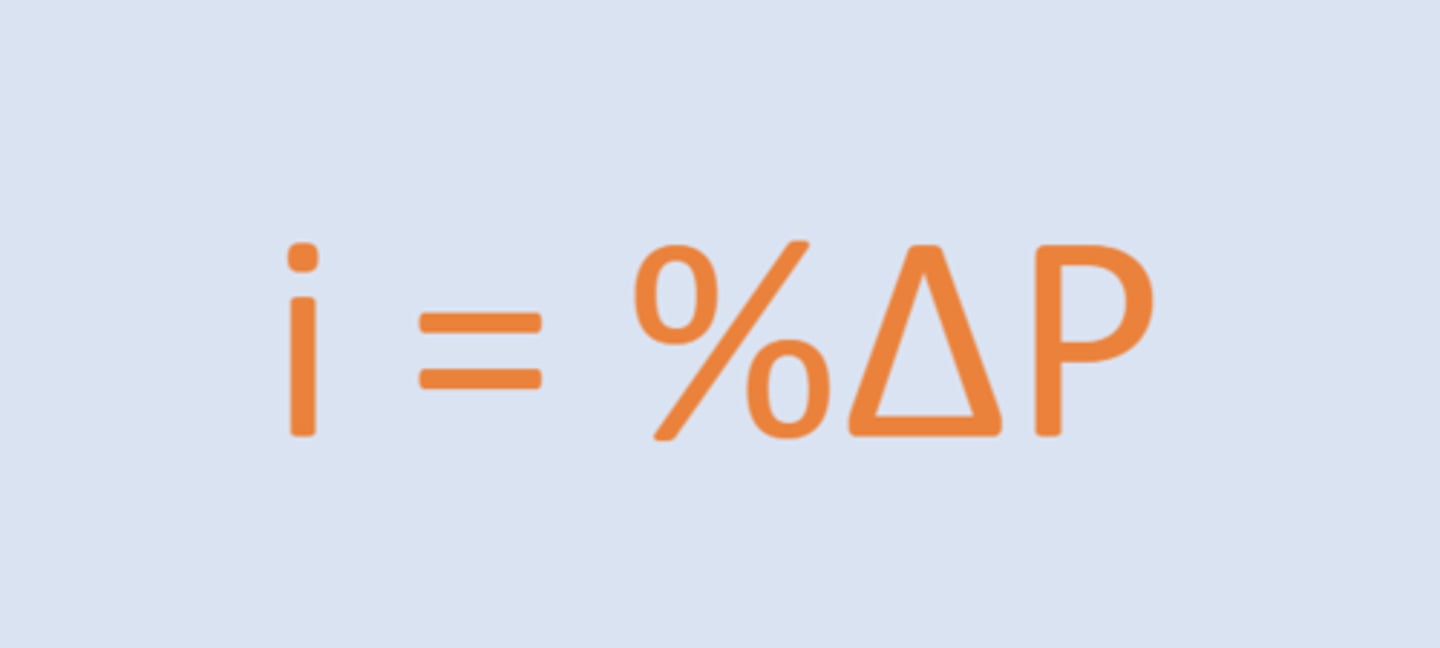

Growth Rate GDP equation

growth of nominal GDP = growth of real GDP + growth of price level

%△ nominal GDP =%△ real GDP + %△ price level

GDP omissions

1. non-market output

==> household/volunteer work

==> biases GDP down

2. underground activity

==> illegal goods, tips ==> biases GDP down

3. leisure time

==> biases GDP down

4. environmental costs

==> biases GDP data up

is GDP really a measure of welfare?

- within-nations ==> wealthier people show more satisfaction than poor income nations

- across nations ==> wealthier > poorer satisfaction

- Easterlin paradox (income increases happiness but only to a point) ==> NOT TRUE

Higher income...

offer more opportunities to pursue happiness

South Korea

- real per capita GDP growing fast (5.5%)

- BTS

- Pres arrested

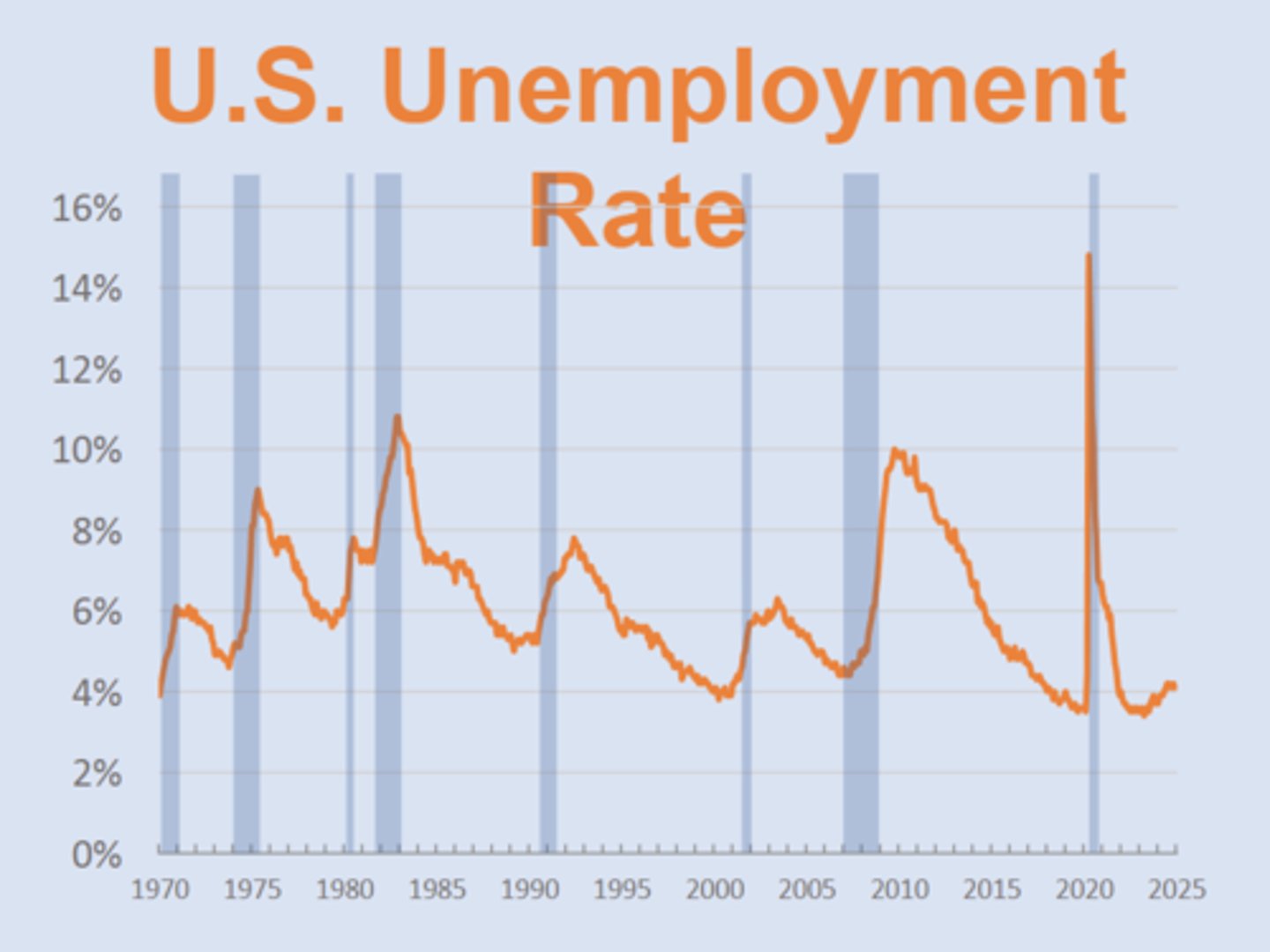

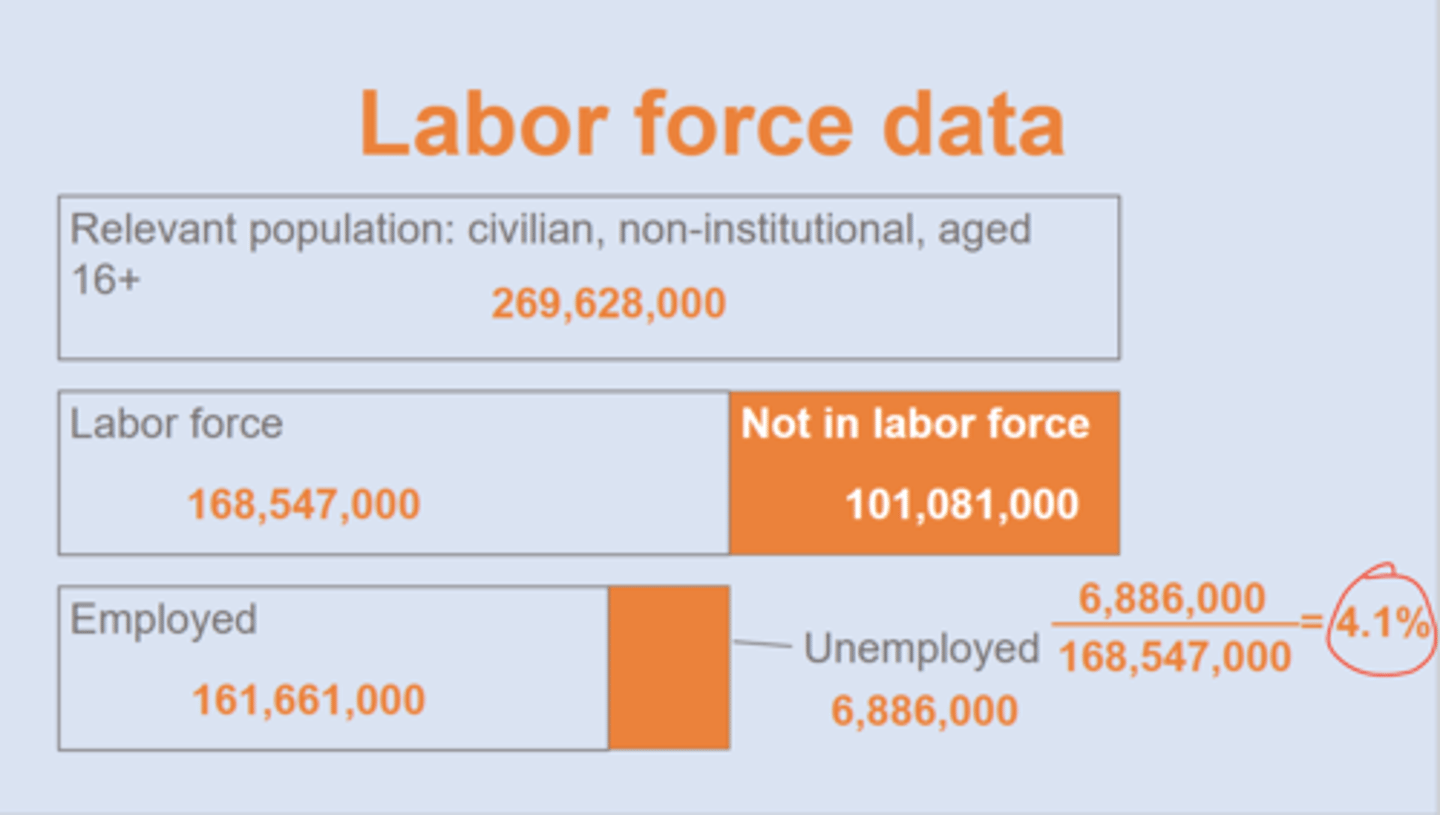

unemployment rate (u) (U-3)

% of the labor force that is unemployed

==> 4% in US

labor force

people who are employed or actively seeking work & part of eligible population

==> note: includes part-time

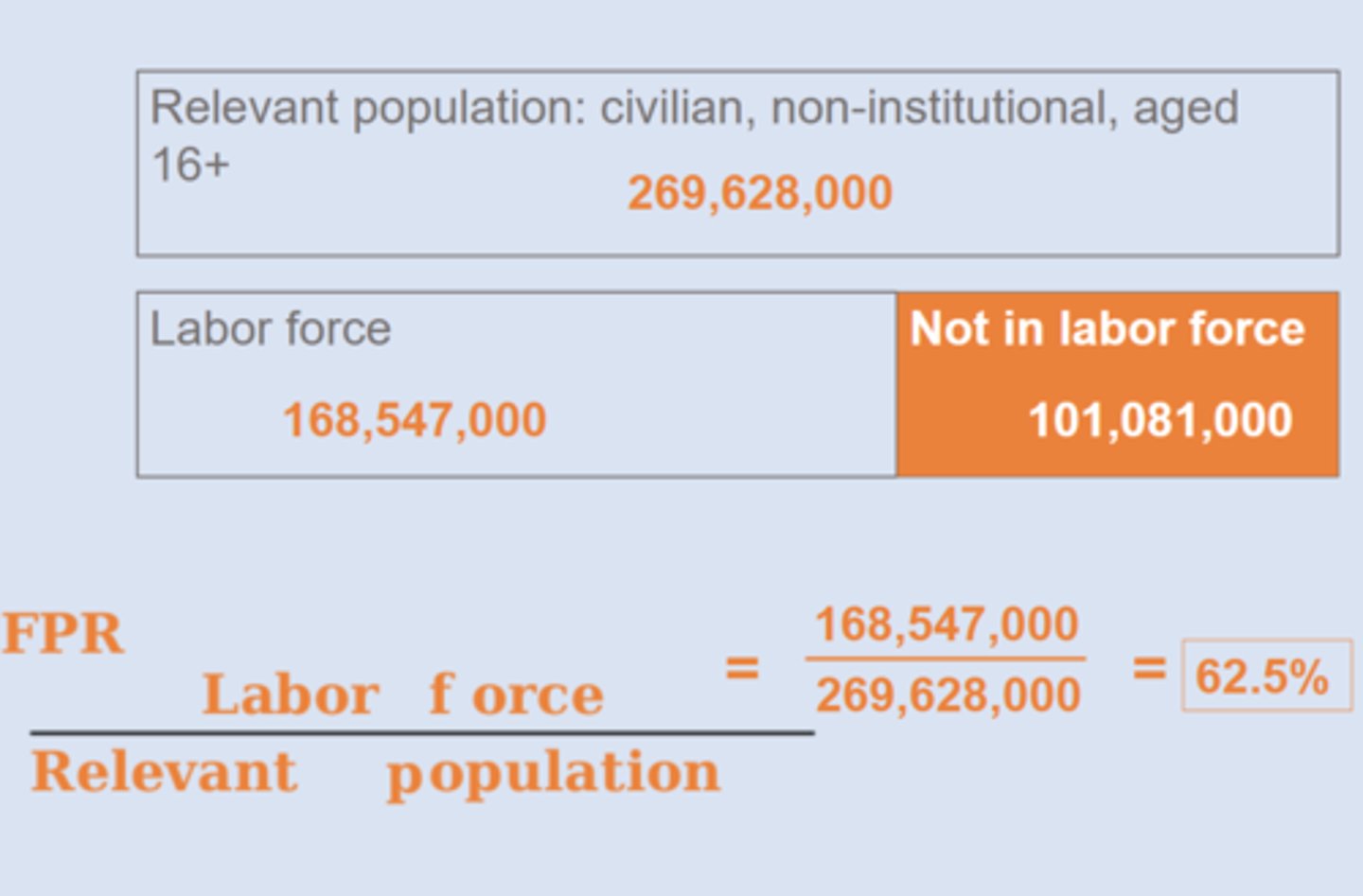

Relevant population

civilian, non-institutional, aged 16+ ==> 269 million

Who is not in the labor force?

+ college students

+ stay @ home workers

+ retirees

- marginally attached workers

marginally attached workers

People who tried to find a job for awhile (in past 12 months) but are no longer looking (in past 4 weeks)

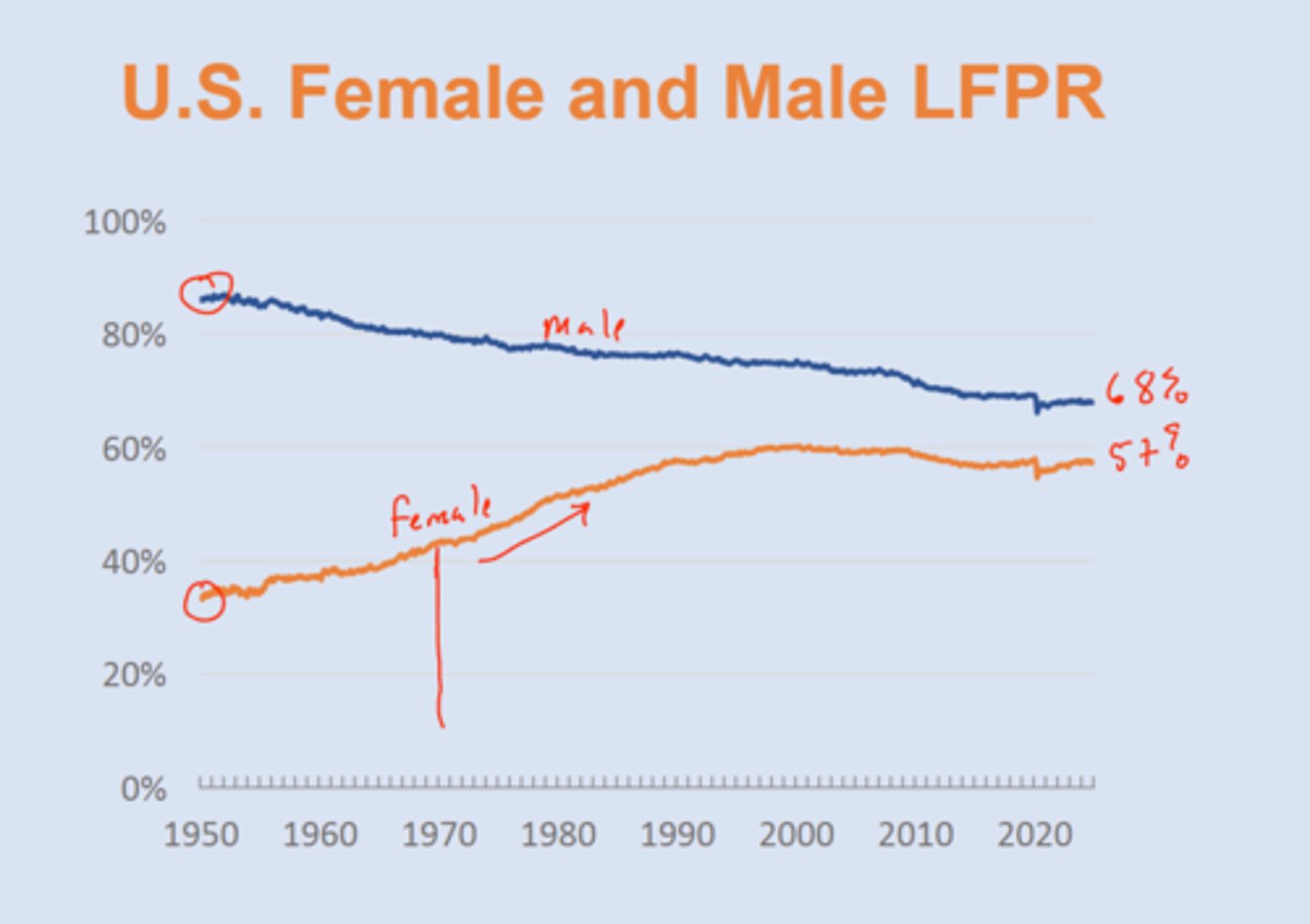

labor force participation rate (LFPR)

percentage of work eligible population that is in the labor force (62.5%)

U-6 Unemployment Rate

total unemployed & marginally attached workers

(Total unemployed + Marginally attached workers + Part-time workers for economic reasons) ÷ (Labor force + Marginally attached workers) x 100

==> higher than u (7.5%)

Historical Trends in Labor Forces

Three Types of Unemployment

- cyclical

NATURAL (occur event when econ is healthy):

- structural

- frictional

cyclical unemployment

unemployment caused by economic downturns

ex: covid

structural unemployment

caused by changed in the industrial makeup (structure of the economy)

==> creative destruction

creative destruction

new innovation makes old jobs obsolete

ex: AI, agriculture ==> services, fewer manufacturing

- inevitable

- sign of growing economy

- gov can help alleviate transition through subsidies

frictional unemployment

caused by delays in matching open jobs w/ workers

==> search takes time

==> technologies/policies (Linked-in) can decrease or increase (hiring/firing regulations, unemployment compensation)

natural rate of unemployment

u*

typical rate of unemployment when economy is growing normally (no cyclical)

approximately 4%

full employment output

Y*

potential output/GDP when the unemployment rate is equal to the natural rate

in recession

u > u*

Y < Y*

pos cyclical unemployment

expansion

u < u*

Y > Y*

neg cyclical unemployment

healthy economy

u = u*

Y = Y*

deflation

occurs when overall price levels fall

inflation

growth rate of overall price level in an economy

price level

The overall price level, computed with weighted averages of prices of individual goods and services

==> weights are based on the average portion of overall spending on each good/service

2 Price Indexes

1. CPI

2. GDP deflator

CPI

consumer price index: based on prices of goods & services bought by an average consumer (not capital)

ex: housing (45%), transportation (15.8%), food, education

think of overall rise in prices for consumers on average

not all prices move together

- basket, if 17% of budget, 17% weight

CPI equation

basket price / basket price in base year

x 100

using CPI to compare dollar values over time

price in todays dollars = price in earlier time x (price level today/price level earlier)

Accuracy of CPI

is it overstating inflation?

==> people substitute goods if price rises

==> changes in quality (bias upward)

==> new goods/services

(delayed record of price drops of new products)

Hedonic Adjustment

how they adjust for changes in quality of goods

chained CPI

typical consumer basket of goods & supplies updated monthly (lowed than CPI)

GDP deflator

based on prices of final goods & services in GDP

C, I, G, NX

problems w/ inflation

Price confusion

firms can be confused about source of current price changes (due to demand or inflation)

"signal extraction problem"

if they increase output, they risk overbuilding

future price uncertainty

market participants are uncertain about future price levels ==> reluctancy to sign long term contracts

Production timeline

money illusion

occurs when people interpret nominal changes in wages or prices as real changes

ex: raise in income and inflation 3% ==> no real change