HW 7 Chapter 30 Government Budgets and Fiscal Policy

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

Which of the following is the correct definition of a budget surplus?

A budget surplus is a financial situation in which the government receives more money in taxes than it spends in a year.

Which of the following is true of state and local government spending?

Education accounts for about one-third of total state and local government spending.

State and local government spending has increased during the last four decades from around 8% to around 14% today. The single biggest item is education, which accounts for about one-third of the total. The rest covers programs like highways, libraries, hospitals and healthcare, parks, and police and fire protection.

What does individual income tax mean?

based on the amount of income an individual makes in a year, largest single source of federal government revenue, but it still represents less than half of federal tax revenue.

What is payroll tax?

(captured in social insurance and retirement receipts), which provides funds for Social Security and Medicare. The second largest source of federal revenue.

What is corporate income tax?

The third-largest source of federal tax revenue, common name for corporate income is “profits.”

What is estate and gift tax?

on people who pass large amounts of assets to the next generation—either after death or during life in the form of gifts

How does a payroll tax differ from other types of taxes?

It is based on wages paid to an employee and is partially paid for by employers.

A payroll tax is a tax based on the pay received from employers. They are partially paid for by employers. Payroll taxes fund programs such as Medicare and Social Security.

Of the following, which are true of state and local taxes?

The main revenue sources for state and local governments are sales taxes, property taxes, and revenue passed along from the federal government.

State and local governments collect taxes imposed on business firms.

What is progressive tax?

The tax rates increase as a household’s income increases.

Taxes also vary with marital status, family size, and other factors

What does marginal tax rates mean?

(the tax due on all yearly income) for a single taxpayer range from 10% to 35%, depending on income.

What is proportional tax?

AKA the Medicare payroll tax. a flat percentage of all wages earned. The Social Security payroll tax is proportional up to the wage limit.

What is regressive tax?

above proportional tax. meaning that people with higher incomes pay a smaller share of their income in tax.

Suppose the U.S. government levies a tax that requires all people to pay 5% of their income to be used for environmental preservation. What type of tax would this be?

Proportional.

Since all people pay 5% of their income regardless of their income, this tax is "proportional."

The answer is proportional, which indicates all income levels pay the same percent.

Compared with state and local government spending, the federal government __________.

can spend more than 5% of its budget on net interest per year

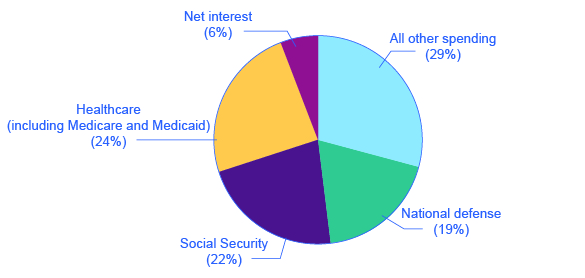

The federal government spends money on net interest. State and local governments have balanced budgets and do not spend on net interest. Federal spending in 2014 included net interest payments of 6%.

Which of the following best defines the term balanced budget?

A balanced budget is a financial situation in which government spending and taxes are equal.

True or false?

A progressive tax collects a greater share of income from those with high incomes than from those with low incomes.

True

A progressive tax is defined as a tax that collects a greater share of income from those with high incomes than from those with low incomes.

Which of the following is the correct components of state and local revenues in the US?

A. Corporate taxes, individual income taxes, property taxes, revenue from federal government, sales taxes and other

B. Corporate taxes, payroll taxes, sales taxes, property tax, revenue from federal government

C. Individual income taxes, corporate taxes, payroll taxes, sales taxes, revenue from federal government

D. Revenue from federal government, sales taxes, property tax, individual income taxes, payroll taxes, corporate tax

A. Corporate taxes, individual income taxes, property taxes, revenue from federal government, sales taxes and other

Revenue sources for state and local governments in the United States is: corporate taxes, individual income taxes, property taxes, revenue from federal government, sales taxes and other.

True or false?

In practice, the estate tax applies to all people who leave inheritances to their beneficiaries, no matter how large or small.

False

The government imposes an estate and gift tax on people who pass large amounts of assets to the next generation—either after death or during life in the form of gifts. According to the Center on Budget and Policy Priorities, in 2015 the estate tax applied only to those leaving inheritances of more than $5.43 million and thus applies to only a tiny percentage of extremely wealthy individuals.

What is a "proportional tax"?

A proportional tax (also known as a flat tax) collects a flat percentage of income earned, regardless of the level of income.

What is national debt?

refers to the total amount that the government has borrowed over time

What is budget deficit?

refers to how much the government has borrowed in one particular year

What is National Debt?

One year’s federal budget deficit causes the federal government to sell Treasury bonds to make up the difference between spending programs and tax revenues.

The budget deficits starting in 2002 then tugged the debt/GDP ratio ______, with a big jump when the recession took hold in 2008–2009. Select the best response to fill in the blank.

Higher.

The budget deficits starting in 2002 then tugged the debt/GDP ratio higher—with a big jump when the recession took hold in 2008–2009.

When a government uses ___________________, aggregate demand shifts inward (to the left).

contractionary fiscal policy

Fiscal policy, whether through changes in spending or taxes, shifts the aggregate demand outward in the case of expansionary fiscal policy and inward in the case of contractionary fiscal policy.

Up until which decade did the debt/GDP ratio reveal a fairly clear pattern of federal borrowing?

1970s

Which of the following would be an example of contractionary fiscal policy?

increasing taxes

The government may increase taxes which will reduce spending by consumers and/or businesses in the economy. This will have a contractionary effect on the economy.

Which of the following best describes discretionary fiscal policy?

when the government passes a new law that explicitly changes tax or spending levels

Fiscal policy is conducted both through discretionary fiscal policy, which occurs when the government enacts taxation or spending changes in response to economic events, or through automatic stabilizers, which are taxing and spending mechanisms that, by their design, shift in response to economic events without any further legislation. Therefore, when the government passes a new law that explicitly changes tax or spending levels, this is best described as discretionary fiscal policy.

If there is an increase in budget deficits by 1% of GDP and the initial interest rate is 5%, the long-term interest rate will be between 5.5% and what?

A consensus estimate based on a number of studies is that an increase in budget deficits (or a fall in budget surplus) by 1% of GDP will cause an increase of 0.5–1.0% in the long-term interest rate. Therefore, if initial interest rate is 5%, the long-term interest rate will be between 5.5% and 6%.

implementation lag

once the government passes the bill it takes some time to disperse the funds to the appropriate agencies to implement the programs

legislative lag

Many fiscal policy bills about spending or taxes propose changes that would start in the next budget year or would be phased in gradually over time.

recognition lag

It often takes some months before the economic statistics signal clearly that a downturn has started, and a few months more to confirm that it is truly a recession and not just a one- or two-month blip

When the government passes a bill it takes time for the bill to take effect. This is because of?

implementation lag

Once the government passes a bill to help improve the economy during a recession it takes some time to disperse the funds to the appropriate agencies to implement the programs. Economists call the time it takes to start the projects the implementation lag.

Unlike the implementation of fiscal policy, what is true of the economy's internal structure?

It evolves and changes over a long period of time.

When an economy recovers from a recession, it does not usually revert to its exact earlier shape. Instead, the economy's internal structure evolves and changes and this process can take time.

If the budget is balanced each and every year, how would automatic stabilizers behave?

they would not work and economic fluctuations would worsen

A requirement that the budget be balanced each and every year would prevent these automatic stabilizers from working and would worsen the severity of economic fluctuations.

How would economists define implementation lag?

The time it takes to disperse funds and start a project.

Economists call the time it takes to disperse funds and start projects to help upturn the economy the implementation lag.

Which of the following are true about permanent tax cuts?

People will likely respond more strongly to permanent changes.

Most people and firms will react more strongly to a permanent policy change than a temporary one.

Which of the following is a consequence of crowding out?

lowered household consumption

Crowding out refers to when federal spending and borrowing causes interest rates to rise and business investment to fall. This can lead to a reduction in business investment and household consumption.

What is a structural economic change?

the expansion of a new set of industries and moving workers to those industries

The process of structural economic change is the expansion of a new set of industries and the movement of workers to those industries.

Some supporters of the balanced budget amendment like to argue that, since households must balance their own budgets, the government should too. What is the flaw with this analogy?

most households do not balance their budgets every year

Some supporters of the balanced budget amendment like to argue that, since households must balance their own budgets, the government should too. However, this analogy between household and government behavior is severely flawed. Most households do not balance their budgets every year. Some years households borrow to buy houses or cars or to pay for medical expenses or college tuition. Other years they repay loans and save funds in retirement accounts. After retirement, they withdraw and spend those savings.

Which of the following is true about the standardized employment budget?

it essentially eliminates the impact of automatic stabilizers

Each year, the nonpartisan Congressional Budget Office (CBO) calculates the standardized employment budget—that is, what the budget deficit or surplus would be if the economy were producing at potential GDP, where people who look for work were finding jobs in a reasonable period of time and businesses were making normal profits, with the result that both workers and businesses would be earning more and paying more taxes. In effect, the standardized employment deficit eliminates the impact of the automatic stabilizers.

Which of the following is true about the standardized employment budget?

The government may run a large budget deficit now to make important long-run investments.

There is also no particular reason to expect a government budget to be balanced in the medium term of a few years. For example, a government may decide that by running large budget deficits, it can make crucial long-term investments in human capital and physical infrastructure that will build the country's long-term productivity.