Industry Organizations

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

market structure

the business environment within which the firm operates

market power

the ability to price a product above marginal cost and earn a positive economic profit

output

the manager's critical decision variable, not price

price

an important decision when a firm accounts for significant proportion of market supply

number, size, and distribution of rival firms

the ability of a firm to set the price of its product frequently depends on the

a single buyer in a market comprising many small buyers does not have the ability to influence the market-determined price

true

monopsony

a market that consists of a single buyer

oligopsony

a market comprising a few large buyers

(govt. expenditures on space exploration)

product differentiation

the degree to which the product of a firm differs from those of its rivals

entry and exit conditions

the ease with which investment flows into and out of an industry

Michael Porter

identified the five “forces" that affect an industry's ability to sustain profitability and attract new investment

threat of entry by potential rivals

threat of substitutes

nature of competitive rivalry

bargaining power of buyers and suppliers

the five forces

threat of entry by potential rivals

threat of substitutes

nautre of competitive rivalry

horizontal competitors / external sources

bargaining power of buyers and suppliers

vertical competitors / internal sources

threat of entry

above-normal returns attract new firms into an industry, which increase total output, depress prices, and squeeze profits

threat of substitutes

demand for the output of an industry tends to be more price elastic the greater the number of close substitutes are

competitive rivalry

main driver in Porter's 5 forces model

degree of product differentiation

switching costs

technological innovations

government legislation

other factors that contribute to nature and intensity of rivalry among firms

bargaining power of buyers

able to extract discounts and other more favorable terms reduce a firm's ability to extract and sustain profits

bargaining power of suppliers

profits tend to be lower in industries where suppliers of raw materials, components, labor services, and so on have the power to negotiate more favorable terms

perfect competition

an industry characterized by a very large number of small firms (in terms of output) producing a homogenous output

entry into, and exit from, this industry is easy

imperfect competition

can exercise a degree of discretion of the price charged for their products

monopolistic competition

oligopoly

two industry types that fall under imperfect competition

monopolistic competition

characterized by a large number of firms in which entry and exit is unimpeded

non-price competition

advertising, brand name identification, and trademarks to promote customer loyalty, is another distinguishing feature of this market structure

(fast-food restaurants, soft drinks, cosmetics…)

oligopoly

consists of a few firms producing a standardized or differentiated product

(steel, automobiles, household appliances…)

informative advertising

when a firm attempts to boost sales by providing consumers with information about the physical attributes of its product

may be positive or negative

persuasive avertising

attempts to boost sales by creating an image that may have little or nothing to do with the product's physical characteristics

monopoly

an industry that consists of a single firm that produces a unique product with no close substitutes

referred to as price makers

industrial concentration

the proportion of total industry sales that is accounted for by the largest firms

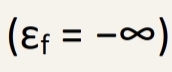

Rothschild Index

a useful indicator for market power

1

Rothschild index = ___ in case of monopoly

0

Rothschild index = ___ in case of perfectly competitive firm