Global Diagrams, gvy policy eval.

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

Absolute advantage

can produce a good with fewer resources, countries should specialize

Comparative Advantage

a country can produce a good with lower opportunity cost

Limitations of theory:

unrealistic assumptions (free trade, fixed fop, full employment, perfect comp, no transport costs)

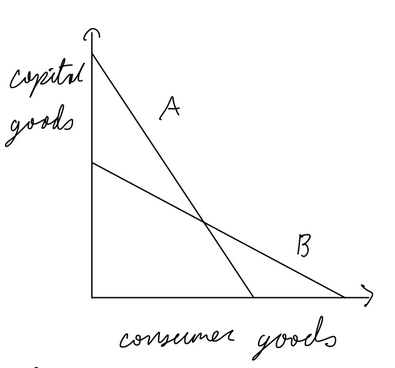

risk of excessive specialization

inability of developing countries to diversify manufacturing

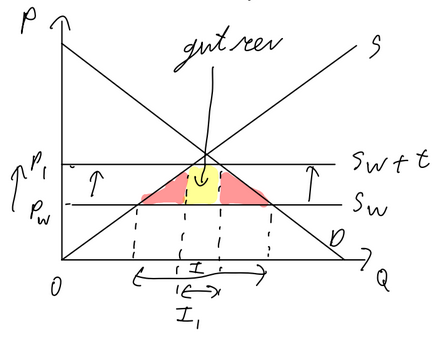

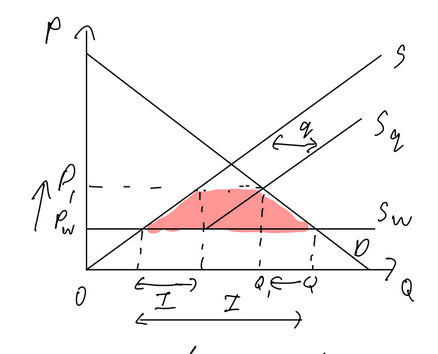

Import Tariff

Pros:

domestic producers gain revenue

workers gain as domestic production increases

gvt revenue

Cons:

price goes up

wellfare loss

imported goods more expensive, domestic productions more expensive

loss of export competitiveness as production price increases

foreign producers lose

global economy lose

risk of retaliation

potential corruption

Import Quota

Pros:

domestic producers gain revenue

workers gain as domestic production increases

Cons:

price goes up

wellfare loss

imported goods more expensive, domestic productions more expensive

loss of export competitiveness as production price increases

foreign producers lose

global economy lose

risk of retaliation

potential corruption

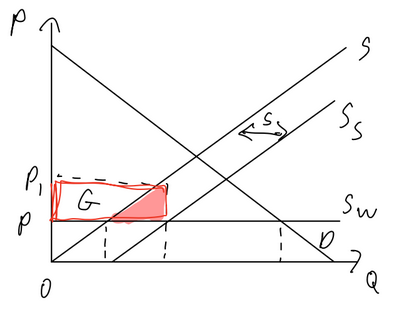

Subsidy (global)

Pros:

domestic producers gain revenue

workers gain as domestic production increases

Cons:

gvt debt

wellfare loss

imported goods more expensive, domestic productions more expensive

loss of export competitiveness as production price increases

foreign producers lose

global economy lose

risk of retaliation

potential corruption

Trade protection

Pros

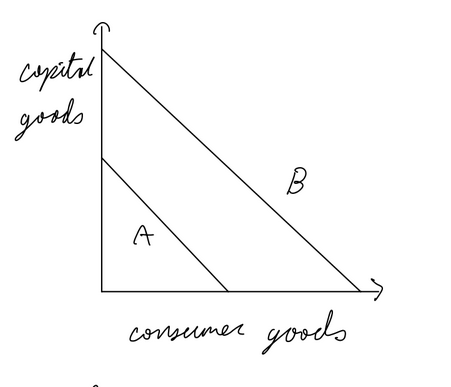

protect infant industries

diversification of developing countries

national security

health, safety, env. standards

gvt revenue

overcoming trade deficit

anti-dumping

protect domestic jobs

cons

difficult to select what industry to protect

can be used to “protect’ unrelated industries

when relying on tariffs for gvt rev. probabluy means theres a problem w the tax system

retaliation is possible

hard to prove dumping

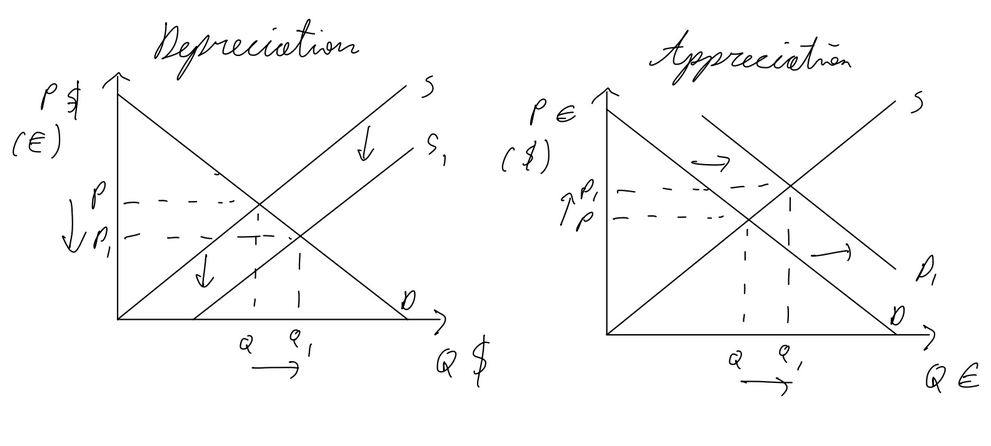

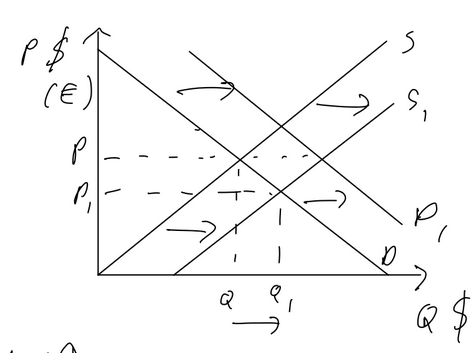

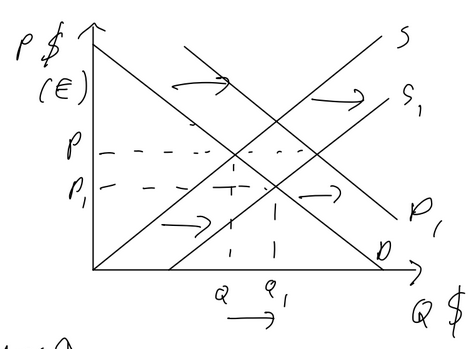

Freely Floating Exchange Rate

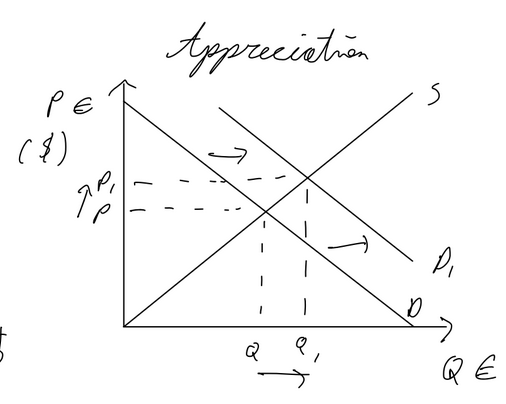

Appreciation: occurs with excess demand. if Americans buy euros w dollars, the demand for euros increases, appreciating the currency

Deppreciation: osccurs with excess supply. the americans buying euros means theyre selling dollars, increasing supply of dollars, leading to depreciation

pros:

allows for greater flexibilty in monetary policies

allows for automatic adjustments to external shocks

Fixed Exchange Rate

fixed at partiy: 1 to 1 ratio, usually doesn’t happen

Appreciation: CB buys it on forex market to increase demand

deppreciation: CB sells it on forex, increase supply

revaluation: change where the exchange rate is fixed to higher price

devaluation: change where the exchange rate is fixed to lower price

pros:

provides stability and predictability

lowers speculative trading and currency volatility

cons:

limits a country’s ability to conduct monetary policies as focus is on exhcange rate and not interest rate

Managed Exchange Rate

allowed to fluctuatie within a specific band, CB intervenes when exchange rate leaves band

Appreciation: CB buys it on forex market to increase demand

deppreciation: CB sells it on forex, increase supply

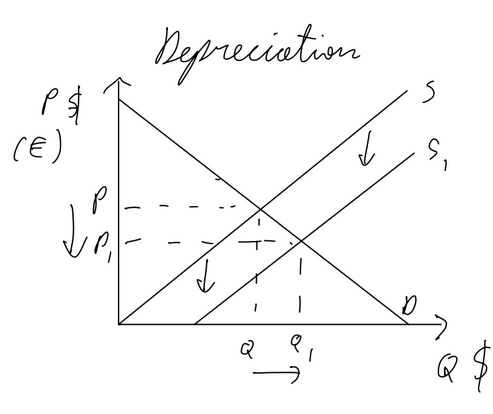

Consequences of curency depreciation

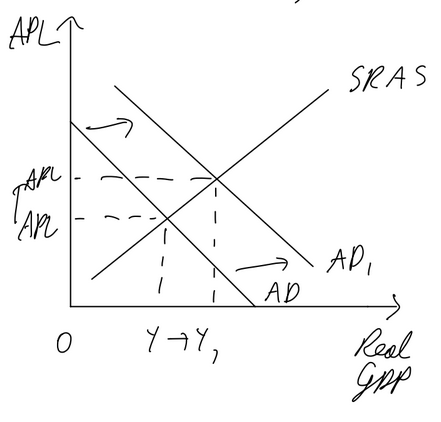

imports are more expensive, exports are cheaper. therefore net exports increase, shifting AD right

cose push inflation as imported raw materials are more expensive

demand pull inflation as AD increases

unemployment falls as exports increase

Consequences of currency appreciation

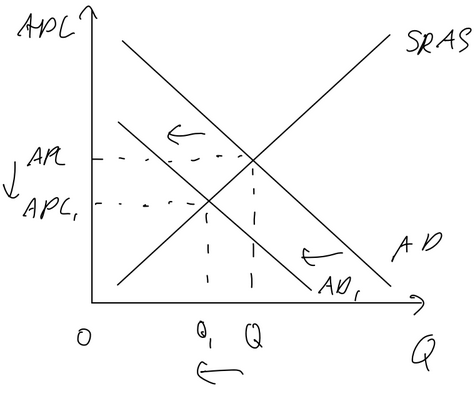

imports are cheaper, exports are more expensive. net exports decrease, AD shifts left

cost push deflation as imported raw materials are cheaper

demand pull deflation as net exports fall

unemployment may increase as less is exported

impact of currenccy depreciation on current account

depreciation → net exports increase → current account balance improves

the extent to which depends on Marshall-Lerner condition

impact of currency appreciation on current account

appreciation → net exports decrease → current account balance worsens

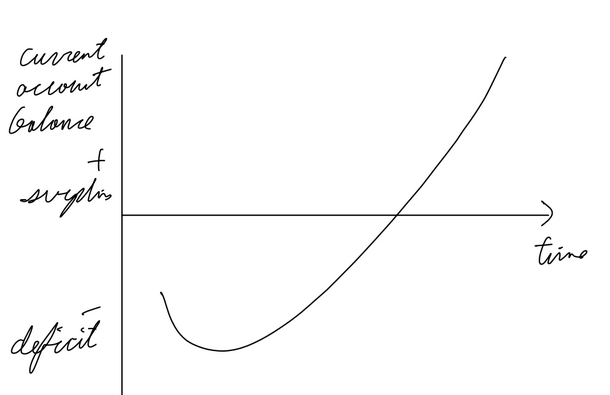

Marshall-Lerner condition / J-Curve

ML condition: extent to which a currency depreciation improves the current account balance, PED imports + PED exports > 1

Time lag between depreciation of a currency and an improvement in current account balance explained by J curve.

If a country’s currency depreciates, its good will become cheaper for other countries. However, it will take time before the other countries switch to that country’s goods as they aren’t sure whether the exchange rate my return in the short run

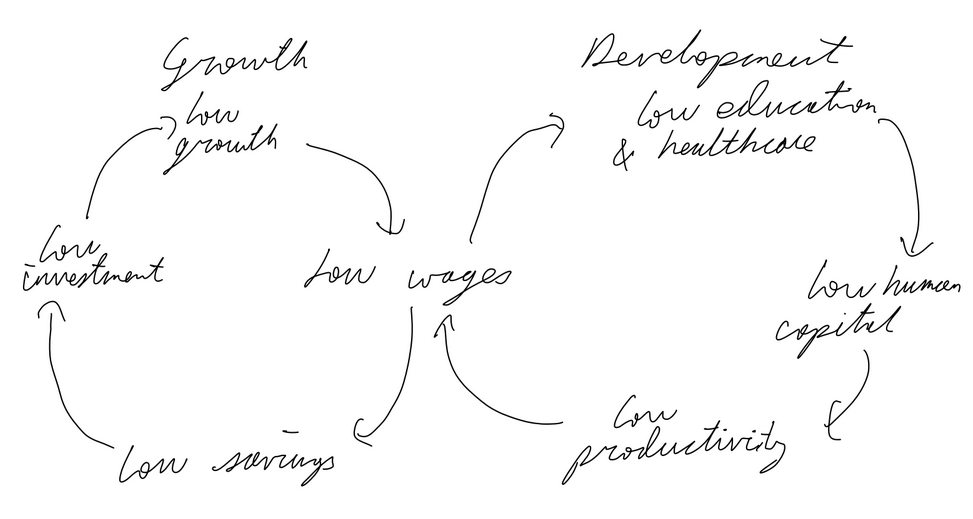

Poverty Cycle

A situation where poverty tends to perpetuate itself from one generation to the next.