Loanable funds market

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

9 Terms

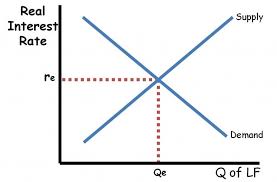

loanable funds market

the private sector supply and demand of loans

show REAL INTEREST RATE

loanable funds market demand

inverse relationship between real interest rate and quantity loans demanded

supply loanable funds market

direct relationship between real interest rate and quantity loans supplied

loanable funds market

investment demand

anything that impacts the profit potential of new investments

savings supply

disposable income, economic outlook, foreign investment meaning foreign people saving their money in the US market

loanable funds equilibrium

increase in saving supply —> decrease in real interest rate —> decrease in real interest rate —> increase in quantity loanable funds

crowding

increase in government deficit life expansionary policy will increase interest rate will increase interest rate and reduce gross investment —> lower economic growth.

crowding

increase demand for loanable funds (rightward shift increases real interest rate resulting in lower quantity of investment purchased)

decreased supply loanable funds: increase rate and reduces the quantity of investment)