IBA

1/64

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

65 Terms

Accounting does this for decision-makers except

Prepares progress report of employees' financial status

Stockholders own which type of business?

Corporation

Users of financial information need accounting to be able to

Prepare reports

The primary users of financial information include

Existing and potential investors, lenders and other creditors

When an entity changed the inventory valuation method, which accounting principle is jeopardized by this change?

Comparability

Recognizing expected losses immediately but deferring expected gains is an example of

Conservatism

Which is the following is not an essential factor in determining the existence of an asset?

Present obligation

Which of the following statements regarding the double-entry system is incorrect?

An increase in asset means a credit entry in asset accounts

Which of the following accounting equations are correct?

(1) Non-current assets + Current assets = Non-current liabilities - Current liabilities + Capital

(2) Assets - Liabilities + Withdrawals = Capital + Revenue - Expenses

(3) Capital + Non-current Liabilities = Non-current Assets + Current Assets - Current Liabilities

2 and 3

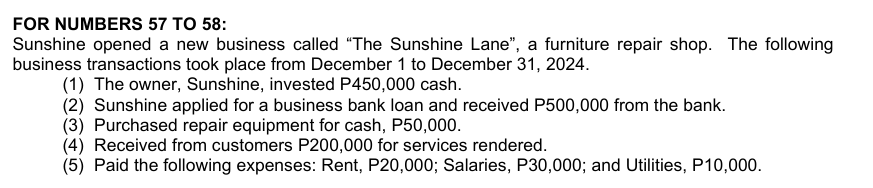

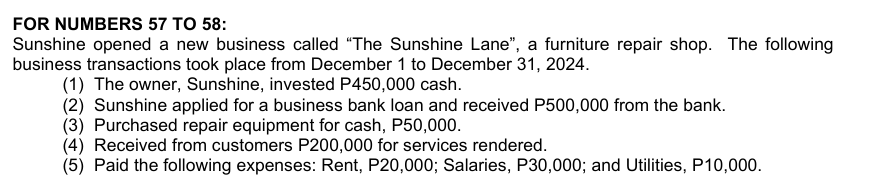

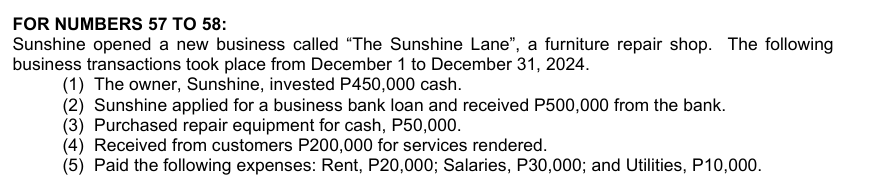

Chito owns the Java Junction, a coffee shop. He borrowed P100,000 in the name of Java Junction and deposited the amount to the bank account of the coffee shop. Which of the following statements is correct regarding this transaction?

The assets of Java Junction increased by P100,000

If current liabilities is P80,000; non-current liabilities is P120,000; and capital is P700,000; then total assets is

900,000

At the beginning of the year, Classique, a dress shop, had liabilities amounting to P96,000 but it decreased by P40,000 during the year. The assets increased by P128,000 during the year and at the end of the year amounted to P288,000. The owner's equity at the start of the year is

64,000

A customer brought equipment to Excellent Reworks for repair. After repairs were done, the customer made a cash payment of P25,000 representing 25% of the repair bill, and issued a note for the balance promising to pay after one month. Under the accrual basis of accounting, the amount of revenue to be recorded by Excellent Reworks is

100,000

The accounting elements of Aether, a perfume shop, have the following balances at the end of the year: Assets, P200,000; Liabilities, P50,000; Capital, P100,000; and Expenses, P60,000. There was no withdrawal made by the owner during the year. How much is the amount of Revenues for the year?

110,000

Using the accounting equation, determine the amount of Owner's Capital if the other accounts have the following balances: Cash, P20,000; Accounts Receivable, P80,000; Accounts Payable, P15,000; Notes Payable, P10,000; Operating Expenses, P150,000; Service Income, P175,000.

50,000

At the start of the year, Prime Partners, a consulting firm, showed an equity balance of P50,000. During the year, the owner made an additional investment of P25,000. How much is the ending balance of equity if at the end of the year, the company recorded the following: Salaries Expense, P173,000; Rent Expense, P48,000; Consulting Fees, P500,000; Primo, Drawings, P40,000; Utilities Expense, P80,000; and Prepaid Supplies, P50,000.

234,000

RightPath Solutions was opened by Fatima Delos Reyes on June 15, 2024, by investing the following: Cash, P250,000; Supplies, P30,000; Equipment purchased on account from Emerald Finds one year ago for P100,000 but has a current fair value of P80,000. The account with Emerald Finds for the purchase of this equipment has a balance of P50,000 which will be assumed by RightPath Solutions. How much is the total assets of RightPath Solutions on June 15, 2024?

360,000

Botanic Bay, a flower shop, has store supplies amounting to P30,000 at the beginning of 2024. During the year, Botanic Bay bought additional supplies for cash, P25,000, and on account, P40,000. Botanic Bay returned P2,500 worth of supplies because of defects and paid P35,000 of the supplies bought on account. The company's owner, Ms. Flor Salvacion, withdrew P1,500 worth of supplies for personal use. At the end of the year, P12,000 worth of supplies remained on hand. Under the accrual basis of accounting, how much is the Supplies Expense that Botanic Bay will report in its 2024 Statement of Income?

79,000

Rent-A-Center, a leases office for 1 year and accepted the following lease contracts, all of which will start by August 1, 2024: (1) BrewBerry, monthly rent of P20,000 payable at the beginning of the month; December 2024 rent was not yet collected; (2) BalancePro, monthly rent of P15,000; no uncollected balance as of December 31, 2024; and (3) Flower Bar, advanced rental payment for 6 months was received in August for P180,0000. How much should Rent-A-Center report as Rent Income in its December 31, 2024 Statement of Income?

325,000

The summary of all account names (and corresponding account numbers) used to record financial results in the accounting system.

Chart of Accounts

It has a direct and measurable financial effect on the assets, liabilities and equity of a business

Transactions

Payment of owner's liability out of the cash of the business

Decrease both assets and owner's equity

A simple journal entry

consist of one debit and one credit

Which of the following statements regarding a trial balance is incorrect?

A. A trial balance proves that no errors of any kind have been made in the accounts during the accounting period.

B A trial balance helps to localize errors within an identifiable time period.

C A trial balance is a list of all of the accounts in the ledger with their balances as of a given date.

D A trial balance is a test of equality of the debit and credit balances in the ledger.

A trial balance proves that no errors of any kind have been made in the accounts during the accounting period.

Perfect Brew bought equipment by paying cash, P25,000. The journal entry to record this transaction is

Equipment 25,000

Cash 25,000

Velvet Bean paid monthly rent, P15,000. The journal entry to record this transaction is

Rent Expense 15,000

Cash 15,000

Capital Creators hired an employee for a monthly salary of P70,000. The contract of employment was signed on September 27, 2024. The employee will start working for Capital Creators on October 1, 2024. The journal entry to record the September 27 transaction is

Hired an employee for a monthly salary of P70,000.

If the Cash account has a debit balance of P502,000 as of December 31, 2024, with debit postings during the year of P848,000 and credit posting of P452,000, what is the January 1, 2024 balance of Cash?

106,000

The Accounts Payable Ledger shows the following amounts: P10,000 (beginning balance, Cr); P8,000 (Cr); P2,000 (Dr); and P1,000 (Dr). How much is the ending balance of the Accounts Payable?

15,000

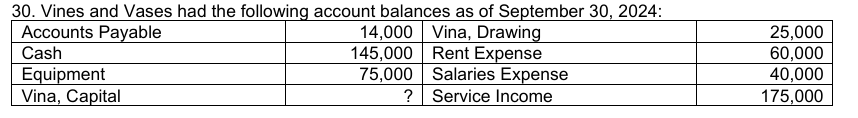

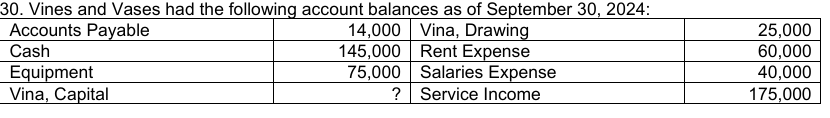

Vines and Vases had the following account balances as of September 30, 2024:

what is the trial balance?

345,000

Using the same information given for Vines and Vases, how much is the balance of Vina, Capital?

156,000

. Which of the following errors can be revealed by a trial balance?

A The debit posting of service fees earned from services rendered on account was posted to “Cash” rather than to “Accounts Receivable”. The credit posting was correct.

B The payment of Utilities Expense as posted as a debit to Salaries Expense and a credit to Cash.

C A sale transaction was recorded but not posted.

D Services rendered of P81,000 were posted as a debit to Cash for P81,000 and a credit to Service Fees for P18,000.

Services rendered of P81,000 were posted as a debit to Cash for P81,000 and a credit to Service Fees for P18,000.

A portion of the cost of property and equipment allocated as an expense for the period.

Depreciation

Adjusting entries

update and correct the accounts at the end of the accounting period

Which is an incorrect adjusting journal entry?

A Debit Doubtful Accounts Expense; Credit Allowance for Doubtful Accounts

B Debit Accumulated Depreciation; Credit Depreciation Expense

C Debit Salaries Expense; Credit Salaries Payable

D Debit Unearned Service Income; Credit Service Income

Debit Accumulated Depreciation; Credit Depreciation Expense

An accrued expense is classified as a/an

current liability

Failure to adjust the prepayment of insurance initially recorded using the expense method will

Overstate Expenses, Understate Net Income, Asset, and Equity

The Prepaid Insurance is P22,500. However, it was determined that the unexpired portion of the insurance premium amounts to P11,500. The adjusting journal entry should include the following?

Debit to Insurance Expense of P11,000

Bridal Blooms began operations in June with store supplies of P16,000. During the month, the company purchased store supplies of P29,000. On June 30, supplies on hand totaled P21,000. Supplies Expense for the period is

24,000

Florist & Forest distributes monthly gardening magazines. On August 1, 2024, the company sold 1,000 units of monthly magazine subscriptions for P120 each. Distribution of the magazines starts in August 2024. As of December 31, 2024, what amount should be reported as a liability in the statement of financial position and an income in the statement of income, respectively?

P50,000; P70,000

The unadjusted balances of Accounts Receivable and Allowance for Bad Debts at the end of the year are P600,000 and P15,000, respectively. These accounts have normal balances. The aging of the Accounts Receivable reveals that the Allowance for Bad Debts should be increased to P24,800. The adjusting journal entries would include

Dr to Bad Debts for P9,800

The carrying amount of the Equipment account at the start of the year is P480,000 and decreased to P450,000 at the end of the year. Depreciation rate is 5% per year. If there are no additions and disposals of assets during the year, the depreciation expense will be

30,000

The company received a 12%, P300,000, 360-day promissory note from a customer on September 14, 2024. The adjusting journal entries to record accrued interest would include

Dr to Interest Receivable for P10,800

Paper Twine Inc. incurred salaries of P12,500 for the last week of December 2024 but this will be paid in January 2025. The adjustment on December 31, 2024 is

Salaries Expense 12,500

Salaries Payable 12,500

First Picks entered into a rent contract with a certain lessee. The contract stipulates a P12,000 monthly rent to be paid on the 10th day of the following month. The last rental payment received by First Picks was dated November 10, 2024. The adjusting journal entry in the books of First Picks on December 31, 2024 is

Rent Receivable 24,000

Rent Income 24,000

A tool used to summarize all information needed to make adjusting entries and facilitate the preparation of the financial statements as well as the closing entries is called a/an

Worksheet

Assuming the company is profitable in the current period, the total of the Statement of Financial Position (SFP) credit column in the worksheet will be

Smaller than the SFP debit column

An important purpose of closing entries is to

set nominal account balances to zero at the start of the next accounting period

When preparing the closing entries for Financial Fusion, a consulting firm, the Income and Expense Summary account is debited with a corresponding credit to Mojica, Capital. This means that

Financial Fusion earned an income during the year

An adjusting entry that should be reversed is the adjustment for

Accrual of expenses incurred

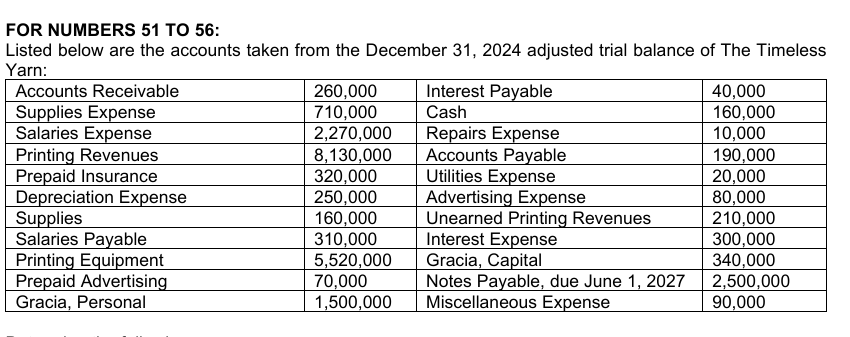

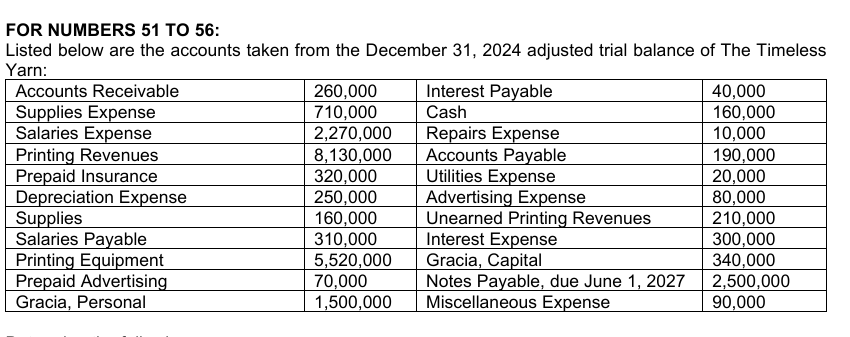

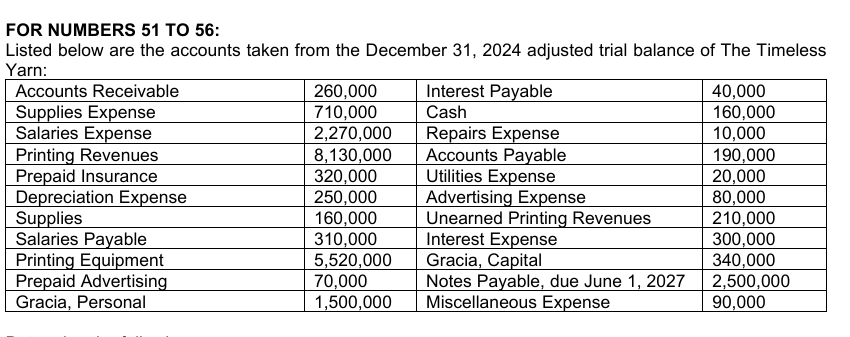

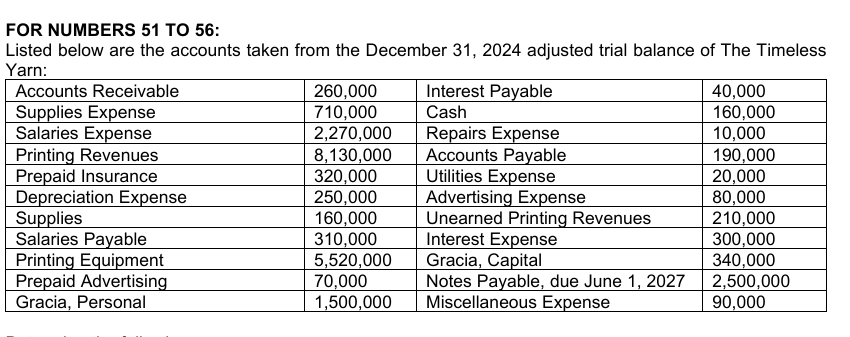

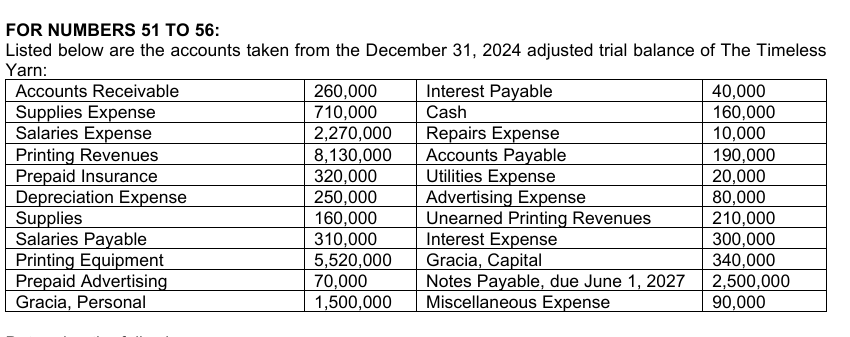

Net Income for the year

4,400,000

Total Assets

750,000

Total Current Liabilities

3,250,000

Total Liabilities

3,250,000

Total Current Assets

970,000

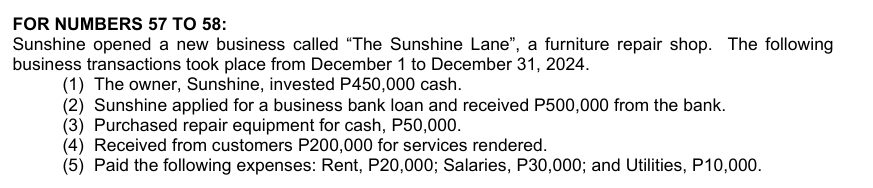

How much is the Net Cash Provided (Used) by Operating Activities?

140,000

How much is the Cash Balance on December 31, 2024?

1,040,000

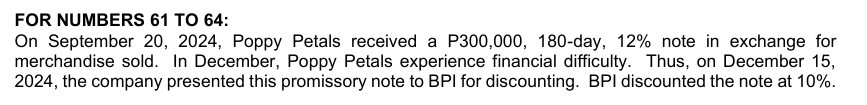

An entity borrowed cash from a bank and issued to the bank a short-term non-interest bearing note payable. The bank discounted the note at 10% and remitted the proceeds to the entity. What is the effective interest rate?

More than the discount rate of 10%

Trendy Threads presented its Notes Receivable to the bank for discounting. If the net proceeds from the discounting is less than the carrying amount of the Notes Receivable on the date of discounting, then the journal entry to record the discounting of Notes Receivable with recourse will include

Dr Loss from Notes Receivable Discounting; Cr Notes Receivable Discounted

The carrying amount of the Notes Receivable on December 15, 2024 is

308,600

The amount of Discount on Notes Receivable given by the bank is

8,303.33

The proceeds from the discounting is

309,696.67

The gain (loss) on discounting the note is

1,096.67

What is considered as an expense of the employer?

EC contribution

The withholding tax deducted by the employer from the salary of its employees is a/an

liability of the employer