Asset Allocation

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

Why is strategic asset allocation important?

Strategic asset allocation is the first element of the portfolio management process to focus on selecting investments.

It’s a bridge to the execution step of portfolio management but at the broad level of asset classes.

Strategic asset allocation is a starting point for portfolio construction and a step of the portfolio management process on which many investors expand considerable thought and effort

SAA sets an investor’s desired long-term exposures to systematic risk.

What are ALM strategies?

ALM strategies run from those that seek to minimize risk w.r.t. net worth or surplus (asset minus liability)

Two matching approaches in ALM

Cashflow matching (A cashflow matching approach structures investment in bonds to match future liabilities or quasi-liabilities)

Immunization (An immunization approach structures investments in bonds to match the weighted average duration of liabilities)

What types of investors gravitate to an ALM approach

The investor has below average risk tolerate

The penalties for not meeting the liabilities and quasi liabilities are very high

The market value of liabilities or quasi-liabilities are interest rate sensitive

Risk taken in the investment portfolio limits the investors’ ability to profitably take risk in other activities

Legal and regulatory requirement and incentive favor holding fixed income securities

Tax incentives favor holding FI securities

Why recommend this portfolio

Is efficient

Is expected to satisfy the return requirement

Is expected to meet his risk objective

Has the highest expected sharpe ratio among the efficient portfolio that meet his return objective

Is the most consistent with the IPS statement concerning minimizing losses with any other investment typpe

Implementation choices of SAA

Passive investing

Active investing

Semi-active investing or enhanced indexing

Some combination of the above

Insurers are taxable enterprises, in contract to defined benefit pension plans, endowments and most foundations.

Therefore, insurers focus on after tax return

TAA

A second major type of asset allocation is tactical asset allocation (TAA), which involves making short-term adjustments to asset-class weights based on short-term expected relative performance among asset classes.

Dynamic approach vs. static approach

A dynamic approach recognizes that an investor’s asset allocation and actual asset returns and liabilities in a given period affect the optimal decision that will be available next period. The asset allocation is further linked to the optimal investment decisions available at all future time periods.

In contrast, a static approach does not consider links between optimal decisions at different time periods.

Advantage of dynamic approach over static approach

The advantage of dynamic over static asset allocation applies both to AO and ALM perspectives. With the ready availability of computing power, institutional investor that adopt an ALM approach to strategic asset allocation frequently choose a dynamic rather than static approach.

A dynamic approach, however, is more complex and costly to model and implement

The ALM approach to strategic asset allocation characteristically results in a higher allocation to fixed-income instruments than an AO approach. Fixed-income instruments have prespecified interest and principal payments that typically represent legal obligations of the issuer. Because of the nature of their cash flows, fixed-income instruments are well suited to offsetting future obligations.

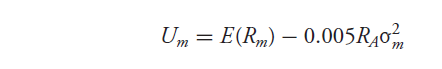

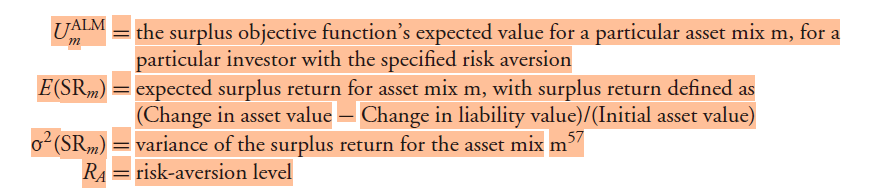

Quantify investors’ risk aversion

Um = the investor’s expected utility for asset mix m

E(Rm) = expected return for mix m

RA = the investor’s risk aversion

σ2m= variance of return for mix m

Five criteria that will help in effectively specifying asset classes

Assets within an asset class should be relatively homogenous

Asset classes should be mutually exclusive

Asset class should be diversifying

The asset class as a group should make up a preponderance of world investable wealth

The asset class should have the capacity to absorb a significant fraction of the investor’s portfolio w/o seriously affecting the portfolio’s liquidity

When investing in international asset classes, investors should consider the following risks

currency risk

increased correlation in times of stress

emerging market concerns

Resampled efficient frontier

To mitigate this instability, the resampled efficient frontier uses multiple simulations of the input data. By creating many alternative efficient frontiers based on these resampled datasets, the resulting portfolios are averaged to form a more stable and diversified efficient frontier

Safety first ratio (SF ratio), also known as Roy’s safety-first criterion

Which is a risk management approach used in investment decisions. It helps investors choose a portfolio that minimizes the probability of returns falling below a minimum acceptable threshold

re = Expected return on the portfolio

rm = Minimum required return set by the investor

σp = Standard deviation of the portfolio returns

SFratio = (re-rm)/σp

By using this ratio, investors can compare different portfolios and select the one with the highest SFRatio, which indicates the lowest probability of falling below the desired return

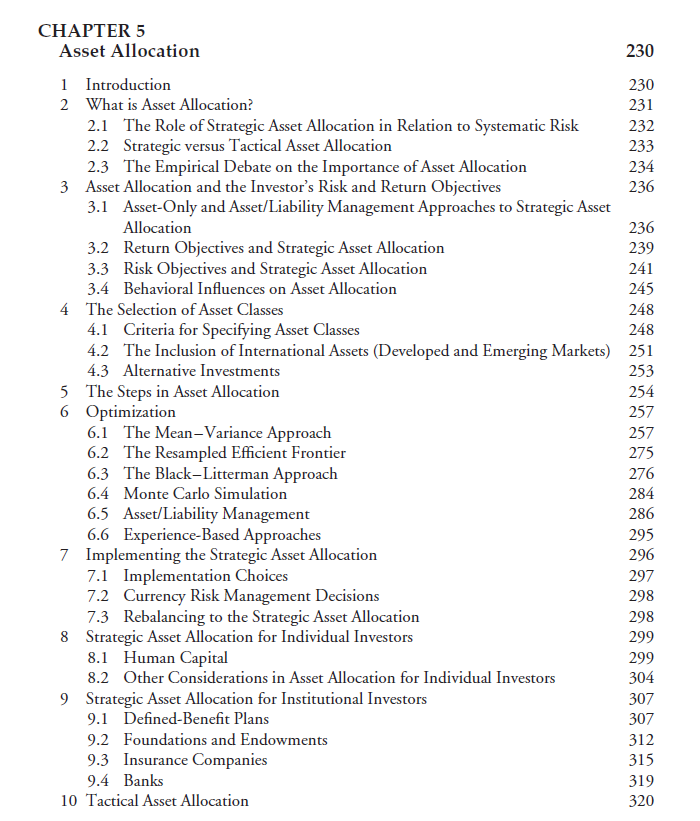

Optimization

Mean variance approach

The resampled efficient frontier

The black litterman approach

Monte Carlo Simulation

ALM

Experience based approaches

Steps in BL model

Define equilibrium market weights and covariance matrix for all asset classes

Back solve equilibrium expected returns

Express views and confidence for each view

Calculate the view adjusted market equilibrium returns

Run mean variance optimization

Advantages of incorporating equilibrium returns in BL model

Incorporating equilibrium returns has two major advantages.

First, combining the investor’s views with equilibrium returns helps dampen the effect of any extreme views the investor holds that could otherwise dominate the optimization. The result is generally better-diversified portfolios than those produced from a MVO based only on the investor’s views, regardless of the source of those views.

Second, anchoring the estimates to equilibrium returns ensures greater consistency across the estimates.

Monte Carlo simulation

Monte Carlo simulation imitates an asset allocation real world operations in an investments laboratory, where the investment advisor incorporates his best understanding of the set of relevant variables and statistical properties

ALM with simulation

Monte Carlo simulation can help confirm that the recommended allocation provides sufficient diversification and to evaluate the probability of funding shortfalls, the likelihood of breaching return threshold and the growth of assets w and w/o disbursements form the portfolio

A simple asset allocation approach that blends surplus optimization with Monte Carlo simulation follows these steps

• Determine the surplus efficient frontier and select a limited set of efficient portfolios, ranging from the MSV portfolio to higher-surplus-risk portfolios, to examine further.

• Conduct a Monte Carlo simulation for each proposed asset allocation and evaluate which allocations, if any, satisfy the investor’s return and risk objectives.

• Choose the most appropriate allocation that satisfies those objectives.

ALM risk penalty function

The monte carol simulation produces a frequency distribution for the future values of asset mix, plan liabilities and NetWorth or surplus

Experience based approaches

A 60/40 stock/bond asset allocation is appropriate or at least a starting point for an average investor’s asset allocation.

The allocation to bonds should increase with increasing risk aversion.

Investors with longer time horizons should increase their allocation to stocks.

A rule-of-thumb for the percentage allocation to equities is 100 minus the age of the investor (This rule of thumb implies that young investors should adopt more aggressive asset allocations than older investors)

Outline

Behavioral influences on asset allocation

Loss aversion

Mental accounting

Regret avoidance

Signed constrained optimization

In practice, MVO, including the constraints that the asset-class weights be non-negative and sum to 1. We call this approach a sign-constrained optimization because it excludes negative weights, and its result is the sign-constrained minimum-variance frontier.

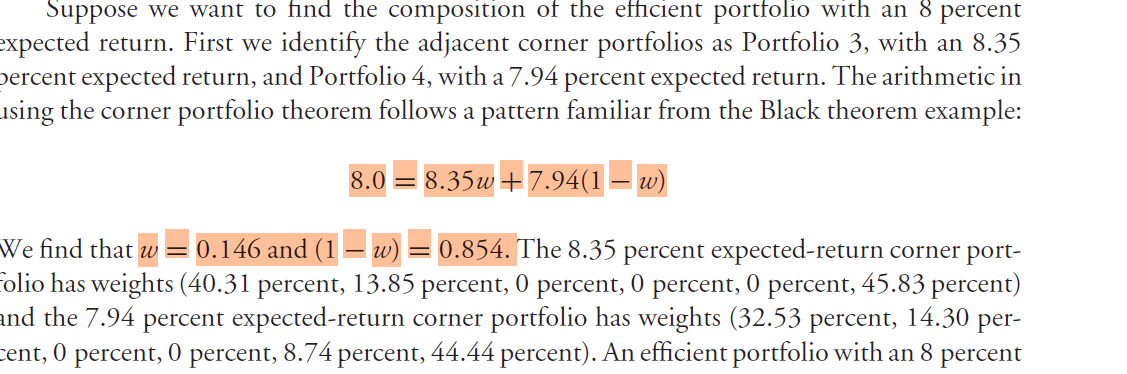

Corner portfolio

Advantages of segmentation

Focus for meeting return objectives by product line / line of business

Easily allocate investment income by LoB

More accurate measurement of profitability by LoB

Better management of interest rate risk by product line

Assist senior management in assessing the suitability of investments

Establishes multiple acceptable asset allocations that are appropriate

Promote competitive crediting rates for each segment