SS201 - West Point - ECON

1/59

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

60 Terms

Equilibrium

Agents simultaneously optimizing--nobody wants to change what they are doing

Optimization

Economics agents choosing the best feasible option given the available information

Optimization in Levels

Calculating TOTAL net benefit of different alternatives then selecting the best one.

e.g. There are two bags of candy. You look at which bag would bring the most enjoyment and you pick that one.

Optimization in Differences

Calculates the CHANGE in net benefits when a person switches from one thing to another then uses marginal comparison to choose the best alternative.

e.g. using "marginal analysis" to determine which option is best-- two bags of candy exactly the same; however, one has a crying baby inside and one does not. The one without will bring the most enjoyment so you pick that one.

Correlation

Relationship between two variables (not necessarily causation)

Opportunity cost

value of the best available alternative (units could be in goods or dollars)

Feasible options

Available & Affordable

Empiricism

Testing ideas using data

Scientific Method

Develops models of the world and test those ideas with data

Variable

Factor that is likely to change or vary

Consumer surplus

Difference between willingness to pay (demand curve) and the price. Area below the demand curve and above the price

Producer Surplus

Difference between willingness to accept (supply curve) and price. Area above the supply curve and below the price.

Price elasticiy of demand

(%Δ Quantity demanded)/(%ΔPrice). We make this positive for convenience, because law of demand says the relationship between demand and supply is always negative.

Income elasticity of demand

(%Δ Quantity demanded)/(%Δ Income)

Price elasticity of Supply

(%Δ Quantity supplied )/(%Δ Price)

Net Exports =

Exports - imports

Protectionism

Reducing competitive forces faced by domestic firm

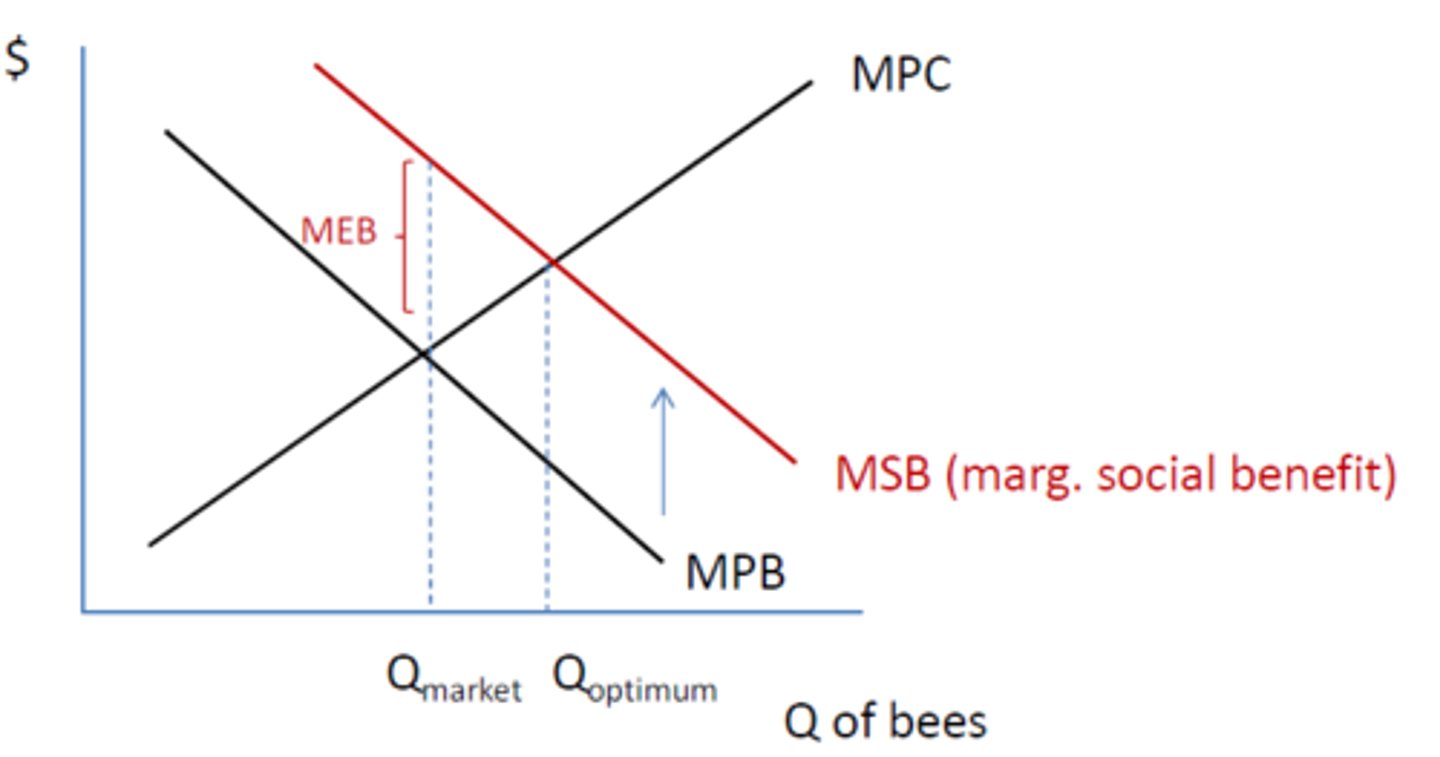

Negative Externality

Costs of economic transactions that do not directly impact seller or buyer e.g. Air pollution

Positive externality

Benefits of economic transactions that do not directly impact seller or buyer e.g. Education

Public Good

Non-excludable, Non-rival good (e.g. protection from the military)

Common pool resource

: Non-excludable, Rival good (e.g. international fishing waters)

Governement Paternalism

Policies to encourage citizens to do what the govt think is in the citizens best interest.

Human Capital

Individuals stock of skills

Monopoly

Market with one seller and high barriers to entry. long-run positive economic profits possible.

Oligopoly

Market with few sellers and high barriers to entry. Optimal actions depend on actions of other oligopolistic firms.

Monopolistic competition

Market with many sellers, differentiated goods, and no barriers to entry.

Macro econ

Study of econ as a whole

GDP Deflator

100x (nominal gdp/real gdp)

Nominal GDP

Value of goods at a given year

Real GDP

Value of goods in a year in base year prices

Q_i×P_b=(Nominal GDP)/(GDP Deflator)

CPI

100*cost of basket goods in a year of interst/cost of basket goods in a base year

Solow growth steady state

I=d*x

Catch up growth

Countries try to take advantage of existing technology to grow

Fundamental causes of prosperity

Geography, Culture, Institutions (institutions most important)

Frictional Unemployment

Unemployment caused by frictions in the labor marker e.g. job search, hiring procedures, budgets. These workers eventually get jobs, but will be unemployed during the search.

Structural Unemployment

Unemployment as a result of persistant gap between labor supplied and labor demanded. can be due to downward wage rigidity, minimum wages, presence of unions, or efficiency wages.

Defined benefit plan

Receiving a promised payout for retirement. Not typically provided anymore, and not transferable between jobs.

Factors influencing consumption decision

Budget restraints

prices

tastes

preferences

Factors that shift demand

Change in prices

population

income

expectations of the future

Impact of a price cieling

demand exceeds supply, there is a shortage of supply

Impact of price floor

There is an excess of supply

Types of Barriers to entry

Legal barriers

Economies of scale

Nash equilibrium

No player can be made better off by changing his or her actions given what others are doing

Things not counted in GDP

Home Production

Underground economy

leisure time

Unemployment rate =

natural rate of unemployment + cyclical unemployment

US Central Bank ...

Influences money supply, sets federal fund rate, monitors financial institutions

Price Elasticity of demand

Elastic > 1 ... Unit Elastic = 1 ... Inelastic < 1

If inflation is unexpectedly low, who would benefit?

A bank that purchased bonds

&

Banks that made home loans

Marginal Benefit

The amount you benefit from having one more quantity of something.

What is the only thing that causes the QUANTITY demanded/supplied to change?

Price

Factors that shift the demand curve

Tastes and preferences

income

availability and prices of related goods

beliefs about the future

Factors that shift the supply curve

Technology

Number and scale of sellers

beliefs about the future

How do we maximize revenue in terms of elastic/inelastic goods?

Raise prices on inelastic goods, and lower prices on elastic goods.

Why are profits zero in a perfectly competitive market

This is the term used to say that a company is "breaking even" meaning that they aren't losing money and are covering operating costs. --they're out of the red.

PCM

Perfectly Competitive Market

Sellers all sell identical goods/services. Buyers/Sellers are all price takers meaning they accept the market price and can't bargain for better prices.

How will a firm maximize labor hired?

Set VMPL=Wage

Nominal Exchange Rate

Units of foreign Currency/1 unit of domestic currency

If the Fed wanted to implement anti-recession monetary policy what would it do with each tool?

A: Open market operations: buy or sell?

B: Increase/decrease interest paid on reserves?

C:Increase/decrease lending from the discount window?

D:raise or lower the reserve requirement?

A: Buy

B:decrease

C:Increase

D: lower

If i just got a job paying $43,600 and inflation is 5%, what must my salary be in 9 years in order to keep the same purchasing power?

43,600*(1+5%)^9=$67,637.91

If i deposit $4200 and earn 10%, how much will i have in 25 years? 30 years?

4200*(1+10%)^25= 45505.76

30 years = 73287.49