Macroeconomics

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

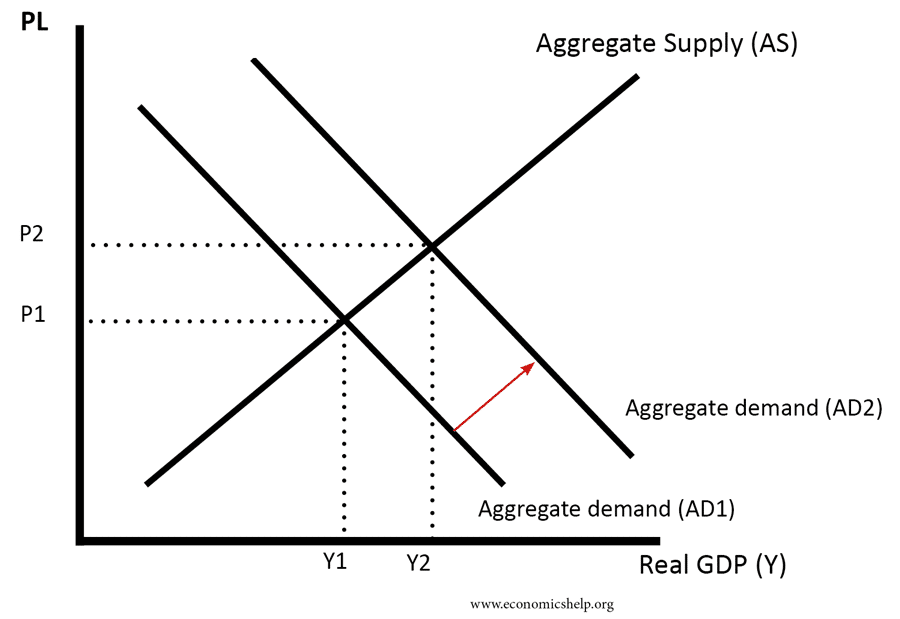

Aggregate Demand

Total planned expenditure on goods and services in an economy

Components of AD

C

I

G

X - M

GDP

Total monetary value of all finished goods and services within a country’s borders

Unemployment

A proportion of the population who are out of work, but is willing, able and searching for work.

Injections

Additions to the circular flow of income that increases total spending

Economic Growth

An increase in the monetary value of goods and services produced as measured by the annual change % in real GDP.

Macroeconomic Objectives

Economic Growth (a positive GDP)

Low unemployment

Low and stable inflation

Have a balanced current and financial account

Leakage

A factor that removes money from the circular flow of income

Different leakages

T

S

M

Circular Flow of Income

How money is passed through the economy

Households

Factors of Productions → Firms

Consumer Expenditure → Firms

Firms

Goods and Services → Households

Factor Incomes → Households

Aggregate Demand shift to the right

Wealth effect

Purchasing power of income increases therefore consumption increases as price level has fallen and therefore making goods and services more affordable due to increases in Real Income.

Trade effect

The decreasing of the price level makes exports more competitive and imports less competitive

Interest effect

Price level decreasing equates to a low inflation hence interest rates are kept low by central banks to meet inflation targets due to lower inflationary pressure which stimulate higher consumption and higher investment.

Interest Rates & Investment

Lower interest rates allow firms to invest more as cost of borrowing is lower.

What is investment

A firms spending on capital

Interest Rates & Exchange Rate

Low interest rates reduces value of exchange rate which increases net export performance.

Lower Price Level

Reduces inflationary pressure

Increasing MPC causes

Lower Interest Rates as it encourages borrowing as consumers are more likely to take out loans to buy big purchases

Increased animal spirits which are increased consumer confidence as consumers are more optimistic about the economy.

Multiplier effect

An initial increase in a component of aggregate demand leads to a bigger increase in real GDP

Accelerator effect

An increase in real GDP leads to an increase in investment

MPC

The willingness to spend any additional income a household earns.

Increased by animal spirits.

Lower interest rates.

Determinants of consumption

Real disposable income

Interest rates

Consumer confidence (animal spirits)

Asset prices (house prices)

Disposable income causes

Income taxes

Current Spending

Maintenance of public sector services

Payment of public sector wages

Capital Spending

Infrastructure spending

Welfare Spending

Benefits and pensions

Budget Deficit

G > T in a fiscal year

Budget surplus

T > G in a fiscal year

National Debt

Total stock of debts over time

SRAS Shift Causes

Costs of production

Costs of Production

Wages

Raw resources

Business Taxes (VAT)

Oil prices

LRAS Shift Causes

Due to the quality of factors of production

Quality & Quantity of FOP

R & D, Capital Investment

Infrastructure

Monetary Policy

Actions taken by the central bank to influence the circulation of money such as lower interest rates and purchasing of government bonds.

Fiscal Policy

Actions taken by the government to influence the economy such as government spending and taxation.

Expansionary Monetary Policy

Actions taken by the central bank to stimulate economic growth such as lower interest rates by purchasing government bonds to increase the money supply and encourage lending.

Contractionary Monetary Policy

Actions taken by the central bank to slow economic growth and control inflation, such as increasing interest rates by selling government bonds and reducing the money supply to discourage borrowing.

Weaker Pound

More exports

Less imports

Stronger Pound

More imports

Less exports

Economic Development

An improvement in living standards, higher incomes, education, reduced poverty

Foreign Direct Investment (FDI)

Investment by foreign firms into productive assets such as infrastructure or factories

Market Failure

When markets fail to allocate resources efficiently leading to welfare loss.

How governments can fix unemployment

Re-education

Apprenticeships

Labour market information

Geographical mobility

Capital Account

Records a country’s transactions with the rest of the world

Financial Account

Records the financial assets of all residents and non-residents.

Current Account deficit

Spending more on imports and exports.

Direct Taxation

Taxies levied directly on income or wealth, such as income tax and corporation tax.

Indirect Taxation

Taxied levied on spending such as VAT.

Regressive as lower income households spend a bigger proportion of their income on taxed goods and services.

Increases income inequality which reduces living standards for lower income households.

Increases disposal income especially for higher earners.

Leads to cost-push inflation.

Regressive Tax

A tax that takes a higher proportion of income from low-income earners and high income earners.

Progressive Tax

A tax that takes a higher proportion of income from high-earners than low-earners.

Disposal Income

Income left after direct taxes have been paid, such as taxes and bills.

Inflation

A sustained increase in the general price level.