Macroeconomics - Module 3: Production & Growth, Module 4: Saving, Investment, and the Financial System

1/72

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

73 Terms

productivity

quantity of goods and services produced from each unit of labor

growth in productivity

when productivity grows rapidly, so do living standards

physical capital

the stock of equipment and structures that are used to produce goods and services

human capital

knowledge and skills that workers acquire through education, training, and experience

natural resources

the inputs into the production of goods and services that are provided by nature, such as land, rivers, and mineral deposits

technological knowledge

society’s understanding of the best ways to produce goods and services

common knowledge

after one person uses it, everyone becomes aware of it

proprietary

it is known only by the company that discovers it

a society’s standard of living depends on…

its ability to produce goods and services, which depends on physical capital per worker, human capital per worker, natural resources per worker, and technological knowledge

saving and investment

raises future productivity by investing more current resources in the production of capital

trade-off

sacrifice current consumption to increase future consumption

higher savings rate

more resources to make capital goods and capital stock increases

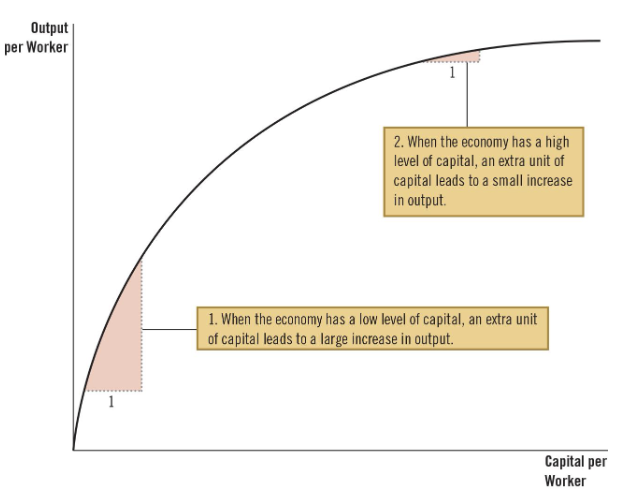

diminishing returns

benefit from an extra unit of an input declines as the quantity of the

input increases

illustrating the production function

This figure shows how the amount of capital per worker influences the amount of output per worker. Other determinants of output, including human capital, natural resources, and technology, are held constant. The curve becomes flatter as the amount of capital increases because of diminishing returns to capital

catch-up effect

countries that start off poor tend to grow more rapidly than countries that start off rich

true or false: growth eventually slows down as capital, productivity, and income rise

true

poor countries

low productivity, return to capital is often high, small amounts of capital investment, increase workers’ productivity substantially, tend to grow faster than rich countries

rich countries

high productivity, additional capital investment, small effect on productivity

way for a country to invest in new capital

domestic savings and foreign investment

foreign direct investment

capital investment that is owned and operated by a foreign entity

foreign portfolio investment

investment financed with foreign money but operated by domestic residents

benefits from foreign investment

some benefits flow back to the foreign capital owners, increase the economy’s stock of capital, higher productivity and higher wages, state-of-the-art technologies developed in other countries, good for poor countries that cannot generate enough saving to fund investment projects themselves

world bank

encourages flow of capital to poor countries, funds from world’s advanced countries, makes loans to less developed countries (roads, sewer systems, schools, other types of capital)

education

investment in human capital where opportunity cost is wages forgone and it’s particularly important for economic growth because of positive externalities (social return is even greater than private return); subsidies to human-capital investment

health and nutrition

investment in human capital where healthier workers are more productive

vicious circle

countries are poor because their populations are not healthy and their populations are not healthy because they are poor and cannot afford adequate healthcare and nutrition

virtuous circle

policies that lead to more rapid economic growth would naturally improve health outcomes, which would further promote economic growth

free trade

trade can make everyone better off

inward-oriented policies

poorest countries aim to raise living standards by avoiding interaction with other countries

infant-industry argument

tariffs and limits on investment from abroad are known to have an adverse effect on economic growth

outward-oriented policies

promote integration with the world economy (ex: elimination of restrictions on trade or foreign investment)

large population

more workers to produce goods and services, larger total output of goods and services, more consumers

stretching natural resources

society’s ability to provide for itself is strained and mankind is doomed to forever live in poverty

diluting the capital stock

high population growth spreads the capital stock more thinly, lower productivity per worker and GDP per worker in a more modern economic growth model, human capital might become lower if there are more children (quantity-quality trade-off)

financial system

group of institutions in the economy that help match one person’s saving with another person’s investment

financial institutions

savers can directly or indirectly provide funds to borrowers (ex: financial markets; financial intermediaries)

financial markets

financial institutions through which savers can directly provide funds to borrowers (ex: bond market; stock market)

bond

a certificate of indebtedness that specifies the obligations of the borrower to the buyer of the bond

date of maturity

time at which the loan will be repaid

rate of interest

paid periodically until the date of maturity

principal

amount borrowed

short-term and long-term bond

long-term bonds are riskier than short-term bonds and long-term bonds usually pay higher interest rates

credit risk

probability that the borrower will fail to pay some of the interest or principal

tax treatment

interest on most bonds is taxable income, municipal bonds are issued by state and local governments and have no tax and lower interest rate

inflation protection

Treasury Inflation-Protected Securities (TIPS); indexed to a measure of inflation so when prices rise, payments rise proportionately

stock

claim to partial ownership in a firm and claim to some of the profits the firm makes; sale of stock to raise money is equity finance where there’s higher return with higher risk; sale of bonds to raise money is debt finance; stocks are traded on organized stock exchanges

financial intermediaries

financial institutions through which savers can indirectly provide funds to borrowers (ex: banks; mutual funds)

primary role of banks

take in deposits from savers (small interest rate) and use these deposits to make loans to borrowers (charge a higher interest rate)

secondary role of banks

facilitate purchases of goods and services; checks and debit cards to access deposits (medium of exchange)

mutual fund

an institution that sells shares to the public and uses the proceeds to buy a portfolio of stocks and bonds

identity

an equation that must be true because of the way the variables in the equation are defined; clarify how different variables are related to one another

gross domestic product

total income = total expenditure

Y = C + I + G + NX

Y = gross domestic product, C = consumption, I = investment, G = government purchases, NX = net exports

closed economy

does not interact with other economies and EX (export) = IM (import) = 0 so NX (net export) = 0

open economy

interacts with other economies and NX (net export) is not necessarily equal to 0

national saving

total income in the economy that remains after paying for consumption and government purchases; private saving + public saving

private saving

income that households have left after paying for taxes and consumption; Y - T - C where t = taxes minus transfer payments

public saving

tax revenue that the government has left after paying for its spending; T - G

budget surplus

excess of tax revenue over government spending; public saving (T - G > 0)

budget deficit

shortfall of tax revenue from government spending; negative public saving (T - G < 0)

balanced budget

T - G = 0 or T = G

what households do with saving

buy corporate bonds or equities, purchase a certificate of deposit at the bank, buy shares of a mutual fund, and let accumulate in saving or checking accounts

market for loanable funds

the market in which those who want to save supply funds and those who want to borrow to invest demand funds; a supply demand model of the financial system helps us understand how the financial system coordinates saving and investment and how government policies and other factors affect saving, investment, the interest rate

supply for loanable funds

saving is the source of the supply of loanable funds; households with extra income can loan it out and earn interest and quantity supplied increases as interest rate rises; positive public saving adds to national saving and the supply of loanable funds and negative public saving reduces national saving and the supply of loanable funds

demand for loanable funds

investment is the source of the demand for loanable funds and firms borrow the funds they need to pay for new equipment; households borrow the funds they need to purchase new houses; as interest rate rises, quantity demanded declines

reaching equilibrium

if interest rate < equilibrium, QS < QD, so shortage of loanable funds encourages lenders to raise the interest rate, encourages saving (increase QS), and discourages borrowing for investment (decreasing QD); if interest rate > equilibrium, surplus of loanable funds and decrease interest rate

government policies

can affect the economy’s saving and investment, government budget deficits and surpluses, and the demand/supply curve

saving incentives

investment incentives

government budget deficits and surpluses

the effect of a government budget deficit

crowding out

budget surplus