Economic Growth

1/35

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

36 Terms

Define Economic Growth

The increase in the total output of an economy over time, measured by GDP.

What is Real GDP?

Value of GDP adjusted for inflation

e.g. if the economy grew by 4% but inflation was 1%, real economic growth was 3%

What is Nominal GDP?

GDP that isn’t adjusted for inflation

Often misleading as growth appears higher

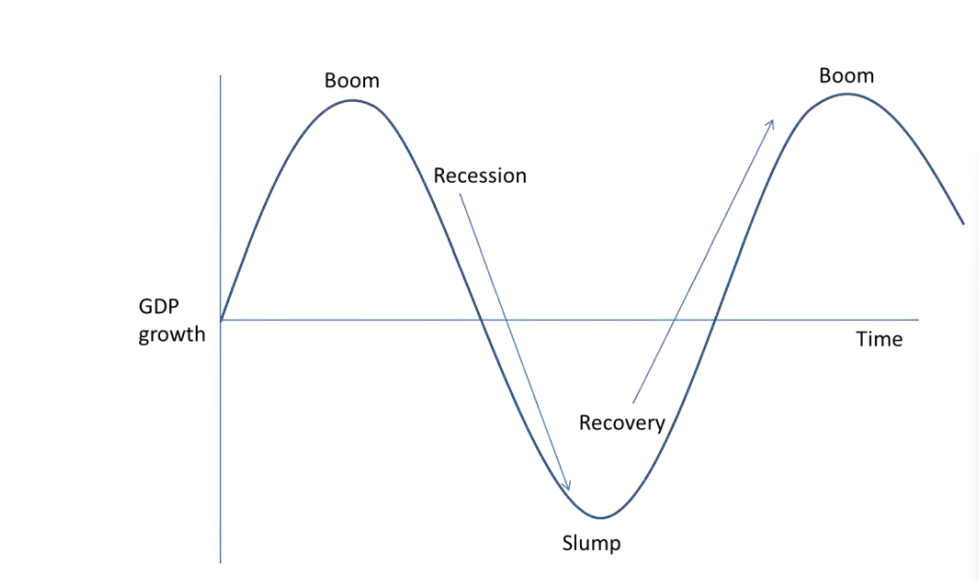

What is the Economic Cycle?

What are characteristics of an economic boom?

High economic growth

Near full productive capacity, or positive output gaps

Demand-Pull inflation

Improved government budget due to higher tax revenues and less spending on welfare payments

What is a recession?

2 consecutive quarters of negative economic growth

What are characteristics of a recession?

Negative economic growth

Far from full productive capacity and negative output gaps

Low Inflation rates

Government budget worsens due to less tax revenue and more welfare payments

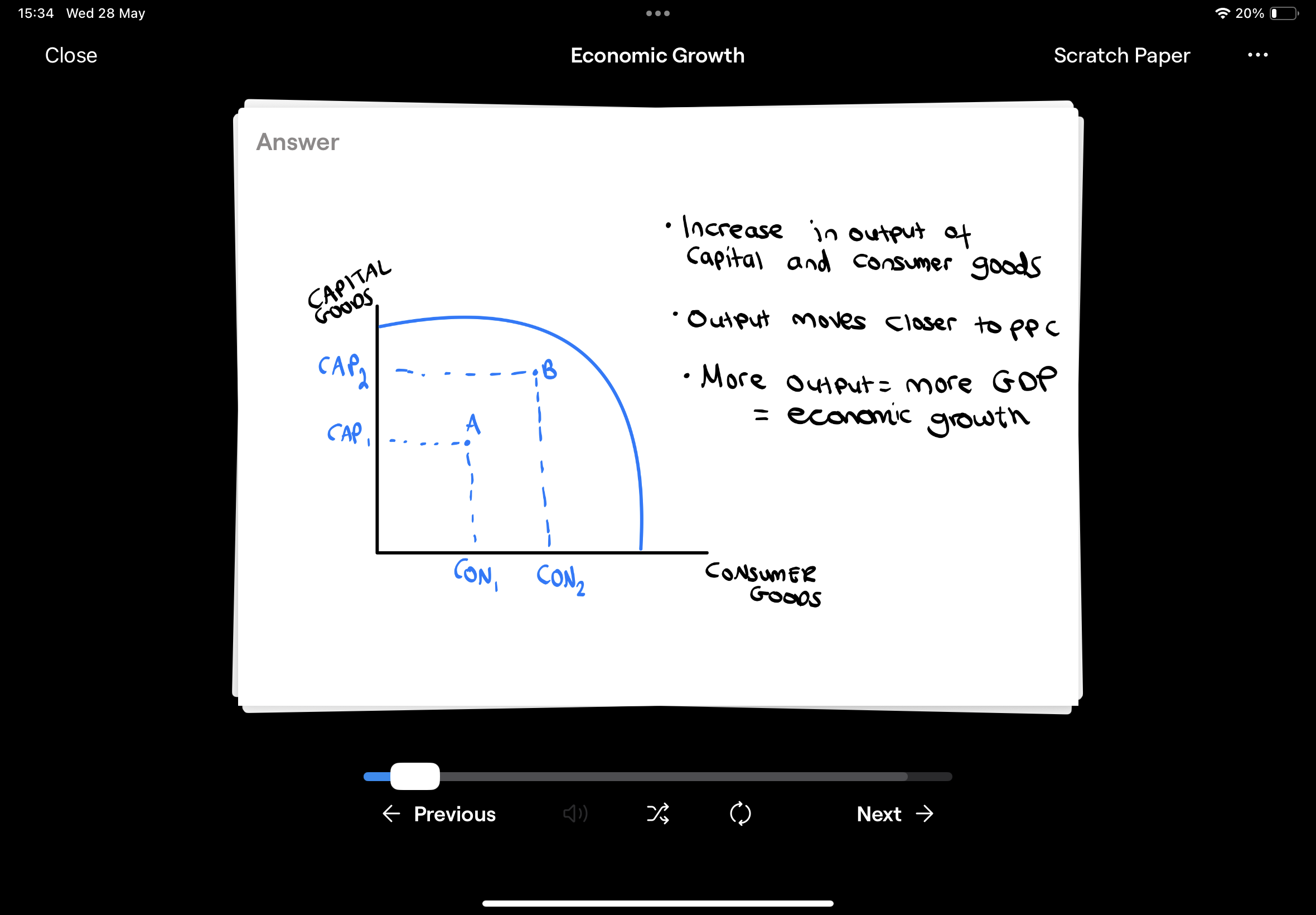

What is Short-Run Economic Growth?

An increase in the actual output of a country’s economy over time

What factors increases Short-Run Economic Growth?

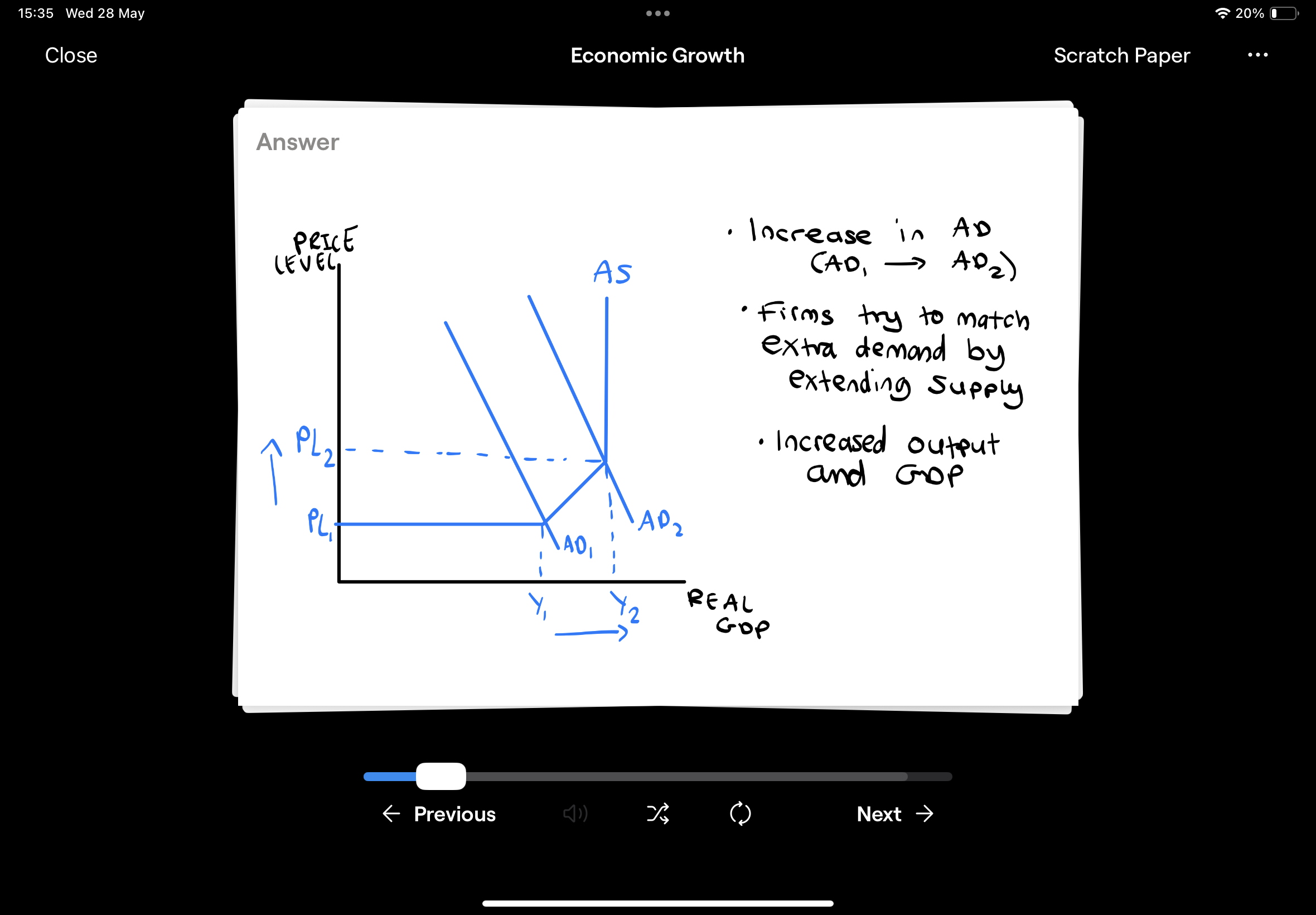

Increased AD

Expansionary Fiscal Policy (Tax Cuts and increased gov spending)

Expansionary Monetary Policy (Lower interest rates)

Lower Unemployment (Shifts economy closer to PPC)

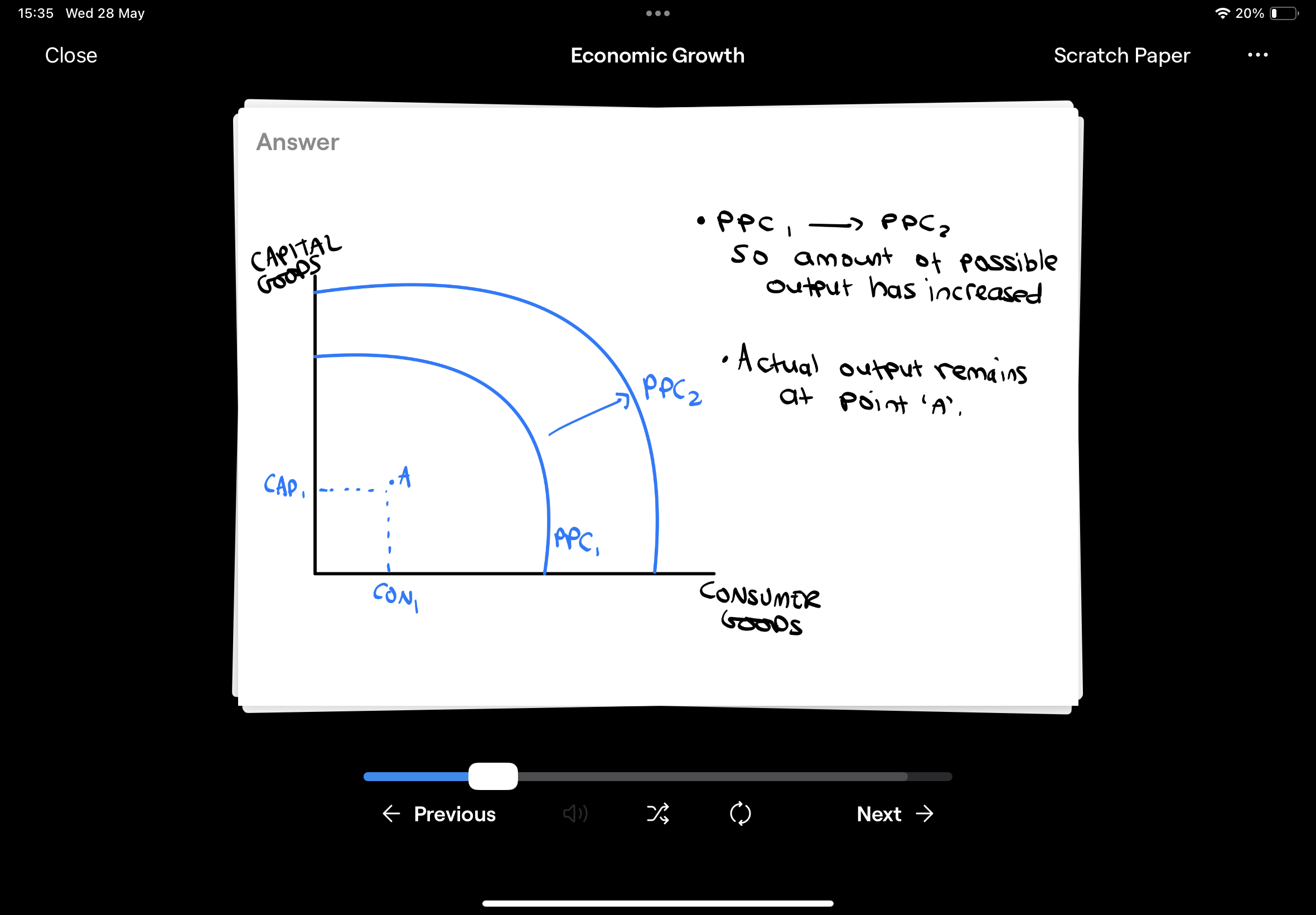

Draw the PPC to show short-run economic growth

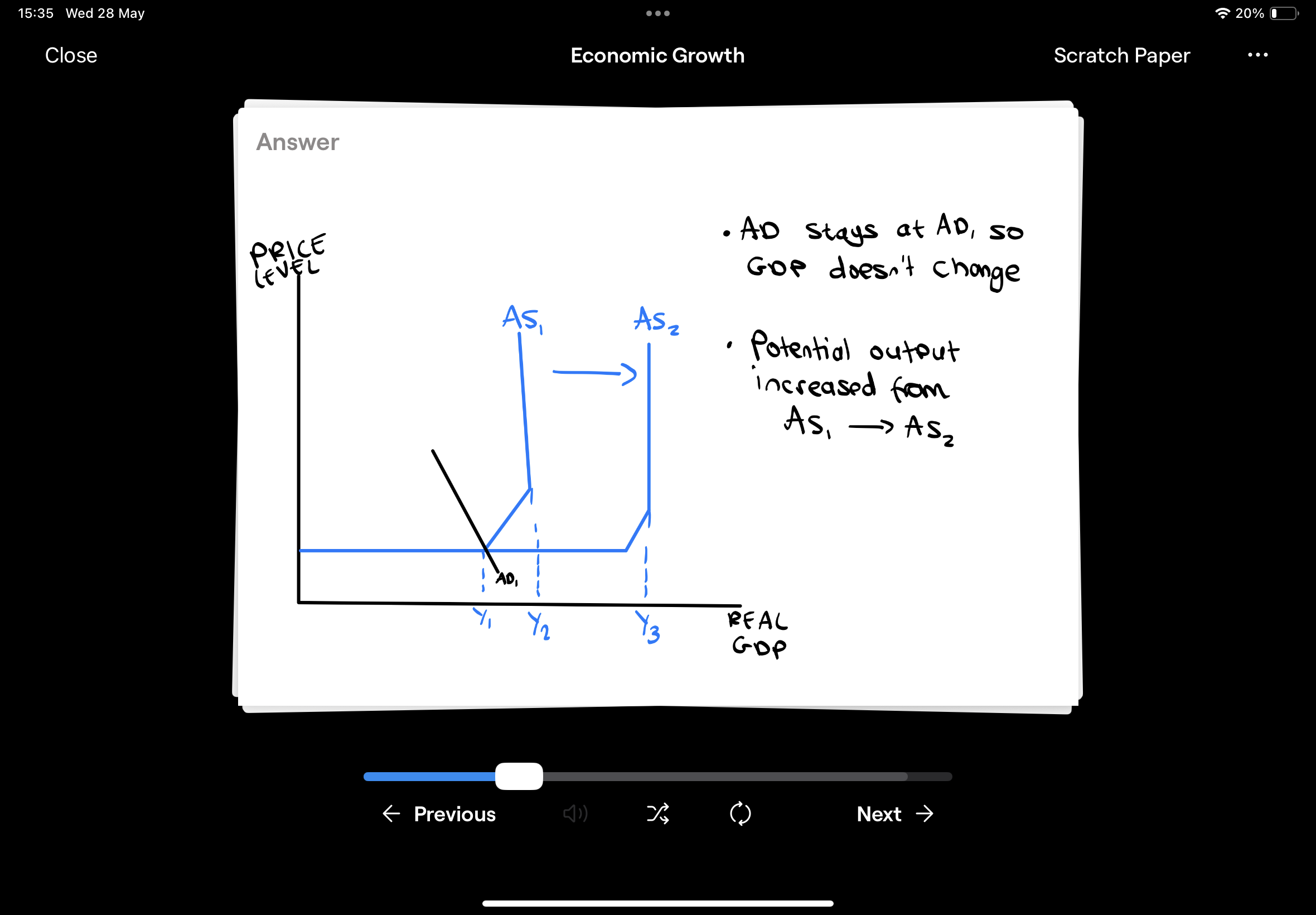

Draw the Keynesian AD/AS Diagram for short-run economic growth

Benefits to consumers of economic growth

Average incomes increase as more people in employment and wages rise

Consumers feel more confident encouraging consumption

Costs to consumers of economic growth

Demand-pull inflation

Shoe leather costs as prices rise, people look for cheapest goods, so more money spent on petrol etc

Those on low incomes are badly affected due to inflation

Benefits to firms of economic growth

Firms make more profits so investment increases

Greater investment means greater ability to develop technology to improve productivity and lower long run average costs

Costs to firms of economic growth

Menu costs as prices on websites, menus etc have to be changed due to inflation

Benefits to government of economic growth

More tax revenue and less welfare payments so could decrease the cyclical budget deficit

Costs to government of economic growth

May have to increase healthcare spending if consumption of demerit goods increases, e.g. cigarettes

Define Long-Run Economic Growth

Expansion of an economy’s productive capacity.

i.e. how much they ‘could produce’ if they maximise the utility of all factors of production

What Increases Long-Run Economic Growth?

Population Growth

Better education and training

Healthcare improvements (less days off sick)

Technology improvements (AI)

Investment in machinery / equipment

Show Long-Run economic growth on a PPC

Show Long-Run Economic Growth on a Keynesian AD/AS Diagram

What is the policy objective of economic growth?

Ensuring that it is sustainable for the economy, environment and society

What is economic sustainability?

The ability to meet the needs of the present without compromising the ability of future generations to meet their own needs

What is environmental sustainability?

The ability of the environment to fulfil its role as a waste disposer, resource provider and producer of amenities.

e.g. growth with pollution isn’t sustainable as it may harm crops

What is social sustainability?

The ability for an economy to grow without compromising the social needs of the future.

e.g. building factories on football pitches isn’t socially sustainable as football pitches are a social amenity

What does the 'classical school of thought’ believe about AS?

They believe that the economy will always self-adjust to be at its full capacity again

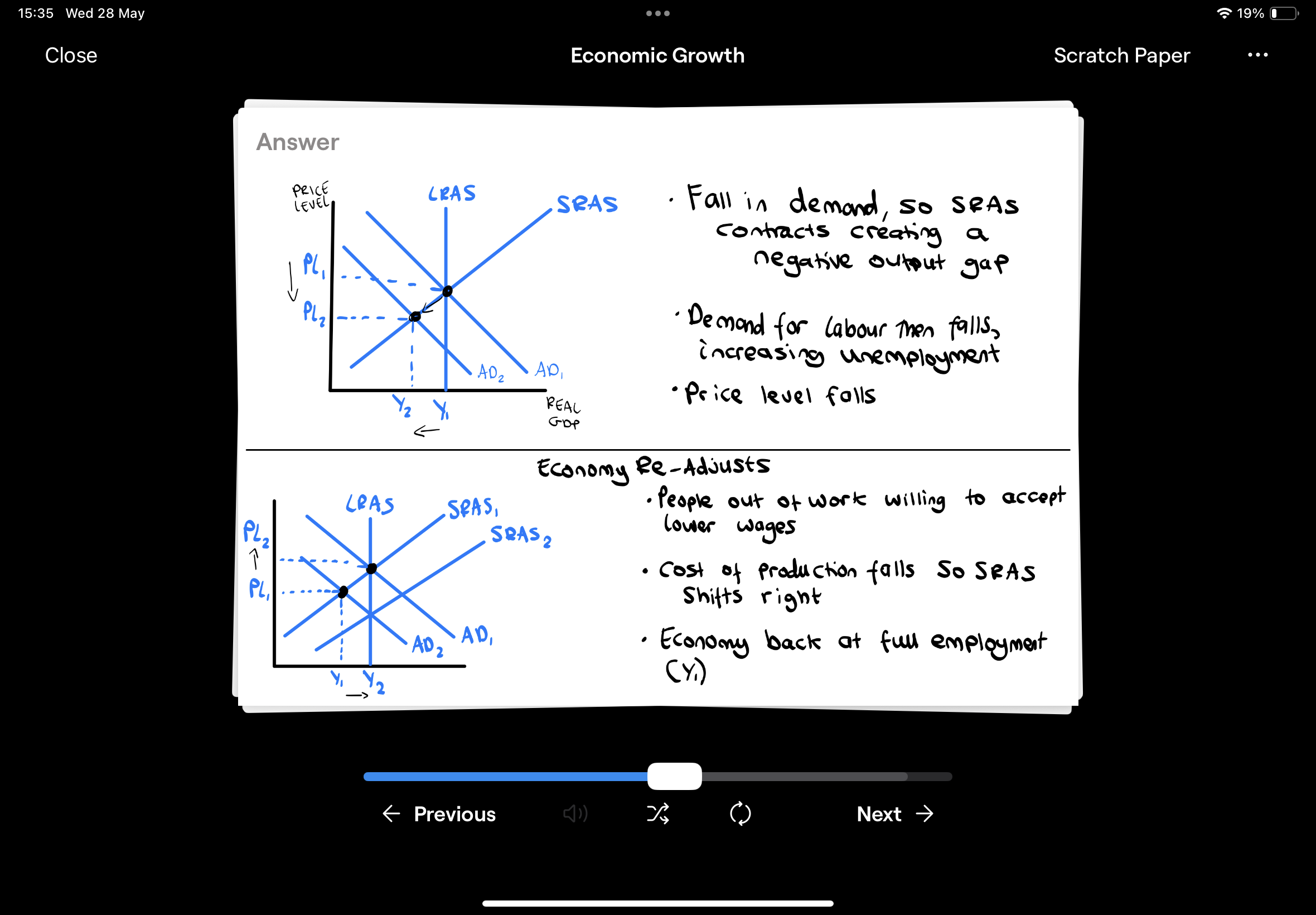

Illustrate a recession using the classical theory

What is a negative output gap?

Occurs when actual output is less than the potential full capacity

What is fiscal policy?

The policy that makes changes to the level of government spending or taxation

How does Fiscal Policy increase economic growth?

If income tax falls, disposable income increases, consumer spending increases, increasing AD, firms increase their supply, increased total output = economic growth

What does the effectiveness of fiscal policy depend on? (EVALUATE Q)

Size of the tax cut

Interest Rates

Consumer Confidence (people save if confidence is low)

What is Monetary Policy?

Changes to interest rates, supply of money and exchange rates

How can monetary policy be used to achieve economic growth?

If the central bank reduces the base rate:

Cheaper for commercial banks to borrow

Commercial banks then decrease interest rates to attract borrowers

Increased borrowing

Increased consumer spending

Increased AD

Increased supply by firms due to profit motive

Increased total output = economic growth

What policy should be used if the productive capacity of the economy isn’t increasing?

i.e. to increase LRAS

Supply-side policy

What is Supply-Side Policy?

Policy attempting to increase productive capacity of the economy

e.g. coorporation tax cuts, deregulation, education, training

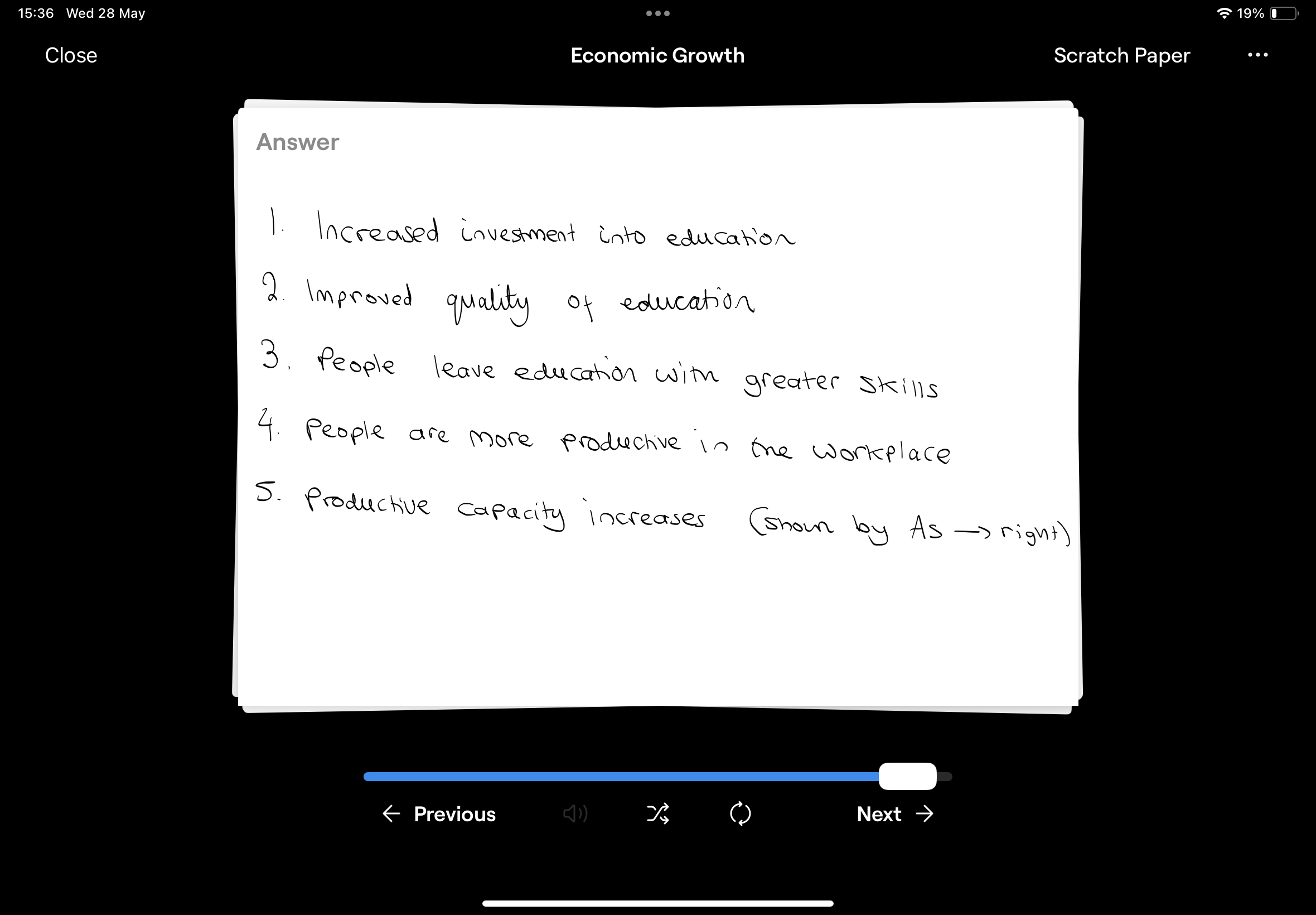

How is Supply Side Policy used in Education?

Increased investment in education

Improved quality of education

People leave education with greater skills

Increased productivity in the workplace as they require less training and are more skilled

Productive capacity increases (LRAS shifts right)