Chapter 5 (Externalities, Environmental Policy, and Public Goods)

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

Externality (5.1)

- Benefit/Cost that affects someone who is NOT DIRECTLY INVOLVED in the production/consumption of a good or service

- Similar to a side-effect

-

- +/- results in DEADWEIGHT LOSS

----- ^ ex of market failure

- eg: pollution

Private Costs

- Costs to firms that is the sum of the costs of production for a good/service

Social Cost

- Higher than Private Costs

- Includes both the private cost and the external cost of things like pollution

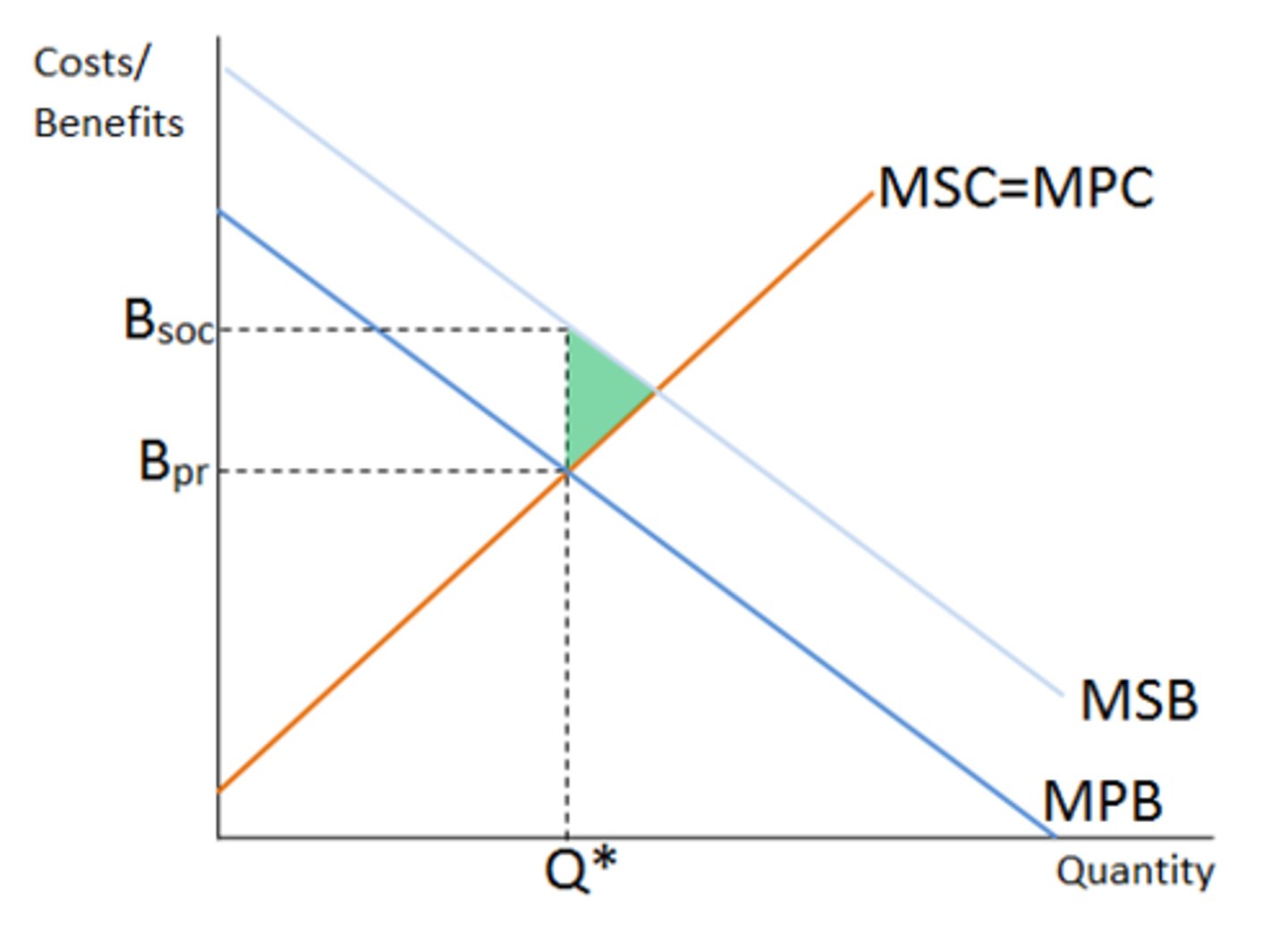

Positive Externality

- Social Benefits EXCEED Private Benefits

----- ex: college

Negative Externality

-

----- ex: second hand smoke

Private Benefit

- Benefit received by CONSUMER of a good/service

Social Benefit

- Total Benefit from consuming a good/service that includes BOTH the Private Benefit and ANY external benefit

Market Failure

- Situation in which the market fails to produce the efficient level of output

- Caused by deadweight loss

- Larger the externality, the greater likelihood the size of the deadweight loss (extent of market failure)

Cause of Externalities

- Includes: Incomplete Property Rights, difficulty of enforcing Property Rights in certain situations

Property Rights

- The rights individuals/businesses have to the exclusive use of the property

- Includes the right to buy/sell it

- Having good ______ avoids market failure

Externalities (ex)

- A Farmer and Paper Mill share a stream

- (1) No-one owns the stream:

----- Paper mill discharges waste into a stream making it unusable for the farmer

- (2) The Farmer owns the stream:

----- Has option to......

----- a) Prevent mill from discharging

----- b) Allow discharge but for a fee

Coase Theorem

- Private Solution to Externalities

- Works as long as PROPERTY RIGHTS ASSIGNED (doesn't matter to whom)

- Both parties have full information about costs/benefits

- Claims that Private Parties can SOLVE Externality Problem through PRIVATE BARGAINING

----- Property Rights are assigned/enforceable

----- Transaction costs are low

Net Benefit

Look at flashcard

Transaction Costs

- Costs in time/other resources that parties incur in the process of agreeing to/carrying out an exchange of goods/services

Government Policies and Externalities (5.3)

A tax of the right size can cancel out both...

--- 1. Inefficiency (deadweight loss)

--- 2. Reducing Production Efficiency

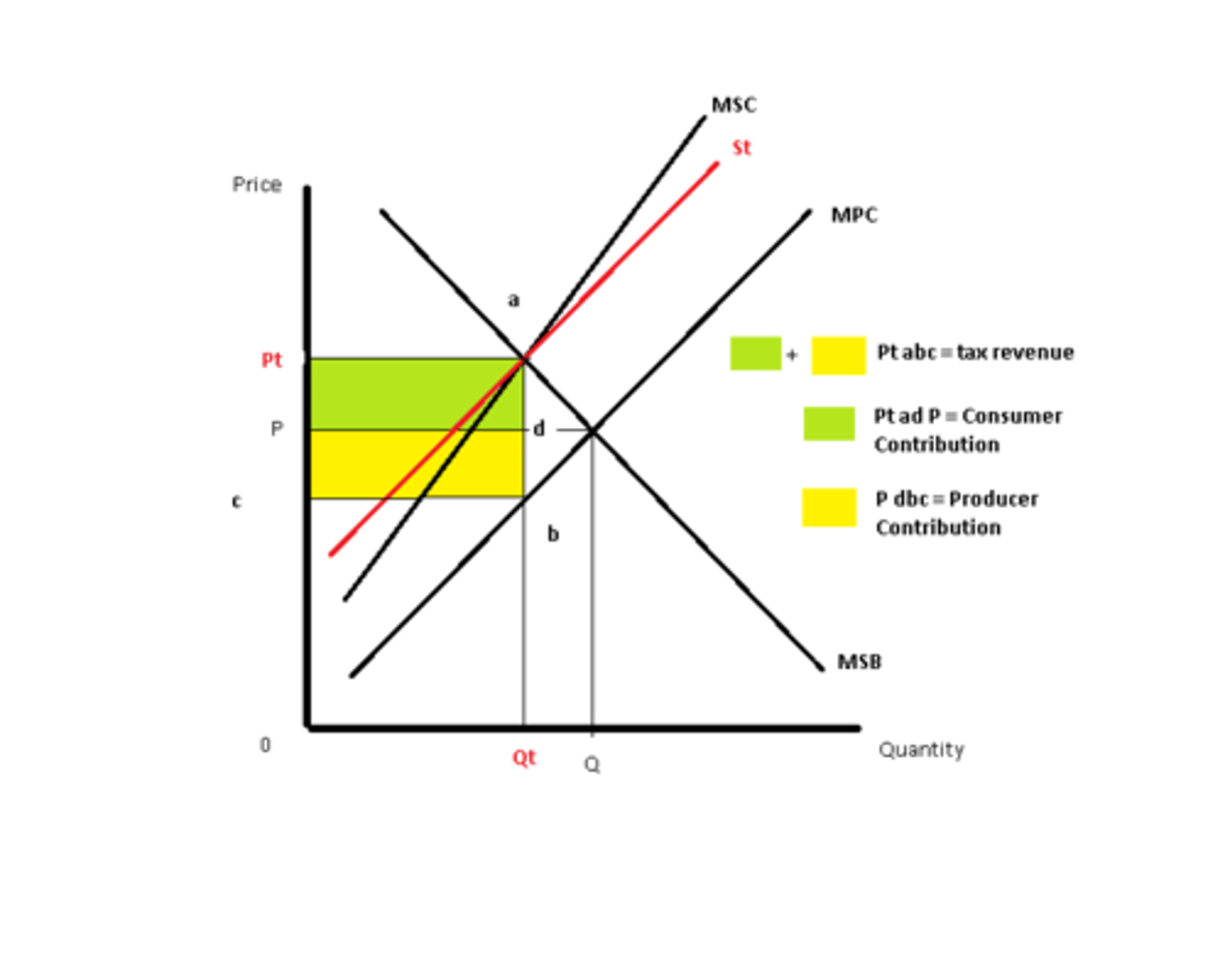

Corrective Taxes (negative externalities)

- Solves Negative Externalities:

----- p: too much being produced

----- s: taxes reduce amount of output

- Shifts SUPPLY curve UP

- Comes from the sum of both the marginal SOCIAL and PRIVATE cost (after tax)

- Equilibrium market QUANTITY FALLS to economically efficient level

Negative Externalities

- Situation in which TOO MUCH will be produced

----- OR -----

- Consumption is too high

- Shifts supply curve UP: Simply means supply will need to decrease to achieve efficient output. NOT that supply has decreased

Subsidies (positive externalities)

- An amount paid to producers/consumers to encourage either the production or consumption of a good

- Shifts DEMAND Curve UP

Positive Externalities

- Situation in which TOO LITTLE is produced

Pigovian Taxes and Subsidies

- Another name of "Corrective Taxes and Subsidies"

- Named after English Economis Arthur Cecil Pigou

- Use of taxes/subsidies used to bring an efficient level of output in the presence of externalities

Pigovian Tax

- Shifts DEMAND Curve DOWN

- Negative Externality = soda tax

- Look at flashcard

Command and Control

- Traditional solution to externality

- Involves government imposing QUANTITATIVE LIMITS or ALTERNATIVE SOLUTIONS

- Emission ex:

--- (1) limit pollution allowed to be emitted

--- or

--- (2) require firms to install Alternatives

Solving Externalities (ex)

Background:

--- Negative Externality; too much pollution

--- Ford is able to reduce pollution cheaply

--- GM has high pollution reduction costs

Proposed Solutions:

--- (1) Command and Control. Ask Ford to reduce pollution more than GM [Though efficient, not fair to Ford]

--- (2) Capitalize and Control. Most efficient and fair solution is to have Ford do more pollution reduction but have GM compensate Ford [Both companies are better off. Pollution reduction remains the same, even cheaper for Ford and GM

Cap and Trade

- Ability for firms to trade "responsibilities" as a solution to dealing with externalities

Cap and Trade (ex)

Background:

--- Government establishes an "allowable" amount of emissions

--- Emission permits are distributed

--- Some firms reduce emissions for less than others

Solution: (cap and trade)

--- Firms with high costs of reducing pollution will buy permits from firms with low costs. Ensures pollution is reduced at the lowest possible cost

--- Market used to achieve EFFICIENT pollution reduction

Categories of Goods (5.4)

(1) Private Goods:

----- Rival and Excludable

----- ex: Running shoes, Cups, etc.

(2) Common Resources:

----- Rival and NON-Excludable

----- ex: Fish in the sea, public pasture land

(3) Quasi-Public Goods:

----- NON-Rival and Excludable

----- ex: Cable TV, Toll Roads

(4) Public Goods:

----- NON-Rival and NON-Excludable

----- ex: National Defense, Court System

Rival

- Type of relationship between goods

- Situation that occurs when one person's consumption of a good means no one else can consume it

Excludability

- Type of relationship between goods

- Situation in which anyone who does not pay for a good cannot consume it

Markets and Goods

(1) Private Goods:

- Good. Works efficiently because the person making decisions about how much to purchase tends to be the only one benefiting from the good so only their preferences matter

(2) Common Resources:

- Not so good. Little Incentive to conserve. Leads to OVER-CONSUMPTION.

(3) Quasi-Public Goods:

- Profit-Maximization tends to lead too many people to be EXCLUDED

(4) Public Goods :

- Not so Good. FREE-RIDE. People can enjoy the benefits w/o playing for them

Market Demand Curves (Private Goods)

- Add HORIZONTALLY the QUANTITY of good demanded at each price by the consumer

Market Demand Curves (Public Goods)

- Add VERTICALLY the PRICE at which the consumer is willing to purchase at a quantity of the good

Efficient Production of a Public Good (4)

(1) Background:

---Where Supply and Demand Curves intersect

(2) Problem:

--- Finding Market DEMAND Curve can be difficult; no incentive to reveal willingness to pay for public goods

(3) Solution:

--- Use COST-BENEFIT Analysis to determine the correct level of Public Goods

Cost-Benefit Analysis

- Useful for understanding willingness to pay for public goods

- Study that compares the costs and benefits to society of providing a public good

Efficient Consumption of a Common Resource (2)

(1) Background:

--- These tend to be OVER-CONSUMED.

(2) Problem:

--- Consumption is RIVAL and NONexclusive

--- Negative Externality

(3) Solution:

--- PIGOVIAN Taxes; ideally make people pay for consumption

(4) Worst-Case Scenario:

--- Tragedy of the Commons

Tragedy of the Commons

(1) What;

---Situation where the Common Resource is OVERUSED

(2) When:

--- Pigovian Taxes cannot be enforced

--- Enforcing Property Rights isn't feasible

(3) Solution:

--- a. If geographic area is LIMITED and SMALL number of people involved, then...Access can be restricted through LAWS and NORMS

--- b. If geographic area/people involved is large, then... LEGAL RESTRICTIONS

Legal Restrictions

- A solution to "Tragedy of Commons"

- Legal Restriction of access to common goods

- eg: Taxes, Quotas, Tradable Permits on Access