Short Run Economic Fluctuations

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

49 Terms

potential output

the maximum output when an economy is reaching productive & allocative efficiency (full employment)

also called trend growth

actual output

fluctuates around potential output

→ short run economic fluctuations influence actual output

sticky prices

tendency of prices to remain constant/adjust slowly

flexible prices

prices that change and adjust more quickly than sticky prices

inflation rate

the percentage change in prices in a given time period

core inflation rate

eliminates volatile prices such as food and energy from the CPI

doesn’t fluctuate as much as it only includes the sticky prices of goods & services

better indicator

CPI

decompose CPI graph to obtain sticky and flexible price inflation graphs

fluctuations in the US inflation rate

1970s = OPEC oil, cost-push inflation

1992-2008 2% inflation target - called average price level targeting

Atlanta Fed

published their inflation analysis of sticky and flexible price inflation to eliminate noise and get a better ideas of the direction of travel of inflation

weighting?

when they use monetary policy tools they’ve put a greater emphasis on sticky prices unlike the UK and give sticky prices a 90:10 weighting in their decision

this is because flexible prices are quite misleading for central bank decision makers

what do firms set prices based on?

expected inflation

output

supply shocks

how does people’s expectations of inflation shape future inflation?

if high inflation is expected, individuals don’t delay purchases as it’s relatively cheaper now → demand pull inflation

rational consumers bring forward spending which creates self-fulfilling inflation

firms then adjust their nominal prices to maintain the same relative price (price of your goods relative to competitor prices)

modelling expected inflation

the expected inflation rate 𝛑^e will be the actual inflation rate 𝛑

as AD increases, there is greater demand for factor inputs into the production process and so costs rise, firms don’t absorb this due to the profit margin and so results in selling prices increasing

what determines expected inflation?

rational expectations

adaptive expectations

rational expectations

assume that inflationary expectations are the best possible forecasts based on all public information

eg actions & statements of the central bank

adaptive expectations

assume expectations are based on past inflation

modelling adaptive expectations

assume expected inflation equals the previous year’s inflation 𝛑(-1)

forecasting that inflation will equal past inflation is an easy shortcut relative to the time-consuming job of forecasting inflation based on all available information

the effect of output on firm’s pricing

in booms firms face increased marginal costs to increase output, which raises prices faster than usual

in recessions firms reduce production which reduces marginal costs and diminishing price increases

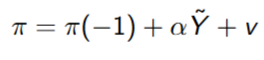

adding the effect of output, inflation equals expected inflation when output is at potential

when output rises above potential, inflation rises above expected inflation and vice versa

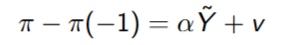

modelling the Phillips Curve

𝛑(-1) = adaptive expectations

α = how responsive prices are to changes in AD (larger = more sensitive) → affects stickiness of prices

Y = output gap

what does the Phillips Curve show?

shows the short run relationship between output & inflation

output & unemployment Phillips Curves are related through Okun’s Law (relationship that output has on unemployment levels in the economy)

shows that during an economic boom inflation rises and a recession reduces it

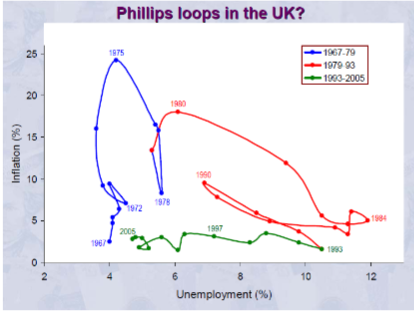

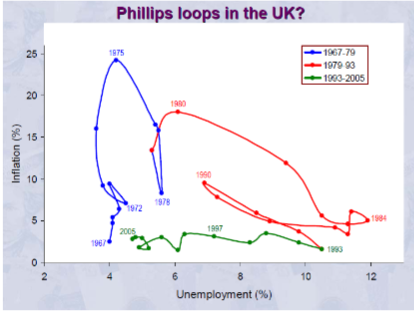

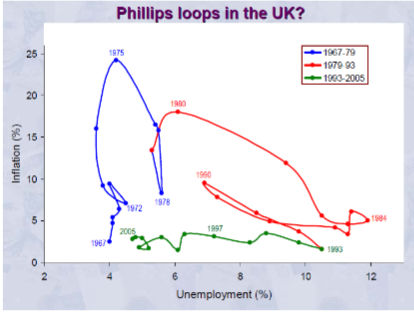

Phillips loop in the UK - first part

1967-79:

oil price shock doesn’t follow trend

stagflation

Phillips loop - second part

1992-2008:

great moderation/stability during the inflation targeting period

horizontal Phillips Curve

Phillips loop - third part

1992 onward:

flat curve due to it being the era of globalisation

UK joined EU and other trading blocs

became far more integrated and connected in the global economy

more free trade meant not resource constrained

supply shocks

an event that causes a major change in firms’ production costs which in turn causes a short run change in the inflation rate

denoted v

adverse supply shock

raises costs while a beneficial supply shock reduces them

what causes supply shocks?

caused by changes in raw material prices such as oil

caused by a jump in wages due to labour contracts

caused by exchange rate changes that change import prices

including supply shocks in the Phillips Curve

if there is no shock v = 0

if v = 2% eg the shock increases inflation by 2%

adaptive expectations version of Phillips Curve

shows that changes in inflation occur if there is an output gap or a supply shock

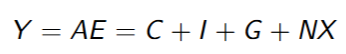

aggregate expenditure determinants

C = purchase of goods & services by individuals

I = purchases of physical capital

G = government expenditure on goods & services of their employees

NX = exports minus imports

role of r in determining aggregate expenditure

real interest rate r = the nominal rate minus expected inflation

affects AE since an increase in r reduces AE and vice versa

shift in monetary policy - effect of higher r on spending

consumption: encourages saving, lowers demand especially spending for durable goods

investment: more expensive to finance investment projects

net exports: reduces capital outflows, appreciates real er (SPICED) makes exports expensive to foreign consumers and imports cheaper for domestic consumers → reduces NX

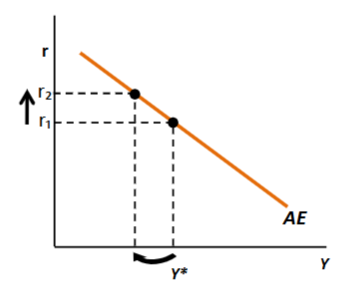

factors that cause positive expenditure shocks

outward shift of AE:

government spending on military

tax cuts

improved consumer confidence

new technology increases investment

how does this affect r?

if the central bank holds the real interest rate constant, equilibrium output rises from a level below potential to a level above potential

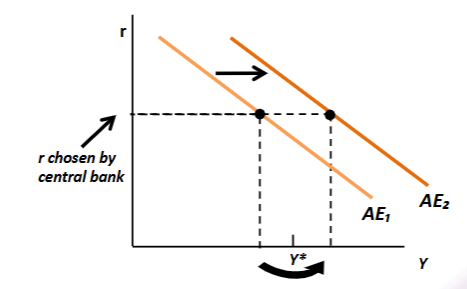

factors that cause negative expenditure shocks

inward shift of AE:

changes in bank lending may cause a credit crunch, reducing consumption

foreign business cycles affect other countries through demand for imports/exports

how does this affect r?

if the central bank holds the real interest rate constant, equilibrium output falls from a level above potential to a level below potentialcou

countercyclical monetary policy

output starts at potential and a positive/negative expenditure shock occurs

AE curve shifts but the central bank adjusts the real interest rate to keep output constant

→ lowers r to offset a negative expenditure shock

→ raises r to offset a positive shock

example of countercyclical monetary policy

Federal Reserve lowered its target federal funds rate from 5.25% in August 2007 to almost 0 in December 2008 to increase output

→ proved inadequate to return output to potential

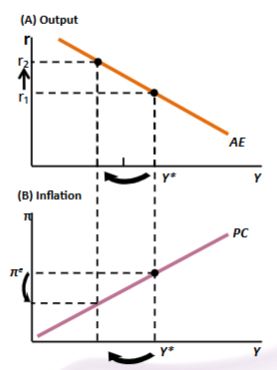

rise in r

starting at potential output and expected inflation, assume an increase in r from r1 to r2

→ higher r pushes output below potential

→ this then pushes inflation below expected inflation (𝛑^e)

→ policymakers can reduce inflation by raising r but at the cost of reduced output in the short run

accommodative monetary policy

decision by the central bank to keep the real interest rate constant when a supply shock occurs, allowing inflation to change

nonaccommodative monetary policy

decision by the central bank to adjust the real interest rate to offset a supply shock and keep inflation constant

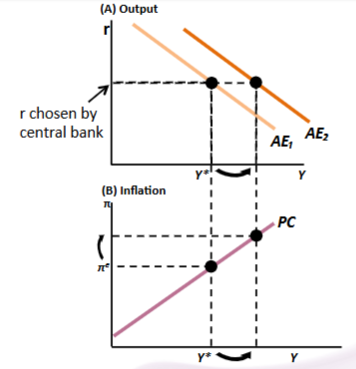

accommodative monetary policy & expenditure shock

output initially at potential

expenditure shock shifts AE curve outward

central banks uses accommodative monetary policy and hols r constant

output rises above potential

this causes inflation to be pushed above expected inflation

vice versa with adverse supply shock

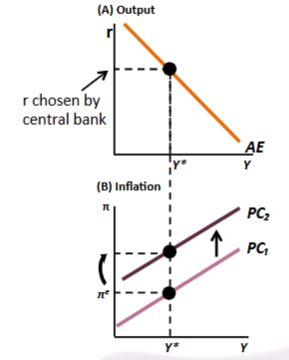

adverse supply shock with accommodative monetary policy

adverse supply shock causes Phillips Curve to shift upward

here central bank uses accommodative policy so output remains constant

with constant output the Phillips Curve raises inflation above expected inflation

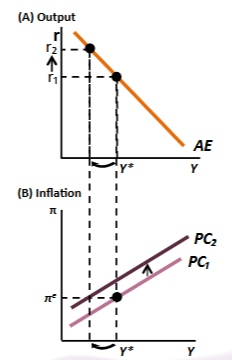

adverse supply shock with nonaccommodative monetary policy

to keep inflation at expected inflation, output must fall

respond to the adverse supply shock by raising the real interest rate

this reduces output which offsets shift in PC, keeping inflation at expected level

effects of accommodative monetary policy

allows a supply shock to raise inflation permanently even after the shock ends since the positive change in inflation increases the level of inflation into the future

effects of nonaccommodative monetary policy

keeps inflation constant and the fall in output is temporary as only a temporary increase in the interest rate is needed to keep inflation constant

long run monetary neutrality

principle that monetary policy cannot permanently affect real variables (variables adjusted for inflation)

→ long-run unemployment is independent of monetary policy

what are the types of long-run unemployment?

cyclical, demand deficient unemployment

→ these exist at the natural rate when output is at potential and so are independent of monetary policy

how can monetary policy create permanent change?

the only permanent effect of monetary policy is to change inflation and nominal values

→ monetary policy can affect actual output (Y) but not potential output (Y*)

effects of a permanent boom?

attempting to create a permanent boom in the economy (where output is above potential) is inflationary

→ continuous situation of rising inflation by stimulating the economy through low r, QE

→ ultimately continuous inflation is adverse for an economy in the long run as accelerating inflation forces the central bank to change its policy, causing wider economic problems concerning labour mobility and functioning of the economy