AP Econ

1/77

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

78 Terms

Labor Participation Rate =

#working/#working age population x 100

Unemployment rate =

#unemployed/work force # x 100

% change in GDP =

new GDP - old GDP/old GDP x 100

Consumer Price Index=

new market basket/base market basket x 100

GDP Deflator=

nominal GDP/Real GDP x 100

GDP (Expenditure approach)

C+I+G+Xn

GDP (Income approach)=

Wages + rent + interest + profit

MPS= (Marginal propensity to save)

1-MPC (Marginal propensity to consume)

spending multiplier=

1/MPS

Tax multiplier

1/MPS - 1 or MPC/MPS

Money Multiplier

1/reserve ratio

Real Interest Rate =

nominal interest - expected inflation

Quantity Theory of Money

M(quantity of money) x V(velocity of circulation)=P(price level) x Y(real GDP)

Increase in human capital causes

increase in economic growth

Increase in demand causes

increase in equilibrium price

Increase in supply causes

decrease in equilibrium price

Increase in consumer spending causes

increase in real GDP

Increase in interest rates causes

decrease in investment

Increase in inflation causes

Decrease in real wages

Increase in discouraged workers causes

decrease in unemployment rate

Increase in aggregate demand causes

increase in price level

Increase in short run aggregate supply causes

decrease in price level

Increase in government spending causes

increase in real GDP

Increase in taxes causes

decrease in disposable income

Increase in marginal propensity to consume causes

decrease in the spending multiplier

Increase in interest rates causes

decrease in bond prices

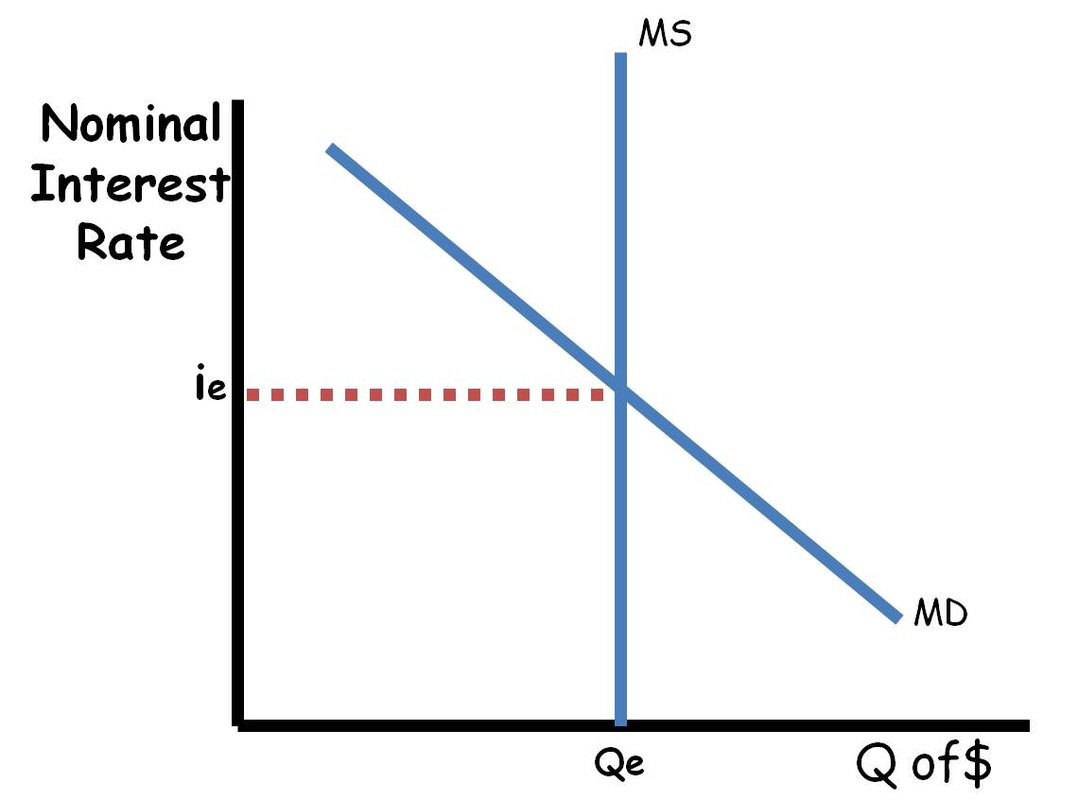

Increase in money supply causes

Decrease in nominal interest rates

Increase in reserve requirement causes

decrease in money supply

Increase in central bank purchasing bonds causes

increase in money supply

Increase in interest on reserves causes

decrease in aggregate demand

Increase in inflation causes

decrease in real interest rates

Increase in deficit spending causes

increase in real interest rates

Increase in deficit spending causes

Increase In real interest rates

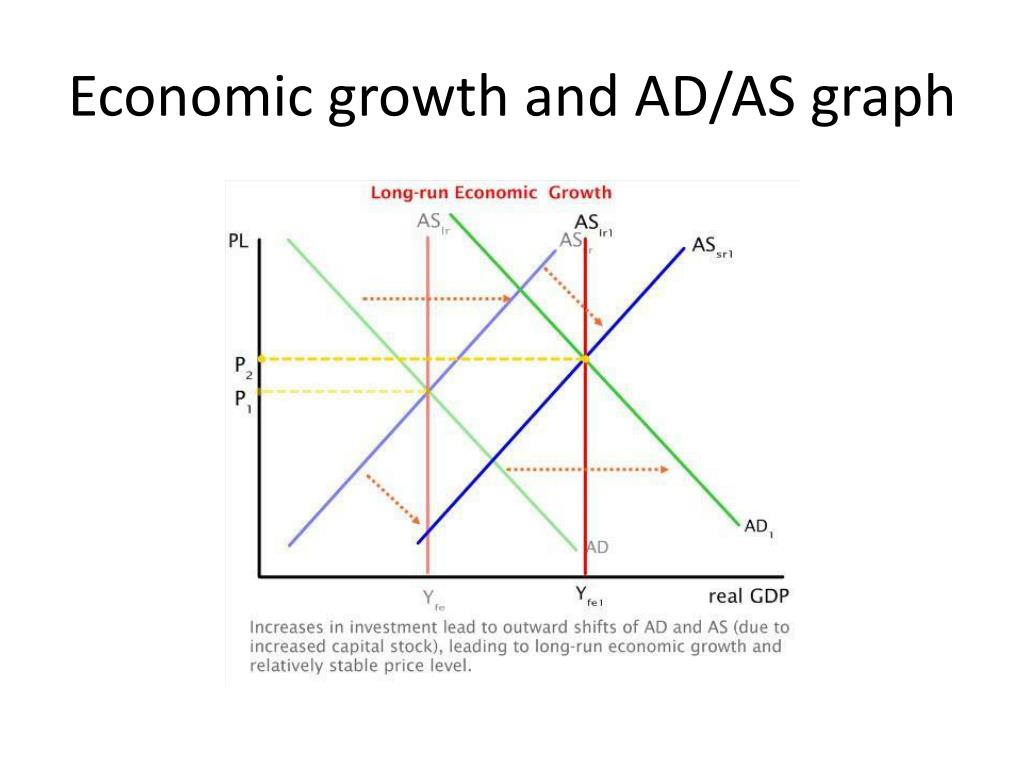

Increase in capital stock causes

Increase in economic growth

Increase in appreciation causes

decrease in net exports

Increase in interest rates causes

increase in net capital inflow

Comparative advantage

a country makes a good at a lower opportunity cost than another country

Investment

business spending on physical capital, never personal investing

Full employment

when there is only structural and frictional unemployment

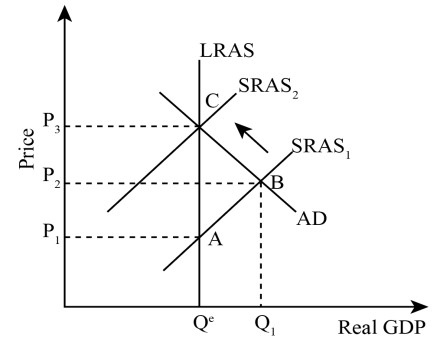

Long run self adjustment

when there’s a positive or negative output gap, SRAS will eventually shift

Fiscal policy

government changes government spending and/or taxes, which shifts AD

Monetary policy

when there are limited reserves, central banks can influence interest rates by changing the reserve requirement discount rate, or by doing open market operations, which shifts AD

Open market operations

buying and selling government securities to either increase or decrease the money supply (buying increases and selling decreases), when central banks buy or sell bonds

Crowding out

deficit spending leads to higher real interest rate and less investment

Capital inflow

High interest rates decrease investment but attract more foreign capital

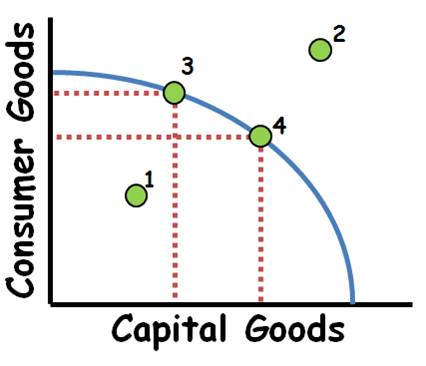

Production possibilities curve

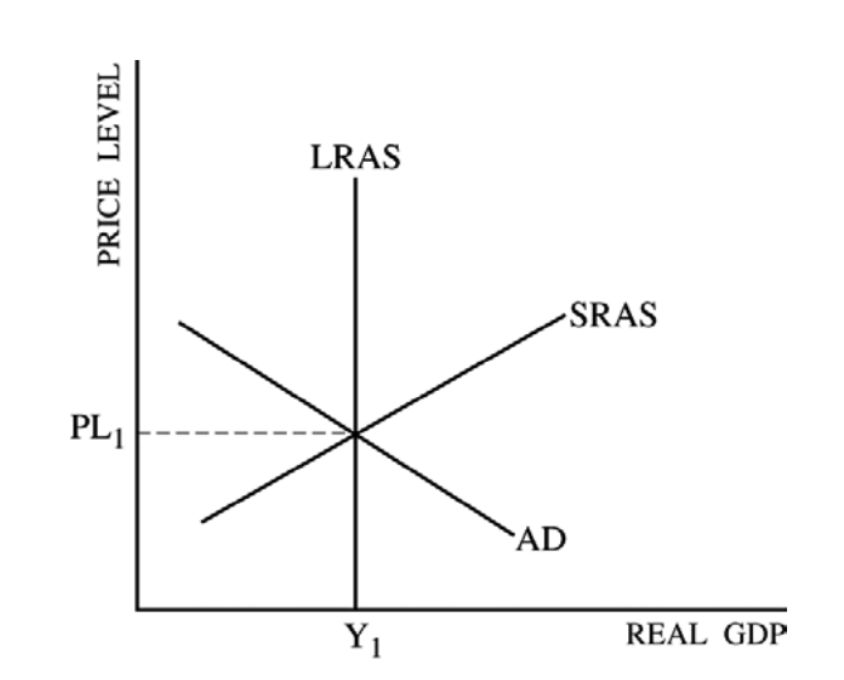

AD/AS (full employment)

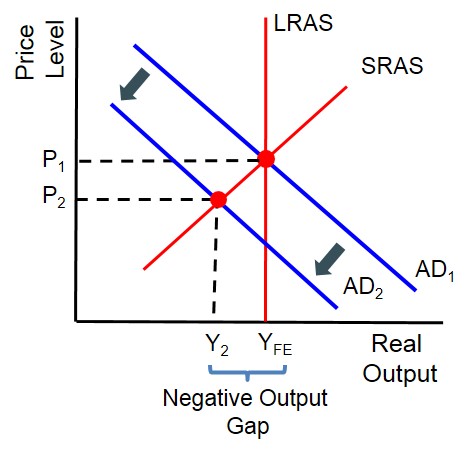

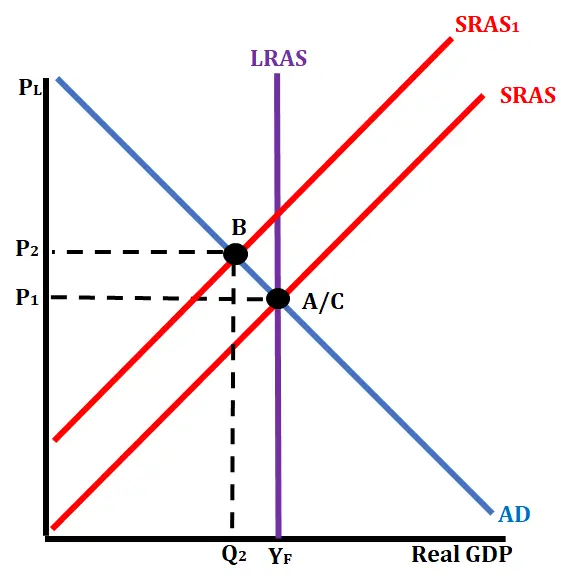

AD/AS negative output gap (equilibrium is left of LRAS)

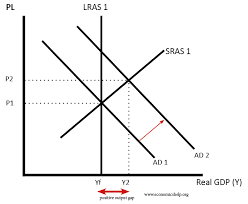

AD/AS positive output gap (equilibrium is right of LRAS)

AD/AS Recession self adjust (SRAS moves right, AD moves left)

AD/AS Inflation self adjust (SRAS moves left, AD moves right)

AD/AS economic growth (LRAS shifts right, AD and SRAS shifts right)

Money market

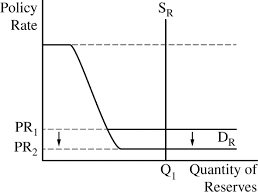

Reserve market

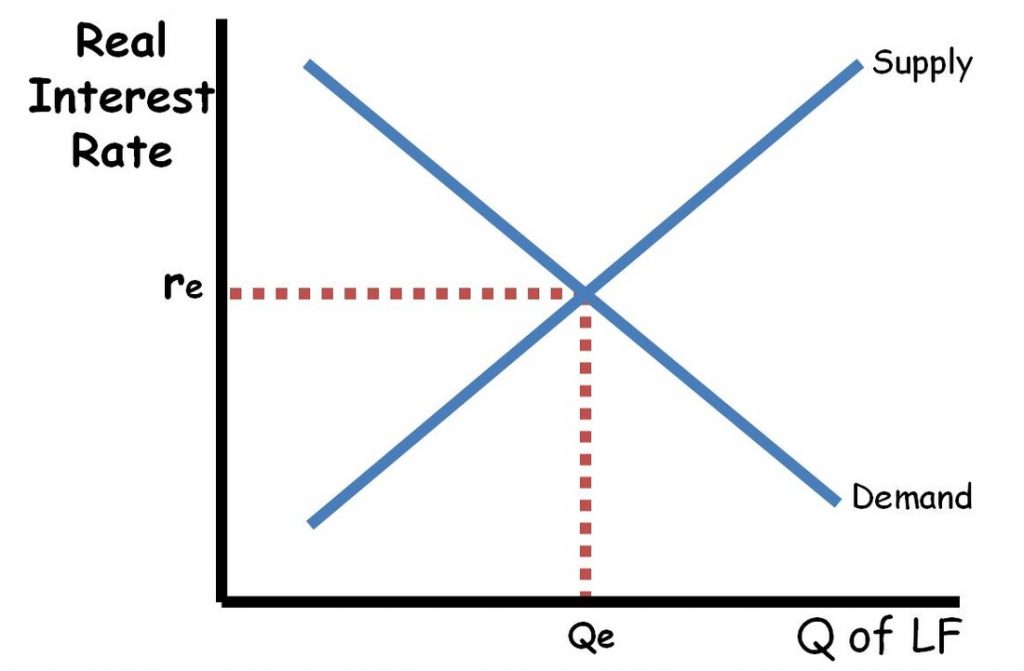

Loanable Funds

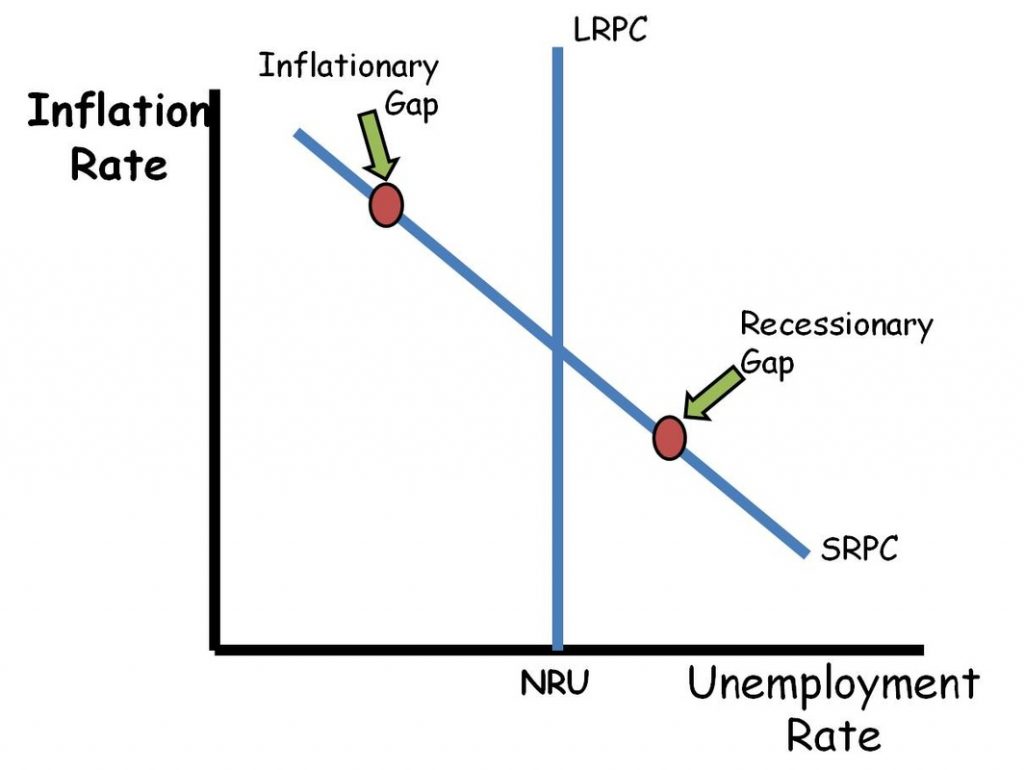

Phillips Curve

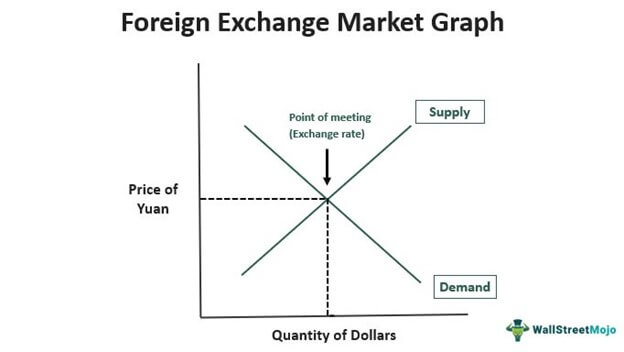

Foreign exchange

Change in price level

moves the point on the AD curve

Factors that shift AD to the right (increase)

increased consumer confidence, business optimism, increased government spending, tax cuts, reduced interest rates, increased net exports

Factors that shift AD to the left (decrease)

decreased consumer confidence, business pessimism, reduced government spending, tax increases, increased interest rates, decreased net exports

Factors that shift SRAS to the right

decreases in wages, increased productivity, decreased regulation, lower inflation expectations

Factors that shift SRAS to the left

increase in wages, increased energy prices, decreased productivity, increased regulation, higher inflation expectations

Shifts money supply curve right

Expansionary monetary policy: central bank increases money supply through open market operations, lowering RR, or lowering discount rate

Shifts money supply to the left

contractionary monetary policy: central bank decreases money supply by selling bonds, raising RR, or raising discount rate

Shifts money demand curve right

increase in real GDP, increase in price level

Shifts money demand curve left

decrease in the price level, decrease in real GDP, advancements in money technology such as more use of credit cards

Loanable funds supply curve shifts right

Increased saving, government policies that encourage savings, government policies that encourage investment, foreign investment

Loanable funds supply curve shifts left

decreased saving behavior, increased government deficit, decrease in financial security risk, decreased foreign investment

Loanable funds demand curve shifts right

increased borrowing, increased confidence (businesses and consumers expecting higher returns on investments), tax incentives, crowding out (government increases borrowing)

Loanable funds demand curve shifts to the left

decreased investment opportunities, reduced business confidence, economic slowdown, increased corporate tax rates

Long run Philips curve shifts right

Philips curve shifts are the same as Natural Rate of Unemployment shifts: increase in structural unemployment

long run Philips curve shifts left

decrease in frictional unemployment

Short run Phillips curve shifts right

all shifts are due to changes in AS, SRPC shifts the opposite direction of AS negative supply shocks shifting AS to the left, increased expected inflation shifting AS to the left

Short run Phillips curve shifts left

AS curve shifts right due to positive supply shocks or decreased expected inflation

Exchange rate increases

decrease in money supply due to tightening monetary policy, this causes appreciation

Exchange rate decreases

increase in the money supply due to central banks increasing the amount of money in circulation, leading to depreciation

Money demand shifts right in foreign exchange

increase in demand for that country’s currency, foreign countries with higher incomes, higher interest rates, supply decrease

Money demand shifts left in foreign exchange

decrease in the demand for the currency, decrease in foreign income, decrease in foreign prices, negative investor sentiment