Intro to Short-Term Economic Fluctuations

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

Recession/Contraction

A period in which the economy is growing at a rate significantly below normal

A period during which real GDP falls for two or more consecutive quarters

A period during which real GDP growth is well below normal, even if not negative

A variety of economic data are examined

Depression

a particularly severe recession

Peak

the beginning of a recession

high point of the business cycle

Trough

the end of a recession

low point of the business cycle

Expansion

a period in which the economy is growing at a rate significantly above normal

Boom

strong and long lasting expansion

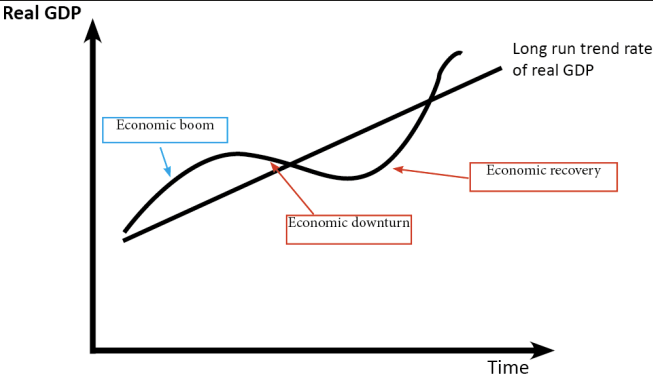

Long Run vs Short Run

Monthly Indicators to Date Recessions

Real personal consumption expenditures

Non-farm employment

Real after-tax household income

Why does Cyclical Unemployment rise during Recessions?

Decrease in unemployment lags the recovery

Real wages grow more slowly for those employed

Promotions and bonuses are often deferred

New labour market entrants have difficulty finding work

What does Inflation generally do during a Business Cycle?

decreases and at other times as well

Potential/Full-Employment Output (Y*)

The maximum sustainable amount of output that an economy can produce

Use capital and labour at greater than normal rates and exceed Y*

for a period of time

Grows over time

Actual output grows at a variable rate

Reflects growth rate of Y*

Variable rates of technical innovation, capital formation, weather conditions, etc.

Actual output does not always equal potential output

Output Gaps

The difference between the economy’s actual output and its potential output, relative to potential output, at a point in time

Policy makers consider stabilization policies when there are output gaps

Output Gap in Percent

Y – Y* Y*

Recessionary Gap

a negative output gap; Y* > Y

Capital and labour resources are not fully utilized

Output and employment are below normal levels

mean output and employment are less than their sustainable level

Expansionary Gap

a positive output gap; Y* < Y

Higher output and employment than normal

Demand for goods exceeds the capacity to produce them and prices rise

High inflation reduces economic efficiency

lead to inflation

Natural Rate of Unemployment, u*

the sum of frictional and structural unemployment

when cyclical unemployment is 0

occurs when Y is at Y*

Frictional Unemployment

Short-term unemployment related to matching of workers and jobs

Structural Unemployment

Long-term chronic unemployment in normal conditions – perhaps skills are outdated

Cyclical Unemployment

The difference between total unemployment, u, and u*

Recessionary gaps have u > u*

Expansionary gaps have u < u*

Okun’s Law

Relates cyclical unemployment changes to changes in the output gap

One percentage point increase in cyclical unemployment means a 2 percent widening of a negative output gap, measured in relation to potential output

Why does the Economy adjust slowly to changes in Aggregate Demand?

because of sticky wages and prices, due to:

long-term contracts

menu costs

coordination problems

morale effects of wage cuts

Why don’t Markets instantly correct Output Gaps?

time needed to reach equilibrium

firms change prices infrequently due to menu costs

frequent changes confuse customers

firms produce based on current demand, not equilibrium

In the long run, what determines the level of output in the Economy?

the economy’s productive capacity, not spending

Self-Correcting Mechanisms

Firms eventually adjust to output gaps

If spending is less than potential output, firms will slow the increase of their prices

If spending is more than potential output, firms increase prices

Potential inflationary pressures

Eventually in the long-run, prices reach equilibrium and eliminate output gaps

Production is at potential output levels

Output is determined by productive capacity (capital and labour)

Spending influences only price levels and inflation (monetarism point of view)

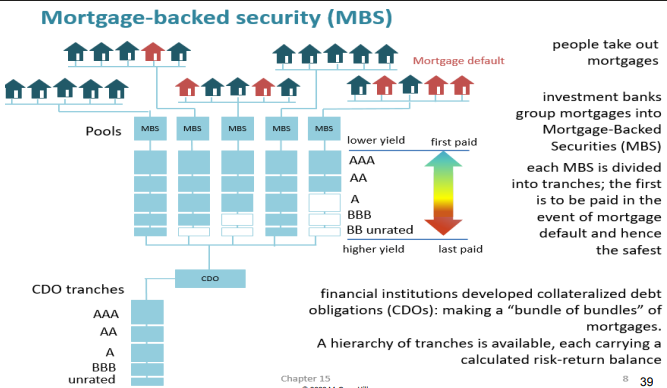

Mortgage-Backed Security

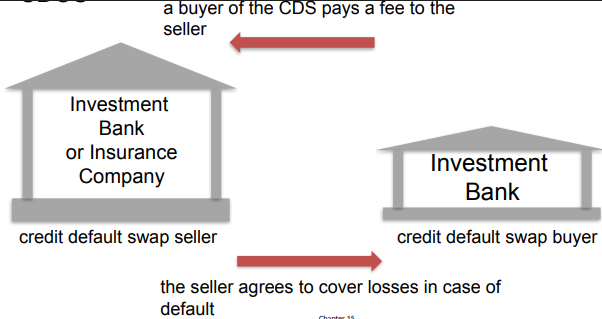

Credit Default Swap

a security that is effectively an insurance policy against defaults related to MBS and CDOS

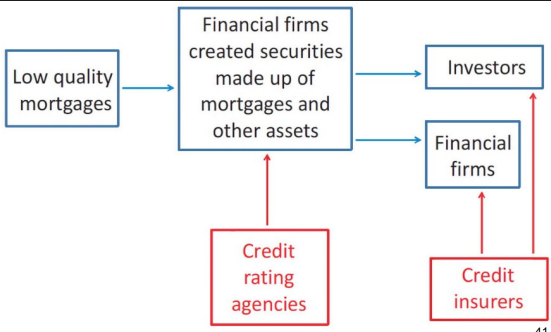

Subprime Mortgage Securitisation

Financial Panic

occurs when providers of short-term credit (depositors in a bank) suddenly lose confidence in the ability of the borrower (the bank) to repay; providers of short-term credit then quickly redraw their funds

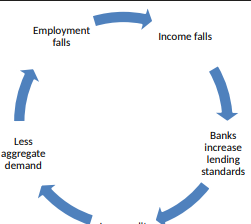

Viscous Recessionary Spiral

Criticism of Financial Regulations

bills create significant costs for financial firms, slowing down business and job creation

legislation is too complex

legislation has been “watered down” by lobbying efforts

How to Redirect Finance to the Goal of Increasing Overall Benefits to Society

limit speculative activities of banks

ban overly complex products or risky products

ask investors to pay a modest tax on financial transactions (Tobin tax)