ACCT 2301 All Questions

1/242

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

243 Terms

Ch 1

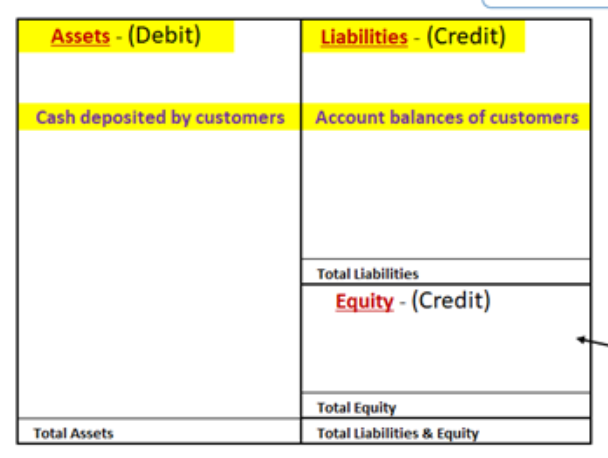

The accounting equation is:

Assets = Liabilities + Equity

True or False

True

Ch 1

Accounts Receivable are an asset.

True or False

True

Receivable = smth (usually cash) will be received in the future.

Ch 1

Accounts Payable are debts owed by the business entity.

True or False

True

Payable = smth (usually cash) will be paid by the corp. in the future

Ch 1

Assets are increased with a

a. Debit

b. Credit

a. Debit

Ch 1

Liabilities are increased with a

a. Debit

b. Credit

b. Credit

Ch 1

The accounting equation can be expressed as

Assets - Liabilities = Shareholder’s Equity

True or False

True

A = L + E

A - L = E

Ch 1

The accounting equation can be expressed as

Assets + Shareholder’s Equity = Liabilities

True or False

False

Should be A - E = L

Ch 1

If Assets total $10,000 & Liabilities are $4000, Equity must be $14,000.

True or False

False

A = L+E

A - L = E

10000 - 4000 = 6000 ✅

Ch 1

Dividends a company pays reduce net income.

True or False

False

Dividends are a distribution of profits paid to the shareholders.

Dividends do not affect net income.

Dividends directly reduce retained earnings.

Ch 1

The Financial Accounting Standards Board (FASB) is the authoritative body that has primary responsibility for developing accounting principles.

True or False

True

The FASB do not have any enforcement authority.

FASB was given the power to set accounting standards for publicly traded companies by the SEC.

Ch 1

The Securities Exchange Commission (SEC) has regulatory authority over all corporations.

True or False

False

The SEC regulate publicly traded companies.

Ch 1

The primary role of accounting is to provide many different users (stakeholders) with financial information needed to make economic decisions.

True or False

True

Ch 2

The Cash account is increased with a

a. Debit

b. Credit

a. Debit

Ch 2

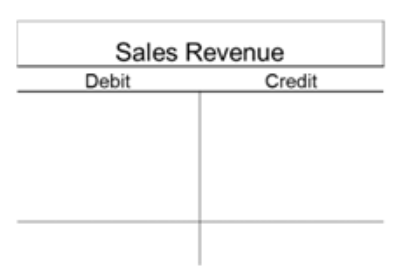

The Sales Revenue account is increased with a

a. Debit

b. Credit

b. Credit

Ch 2

The Equipment account is increased with a

a. Debit

b. Credit

a. Debit

Ch 2

The Loan Payable account is increased with a

a. Debit

b. Credit

b. Credit

Ch 2

The chart of accounts should be the same for each business.

True or False

False

Ch 2

To determine the balance in an account, always subtract credits from debits.

True or False

False

If the normal sign is a debit, then debits - credits.

If the normal sign is a credit, then credits - debits.

Ch 2

To determine the balance in an account which has a normal credit balance. always subtract debits from credits.

True or False

True

If the normal sign is a credit, then credits - debits.

Ch 2

Both debits & credit entries are posted to accounts like Cash & Inventory.

True or False

True

Ch 2

The Inventory account may have a credit balance.

True or False

False

Inventory is under Assets (Debit)

Ch 2

Revenues - Expenses = Net Income

True or False

True

If Assets total $30,000 & Equity is $21,000, Liabilities must be $9,000.

True or False

True

A = L + E

A - E = L

30000 - 21000 = 9000 ✅

Ch 2

Providing services to a customer increases revenue which increases equity.

True or False

True

Ch 2

The Inventory account is decreased with a credit when a product is delivered to a customer.

True or False

True

Ch 2

The transactions that have been “journalized” are “posted” to the general ledger.

True or False

True

Ch 2

Revenue & Liability accounts are increased with a debit.

True or False

False

They are increased with a credit.

Ch 2

Consuming goods & services in the process of generating revenues results in expenses.

True or False

True

Ch 2

Debiting the asset account “Accounts Receivable” will increase the account.

True or False

True

Ch 2

The expense account “Rent Expense” may have a credit balance.

True or False

False

It has a debit balance.

Ch 2

If inventory is purchased “on account,” the liability is credited to Accounts Receivable.

True or False

False

The liability is credited to Accounts Payable.

Ch 2

Revenue & liability accounts are increased with a debit.

True or False

False

They are increased with a credit & decreased with a debit.

Ch 3

An account in its simplest form has three parts to it: a title, an increase side, & a decrease side.

True or False

True

Ch 3

The Common Stock account appears in which area of the financial statements.

a. Asset

b. Liability

c. Equity

d. Revenue

c. Equity

Ch 3

The Salaries account appears in which area of the financial statements.

a. Asset

b. Liability

c. Revenue

d. Expense

d. Expense

Ch 3

The Sales account appears in which area of the financial statements.

a. Liability

b. Equity

c. Revenue

d. Expense

c. Revenue

Ch 3

The Loan Payable account appears in which area of the financial statements.

a. Asset

b. Liability

c. Equity

d. Revenue

b. Liability

Ch 3

The Inventory account appears in which area of the financial statements.

a. Asset

b. Liability

c. Revenue

d. Expense

a. Asset

Ch 3

The Interest Income account appears in which area of the financial statements.

a. Asset

b. Equity

c. Revenue

d. Expense

c. Revenue

Ch 3

The Note Receivable account appears in which area of the financial statements.

a. Asset

b. Liability

c. Revenue

d. Expense

a. Asset

Ch 3

The Retained Earnings account appears in which area of the financial statements.

a. Asset

b. Liability

c. Equity

d. Revenue

c. Equity

Ch 3

An adjusting entry would adjust revenue so it is reported when earned and not when the cash was received.

True or False

True

Revenue is recognized when earned.

Ch 3

Salary & wage expenses are recorded when the cash is direct deposited into their bank accounts.

True or False

False

The expenses must be recorded in the period that the employee performs the services.

Ch 3

Salaries & Wages are recorded as expenses only when the employee receives their paycheck.

True or False

False

Expenses are recognized when incurred/used.

Salaries & Wages are incurred when the employee provides their services to the business.

Ch 3

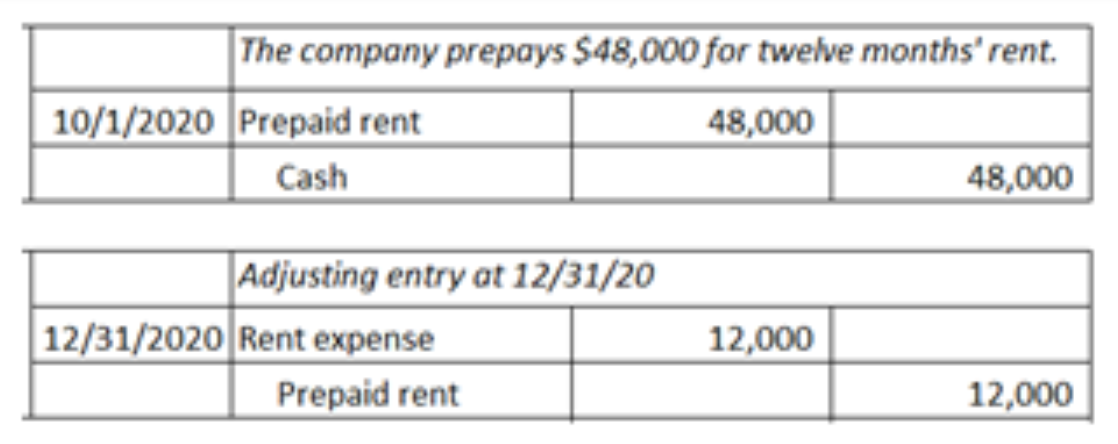

A company pays $48,000 for twelve months' rent on October 1, recording the prepayment as an asset. The adjusting entry on December 31 is a debit to Rent Expense, $12,000, and a credit to Prepaid Rent, $12,000.

True or False

True

Ch 3

A company buys a laptop for $3,600 on January 2nd. It plans to use the laptop for 3 years. It depreciates equipment using straight line (same amount of depreciation each year). The adjusting entry on December 31st is a debit to Depreciation Expense, $1,200, and a credit to Accumulated Depreciation.

True or False

True

⭐️ Ch 3

The matching concept:

a. addresses the relationship between the journal and the balance sheet

b. determines whether the normal balance of an account is a debit or

credit

c. states that expenses related to revenue be reported at the same time

the revenue is reported

d. requires that the dollar amount of debits equal the dollar

amount of credits on a trial balance

c. states that expense related to revenue be reported at the same time

Ch 3

Microsoft receives your payment for a 12 month subscription to Office 365. For Microsoft, this is a/an

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

c. unearned revenue

Ch 3

You pay Microsoft for a 12 month subsciption to Office 365. For you (the customer), this is a/an

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

a. prepaid expense

Ch 3

A company agrees to reimburse travel expenses next month for a business trip completed this month by an employee. For the company, this is a/an

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

d. accrued expense

Ch 3

A customer is interested in buying a soon to be released new version of an iPhone and pays for the phone in advance. From the customers’ point of view, this is a/an

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

a. prepaid expense

Ch 3

A customer is interested in buying a soon to be released new version of an iPhone and pays for the phone in advance. From the retailer’s point of view, this is a/an

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

c. unearned revenue

Ch 3

Retainers received in cash by a law firm in advance of providing legal services is an example of

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

c. unearned revenue

Ch 3

A law firm has provided legal services to a client but has not invoiced/billed the client. This is an example of

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

b. accrued revenue

Ch 3

Paying three months of rent in advance is an example of

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

a. prepaid expense

Ch 3

On December 31st a calendar year corporation owes employees for services performed during the last week of December.

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

d. accrued expense

Ch 3

Expenses result from selling services or products to customers.

True or False

False

Revenue is the result of selling services/products to customers.

Expenses are incurred/generated to provide the services.

Ch 3

Prepaid expenses are an expense & appear on the income statement.

True or False

False

Prepaid expenses are an asset on the balance sheet.

Prepaid expenses have future value.

Ch 3

When a business receives a bill from the utility company, no entry should be made until the invoice is paid.

True or False

False

GAAP requires the company be on the “accrual basis.”

Expense recognition cannot be delayed until the expense is paid.

Ch 3

An example of deferred (unearned) revenue is Unearned Car Insurance Premium Revenue on an insurance company’s balance sheet.

True or False

True

Ch 3

If the adjusting entry to recognize expired prepaid auto insurance at the end of the period is inadvertently omitted, insurance expense will be understated and net income overstated.

True or False

True

Ch 3

The difference between the balance of a fixed asset account and the balance of its related accumulated depreciation account is termed the book value of the asset.

True or False

True

Ch 3

Accumulated depreciation is reported on the income statement.

True or False

False

Accumulated depreciation is a “contra asset” account.

Ch 3

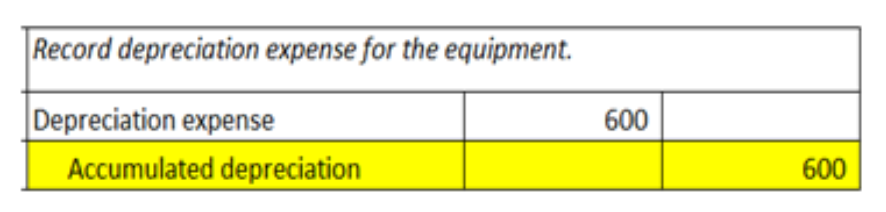

A company depreciates its equipment $600 a year. The adjusting entry on December 31 is a debit to Depreciation Expense, $600, and a credit to Equipment, $600.

True or False

False

The depreciation expenses is accumulated in the Accumulated depreciation “contra asset” account.

Ch 3

Office Furniture is an example of a current asset.

True or False

False

> 12 months is long term

Ch 3

Inventory is reported as a current asset.

True or False

True

Ch 3

Accrued expenses to be paid next month are listed on the balance sheet as a current asset.

True or False

False

Accrued expenses to be paid next month are current liabilities.

Ch 3

A company pays $12,000 for twelve months' rent on November 1st, recording the prepayment as an asset. The adjusting entry on December 31 is a debit to Rent Expense, $2,000, and a credit to Prepaid Rent, $2,000.

True or False

True

The asset prepaid rent is reduced each month by the amount of the rent for that month.

Ch 3

The company debits cost of goods sold when it buys merchandise to resell to its customers.

True or False

False

The company debits inventory when it buys merchandise.

The company debits Cost of Goods Sold when it sells merchandise,

Ch 3

Accruals are needed when:

an unrecorded expense has been incurred or

an unrecorded revenue has been earned.

True or False

True

Ch 3

Generally accepted accounting principles require cash‐basis accounting.

True or False

False

Must be accrual basis.

Cash basis doesn’t capture all of the economic activity.

Ch 3

The revenue recognition principle states that revenue should be recorded only when the cash is received from the customer.

True or False

False

Revenue recognized when earned. When the cash is received cannot be the rule since cash received in advance creates the liability unearned revenue and sales on account generate revenue before the cash is received.

Ch 4

The amount of the net income appears on both the income statement and the balance sheet for that period.

True or False

False

Net income appears on the Income Statement and the Statement of Changes to Equity becuz it is part of the changes to retained earnings.

Ch 4

Assets, liabilities, & stockholders’ equity accounts are permanent accounts & do not get closed at the end of the period.

True or False

True

Ch 4

Inventory will not appear on the post-closing trial balance.

True or False

False

Ch 4

Sales Revenue will not appear on the post-closing trial balance.

True or False

True

Ch 4

The matching concept:

a. requires that the dollar amount of debits equal

the dollar amount of credits on a trial balance balancing

b. states that expenses related to revenue be

reported at the same time the revenue is reported matching

c. addresses the relationship between the journal

and the balance sheet

d. determines whether the normal balance of an

account is a debit or credit

b. states that expenses related to revenue be reported at the same time the revenue is reported matching

Ch 4

The Unearned Revenues account is an example of a liability.

True or False

True

The unearned revenue must be “earned” before it can be recognized on the income statement.

Ch 4

The expense account “Salaries Expense” may have a credit balance.

True or False

False

Ch 4

Prepaid Supplies are an example of a temporary account since the supplies are used up in a short time.

True or False

False

Prepaid supplies are not zeroed out.

This is a balance sheet account.

Ch 4

When an account receivable is collected in cash, the total assets of the business increase.

True or False

False

Cash increases

Accounts receivable decreases

Total assets stays the same

Ch 4

Revenue - Expenses = Net Income

True or False

True

Ch 4

Microsoft receives a cash payment in advance for cloud services is an example of

a. prepaid expense

b. accrued revenue

c. unearned revenue

d. accrued expense

c. unearned revenue

Ch 4

A company’s accounts payable represents an amount that the company will collect from customers.

True or False

False

Accounts payable represents an amount the company must pay to its vendors/creditors.

Ch 4

The amount of the net income appears on both the income statement & the balance sheet for that period.

True or False

False

Net income appears on the income statement & the statement of changes to retained earnings (on statement of changes to equity)

Ch 4

Assets, liabilities, & stockholders’ equity accounts are permanent accounts & do not get closed at the end of the period.

True or False

True

Ch 4

Cash and other assets that are reasonably expected to be realized in cash, sold, or consumed through the normal operations of a business more than one year after the balance sheet date are called current assets.

True or False

False

> 12 months are long term

Ch 4

The accounting equation can be expressed as

Liabilities = Assets + Shareholder’s Equity

True or False

False

A = L + E

A - E = L

Ch 4

To determine the balance in an account, always subtract credits from debits.

True or False

False

If normal sign is a debit, debits - credits.

If normal sign is a credit, credits - debits.

Ch 4

A credit to the cash account will decrease the account.

True or False

True

Cash is an asset & the normal sign is a debit.

Increase cash with a debit & decrease cash with a credit.

Ch 4

Both debits & credit entries are posted to accounts like Accounts Receivable & Accounts Payable.

True or False

True

Ch 4

Debiting the asset account “Equipment” will increase the account.

True or False

True

Ch 4

Crediting the revenue account “Rent Income” will increase the account.

True or False

True

Ch 4

Inventory has a normal debit balance but it can have a credit balance?

True or False

False

A company cannot deliver more items than it bought/received.

Ch 4

If Equity is $12,000 & total Liabilities are $4000, then total Assets must be $16,000.

True or False

True

A = L + E

16000 = 4000 + 12000 ✅

Ch 4

The updating of accounts when financial statements are prepared is called the adjusting process.

True or False

True

Example: Cash - checking account fees.

Ch 4

Cost of Goods Sold

a. debit

b. credit

a. debit

Ch 4

Accounts Payable

a. debit

b. credit

b. credit

Ch 4

Cash

a. debit

b. credit

a. debit

Ch 4

Prepaid Expenses

a. debit

b. credit

a. debit