Tax Planning - CPWA

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

36 Terms

Define the formulas for regular federal income tax calculations

Recall the income and deduction limitations on each interest classification

Add together all income to determine gross income

Make certain adjustments to get AGI

These adjustments are “above-the-line”

IRA, alimony payment, student loan interest, tuition and fees, moving expenses, one-half of self-employment tax, HSA, 401k, losses from sale of property, rental expenses

Subtract standard or itemized deduction plus the allowable exemptions - itemized deductions are below the line

This is taxable income

Next taxable income is computed, the tax is generally determined by referring to the tax tables

Subtract any credits to determine tax liability

Apply tax requirements and safe harbors to an individual tax situation

You pay at least 90% of the tax you owe for the current year, or 100% of the tax you owed for the previous tax year, or. You owe less than $1,000 in tax after subtracting withholdings and credits.

Define the formulas for the AMT

taxable income +/- AMT adjustments + AMT preference items = AMTI (alternative minimum taxable income)

AMTI - exemption amount (subject to phaseout) = AMT Base

AMT base x AMT rate = preliminary AMT

26% on first $232,600

28% on amounts above $232,600

Preliminary AMT - tax credits = tentative AMT

Tentative AMT - regular tax = AMT due

AMT Exemptions and tax rates

Exemption amount - $133,300 for MFJ

Exemption phaseout begins - $1,218,700 for MFJ

AMT Rates

26% for amounts up to $232,600 for MFJ

28% above that for MFJ

AMT adjustment and preference items

Start with taxable income

Add or subtract adjustments including:

standard deduction

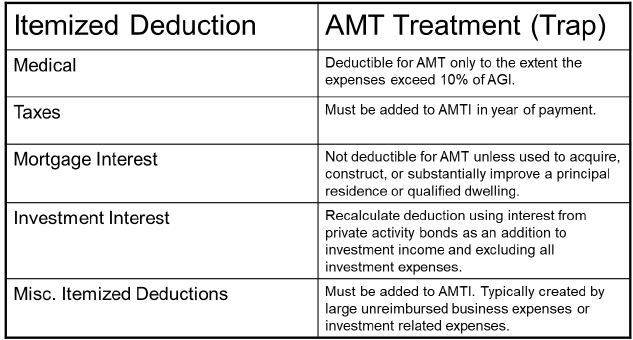

certain itemized deductions - medical expenses over a threshold percentage, investment interest expense, refund of state income taxes, private activity bond interest, ISO spread

depreciation

tax refunds

ISOs

Add tax preference items including:

tax-exempt bond interest from certain private activity bonds

excluded gain on sale of qualified small business stock

Results in AMTI

charitable not added back, mortgage interest not added back

Define the common components of the tax calculation that would trigger the use of the AMT tax

You have an income above the AMT exemption (see above). The 2017 TCJA reduced five out of the seven regular tax rates but it held AMT rates at 26% and 28%. This combination could potentially cause high income taxpayers to end up owing AMT.

You exercise incentive stock options (i.e., ISO’s) to buy stock at a discounted strike price. This is not a taxable event for regular tax purposes but is for AMT purposes.

You have a high ratio of long-term capital gains to ordinary income. This trigger would only affect people with incomes of more than $1 million combined. A potential scenario would be a business owner who sold a business that had appreciated steeply over a period of 25 to 30 years. While qualified dividends and long-term capital gains are still taxed at preferential rates of 15 to 20%, large amounts of such income may cause the phase out of the alternative minimum tax exemption and indirectly cause the AMT to apply to other income.

You earn income from specific sources. Incentive stock options, intangible drilling costs, tax-exempt interest from certain private activity bonds (PAB) and depletion and accelerated depreciation on certain leased personal or real property may all prompt the alternative minimum tax.

Evaluate a client profile for indicators that the AMT will be used

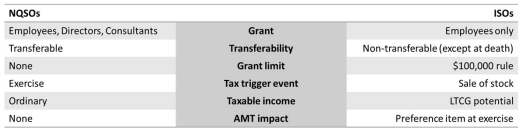

ISOs - treated like NQSO - value of stock acquired at time of exercise in excess of exercise cost creates positive AMT adjustment

tax exempt interest from private activity bonds

Develop strategies to avoid or minimize AMT and/or maximize the use of AMT credits

moving income into an AMT year

moving deductions into a non-AMT year

timing the recognition of adjustments or preference items

making elections to minimize the AMT

List interest expense classifications and applicable limitations including the treatment of mortgage expense

qualified residence

principal or second residence

$750k principal maximum, older higher amounts grandfathered in

Define the terms passive and active income

passive activity - any activity that involves the conduct of a trade or business in which the taxpayer does not “materially participate” or any rental activity

Material participation - participation on a regular, continuous and substantial basis - pass 1 of 7 tests

List interest expense classifications and applicable limitations including the treatment of investment interest on business activities

interest incurred as part of a trade or business is deductible in the same manner as any other business expense

passive activity - interest accrued on debt of pass activity is passive activity interest expense

Explain the difference between qualified and non-qualified dividends

Generally, qualifying dividends are dividends paid by domestic corporations and qualified foreign corporations (a foreign corporation’s dividends would normally qualify provided the corporation was not in a country designated as a “tax haven”).

Qualified divs are granted to entities that pay tax on income at the entity level to avoid double taxation.

Dividends which do not qualify for the lower tax rate

include:

divs paid by credit unions, mutual insurance companies, tax-exempt organizations, REITS, and ESOPs

divs paid on a stock that was not held for more than 60 days during the 120-day period beginning 60 days before the ex-dividend date

Explain wash sale rules

taxpayer sells a security at a loss and within a period beginning 30 days before the sale and ending 30 days after the sale, they buy a substantially identical security, the loss will not be allowed

The loss for those shares is added to the basis of the new shares (300 shares in the new purchase meaning you take the previously allowed loss for those 300 shares ($5 per share) and add that to the basis of the new shares ($33 + $5 = $38))

Recall the tax rates for short capital gains/losses and long-term capital gains/losses

Short-term capital gains are generally taxed at the individual's ordinary income tax rates, which range from 10% to 37% based on the taxpayer's income level. Long-term capital gains, on the other hand, are taxed at reduced rates, typically either 0%, 15%, or 20%, depending on the income level of the taxpayer.

Describe how short-term gains/losses and long-term gains/losses offset each other

short-term gains/losses are netted against each other.

long-term gains/losses are netted against each otherand then the resulting net gain or loss is used to offset any capital gains of the opposite type. If there are excess losses, they can be used to offset up to $3,000 of ordinary income per year.

Recognize the tax liability of the exercise of executive ISO stock options

The exercise of Incentive Stock Options (ISOs) can lead to Alternative Minimum Tax (AMT) liability, as the difference between the exercise price and the fair market value of the stock at exercise is considered an adjustment for AMT purposes.

However, if the shares are held for the required period, gains may qualify for favorable long-term capital gains treatment upon sale.

Explain the relationship of holding periods, basis, timing to options tax treatment

Compare and contrast the tax treatment of ISOs and NQSOs

Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NQSOs) are taxed differently upon exercise and sale. ISOs may qualify for favorable long-term capital gains treatment if certain holding periods are met, while NQSOs are taxed as ordinary income upon exercise.

Explain the common tax implications of exercising NQSOs

Upon exercise, NQSOs result in ordinary income tax on the difference between the exercise price and the fair market value of the stock. Additionally, any gains from subsequent sales are taxed as capital gains.

Properly characterize income to the individual tax-payer based on the nature of the pass-through entity

non-taxable to partner to extent of basis; usually capital gain thereafter

Describe passive loss limitations and carry-forward rules

net losses can be carried over forever

losses deductible to the extent there is passive income

Describe the treatment of passive losses and the disposition of passive activities

Describe the tax basis rules and gains from disposition as they apply to pass through entities owned by individuals

Identify strategies to defer gains on various property transactions, including like-kind exchanges and sales of certain small business stock

transfers property to another party and in exchange receives property that is similar

no gain or loss recognized of equivalent value

holding period of relinquished asset usually carries over

only apply to real property held for productive use in a trade or business or for investment

1031 - exclusively for real estate

Other strategies:

negotiate installment sale

use of opportunity zones

Compare the risks and benefits of like-kind exchanges and sales of certain small business stock

Deductions

Itemized - Medical, interest, charitable, casualty, SALT

Business losses - sale or exchange of property for less than basis

Net operating loss (NOL) - business deductions exceed income, unused NOL can be carried forward by most taxpayers

Simple Trust

required to distribute all income annually

no charitable contributions

does not distribute principal

each year, benes are deemed to receive all income

benes report the income

trusts deduct all income deemed distributed

Complex Trust

trustee may have the discretion to accumulate or distribute income

benes may receive mandatory or discretionary distributions

trustee may have the discretion to distribute corpus or income accumulated in prior years

trust may provide for charitable contributions

Grantor trust

grantor and trust are considered same person for income tax code

grantor pays the income tax on all trust income

most coming is revocable living trust

avoids probate

provides privacy

NIIT

$250k married, $200k single

The NIIT is 3.8% of the lesser of:

a taxpayers’ net investment income or

the amount by which the taxpayer's AGI exceeds the applicable threshold

First, identify items included in gross income that

fit the Code definition of “investment income.”

2. Second, identify deductions properly allocable

to that income to determine the amount of “net

investment income.”

3. The final step—assuming the applicable

threshold for the imposition of the tax has

been crossed—is to multiply the NIIT rate of

3.8 percent by the lesser of:

a. net investment income (as calculated in the

second step), or

b. the difference between the taxpayer’s

adjusted gross income and the applicable

threshold.

Modified AGI

add back Foreign earned income

Basis of a gift

original owner basis carries over

take on holding period of donor

If gift declines in value & sell for less than FMV of gift, basis is FMV when it was acquired

Sell it in-between original basis and FMV when acquired - no gain or loss

Section 1202 Stock - qualified small business stock

can exclude 100% of gain, up to the greater of $10 million or 10X basis realized on disposition of qualified small business

must be founder of company

held more than 5 years

must have purchased stock at issuance

total assets must not exceed $50 million

cannot be personal service business, usually C corp

for AMT purposes, 7% of the excluded gain must be added back

(1), 50 percent of the gain on disposition is excluded if the

QSBS was acquired before February 18, 2009. The American

Recovery and Reinvestment Tax Act of 2009 raised

the Section 1202 exclusion percentage from 50 percent to

75 percent for QSBS acquired after February 17, 2009 but

before September 27, 2010. The Small Business Jobs Act of

2010 then amended Section 1202 to exclude 100 percent

of the gain from the sale or exchange of QSBS acquired

between September 27, 2010 and January 1, 2011. Then,

in 2015, the Protecting Americans from Tax Hikes Act

(“PATH Act”) made permanent the exclusion of 100 percent

of the gain from disposition of QSBS acquired after

September 27, 2010 and held for more than five years.

Investment interest expense

only deductible to extent of net investment income

carryforward is unlimited

Tax-free stock sale

II. tax consequences of a tax-free sale include no tax to the seller at the time of the transaction

IV. tax consequences of a tax-free sale include the exchange being tax free but the seller will be taxed when he or she sells the new shares.

Mezzanine Financing

This method of financing is usually a private placement often used by smaller companies that may involve higher levels of leverage than junk bonds. Additionally, this type of financing usually takes the form of unsecured, subordinated debt or preferred stock.