Corporate Finance Midterm (new)

1/66

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

67 Terms

Dupont Analysis (Goal(3) + Written/Number Formula + Driven by what)

Goal: To show whether ROE is coming from 1) Profitability 2) Efficiency or 3) Leverage

Formula(s):

ROE = Net Income / Avg. Equity

Dupont ROE = (1) Profit Margin x (2) Asset Turnover x (3) Equity Multiple

Dupont ROE = (NI / Revenue) x (Revenue / Avg. Assets) x (Avg. Assets / Avg. Equity)

Takeaway:

ROE can be driven by:

1. Change in Operation Side (profit margin & asset turnover)

2. Change in Financial Leverage (equity multiple)

Effect of Equity Multiple on ROE

Equity Multiple amplifies ROE:

Losses are bigger

Wins are bigger

This can be seen through ROE = ROA (1 + D/E)

if debt is higher → ROA is higher by a multiplied factor → ROE is higher

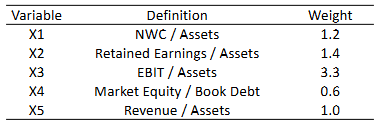

Financial Ratios & “Z-Score” of Bankruptcy Risk (What ratios used? Why? - 5)

5 ratios used:

NWC / Asset → Captures Liquidity

R.E. / Assets → Captures Retained Profit

EBIT / Assets → Profitability

Market Equity / Book Debt → Market Sentiment on Leverage

Revenue / Assets → Sales Efficiency

Z-score = weighted avg → on formula sheet.

yes, widely used, but no: not up-to-date! shouldn’t be 100% trusted

What is change of cash? (3 factors, what they break down into)

Change of Cash = Operating CF + Investing CF + Financing CF

Breaks down to cash inflows & outflows:

Operating CF: Net Income + Non-Cash Expenses - Change in NWC

Investing CF: - PP&E (capex) → cash outflow

Financing CF: Change in LTD + Change in CS - Dividends

What is Net Income? Break it down (4 steps)

Net Income = Revenue - COGS - Operating Expenses - Interest Expenses - Taxes

Step by step:

Gross Profit = Revenue - COGS

Operating Income (EBIT) = Gross Profit - Operating Expenses

EBT = EBIT - Interest Expense

Net Income = EBT - Taxes

Valuation (Definition, 3 steps, What do we have to consider about the firm?)

Def: Estimating Cash Value today (PV) based on stream of future cash flows

3 steps:

Estimate our cash flows (C0,C1,C2)

Estimate our discount rate (how risky the project is)

Sensitivity & Scenario Analysis →

Have to consider whether firm is levered or unlevered:

Leveraged firms amplify “r”

Unlevered Firm (Def, significance, Value = ?)

Def: Firm or project financed entirely with equity

Significance:

ALL cash flows belong to firm’s shareholders & is reflected in equity value

No interest expenses

Profits (after taxes) belong to shareholders

Vu = PV (CF to shareholders)

Vu = Equity

Levered Firm (Def, Significance, Value=?)

Def: Firm that is financed with both equity & debt

Significance:

Leveraged Firms amplify Shareholder Returns

VL = PV (CF to Shareholders) + PV (CF to Creditors)

VL = E + D

ROE & Re (Def + Connection + For what firm?)

For a Levered Firm

ROE = Return on Equity = (NI / Avg. Equity)

Re = Cost of Equity

Connection:

If ROE > Re: Firm is generating value for shareholders! (earning more than required)

If ROE < Re: Firm is destroying value (not meeting investor expectations)

Explain: “Leveraged Firms amplify Shareholder Returns”

Leveraged Firms amplify Shareholder Returns:

If firms owns more than cost of debt → shareholders earn higher returns (Ra > Rd → ROE > ROA)

If firms owns less → shareholders lose more (Ra < Rd → ROE < ROA)

Why?:

Debt holders pay fixed interest, so remaings profits/losses are borne by shareholders

This is linked w/ creditors not having to deal with business risk.

Enterprise Value (Def + Formula + Application)

Def: Firm’s EV is value of core operating assets excluding cash.

EV = V - C

Where V = E + D - Cash

Market Value of Equity

Market Value of Debt (if available, book value if not)

Cash & Cash-equivalents

Application:

Acquisitions

“D-C” shows net debt → uses the excess cash to “pay off debt” before buying company. Shows true value of company

What does Vu = E actually mean?

Shows intrinsic value of Equity.

What does EV consist of? (2 - breaks down)

Market Value of Assets:

Enterprise Value of Core Assets

Value of Non-Core Assets

Market Value of Liabilities & Equity:

Equity Value

Debt Value

Debt-Equivalents Value

Minority Interest Value

Preferred Equity Value

********* NOT DONE Minority Interest Value (Appears when?, significance)

Appears when a firm owns a majority of another firm’s equity.

Valuation Approaches (5):

DCF / NPV

Internal Rate of Return vs. Hurdle Rate

Payback & Discounted Payback Period

Multiples (relative valuation)

Adjusted PV

DCF of Risky Project (risky cash flows)

In case of risky cash flows:

C1 is the expected value

Ex: (0.5) x ($100,00) + (0.5) x ($40,000)

“R” is the risk-adjusted return → relevant

Should reflect SYSTEMATIC risk.

Through CAPM

Common mistakes that Managers make in Capital Budgeting

Overconfidence:

Overconfident in estimation of Cash Flows (C1, C2, …) & risk-adjusted “r”.

Could lead to “razor thin margins” → no room for error

Overoptimistic:

Believes their cash flow (C1, C2, …) is much better than it actually is.

Fudge Factor (Def, Significance)

Def: A way to “counter balance” over estimation of NPV by increasing risk adjusted “r”.

Significance:

Does NOT work.

Since “r” is already super sensitive, it just muddies the whole point.

Valuation Issues when Capital is Abundant

Lazy Screening Process: Lax in screening projects

Empire Building: Making acquisitions for little to no benefit just to be bigger → can actually cause large losses to shareholders

Manager’s pet projects

Tax Deductible meaning

Reduces taxable income

Developing FCF Forecasts for a Project

Focus on incremental FCF (change in firm’s FCF if it takes the project)

Revenues & Costs:

impute externalities on other projects

impute all opportunity costs

ignore sunk costs

include only additional overhead expenses

Corporate Taxes

Required Investment

Depreciation

Salvage value of assets at end of life of the project

Changes (or investment) in NWC

Externalities (2 types + Examples)

Positive Externality:

Indirect Reduction of costs (ex: discounts on purchases of materials)

Indirect increase in revenues (ex: more people buying ice cream from zoo → new giraffe)

Negative Externality:

Indirect increase in costs (ex: congestion at warehouse)

Indirect decrease in revenues (ex: cannibilization)

Opportunity Cost (Def + Examples + When does it happen)

Def: forgone income that could’ve been used elsewhere

Happens when:

Project needs limited resources to operate.

Example:

Forgone rent

Forgone crop in a field

Forgone use of talent (key staff member)

Sunk Cost (Def, examples)

Def: Costs already incurred prior to launching project; can’t be recovered.

Ex:

Cost of R&D, advertising, feasibility studies

Salvage Value when Assets are sold (2, breaks down)

Sale < Purchase Price (3):

Sale Price = Residual Book Value

No adjustments needed

Sale Price > Residual Book Value

Recaptured Depreciation

Tax of MTR * (Sale - Residual Book Value)

IMPORTANT: Only captures up to original cost

Sale Price < Residual Book Value

Capital Loss

Tax of MTR * (Book Value - Sale)

Sale Price > Purchase Price > Residual Book Value (broken down to 2 steps)

Sale > Purchase Price

Capital Gain

0.5 * MTR * (sale - purchase)

Purchase Price > Residual Book

Recaptured Depreciation

MTR * (Purchase Price - Residual Book)

Salvage Value “Factors”

Sale Price

Purchase Price

Residual Book Value (salvage)

What type of cash flow does NWC show?

It shows the cash flow required for operations

**** NOT DONE Relationship between CapEx & Depreciation?

2 phases of a infinite life project & its significance

Initial Phase

Steady Phase

Significance: Used to find Terminal Value in Steady state

Terminal Value Calculation (2)

Intrinsic Terminal Valuation with growth: FCFt+1 / (r-g)

Relative Terminal Valuation:

TV = FCFt * Mt

TV = SalesT * Mt

is used to compare other businesses; hence “relative”

Stock Beta is higher based on what type of risks:

Business Risk:

Operates in a cyclical sales cycle

High fixed costs (OPERATING leverage)

Financial Risk:

Leverage amplifies business risk

Does high fixed cost (a business risk) amplify risk?

Yes, it acts very much like leverage

Rf & CAPM relation (takeaway)

Higher Rf → Higher E[Ri]

Lower Rf → Lower E[Ri]

Meaning:

Lower Rf → Cheaper capital!

Does Risk-Free rate capture time value of money?

yes

What does Cost Of Capital depend on? (3) (double check again, i think this is only for equity)

Risk Free Rate: (Rf)

Risk Premium of i: (Beta * (Rm-Rf))

Financial Leverage:

Levered Firm has higher fixed interest payments → leads to lower EBIT → Higher vlolatility against market

Does Idiosyncratic risk affect cost of capital?

NO! Only systematic risk

How do we calculate Market Risk Premium? (Rm - Rf) What is the benefit of this?

Historical Average of Rm - Current Rf

Benefit:

No need for adjustments

How do you calculate Cost of Capital for Levered Firm?

CAPM hehe

Project vs. Firm Cost of Capital

For a project, the discount rate has to adjust for the opportunity cost.

Should you always use Rwacc for every project? Why?

No. ANSWER WHY

You use Rwacc only for projects that are similar in risk to the firm’s existing operations. If the project’s risk differs, you adjust the discount rate to reflect that difference — otherwise, you misvalue the project.

Must make sure same business risk & financial risk!

If a project has similair business + financial risk, can we use their Rwacc?

yes

How do you get cost of capital with (1. same d/e or 2. different d/e)

Easy case - comparable firms all have same D/E ratio:

Estimate Betas

take avg Beta

Plug into CAPM & get E[Ri]

Annoying case - comparably firms have different D/E ratio:

Lever / unlever beta & average

Plug into CAPM & get E[Ri]

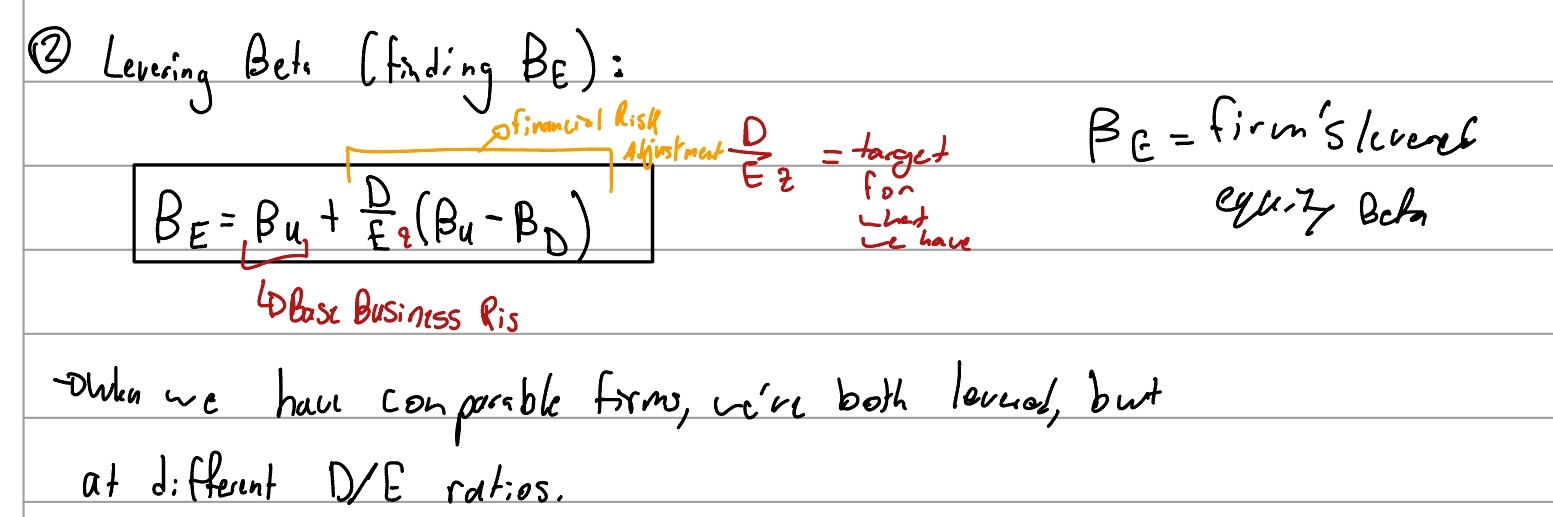

Delevering Beta - (Goal + When to use + Formula)

When delevering Beta you are solving for Bu.

Goal: Strip the effects of financing of a levered’s firm to show pure business risk.

When to use: You have Be

Formula:

Be = (D/V)*Bd + (E/V)* Be

Levering Beta - (Goal + When to use + Formula)

When levering beta you are solving for Be. (Beta of Levered Equity)

Goal: to convert equity beta to the D/E that we need

What is Be?

Firm’s Levered Equity Beta

IRR & Hurdle Rates (Whats the bad thing we do? + Decision Rule)

For IRR, we do a bad thing and use a single hurdle rate for all projects.

Rhurdle = Rwacc

IRRp >= Rh → same as Rwacc

What is Bd if debt is risk-free?

Bd = 0!

Relative Valuation (Def + Requirements to compare (4))

Def: Method that relies on looking at existing comparable assets

Must be:

Publically traded

Similair Cash Flows

Similair Risk

Similair Growth Potential

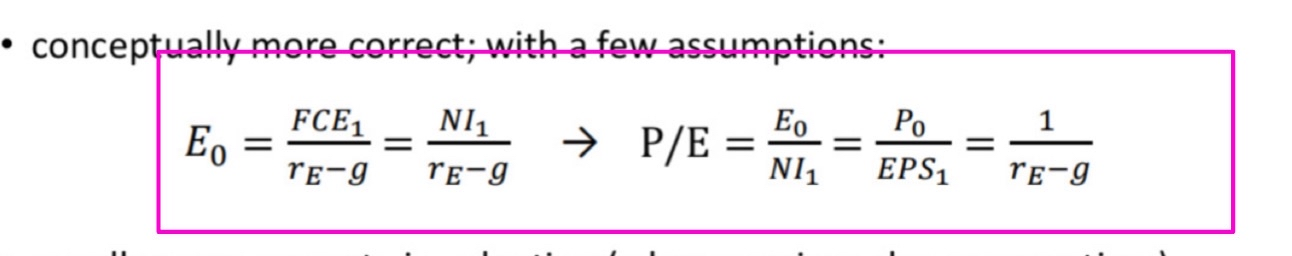

P/E: Estimating Equity Value & Enterprise Value (steps)

Get Equity first → Multiply P/E by Net Income

P/E = (Market Equity / Net Income) * Net Income

Get Enterprise Value Second → Add Debt minus Excess Cash

Market Equity + Debt - Cash = Enterprise Value

EV/EBITDA: What are you finding? (steps)

First Find EV → Multiply by EBITDA

EV/EBITDA * EBITDA → EV

Second find Equity Value → add excess cash, minus debt

EV + Cash - Debt = Equity

Do both multiples give the same answers?

No. EV/EBITDA and P/E do not give the same answers.

Advantage / Disadvantages of Multiples. When is it used?

When is it Used?:

As a quick estimate to see if doing the DCF analysis is worth it.

Advantage:

Easy to use

Gives quick estimates

Disadvantage:

Since it’s “relative” valuation: choice of comparable firm is subjective.

Easily manipulated

Forward vs Trailing Multiples

Forward Multiples:

Use next year estimated NI & EBITDA instead of this years.

Better to use!

Trailing Multiples:

Uses last years estimation of NI & EBITDA

** DONT KNOW WHAT THIS MEANS: Forward Multiples Assumptions

Multiples - How to choose Comparable Firms?

Where to start?:

Key competitors → usually annual report

Firm with same industry classifications

Focus on pure plays when possible

Pure play: only one line of business

Pure Play Definition

Only in one line of business! → sales all come from one type of service/good.

Ex: Lucid Motors → only focuses on EV production

Not Pureplay: Tesla → offers energy generation, software, batteries, etc.

Which multiple do we choose? (4 factors to consider: P/E vs EV/EBITDA)

Factors to consider:

Firms w/ different amounts of Excess Cash:

EV/EBITDA: ✅ Adjusts for changes

Captured in EV = Equity + Debt - Excess Cash

P/E: ❌ Ignores them

Shows higher equity.

Firms w/ different financial leverage:

EV/EBITDA: ✅ Adjusts for changes

Captured in EV = Equity + Debt - Excess Cash

Captured in EBITDA = does not include interest

P/E: ❌ Distorted

Includes interest in Net Income → equity lower than it should be

Market Equity reflects

Firms w/ a lot of Machines (capital intensity):

EV/EBITDA: ❌ Ignores differences in depreciation

P/E: ✅ Net Income includes depreciation

Firms w/ different accounting methods:

EV/EBITDA:✅ When depreciation is the same

P/E: ❌ Distorted, earnings differ w/ calculation of depreciation.

Is P/E ratio reliable when comparing firms with different financial leverage?

NO!

Do NOT use P/E if firms have different leverage.

Where is tax benefit of Depreciation caught vs. tax benefit of Interest Expense?

What is taxable income?

Revenue - Costs - Depreciation

Statutory vs Effective Tax Rate

Statutory Tax Rate: % of earnings (EBT) before taxes a firm should pay by law

Effective Tax Rate: % of EBT the firm actually pays after accounting for tax breaks.

Te = Tc * [(EBT - special tax breaks) / EBT]

Financial Planning Model (What does it need to consider to grow? What is it’s goal?)

To grow considers:

Financial Requirement (how much money it will need)

Financing Options (how it will get that money)

Goal: Builds a forward-looking plan that links:

Growth assumptions (g)

Financing

Operations

Extra Financing Needed (formula)

EFN = Assets - (Liabilities+ Equity)

EFN = Increase in Assets - Addition to R.E. - Increase in CL

What do you do w/ Excess Financing?

Anything that decreases Equity + Liabilities:

Pay back LT debt

Pay dividends

Buy back shares

Store Cash