Balance of Payments

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

19 Terms

Explain the Balance of payments on current account

The balance of payments on current account is the difference in trade between goods and services imported and exported as well as the balnce of income flows and transfer

-Made up of four areas:

-Trade in goods

-Trade in services

-Income flows

-Transfers

What is the Trade in goods and services refer to?

What does the Uk tend to have?

-This is the difference between goods and services exported and those imported

-The Uk tends to have a trade deficit on goods and a trade surplus on services

What does Income flow refer to?

-Where Uk investors are earning interest on investments they have abroad

-OR when Foreign investors receive interest on investments in the Uk

What are Transfers?

-Transfers takes into account things like foreign aid and the money foreign nationals working in the Uk might send back to people overseas

What is a Balanced current account?

Where sum of exports plus inflow of income and transfers is equal to the sum of imports plus the outflow of income and transfer

What is a current account surplus?

Where the sum of exports plus inflow of income and transfers is greater than the sum of imports plus the outflow of income and transfers

What is a current account deficit?

Where the sum of exports plus the the inflow of income and transfers is less than the sum of imports plus the outflow of income and transfer

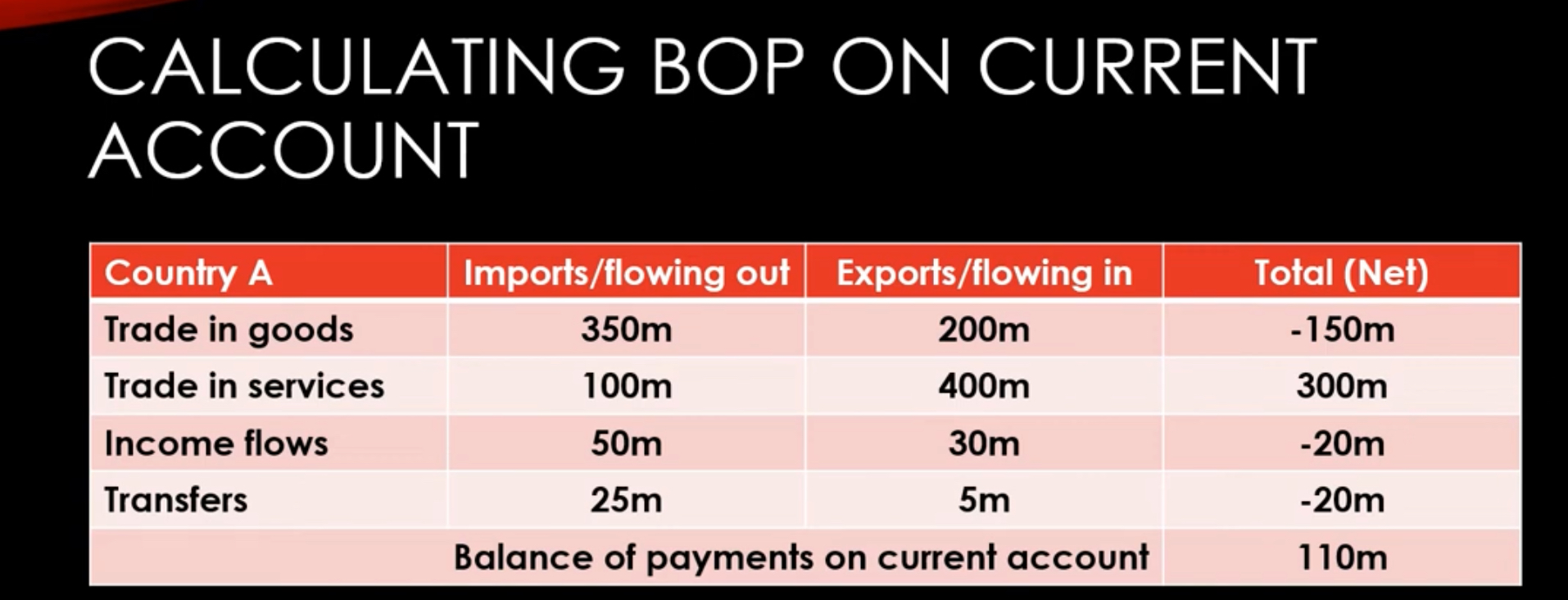

How do you calculate the balance of payments on current account?

Calculate net of trade in goods,services and income flows and transfers. Then add them together

Evaluate the importance of a balance of payments on current account deficit

-If the deficit is a result of a fall in demand for domestic produced goods this means that firms that produces those goods needs less workers.Therefore they reduce their workforce which means an increased in Unemployment. So this means they have less income to spend elsewhere which will affect other firms due to a fall demand. This also means less income tax revenue and higher benefit payments for the government

-If the deficit is a result of low productivity this will take a while to fix as issues like productivity require lots of training and education.Also it takes a while for people to go through courses.,

-It could also mean that the extra spending on exports is not fully funded by income from exports, so debt increases

HOWEVER,

-Length of deficit is also important as if it’s short it will be or less importance while if you’re in a consistent one then it’s concerning

-Helps reduce prices as there’s less demand from domestic firms which reduces inflation.

-Also as less people purchase our exports and we purchase more imports they’ll be less people buying our pound and more people selling pound.This leads to a reduction in exchange rate. Increasing our competitiveness and exports

-Depends on what goods we’re importing e.g capital goods that can be used to improve productivity

Evaluate the importance of a balance of payments on current account surplus

-If the surplus is due to the increased increases in demand for domestic goods this will means firms will need additional workers to produce additional goods which means people have higher overall incomes and demand for other goods within the economy.Also we see a reduced in unemployment and more income tax revenue and lower benefit payments for the government.

-We also see a decreases in debt as more money is flowing in from exports than being spent on imports.

HOWEVER,

-May cause inflation in the domestic economy as exports are greater than imports which increases total demand and therefore increases demand pull inflation

-Long run it could lead to a rise in the exchange rate as there’s a greater demand for currency due to exports and with fewer imports there’s less reason to sell.

-Surplus countries may have to lend to deficit countries. This could be a problem if they can’t pay them back.

-Depends on time period-Less significant if only temporary.

-Depends on size of surplus-smaller % if less beneficial.

How does Reputation cause a surplus of the balance of payments on current account?

-Some counties with a strong history of trade surpluses have reputation for producing high quality goods and services that are in high demand.

-The Uk has a good reputation in areas such as financial services,medical research,education

How does the state of the economy cause a a surplus of the balance of payments on current account?

-If the domestic economy is weak then firms may be looking to sell more in foreign markets.

-Also if domestic consumers don’t have much income they may not be able to afford imports.Likewise if democratic demand is low firms will sell abroad.

How does fall in exchange rates cause a surplus of the balance of payments on the current account?

-If countries exchange rate falls, this means its exports become cheaper in other countries increasing demand.

-Also imports become more expensive for domestic consumers.

How does a net inflows from investment cause a surplus on the balance of payments on current account?

-If more money is coming into the country from investments that its residents have made abroad than going out to foreign investors that invested into the uk, then it can boost the balance of payments

How does Reputation cause a deficit in the balance of payments on current account?

-If countries domestic goods are too expensive/poor quality/no longer in demand it will decreases the level of exports. Also it leads to domestic consumers to seek imports.

How does declining industries cause a deficit on the balance of payments on current account?

If a county is gravely invested in declining industries with decreasing demand, it can decrease exports

How does rising exchange rates cause a deficit in balance of payments on current account?

As a country’s exchange rate rises that means it’s more expensive for foreigners to buy our exports, decreasing demand and simultaneously less expensive for our citizens to buy imports.

How does a fall in incomes oversea cause a deficit in balance of payments on current account

As people or countries overseas have lower incomes demand for our exports will fall. Likewise if domestic incomes are rising we may look to buy imports.

How does a net outflow of investment cause a deficit in balance of payments in current account?

-If less money is coming into the country from investments, that it’s residents have made abroad than going out to foreign investors investing into uk then it can reduce the balance of payments

-Low productivity- if you aren’t supplying goods that consumers want, they’ll start to look at competitors in other countries