4.3 - Monopolistic competition, TP uncertainty & Brexit

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

Are certain TP realistic

Firms may not know what tariffs in place in future but have to make trade decisions today

Under functioning international systems it can be realistic - WTO pre Trump

Under WTO rules nations cant raise tariffs above bound rate

Some uncertainty within bounds but mitigates a bit

MFN tariffs dont move much in reality

PTAs more certain than general WTO MFN

Classic trade models

Ricardian model

argues trade takes place due to CA

CA caused by different productivities between sectors & nations

HO model

Different factor abundance between nations + goods with different factor intensity drive trade

New trade model - Krugman 1979

Explain trade between similar countries (similar in productivity & factor endowment) - NOT EXPLAINED BY CLASSICAL MODELS

Increasing RtS {Larger market size

Consumer love for variety. {

Monopolistic competition - each firm monopolist of residual D for its variety

Monopolistic comp with heterogenous firms - Assumptions

Basic model assumes homogenous firms - in reality no true

Exporters more productive on avg BUT even among Exporters there is heterogeneity

More productive firms will charge lower p - to increase market share

Under heterogeneity, firms have to pay a sunk/fixed cost to enter a market - source of RtS

Sunk/fixed - if paid before/after learning market conditions to enter

LR equilibrium of heterogenous firms model

Firms enter market until marginal firm equates Expected profits to sunk entry cost

E(pi) = sunk cost

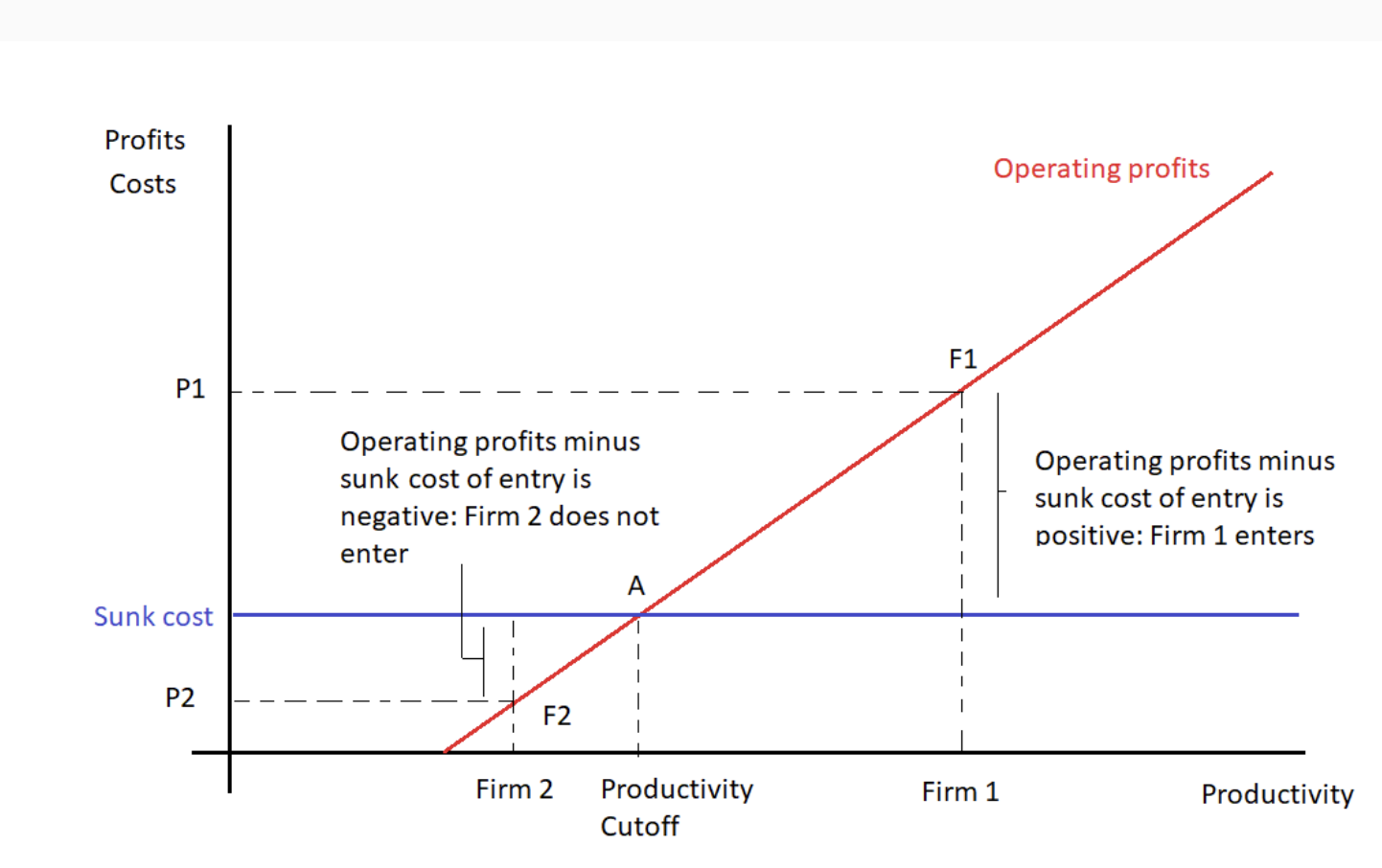

Mono comp with heterogenous firms - graph

Firms have an idea of future profits

Firms only join the market if E(pi) > sunk cost

Only most productive join (productivity UP = pi UP)

2 doesnt enter but 1 does

Mono comp with heterogenous firms - with FT effects

Similar result to case with homogenous firms

Less productive dom firms exit

More productive F firms join & start exporting to H

Access to variety UP → Welfare UP

Productivity increases as least productive leave → P falls

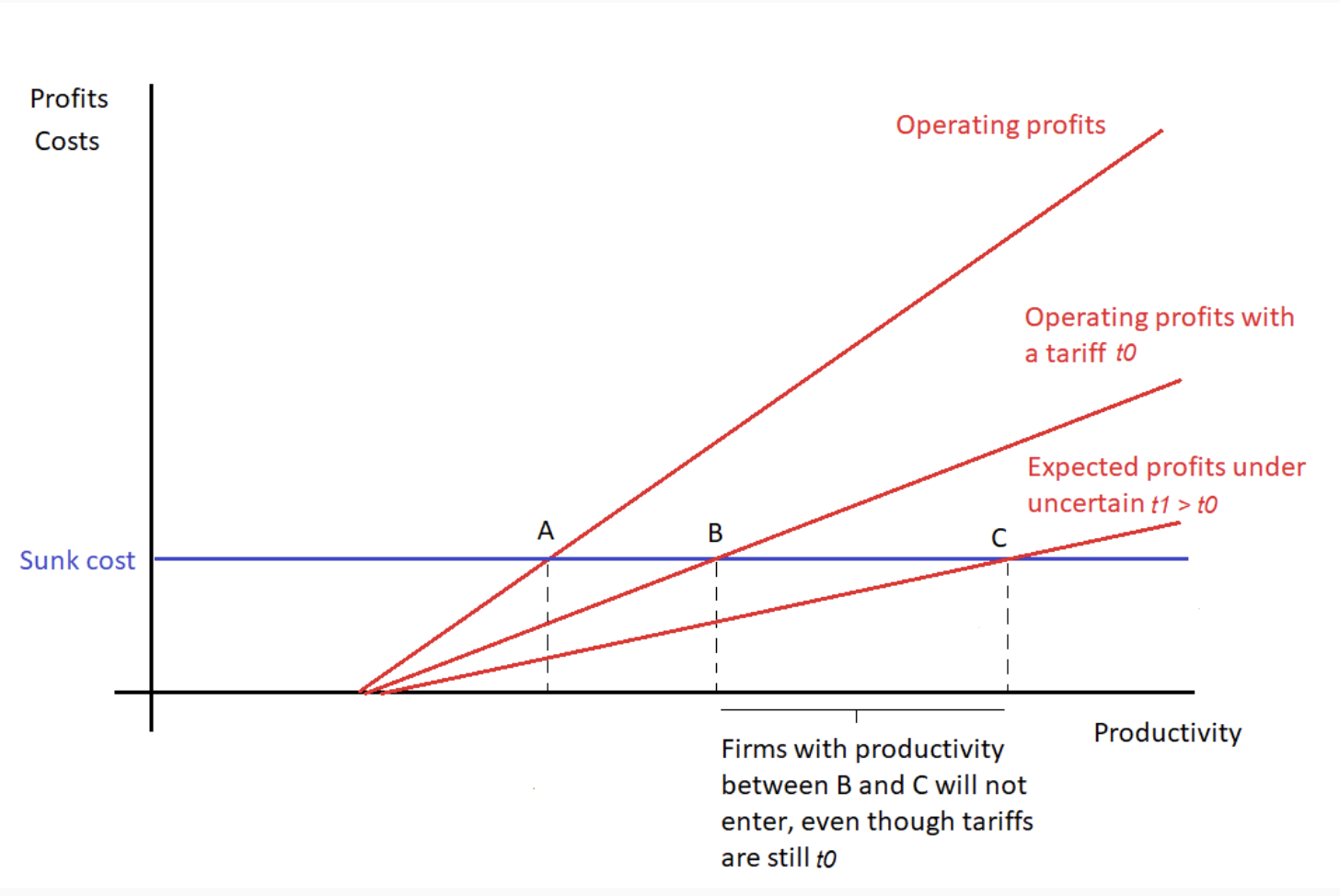

Mono comp with heterogenous firms - graph

Assume no dom firms

H charges tariff on M - t a % of sales → profits fall

Some F exporters wont enter market (pi < sunk)

Consumer access to variety falls → CS down

Firms only enter if productivity > B

Firms with productivity A-B leave market

firms reevaluate if they want to invest in X capital

TP uncertainty theory

Firms have to make investment decisions when entering a market - often under uncertainty

They decide based on Pi given information available today

Entry cost sunk upon joining BUT changing conditions can reduce Pi

may force them to leave market & lose sunk cost

markup p < initial investment

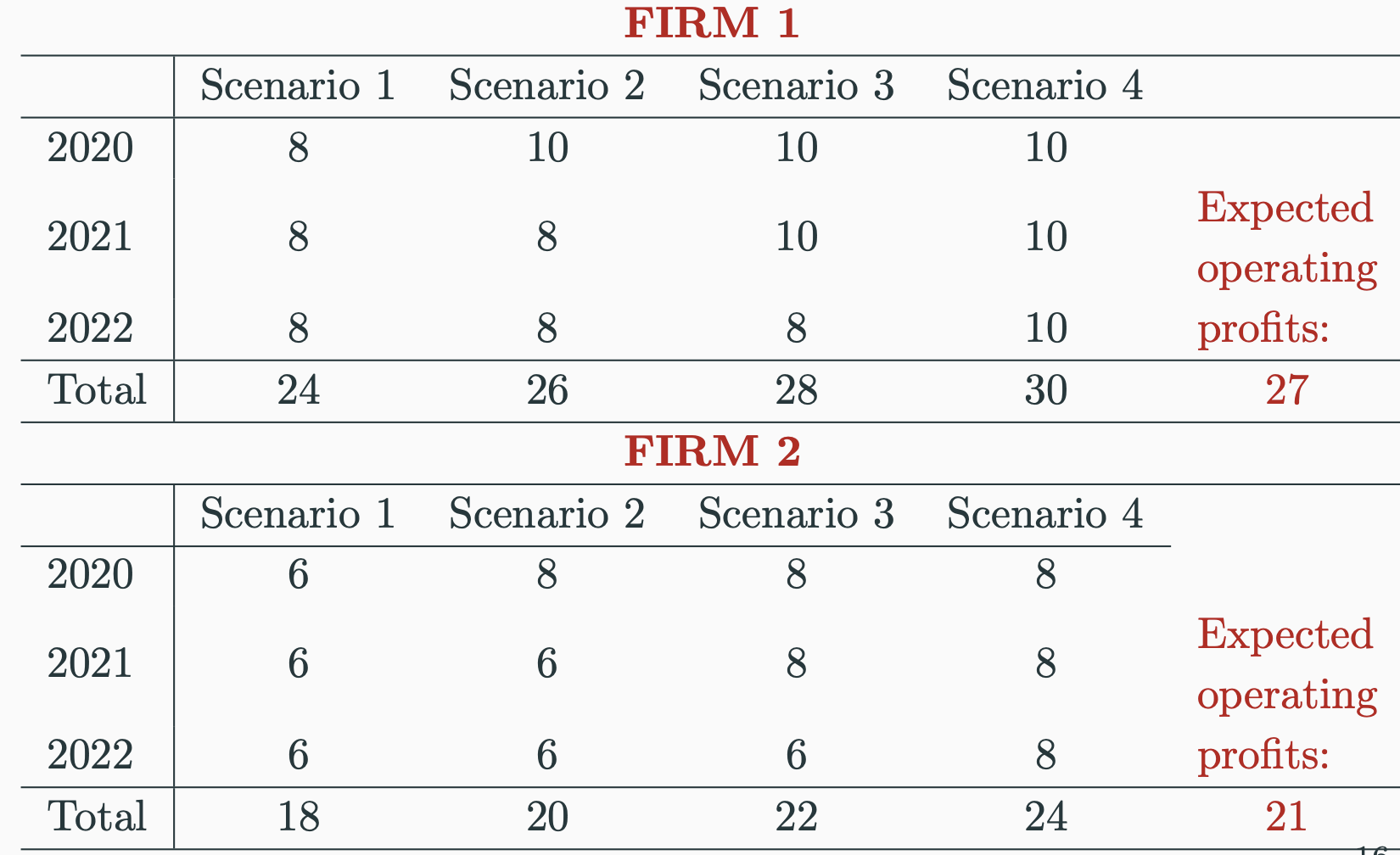

TP uncertainty example OV

Assume an event makes tariff rate uncertain - scenarios equally likely

2 firms - 2 is less productive than firm 1

dont discount future profits

To X to F, each firm has to invest in X capital today

Sunk cost = £23000 in this example

4 scenarios - tariffs rise in 2020,21,22 or never

tariff UP = profits fall

TP uncertainty example RESULTS

If firms certain tariffs wont rise then both X

1: 30-23 > 0. 2: 24-23>0

However there is 75% chance tariffs rise

1: 27-23 > 0. 2: 21-23<0

only 1 X if it decides to enter market

TP uncertainty graph

Firms with productivity B-C leave / dont join market - even though tariffs still t0

uncertainty of rise forces them out

TP uncertainty effects

Fewer firms join market / more leave from the tariff uncertainty

Aggregate F X fall as no. exporters fall

Varieties fall → CS falls

F firms that exit due to TP uncertainty could be replaces by less efficient dom firms

Productivity down → P rise

Therefore TPU works as protection for dom firms

Brexit uncertainty

2015 general election winners promised referendum

created TP uncertainty

Caused EU & UK firms to lower E(pi) due to expected tariff rise

decreased market entry

CS fell Varieties down + M price index UP

Brexit uncertainty measured - Graziano et al (2020) OV

Used betting market probabilities as prob of Brexit + opinion polls

showed uncertainty varied over time

Brexit uncertainty measured - Graziano et al (2020) RESULTS - impact on EU X to UK

Impact on EU X to UK relative to non-EU

X fell sharply when referendum date announced

X fell again when article 50 put in place (but recovered)

Shows extreme uncertainty

Brexit uncertainty measured - Graziano et al (2020) RESULTS - Tariff threat & Trade

Paper estimated avg trade across affected products

-11-20% trade between UK & EU

Bilateral trade down -15% if MFN applied to all products

Brexit uncertainty measured - Graziano et al (2020) RESULTS - Uncertainty & M price

Import price captured changes in CS effectively

M price of EU goods relative to all M tracked closely with Brexit probabilities

strong supportive evidence of model

If only focused on high risk of tariff products (proxy of UK tariff to EU was EU MFN tariffs)

still tracks Brexit prob well

With mean tariff threat - M price index 12% increase

Brexit uncertainty alone increased consumer prices by +0.5-0.7%